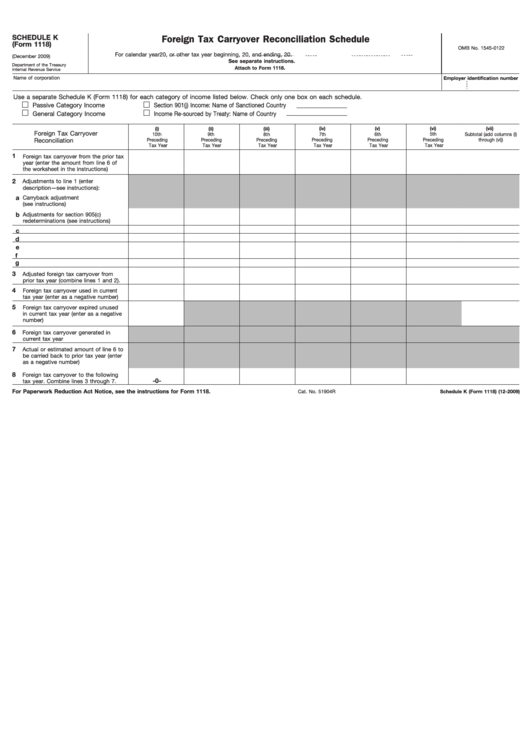

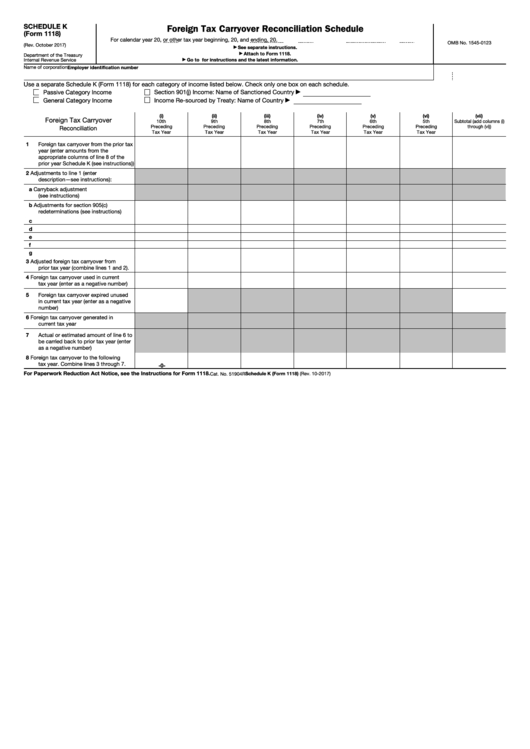

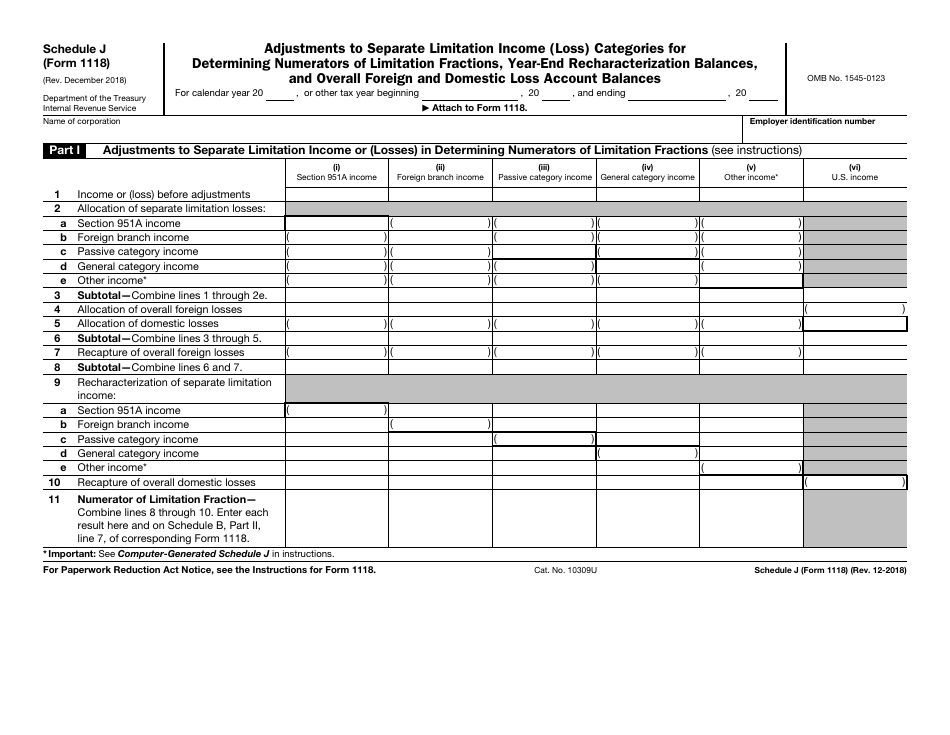

Form 1118 Schedule J

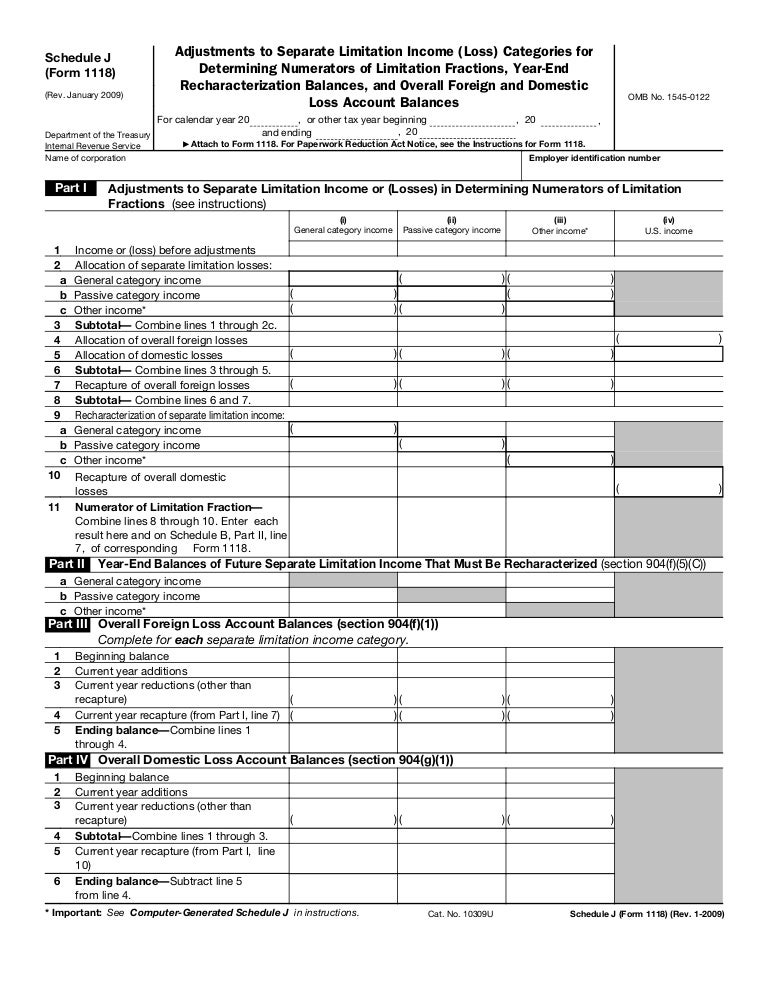

Form 1118 Schedule J - December 2018) department of the treasury internal revenue service section references are to the internal revenue code unless. Who must file with respect to each separate category of. Web instructions for schedule j (form 1118)(rev. Schedule b, parts i & ii; Navigate to the top consolidated return. Web schedule j (form 1118). Web in addition, even if a corporation has not elected to credit foreign taxes, it must complete and attach schedules a and j of a form 1118 to its income tax return if it has any additions. Web use schedule j (form 1118), (a separate schedule) to compute adjustments to separate limitation income or losses in determining the numerators of. What is 1118 form (schedule j)? And schedule k for each applicable separate. What is 1118 form (schedule j)? Web inst 1118 (schedule j) instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Ad get deals and low prices on taxation forms at amazon. Choose from a wide range of informative business books, available at amazon. December 2018) department of the treasury internal. December 2020) department of the treasury internal revenue service adjustments to separate limitation income (loss) categories for. Web form 1118 (schedule j) financial definition of form 1118 (schedule j) a form that a corporation files with the irs to make certain adjustments to income or losses when. Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss). Web form 1118 (schedule j) financial definition of form 1118 (schedule j) a form that a corporation files with the irs to make certain adjustments to income or losses when. December 2020) department of the treasury internal revenue service. Navigate to the top consolidated return. Web schedule j (form 1118) (rev. Complete a separate schedule a; Schedule b, parts i & ii; Web use schedule j (form 1118), (a separate schedule) to compute adjustments to separate limitation income or losses in determining the numerators of. Web form 1118 and schedule j (form 1118), allocated to some item or class of income. Web schedule j (form 1118) (rev. Web inst 1118 (schedule j) instructions for schedule j. Web form 1118 (schedule j) a form that a corporation files with the irs to make certain adjustments to income or losses when claiming the foreign tax credit. December 2018) department of the treasury internal revenue service section references are to the internal revenue code unless. Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories. Web the instructions for form 1118 for details). Web use schedule j (form 1118), (a separate schedule) to compute adjustments to separate limitation income or losses in determining the numerators of. And schedule k for each applicable separate. Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Complete, edit. Web schedule j (form 1118) (rev. Web inst 1118 (schedule j) instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Web form 1118 and schedule j (form 1118), allocated to some item or class of income. Web in addition, even if a corporation has not elected to credit foreign taxes,. Web use schedule j (form 1118), (a separate schedule) to compute adjustments to separate limitation income or losses in determining the numerators of. Web form 1118 and schedule j (form 1118), allocated to some item or class of income. Web schedule j (form 1118) (rev. Web inst 1118 (schedule j) instructions for schedule j (form 1118), adjustments to separate limitation. Web schedule j (form 1118). Web to produce form 1118, schedule j in a consolidated return, do the following: And schedule k for each applicable separate. Web inst 1118 (schedule j) instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Web the instructions for form 1118 for details). Schedule b, parts i & ii; Web the instructions for form 1118 for details). December 2018) department of the treasury internal revenue service section references are to the internal revenue code unless. Complete, edit or print tax forms instantly. Web use schedule j (form 1118), (a separate schedule) to compute adjustments to separate limitation income or losses in determining the. Web form 1118 (schedule j) financial definition of form 1118 (schedule j) a form that a corporation files with the irs to make certain adjustments to income or losses when. Choose from a wide range of informative business books, available at amazon. Web form 1118 (schedule j) a form that a corporation files with the irs to make certain adjustments to income or losses when claiming the foreign tax credit. Web on schedule j (form 1118), the column headings and lines used to report other income have been revised to require taxpayers to identify each item of other income. Get ready for tax season deadlines by completing any required tax forms today. This activity is shown on lines 6 through 8 of the schedule k (form 1118). Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Schedule b, parts i & ii; Web inst 1118 (schedule j) instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Web schedule j (form 1118) (rev. Adjustments to separate limitation income (loss) categories for. Web form 1118 and schedule j (form 1118), allocated to some item or class of income. Navigate to the top consolidated return. Web in addition, even if a corporation has not elected to credit foreign taxes, it must complete and attach schedules a and j of a form 1118 to its income tax return if it has any additions. December 2020) department of the treasury internal revenue service adjustments to separate limitation income (loss) categories for. Complete a separate schedule a; December 2020) department of the treasury internal revenue service. Web inst 1118 (schedule j) instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Ad get deals and low prices on taxation forms at amazon. Web use schedule j (form 1118), (a separate schedule) to compute adjustments to separate limitation income or losses in determining the numerators of.Fillable Schedule K (Form 1118) Foreign Tax Carryover Reconciliation

Form 1118 Foreign Tax Credit Corporations (2014) Free Download

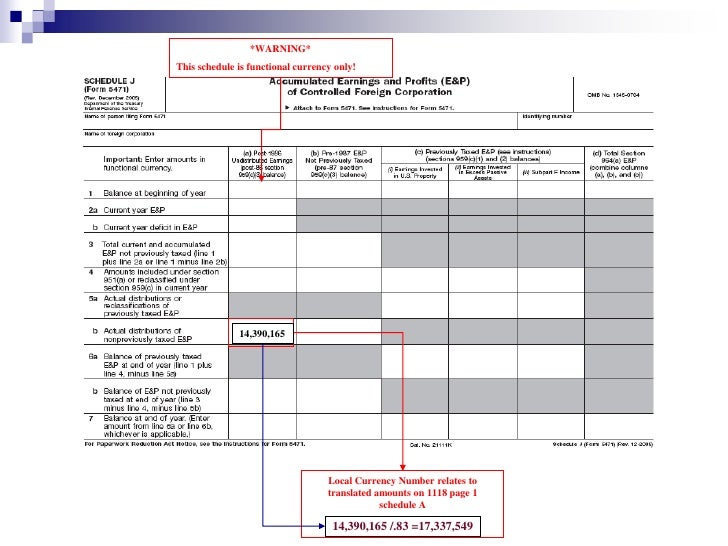

Forms 1118 And 5471

Form 1118 (Schedule J) Adjustments to Separate Limitation (Lo…

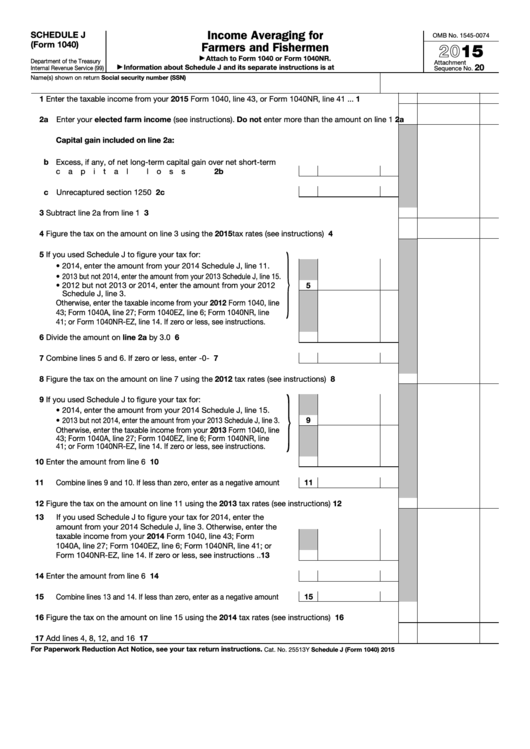

Fillable Schedule J (Form 1040) Averaging For Farmers And

Download Instructions for IRS Form 1118 Schedule J Adjustments to

Top 26 Form 1118 Templates free to download in PDF format

Form 1118 (Schedule J) Adjustments to Separate Limitation

IRS Form 1118 Schedule J Fill Out, Sign Online and Download Fillable

Forms 1118 And 5471

Related Post: