Form 1118 Schedule H

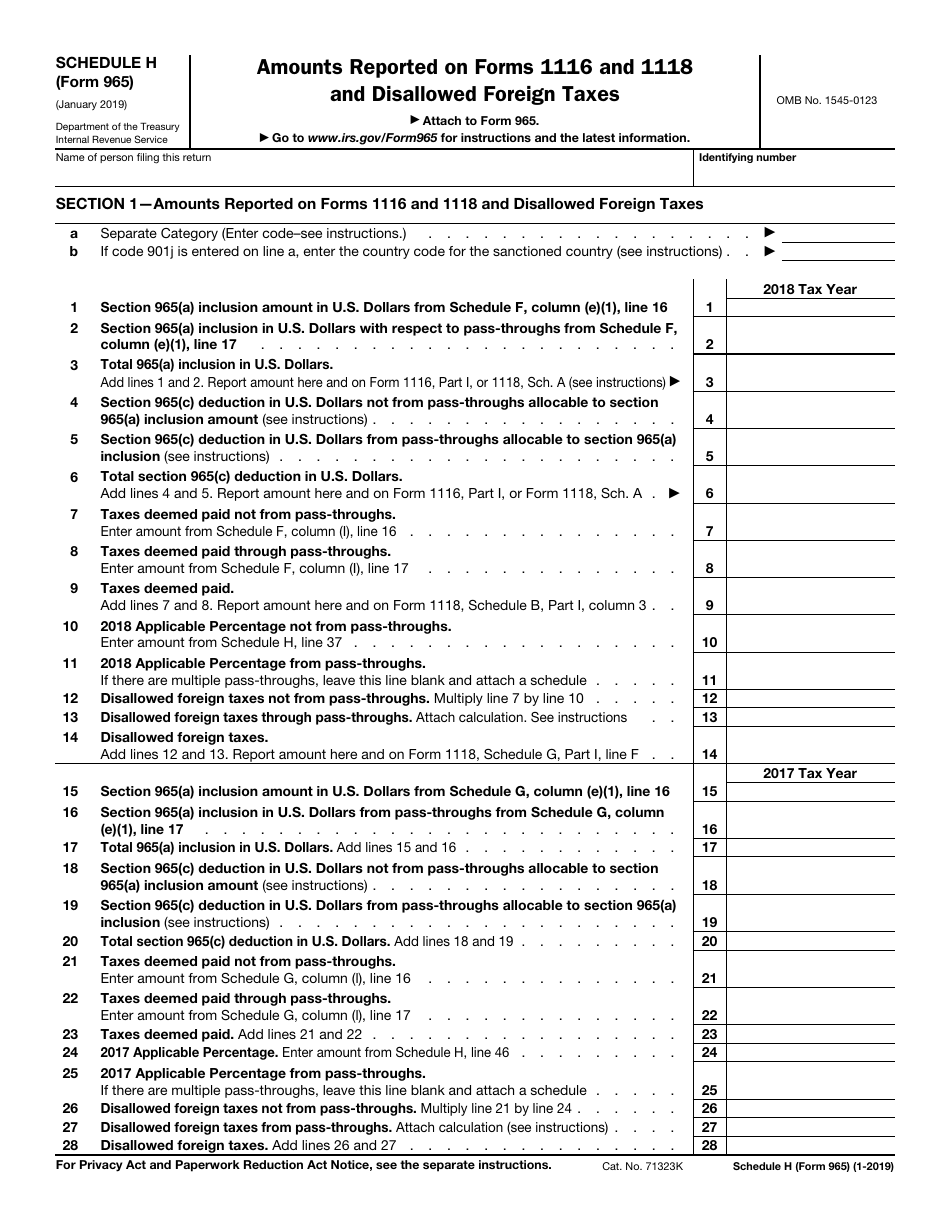

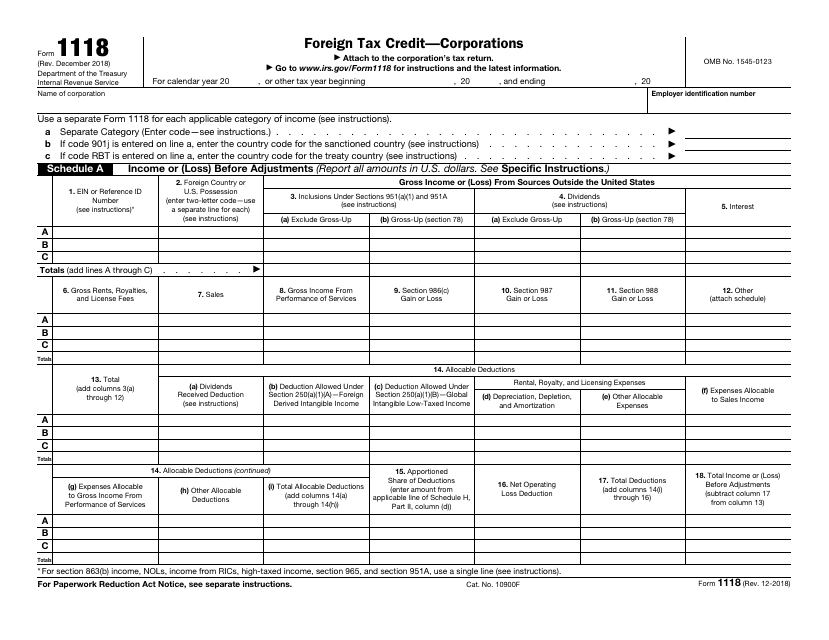

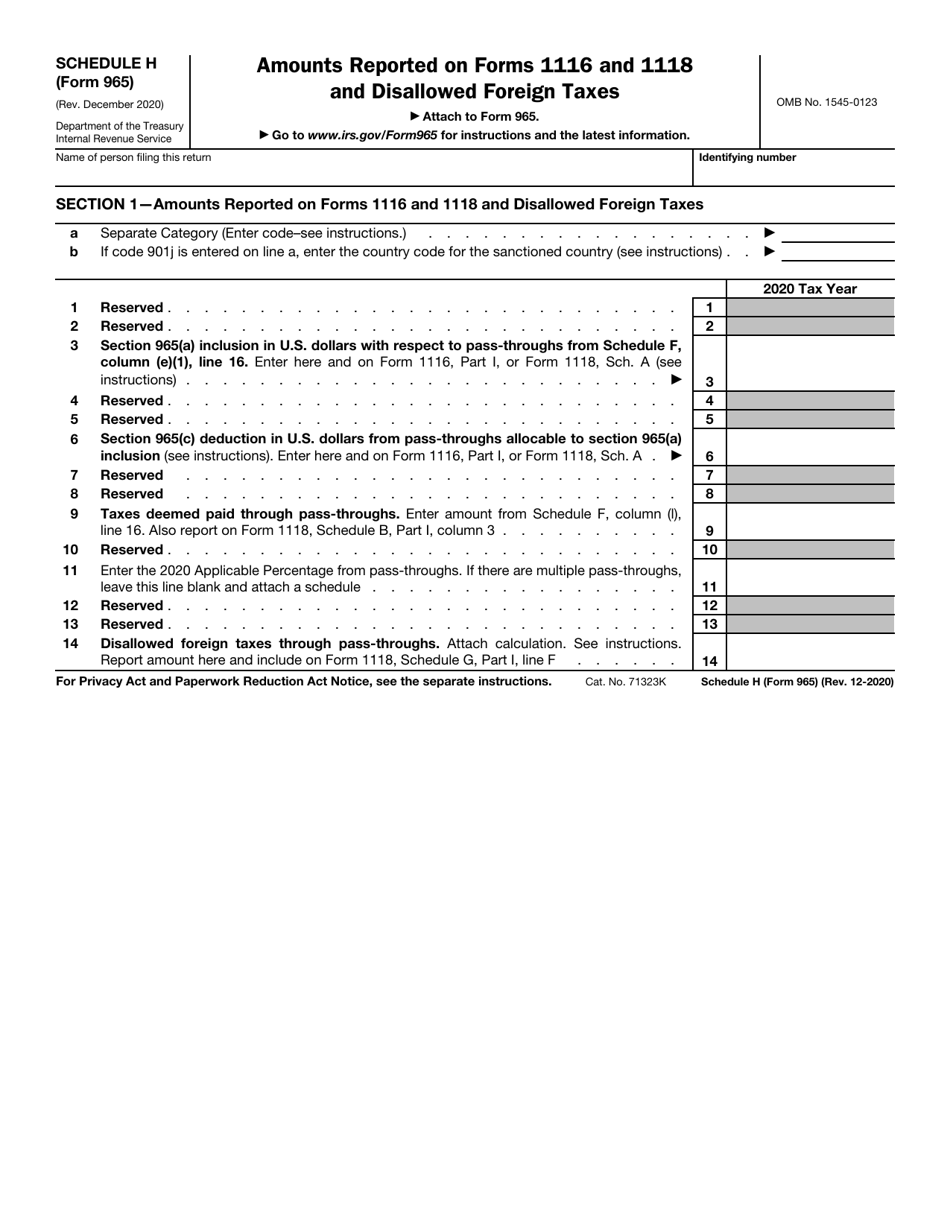

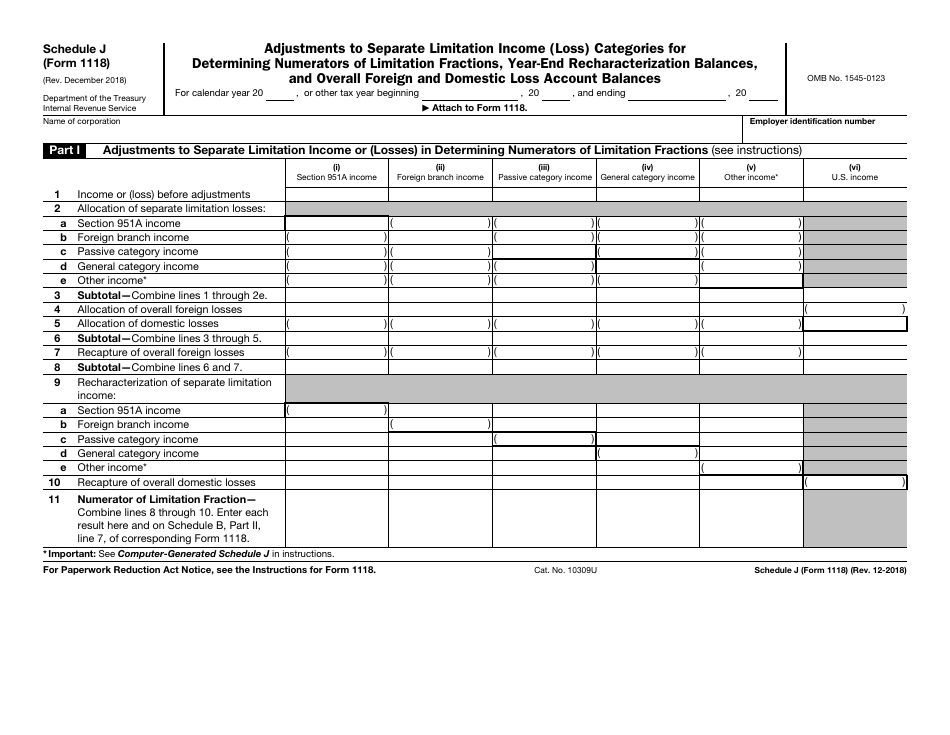

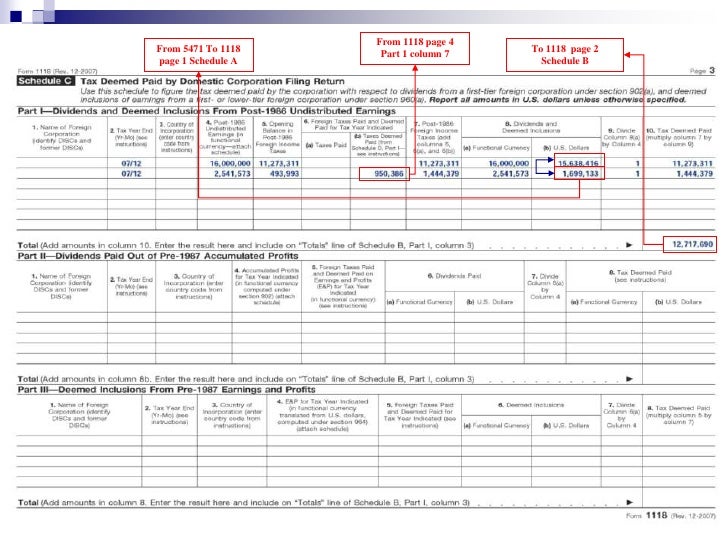

Form 1118 Schedule H - The amount on line 3, column (i) is $80. In order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. Web foreign tax credit. Corporation claiming a foreign tax credit must attach. On page 11 of form 1118, schedule h, part ii, has been extensively revised. Navigate to the top consolidated return. Web due to changes made to schedule h (explained below), on page 1 of form 1118, schedule a, column 14 (apportioned share of deductions) now requests amounts from. Web form 1118, schedule a, requires a corporation to separately report certain types of gross income by source and separate category. In order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions 1220 01/29/2021. On page 11 of form 1118, schedule h, part ii, has been extensively revised. Corporation claiming a foreign tax credit must attach. Navigate to the top consolidated return. In order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. The amount on line 3, column (i) is $80. Web form 1118, schedule a, requires a corporation to separately report certain types of gross income by source and separate category. Schedule h, part ii is now used to report deductions allocated and apportioned. Navigate to the top consolidated return. Web form 1118 that is more than the amount treated as a • schedule h, part i, column (b) has. Web due to changes made to schedule h (explained below), on page 1 of form 1118, schedule a, column 14 (apportioned share of deductions) now requests amounts from. Web in order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. Web schedule h, part ii. Navigate to the top consolidated. Web form 1118 that is more than the amount treated as a • schedule h, part i, column (b) has dividend under section 1248. Web schedule h, part ii. Web in order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. In order to provide the internal revenue service (“irs”). Corporation claiming a foreign tax credit must attach. The amount on line 3, column (i) is $80. Schedule h, part ii is now used to report deductions allocated and apportioned. Web schedule h, part ii. Web due to changes made to schedule h (explained below), on page 1 of form 1118, schedule a, column 14 (apportioned share of deductions) now. Web in order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. Navigate to the top consolidated return. The amount on line 3, column (i) is $80. December 2022) foreign tax credit—corporations department of the treasury internal revenue service attach to the corporation’s tax return. Web $250 (i.e., form 1118,. Web form 1118, schedule a, requires a corporation to separately report certain types of gross income by source and separate category. Web $250 (i.e., form 1118, schedule b, part ii, line 11 exceeds the sum of lines 1 through 4 of form 1118, schedule b, part ii by $250). Web foreign tax credit. Web form 1118 that is more than. Navigate to the top consolidated return. Web in order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. Web to produce form 1118, schedule j in a consolidated return, do the following: On page 11 of form 1118, schedule h, part ii, has been extensively revised. The amount on line. Corporation claiming a foreign tax credit must attach. Navigate to the top consolidated return. Web foreign tax credit. In order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. However, in been modified to include additional important. Web foreign tax credit. Web in order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions 1220 01/29/2021. Web $250 (i.e., form 1118, schedule b, part ii, line 11 exceeds. Web $250 (i.e., form 1118, schedule b, part ii, line 11 exceeds the sum of lines 1 through 4 of form 1118, schedule b, part ii by $250). Web to produce form 1118, schedule j in a consolidated return, do the following: On page 11 of form 1118, schedule h, part ii, has been extensively revised. Web form 1118, schedule a, requires a corporation to separately report certain types of gross income by source and separate category. In order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. Corporation claiming a foreign tax credit must attach. December 2022) foreign tax credit—corporations department of the treasury internal revenue service attach to the corporation’s tax return. The amount on line 3, column (i) is $80. Web schedule h, part ii. Schedule h, part ii is now used to report deductions allocated and apportioned. However, in been modified to include additional important. Web foreign tax credit. Web in order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. Web form 1118 that is more than the amount treated as a • schedule h, part i, column (b) has dividend under section 1248. In order to provide the internal revenue service (“irs”) with the information necessary to claim a foreign tax credit, a u.s. Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions 1220 01/29/2021. Navigate to the top consolidated return. Web due to changes made to schedule h (explained below), on page 1 of form 1118, schedule a, column 14 (apportioned share of deductions) now requests amounts from.Forms 1118 And 5471

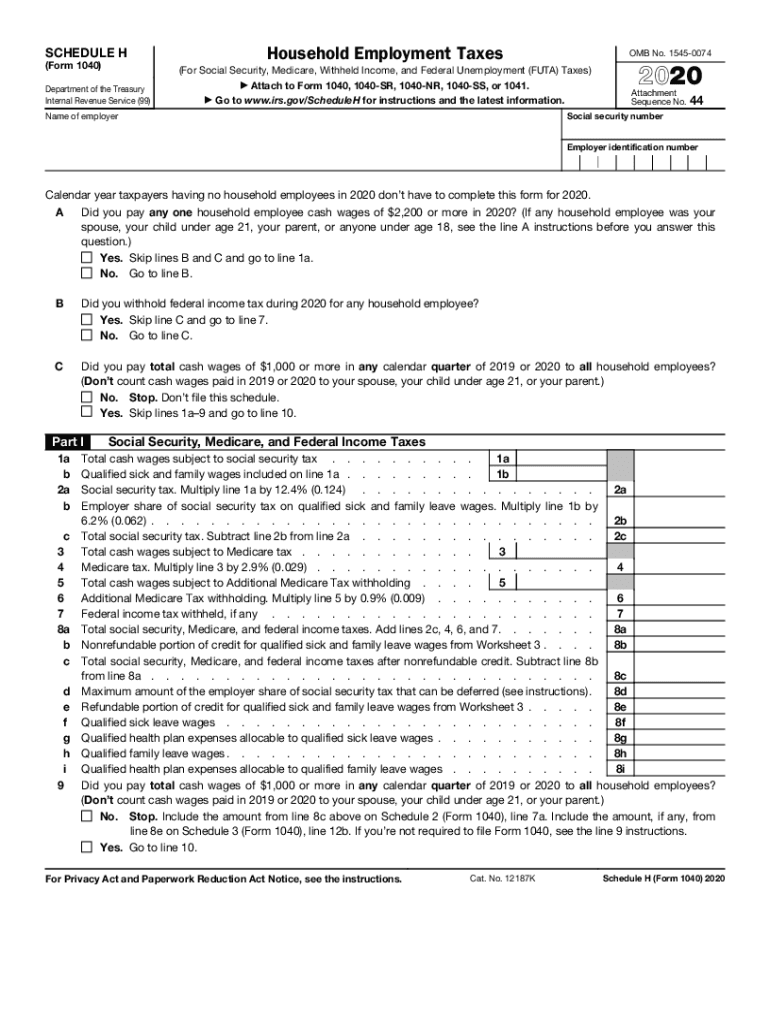

Have a Nanny? Schedule H Guidance A How To

IRS Form 965 Schedule H Download Fillable PDF or Fill Online Amounts

IRS Form 1118 Download Fillable PDF or Fill Online Foreign Tax Credit

IRS Form 965 Schedule H Download Fillable PDF or Fill Online Amounts

Form 1118 Foreign Tax Credit Corporations (2014) Free Download

IRS Form 1118 Schedule J Fill Out, Sign Online and Download Fillable

Schedule h form Fill out & sign online DocHub

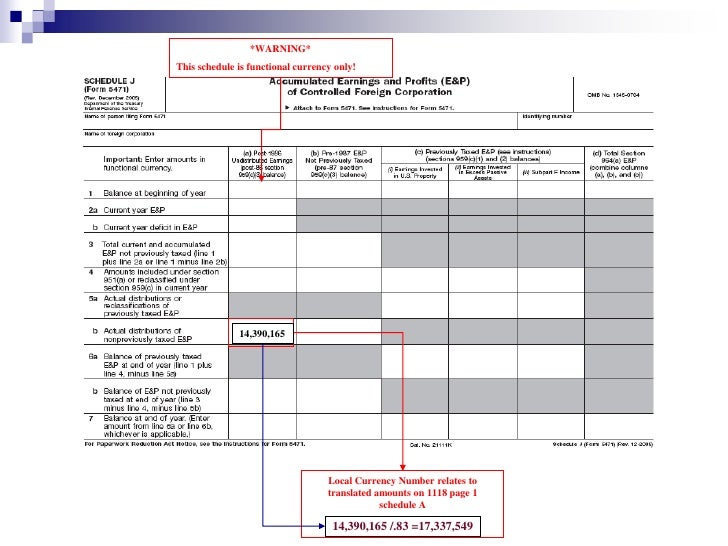

Forms 1118 And 5471

Forms 1118 And 5471

Related Post: