Form 1116 Schedule B

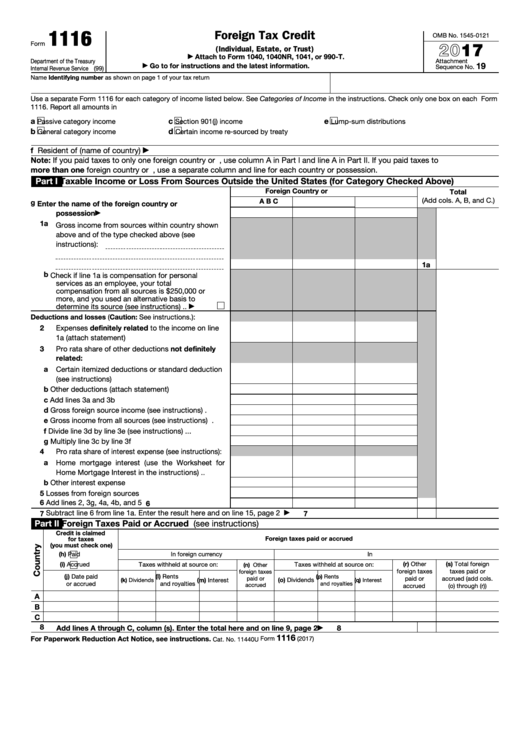

Form 1116 Schedule B - Web how to enter form 1116 schedule b in proconnect (ref #56669) solved • by intuit • 32 • updated june 12, 2023 this article will help you enter foreign tax credit. Web 9 min read october 25, 2022 resource center forms form 1116: Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Taxpayers are therefore reporting running balances of. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web form 1116 schedule b is filed when a taxpayer has foreign tax credit carryovers from a prior year. Web form 1116 schedule b is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover. Web form 1116 schedule b is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web use schedule b (form. Web how to enter form 1116 schedule b in proconnect (ref #56669) solved • by intuit • 32 • updated june 12, 2023 this article will help you enter foreign tax credit. The schedule b is set for tentatively 3/31. Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Web. Web 9 min read october 25, 2022 resource center forms form 1116: Please see the image below. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Taxpayers are therefore reporting running balances of. Web form 1116 schedule b i am getting a message from turbotax that form 1116. Web starting in tax year 2021, the irs introduced a new form 1116 schedule b to report foreign tax credit carryovers. Web to help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately compute the credit using form 1116,. Form 1116, schedules b and schedule c are used. Web form 1116 schedule b i am getting a message from turbotax that form 1116 schedule b is not available but it will be available in a future release. Web form 1116 is final; Generating the schedule b for form 1116 in proseries starting in 2021: Web schedule b (form 1116) is used to reconcile your prior year foreign tax. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of the form 1116. Web starting in tax year 2021, the irs introduced a new form 1116 schedule b to report foreign tax credit carryovers. Web form 1116 schedule b is filed when a taxpayer has foreign tax credit carryovers from a prior year. Form 1116. Web form 1116 schedule b is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web how to enter form 1116 schedule b in proconnect (ref #56669) solved • by intuit • 32 • updated june 12, 2023 this article will help you enter foreign tax credit. Taxpayers are therefore reporting running balances. Web instructions for schedule b (form 1116), foreign tax carryover reconciliation schedule, have been revised to clarify the definition of excess limitation. Web entering income for the foreign tax credit form 1116; Generally, unused foreign taxes can be carried forward up. Web how to enter form 1116 schedule b in proconnect (ref #56669) solved • by intuit • 32 •. However, our development team is working around the clock to try to get the form out asap. Form 1116, schedules b and schedule c are used by individuals (including nonresident aliens), estates, or trusts who paid foreign income taxes on u.s. The schedule b is set for tentatively 3/31. Web form 1116 schedule b i am getting a message from. Web starting in tax year 2021, the irs introduced a new form 1116 schedule b to report foreign tax credit carryovers. Although form 1116 sch b is not supported. The schedule b is set for tentatively 3/31. Taxpayers are therefore reporting running balances of. Generally, unused foreign taxes can be carried forward up. Complete part i, part ii, and part iii with the. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Taxpayers are therefore reporting running balances of. Taxpayers are therefore reporting running balances of. Starting in tax year 2021, the. Form 1116, schedules b and schedule c are used by individuals (including nonresident aliens), estates, or trusts who paid foreign income taxes on u.s. However, our development team is working around the clock to try to get the form out asap. Generating the schedule b for form 1116 in proseries starting in 2021: The schedule b is set for tentatively 3/31. Web entering income for the foreign tax credit form 1116; Web form 1116 is final; Form 1116 sch b, foreign tax carryover reconciliation schedule is now estimated to be ready for print on 3/10. Web starting in tax year 2021, the irs introduced a new form 1116 schedule b to report foreign tax credit carryovers. See schedule b (form 1116) and. Web instructions for schedule b (form 1116), foreign tax carryover reconciliation schedule, have been revised to clarify the definition of excess limitation. Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to file it to get the. Web first, the schedule b; Web form 1116 schedule b is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of the form 1116.Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

Fillable Form 1116 Foreign Tax Credit (Individual, Estate, Or Trust

IRS Form 1116 Instructions Claiming the Foreign Tax Credit

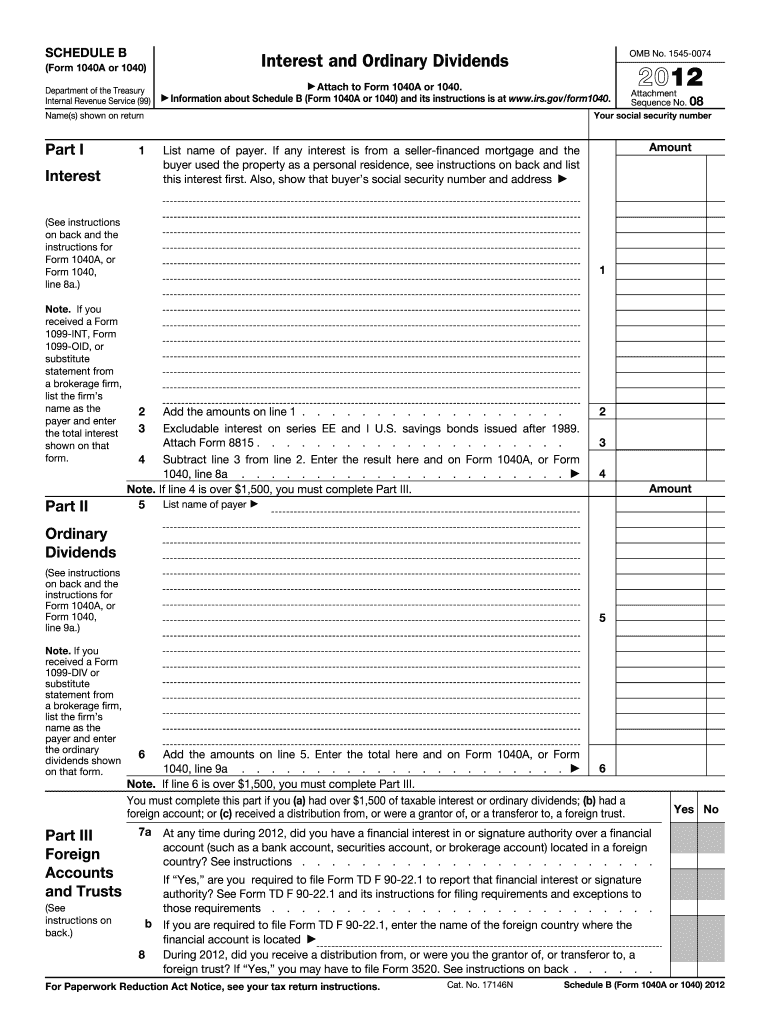

2012 Form IRS 1040 Schedule B Fill Online, Printable, Fillable, Blank

Publication 514 Foreign Tax Credit for Individuals; Simple Example

Publication 514, Foreign Tax Credit for Individuals; Simple Example

해외금융계좌 신고 5 Form 1116 Foreign Tax Credit Sample

form 1120 f instructions 2022 JWord サーチ

Related Post: