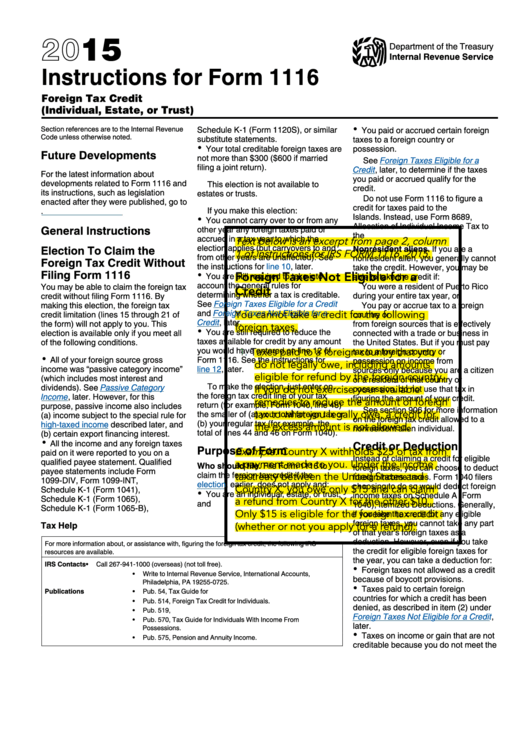

Form 1116 Inst

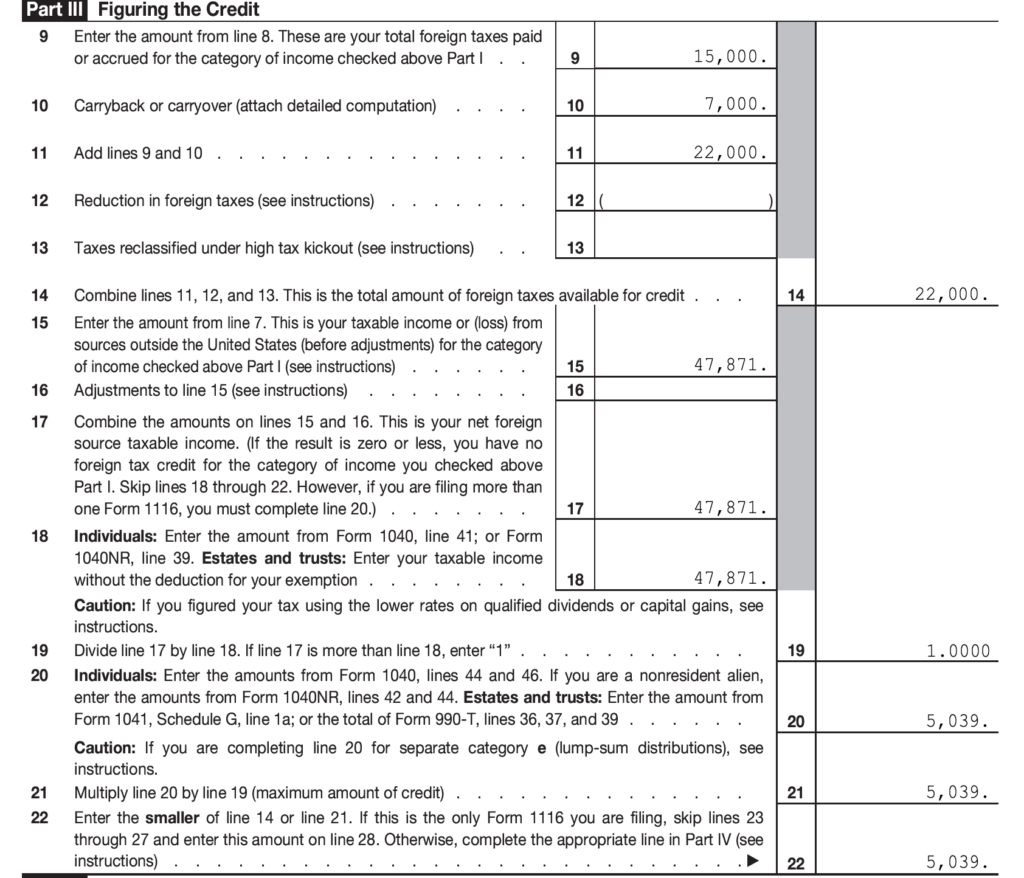

Form 1116 Inst - Web this is how to do that: Web more about the federal form 1116 individual income tax tax credit ty 2022. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you can claim on your us income tax return. This is likely if your overseas holdings come to less than $100,000. Here you need to report the income and name of the foreign country. Web on your form 1116 for passive category income, enter as a negative number (in parentheses) the amount of your foreign taxes that relate to that income. Columns a, b, and c stand for multiple countries in which a taxpayer. Web to help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately compute the credit using form 1116,. Web you may be able to claim the foreign tax credit without filing form 1116. The taxact ® calculation of line 3e gross income from all sources of federal form 1116 foreign tax credit is not. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Columns a, b, and c stand for multiple countries in which a taxpayer.. By making this election, the foreign. Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you can claim on your us income tax return. We last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this. Expatriates, understanding the details of the foreign tax credit and form 1116. Taxpayers are therefore reporting running balances of. Web general instructions election to claim the foreign tax credit without filing form 1116 you may be able to claim the foreign tax credit without filing form 1116. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to. Foreign taxes less than $600. Web this is how to do that: We last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this. Web election to claim the foreign tax credit without filing form 1116 you may be able to claim the foreign tax credit without filing form 1116. Web this section is generally completed. So if you have more than one form 1116, leave. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. The taxact ® calculation of line 3e gross income from all sources of federal form 1116 foreign tax credit is not. Web you may. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web election to claim the foreign tax credit without filing form 1116 you may be able to claim the foreign tax credit without filing form 1116. Columns a, b, and c stand for multiple countries in which a. The taxact ® calculation of line 3e gross income from all sources of federal form 1116 foreign tax credit is not. Columns a, b, and c stand for multiple countries in which a taxpayer. By making this election, the foreign tax credit limitation (lines 15 through 21 of the form) won't apply to. Web for accountants working with u.s. Web. Web the irs’s instructions to form 1116 provide an example as to how to allocate interest expense using the “asset method.” for example, you have investment interest expense. Web more about the federal form 1116 individual income tax tax credit ty 2022. Expatriates, understanding the details of the foreign tax credit and form 1116 is essential in preventing double taxation. Web this is how to do that: Here you need to report the income and name of the foreign country. Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you can claim on your us income tax return. Web the irs’s instructions to form 1116 provide an example as to how to. This is likely if your overseas holdings come to less than $100,000. Web the irs’s instructions to form 1116 provide an example as to how to allocate interest expense using the “asset method.” for example, you have investment interest expense. We last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this. Expatriates, understanding the details. Web the irs form 1116 is a form used to calculate the amount of foreign tax credit you can claim on your us income tax return. Use form 2555 to claim. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate,. Columns a, b, and c stand for multiple countries in which a taxpayer. Web more about the federal form 1116 individual income tax tax credit ty 2022. Here you need to report the income and name of the foreign country. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Expatriates, understanding the details of the foreign tax credit and form 1116 is essential in preventing double taxation of income. This is likely if your overseas holdings come to less than $100,000. From inside the return, scroll down to tax tools on the bottom of the left side menu. Web this is how to do that: Web election to claim the foreign tax credit without filing form 1116 you may be able to claim the foreign tax credit without filing form 1116. Web there is a new schedule b (form 1116) which is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web the irs’s instructions to form 1116 provide an example as to how to allocate interest expense using the “asset method.” for example, you have investment interest expense. Web this section is generally completed on the form 1116 with income category that has a largest allowable foreign tax credit. Click on delete a form (third on the list at the. We last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this. Web you may be able to claim the foreign tax credit without filing form 1116. Use form 2555 to claim the. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs.2015 Instructions For Form 1116 printable pdf download

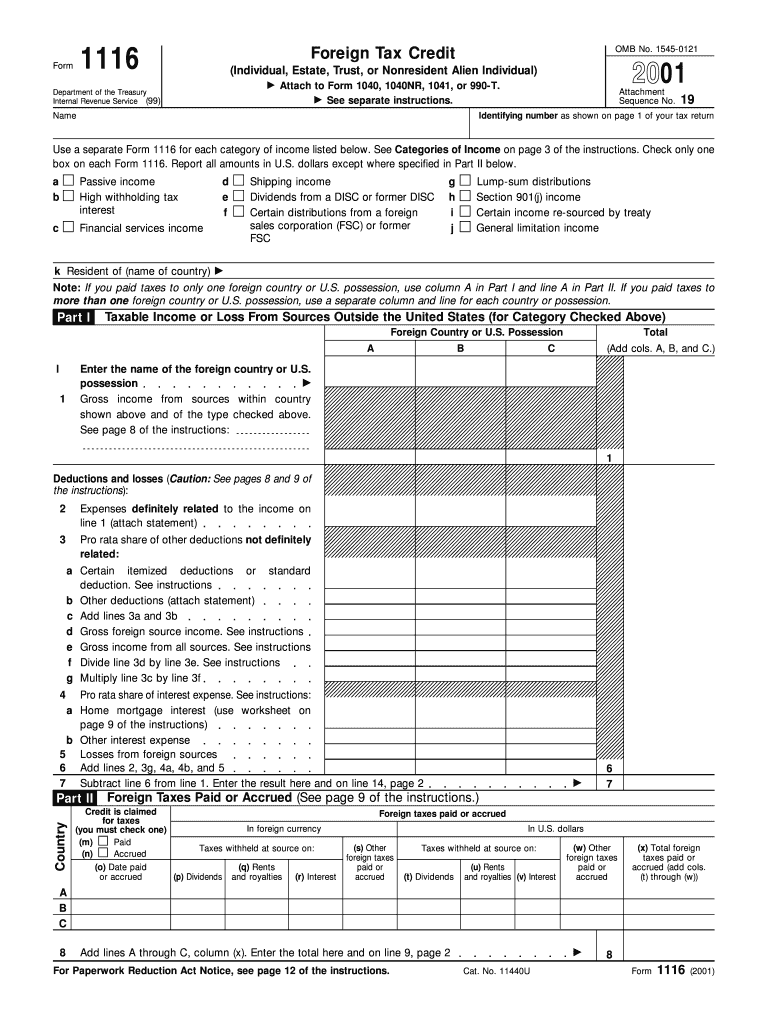

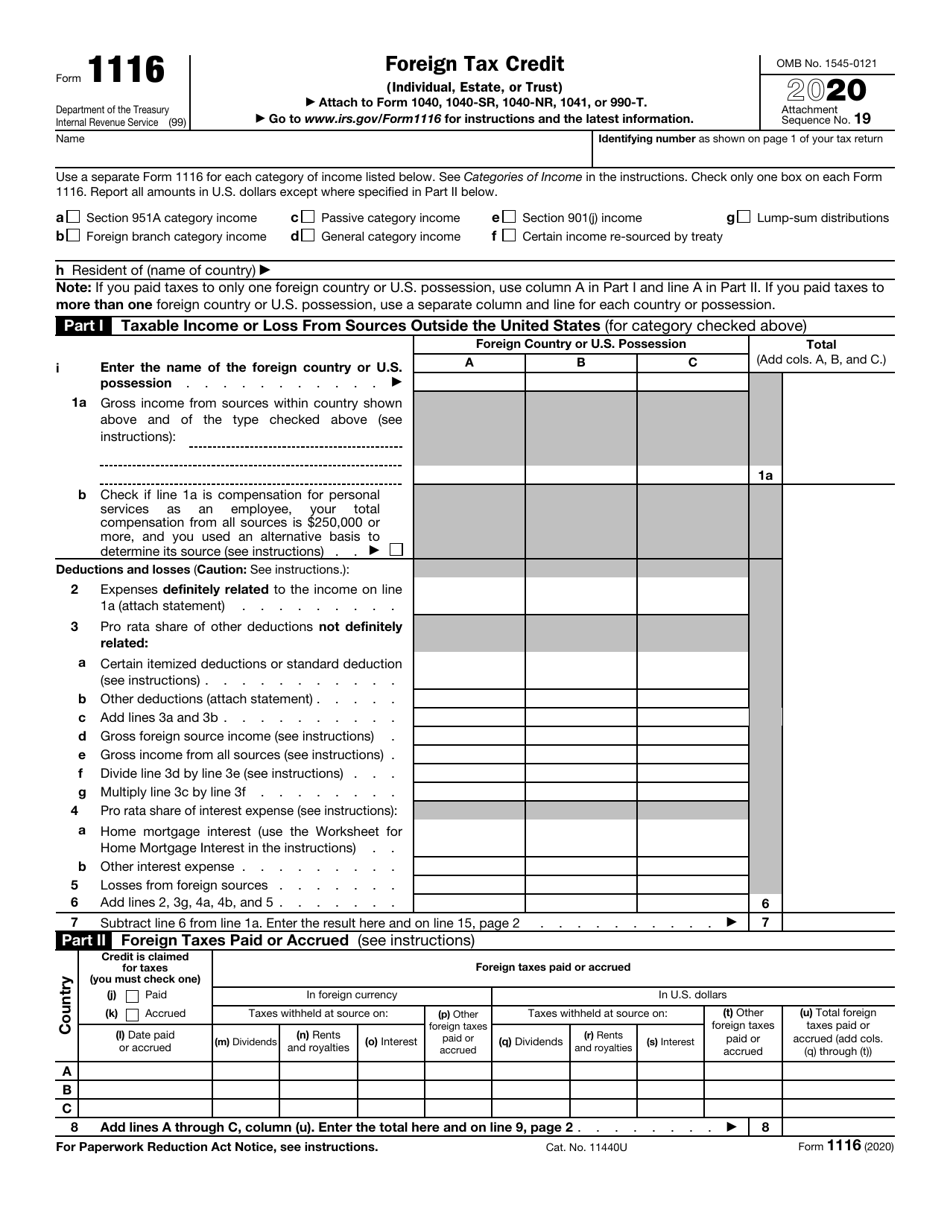

Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

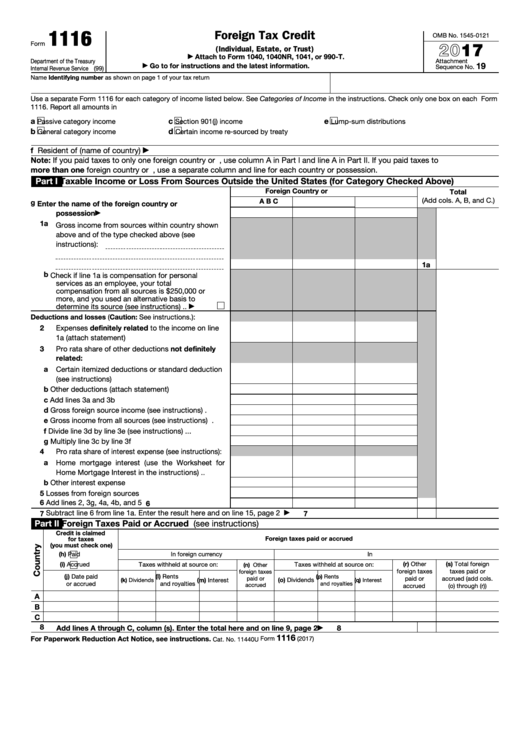

Fillable Form 1116 Foreign Tax Credit (Individual, Estate, Or Trust

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

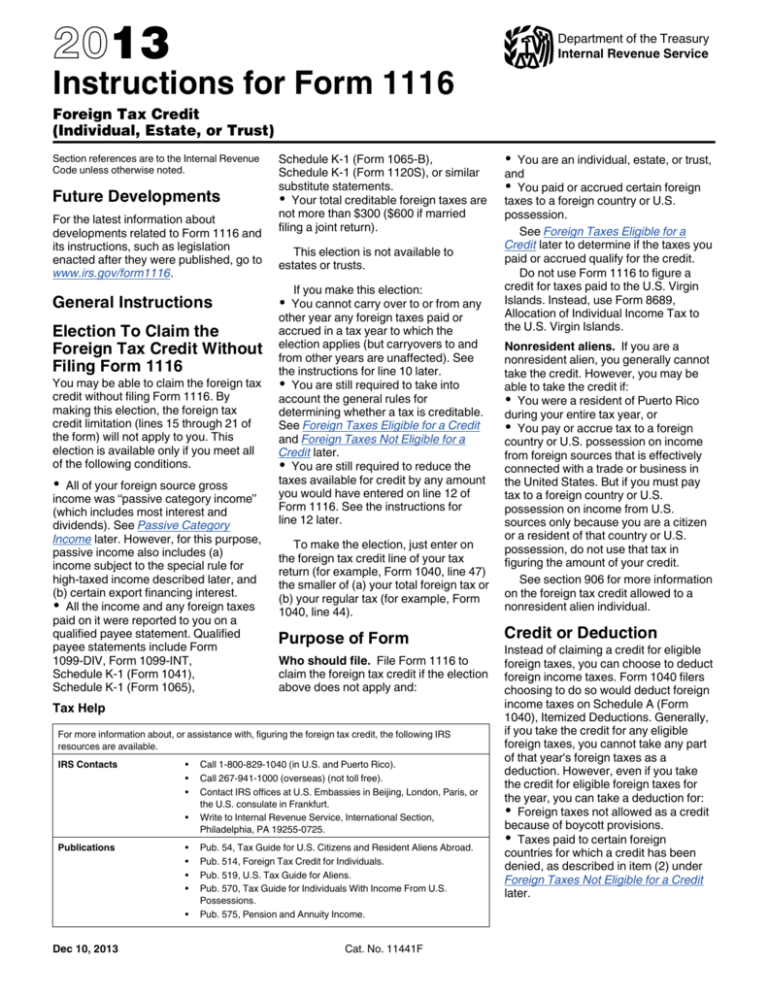

Instructions for Form 1116

IRS Form 1116 Instructions Claiming the Foreign Tax Credit

Form 1116 part 1 instructions

IRS Form 1116 Download Fillable PDF or Fill Online Foreign Tax Credit

Foreign Tax Credit & IRS Form 1116 Explained Greenback Expat Taxes

Related Post: