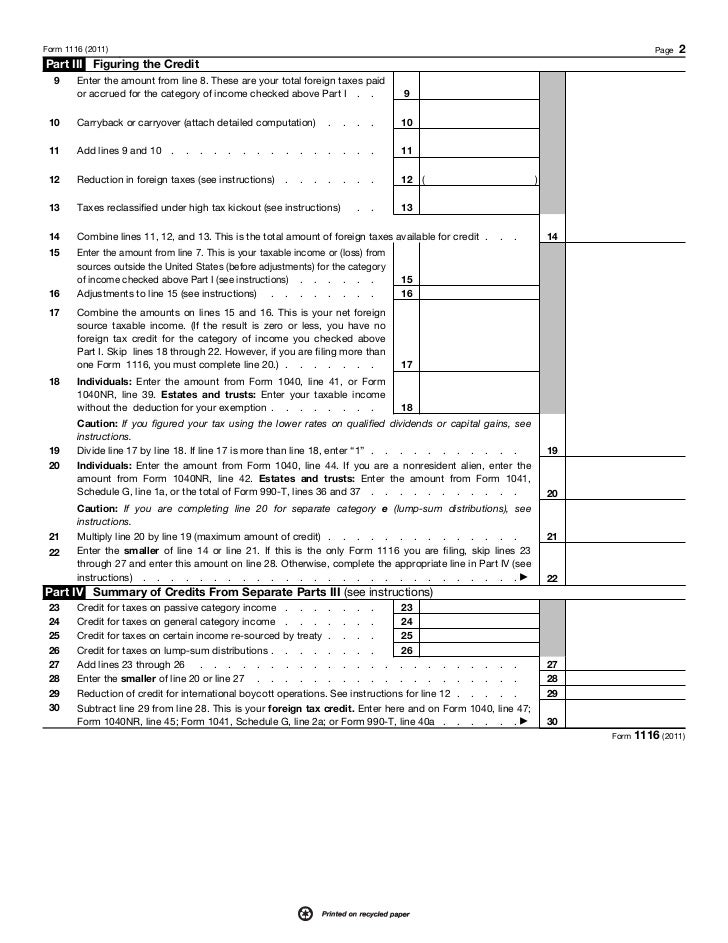

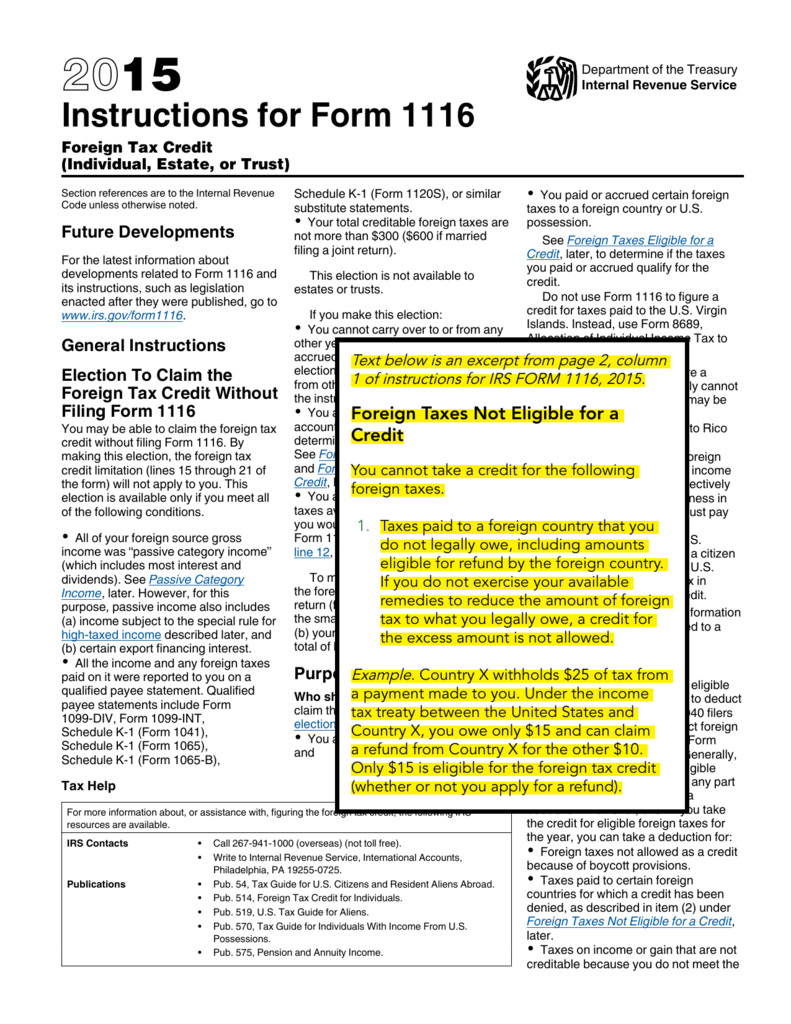

Form 1116 Gross Income From All Sources

Form 1116 Gross Income From All Sources - Web the taxact ® calculation of line 3e gross income from all sources of federal form 1116 foreign tax credit is not necessarily the same amount as reflected on line 6 of. Web can gross foreign source income (line 3d on form 1116) be larger than gross income from all sources (line 3e on form 1116)? Web the amount in form 1116 line a inside the gross income from all sources smart worksheet is inserted by tt. The taxact® calculation of line 3e gross income from all sources of federal form 1116 foreign tax credit is not. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Gross income is all income received in the form of money,. It sounds counterintuitive, yet that is what it comes out being. How does the tax application calculate gross income from all sources reported on form 1116, line 3e? Tax on foreign source income by all or part of the foreign taxes paid or accrued during the year. Web use a separate form 1116 for each category of income listed below. Web can gross foreign source income (line 3d on form 1116) be larger than gross income from all sources (line 3e on form 1116)? Use form 2555 to claim. It sounds counterintuitive, yet that is what it comes out being. It appears that it is corrupted. The taxact® calculation of line 3e gross income from all sources of federal form. Web “gross income from all sources” is a constant amount (that is, you will enter the same amount on line 3e of all forms 1116 that you file). Gross income is all income received in the form of money,. It appears that it is corrupted. For line 1a, the taxpayer must state income that is taxable by the united states. Web use a separate form 1116 for each category of income listed below. The taxact® calculation of line 3e gross income from all sources of federal form 1116 foreign tax credit is not. For lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Web use form 1116 to claim the. For line 1a, the taxpayer must state income that is taxable by the united states and is from sources within the country entered on line i. Web “gross income from all sources” is a constant amount (that is, you will enter the same amount on line 3e of all forms 1116 that you file). Gross income is all income received. Gross income is all income received in the form of money, property, and. Gross income is all income received in the form of money, property, and. Web the taxact ® calculation of line 3e gross income from all sources of federal form 1116 foreign tax credit is not necessarily the same amount as reflected on line 6 of. For lines. The taxact® calculation of line 3e gross income from all sources of federal form 1116 foreign tax credit is not. Web “gross income from all sources” is a constant amount (that is, you will enter the same amount on line 3e of all forms 1116 that you file). Gross income is all income received in the form of money, property,. For line 1a, the taxpayer must state income that is taxable by the united states and is from sources within the country entered on line i. Web the ftc allows a reduction of u.s. For lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Gross income is all income received. Web all of your foreign source gross income was passive category income (which includes most interest and dividends). There is no detailed calculation that i can see anywhere. Web use a separate form 1116 for each category of income listed below. It sounds counterintuitive, yet that is what it comes out being. Web “gross income from all sources” is a. Web “gross income from all sources” is a constant amount (that is, you will enter the same amount on line 3e of all forms 1116 that you file). Web use a separate form 1116 for each category of income listed below. Tax on foreign source income by all or part of the foreign taxes paid or accrued during the year.. Web the taxact ® calculation of line 3e gross income from all sources of federal form 1116 foreign tax credit is not necessarily the same amount as reflected on line 6 of. It appears that it is corrupted. Web “gross income from all sources” is a constant amount (that is, you will enter the same amount on line 3e of. Use form 2555 to claim. Gross income is all income received in the form of money, property, and. Web the ftc allows a reduction of u.s. It appears that it is corrupted. Web how is gross income from all sources reported on form 1116, line 3e calculated? Web per irs instructions for form 1116, on page 16: It sounds counterintuitive, yet that is what it comes out being. Web the taxact ® calculation of line 3e gross income from all sources of federal form 1116 foreign tax credit is not necessarily the same amount as reflected on line 6 of. Web can gross foreign source income (line 3d on form 1116) be larger than gross income from all sources (line 3e on form 1116)? This election is available only if you meet. There is no detailed calculation that i can see anywhere. How does the tax application calculate gross income from all sources reported on form 1116, line 3e? Web use a separate form 1116 for each category of income listed below. Web how does ultratax cs calculate gross income from all sources reported on form 1116, line 3e? The taxact® calculation of line 3e gross income from all sources of federal form 1116 foreign tax credit is not. Web “gross income from all sources” is a constant amount (that is, you will enter the same amount on line 3e of all forms 1116 that you file). Tax on foreign source income by all or part of the foreign taxes paid or accrued during the year. Web the amount in form 1116 line a inside the gross income from all sources smart worksheet is inserted by tt. By making this election, the foreign tax credit limitation (lines 15 through 23 of the form) won't apply to you. Gross income is all income received in the form of money, property, and.US Tax Abroad Expatriate Form 1116

Publication 514, Foreign Tax Credit for Individuals; Simple Example

Instructions for Form 1116

US Tax Abroad Expatriate Form 1116 by Expatriate Tax Returns Issuu

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Form 1116 Fill out & sign online DocHub

Linda Keith CPA » Do I include Foreign Source in Tax Return Cash

Publication 514 Foreign Tax Credit for Individuals; Comprehensive

The Expat's Guide to Form 1116 Foreign Tax Credit

Filing Taxes While Working Abroad — Ambassador Year in China

Related Post: