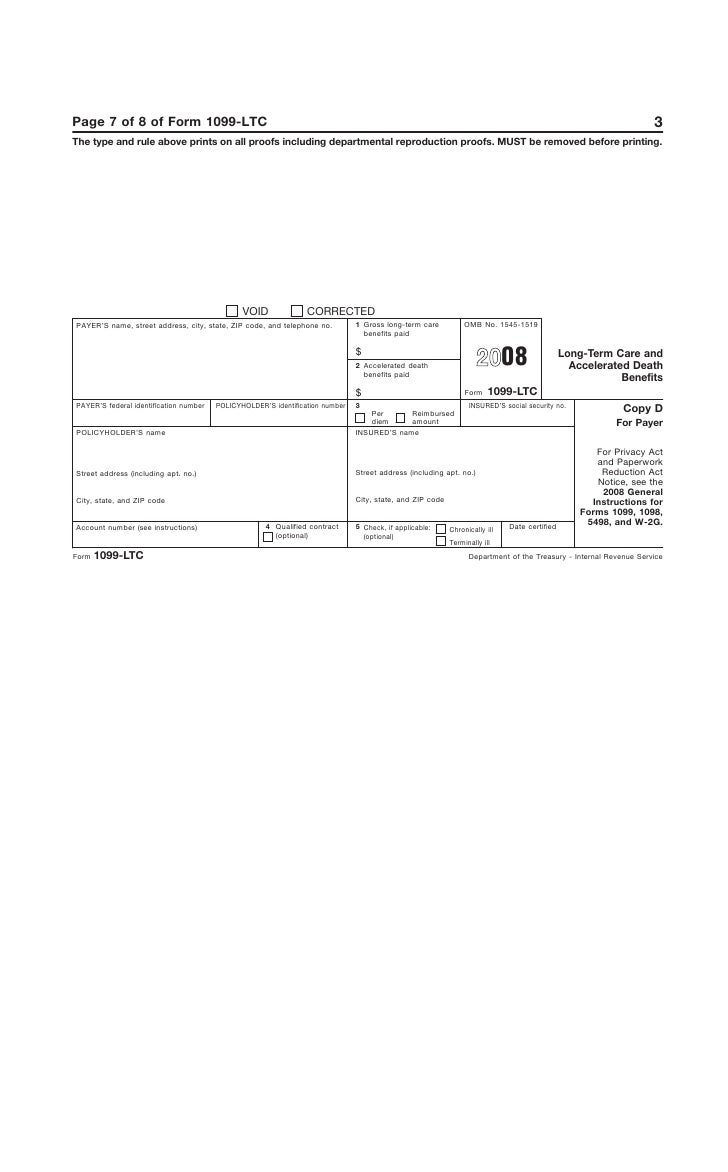

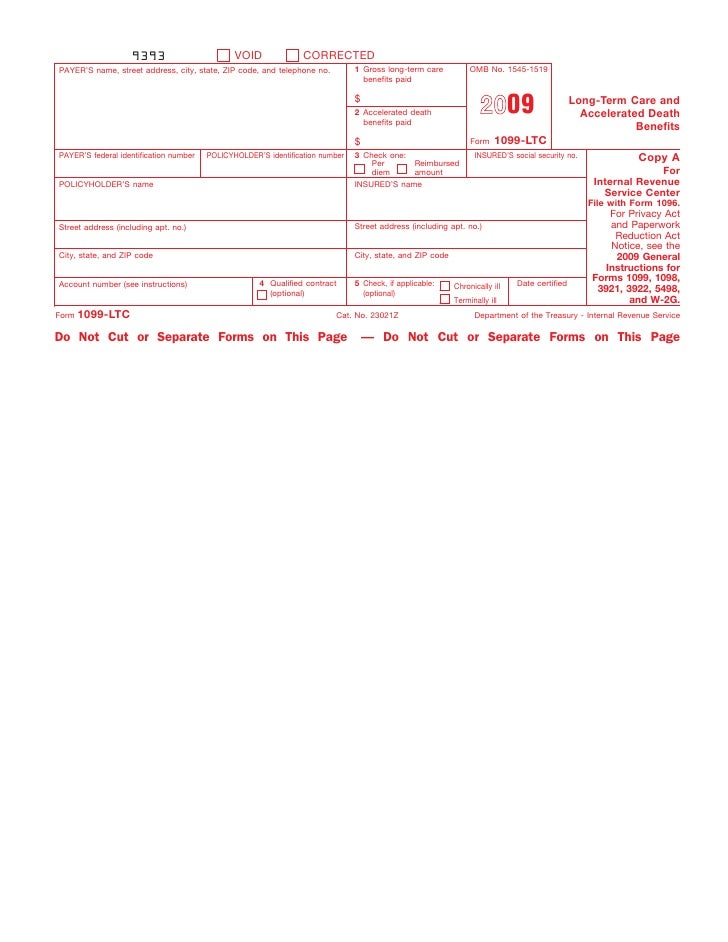

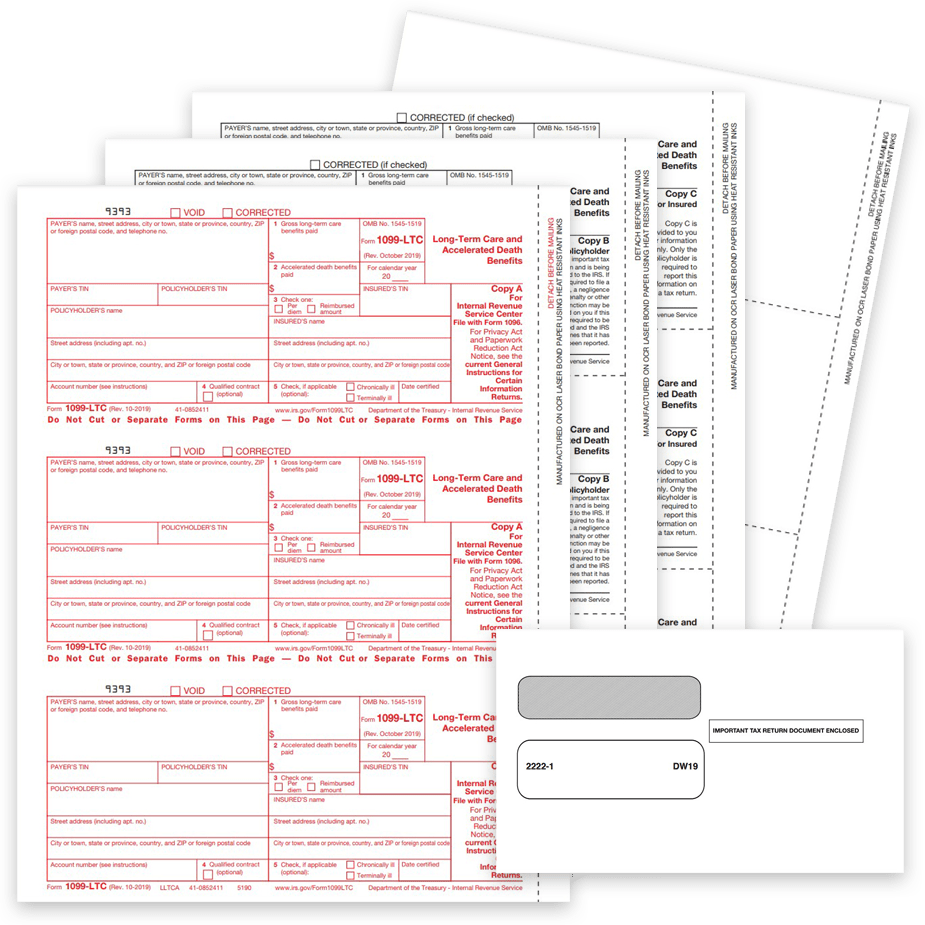

Form 1099-Ltc

Form 1099-Ltc - Web enter all applicable amounts, including the portion of gross from qualified ltc insurance contracts (code 108). Here's how to enter your 1099. Ad shop our selection of 1099 forms, envelopes, and software for tax reporting. Then, on the following screen,. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Order 1099 forms, envelopes, and software today. Go to income/deductions > medical savings accounts. Any payments made under a product that is. Insurance companies usually issue these 1099 ltc forms in january for the prior tax. Ad expatriate tax expert for returns, planning and professional results. Ad approve payroll when you're ready, access employee services & manage it all in one place. Web enter all applicable amounts, including the portion of gross from qualified ltc insurance contracts (code 108). Ad expatriate tax expert for returns, planning and professional results. Then, on the following screen,. Any payments made under a product that is. Ad expatriate tax expert for returns, planning and professional results. Prepare for irs filing deadlines. Box 3 shows if you paid the amount in box 1 or 2 on a per. Thus, amounts (other than dividends or premium refunds). Here's how to enter your 1099. Ad expatriate tax expert for returns, planning and professional results. Web enter all applicable amounts, including the portion of gross from qualified ltc insurance contracts (code 108). Ad expatriate tax expert for returns, planning and professional results. Prepare for irs filing deadlines. Here's how to enter your 1099. Payroll seamlessly integrates with quickbooks® online. Thus, amounts (other than dividends or premium refunds). Ad approve payroll when you're ready, access employee services & manage it all in one place. Insurance companies usually issue these 1099 ltc forms in january for the prior tax. Ad expatriate tax expert for returns, planning and professional results. Any payments made under a product that is. Ad expatriate tax expert for returns, planning and professional results. Prepare for irs filing deadlines. Here's how to enter your 1099. Ad approve payroll when you're ready, access employee services & manage it all in one place. Box 3 shows if you paid the amount in box 1 or 2 on a per. Web enter all applicable amounts, including the portion of gross from qualified ltc insurance contracts (code 108). For internal revenue service center. Thus, amounts (other than dividends or premium refunds). Ad ap leaders rely on iofm’s expertise to keep them up to date on. Prepare for irs filing deadlines. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ad expatriate tax expert for returns, planning and professional results. Enter the amount from box 2 in accelerated death. Box 3 shows if you paid the amount in box 1 or 2 on a per. Here's how to enter your 1099. Iris is a free service that lets you: Web enter all applicable amounts, including the portion of gross from qualified ltc insurance contracts (code 108). Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Submit up to 100 records per. Then, on the following screen,. For internal revenue service center. Any payments made under a product that is. Box 3 shows if you paid the amount in box 1 or 2 on a per. Ad expatriate tax expert for returns, planning and professional results. Insurance companies usually issue these 1099 ltc forms in january for the prior tax. Any payments made under a product that is. Web enter all applicable amounts, including the portion of gross from qualified ltc insurance contracts (code 108). Submit up to 100 records per. Here's how to enter your 1099. Iris is a free service that lets you: Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Ad approve payroll when you're ready, access employee services & manage it all in one place. Then, on the following screen,. Web enter all applicable amounts, including the portion of gross from qualified ltc insurance contracts (code 108). Here's how to enter your 1099. This irs form helps individual taxpayers to report their ltc. Box 3 shows if you paid the amount in box 1 or 2 on a per. Go to income/deductions > medical savings accounts. Payroll seamlessly integrates with quickbooks® online. Any payments made under a product that is. Prepare for irs filing deadlines. Ad expatriate tax expert for returns, planning and professional results. Ad expatriate tax expert for returns, planning and professional results. Thus, amounts (other than dividends or premium refunds). Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ad shop our selection of 1099 forms, envelopes, and software for tax reporting. Enter the amount from box 2 in accelerated death. Insurance companies usually issue these 1099 ltc forms in january for the prior tax. Submit up to 100 records per.Formulário 1099LTC Benefícios de cuidados de longo prazo e morte

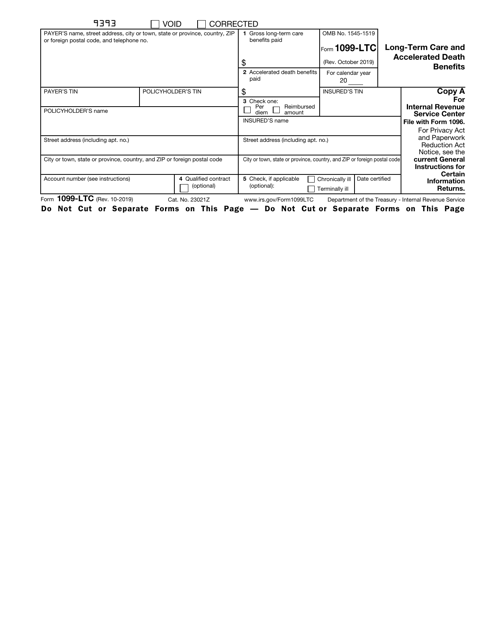

IRS Approved 1099LTC Federal Copy A Tax Form

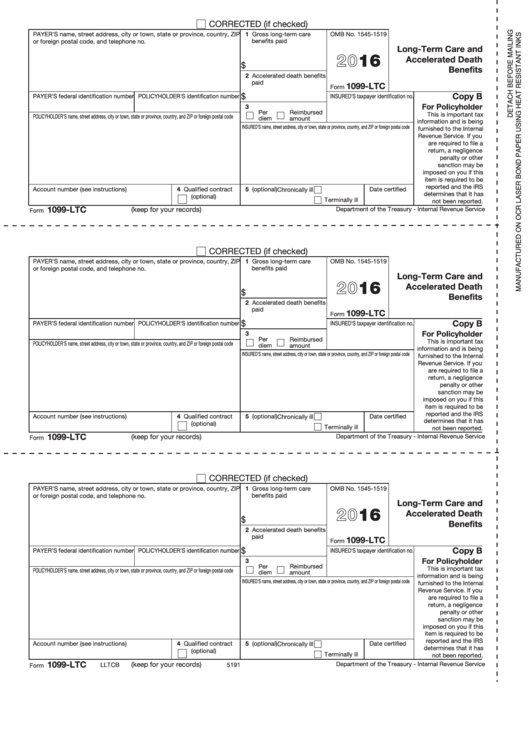

Form 1099Ltc LongTerm Care And Accelerated Death Benefits 2016

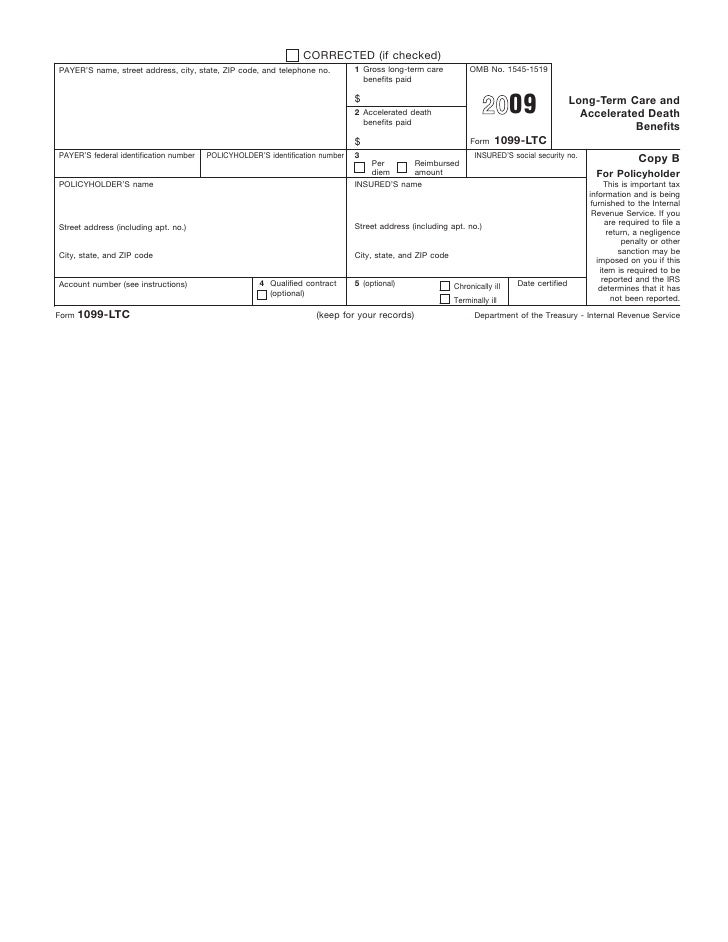

IRS Form 1099LTC Download Fillable PDF or Fill Online Long Term Care

Form 1099LTC Long Term Care and Accelerated Death Benefits

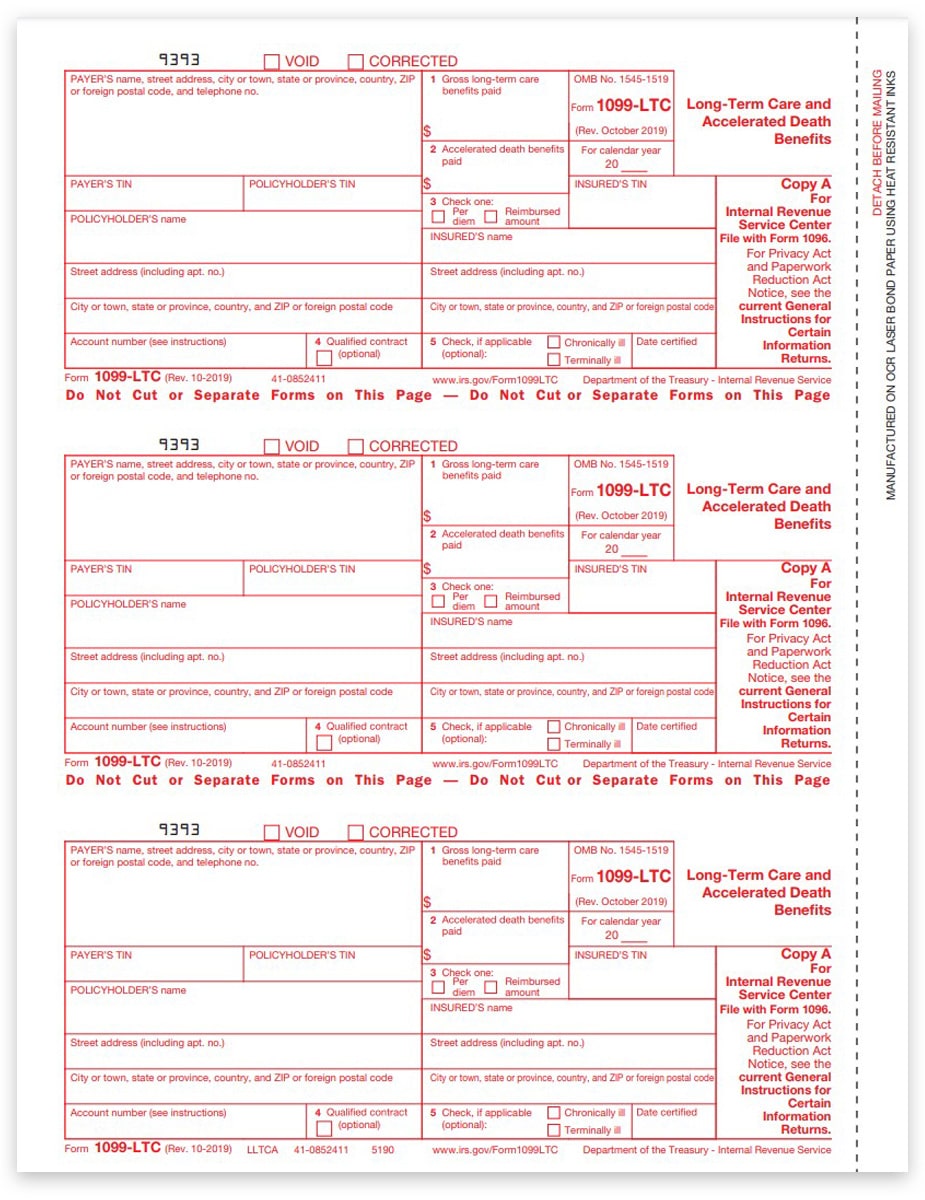

1099LTC Forms for Long Term Care Benefits DiscountTaxForms

Form 1099LTCLong Term Care and Accelerated Death Benefits

Form 1099LTC Long Term Care and Accelerated Death Benefits

John hancock 1099ltc Fill online, Printable, Fillable Blank

1099LTC Forms for LongTerm Care & Benefits DiscountTaxForms

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.59.31AM-16c4406790a34c33b8850b5af06d2ae7.png)