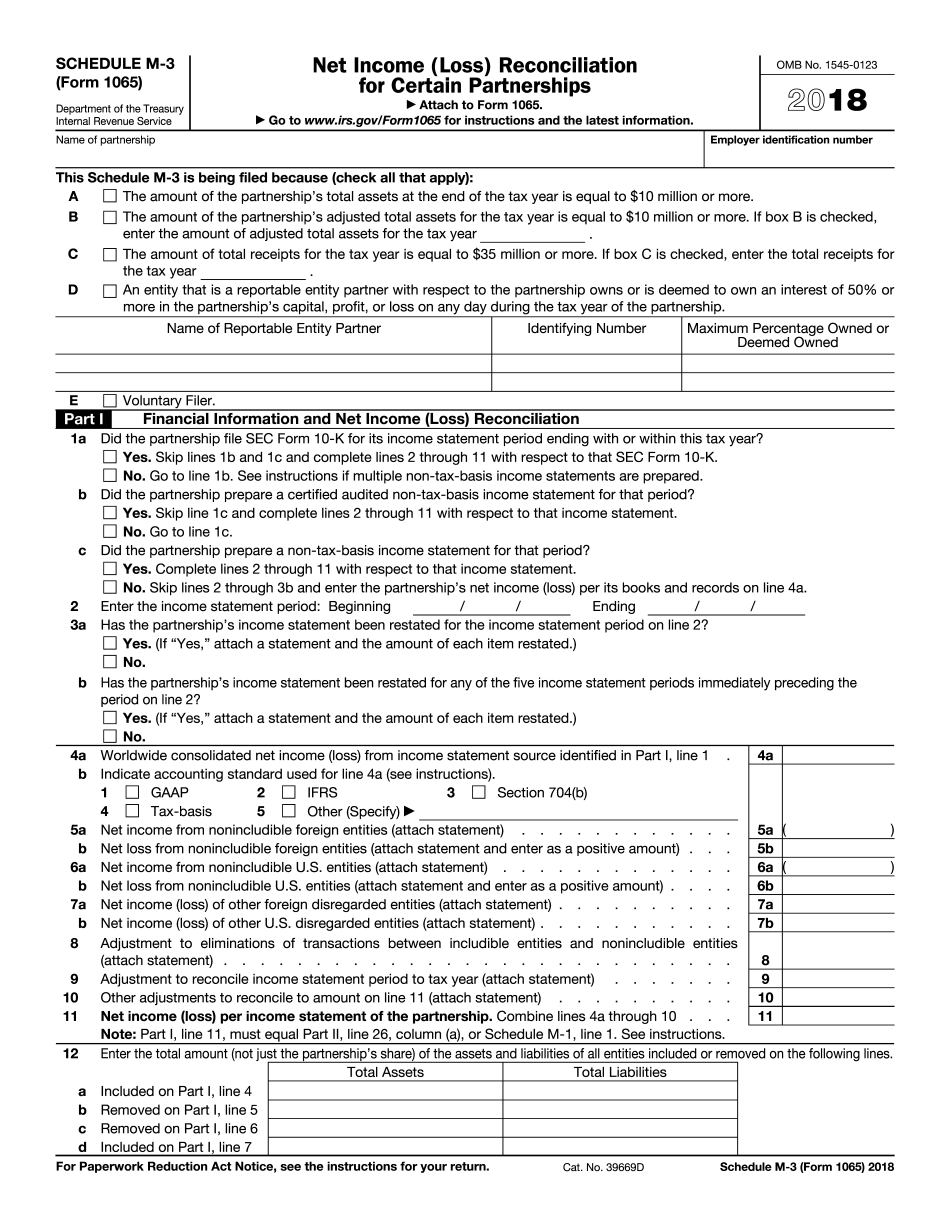

Form 1065 Schedule M 3

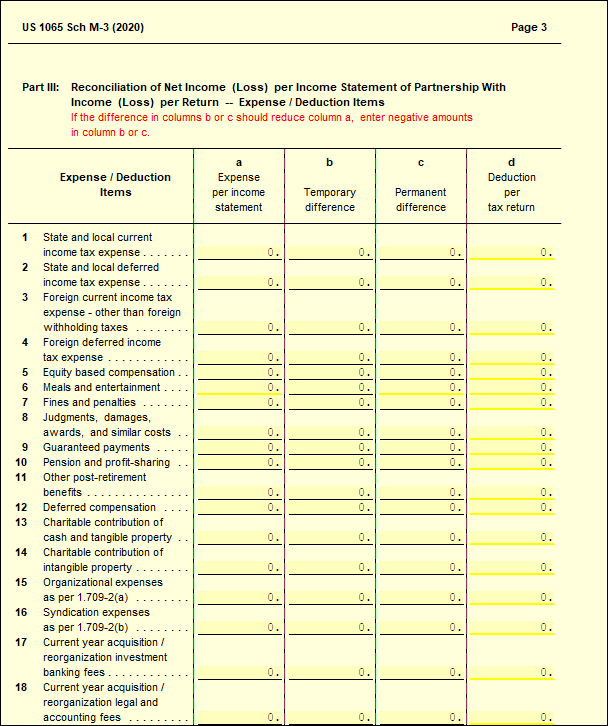

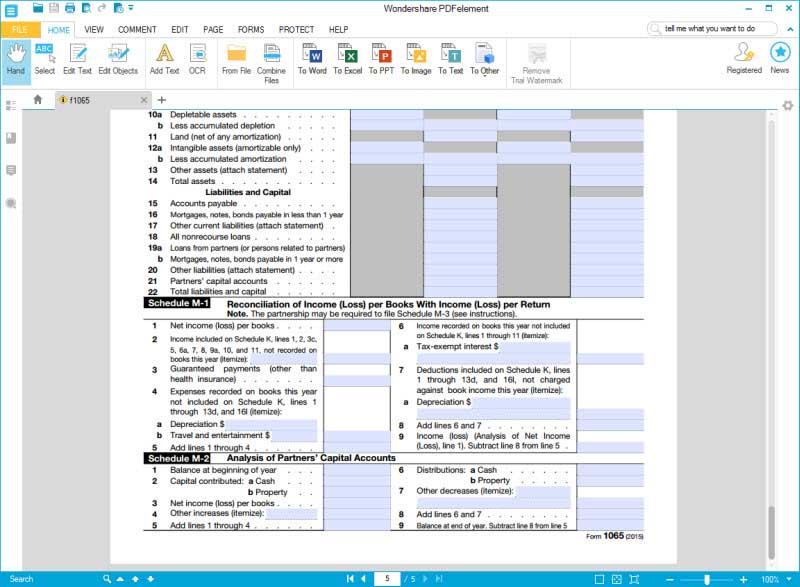

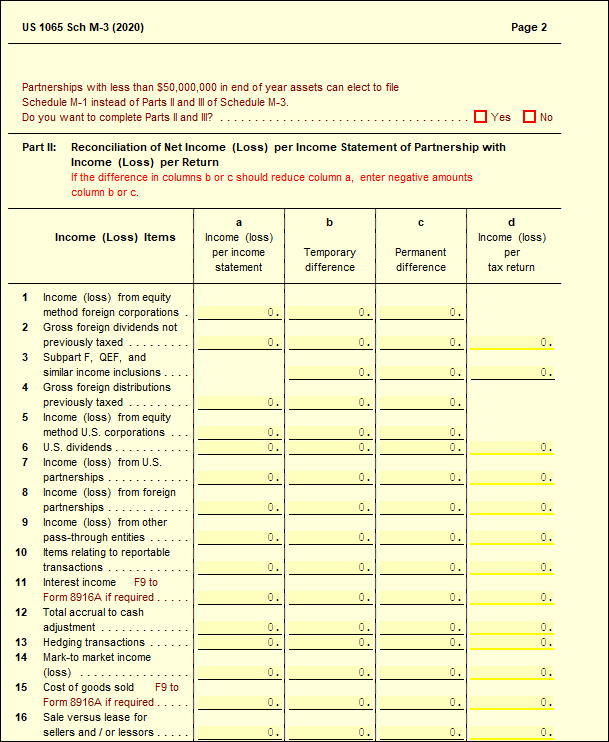

Form 1065 Schedule M 3 - Web see schedule b, question 6; Reconciliation of net income (loss) per income. Form 1065 requires a variety of financial documents. Web line 26, column (a), must equal part i, line 11, and column (d) must equal form 1065, analysis of net income (loss), line 1. We last updated the net income (loss) reconciliation for certain partnerships in february 2023,. Complete, edit or print tax forms instantly. Web file form 1065 annually, by the 15th of the third month of the following tax year. File it electronically or by mail. December 2021) net income (loss) reconciliation for certain partnerships department of the treasury internal revenue service attach to. For additional details about the. Click on the get form. While in a return, use the add. Web line 26, column (a), must equal part i, line 11, and column (d) must equal form 1065, analysis of net income (loss), line 1. The amount of total assets at the end of the tax year reported on schedule l is greater than or equal to $10. Complete, edit or print tax forms instantly. Web what is the form used for? The amount of total assets at the end of the tax year reported on. How to access the form: While in a return, use the add. For instructions and the latest. Reconciliation of net income (loss) per income. File it electronically or by mail. How to access the form: Department of the treasury internal revenue service. Web what is the form used for? Click on the get form. Web file form 1065 annually, by the 15th of the third month of the following tax year. We last updated the net income (loss) reconciliation for certain partnerships in february 2023,. For additional details about the. How to access the form: Click on the get form. Web see schedule b, question 6; While in a return, use the add. Ad get ready for tax season deadlines by completing any required tax forms today. We last updated the net income (loss) reconciliation for certain partnerships in february 2023,. Choose the template you require from the library of legal forms. The amount of total assets at the end of the tax year reported on schedule l is greater than or equal to $10 million. Complete, edit or print tax forms instantly. Web see schedule b,. Web line 26, column (a), must equal part i, line 11, and column (d) must equal form 1065, analysis of net income (loss), line 1. Click on the get form. We last updated the net income (loss) reconciliation for certain partnerships in february 2023,. File it electronically or by mail. The amount of total assets at the end of the. December 2021) net income (loss) reconciliation for certain partnerships department of the treasury internal revenue service attach to. For additional details about the. A partnership must complete parts ii and iii if ending total assets are $50 million or more. Web file form 1065 annually, by the 15th of the third month of the following tax year. Complete, edit or. Web line 26, column (a), must equal part i, line 11, and column (d) must equal form 1065, analysis of net income (loss), line 1. Ad get ready for tax season deadlines by completing any required tax forms today. While in a return, use the add. Department of the treasury internal revenue service. Web what is the form used for? Reconciliation of net income (loss) per income. Choose the template you require from the library of legal forms. For additional details about the. For instructions and the latest. December 2021) net income (loss) reconciliation for certain partnerships department of the treasury internal revenue service attach to. While in a return, use the add. How to access the form: The amount of total assets at the end of the tax year reported on. Click on the get form. For additional details about the. A partnership must complete parts ii and iii if ending total assets are $50 million or more. Reconciliation of net income (loss) per income. We last updated the net income (loss) reconciliation for certain partnerships in february 2023,. December 2021) net income (loss) reconciliation for certain partnerships department of the treasury internal revenue service attach to. Web line 26, column (a), must equal part i, line 11, and column (d) must equal form 1065, analysis of net income (loss), line 1. File it electronically or by mail. Web see schedule b, question 6; Department of the treasury internal revenue service. Form 1065 requires a variety of financial documents. The amount of total assets at the end of the tax year reported on schedule l is greater than or equal to $10 million. Web file form 1065 annually, by the 15th of the third month of the following tax year. Choose the template you require from the library of legal forms. For instructions and the latest. Complete, edit or print tax forms instantly. Web what is the form used for?How to fill out an LLC 1065 IRS Tax form

Fill Free fillable F1065sm3 Accessible 2019 Schedule M3 (Form 1065

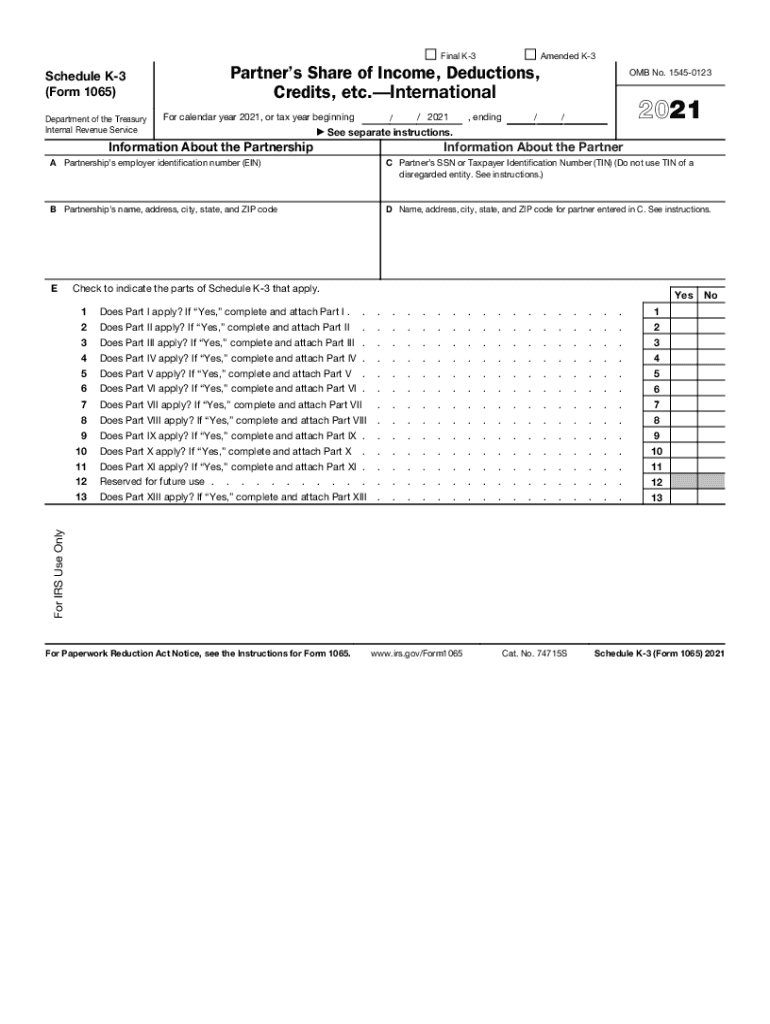

IRS 1065 Schedule K3 20212022 Fill and Sign Printable Template

Schedule M3 (1065) Net (Loss) Reconciliation for Partnerships

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

IRS Form 1065 How to fill it With the Best Form Filler

Form 1065 (Schedule C) Additional Information for Schedule M3 Filers

Schedule M3 (1065) Net (Loss) Reconciliation for Partnerships

IRS Form 1065 (Schedule M3) 2018 2019 Fill out and Edit Online PDF

IRS Form 1065 (2020) U.S. Return of Partnership

Related Post: