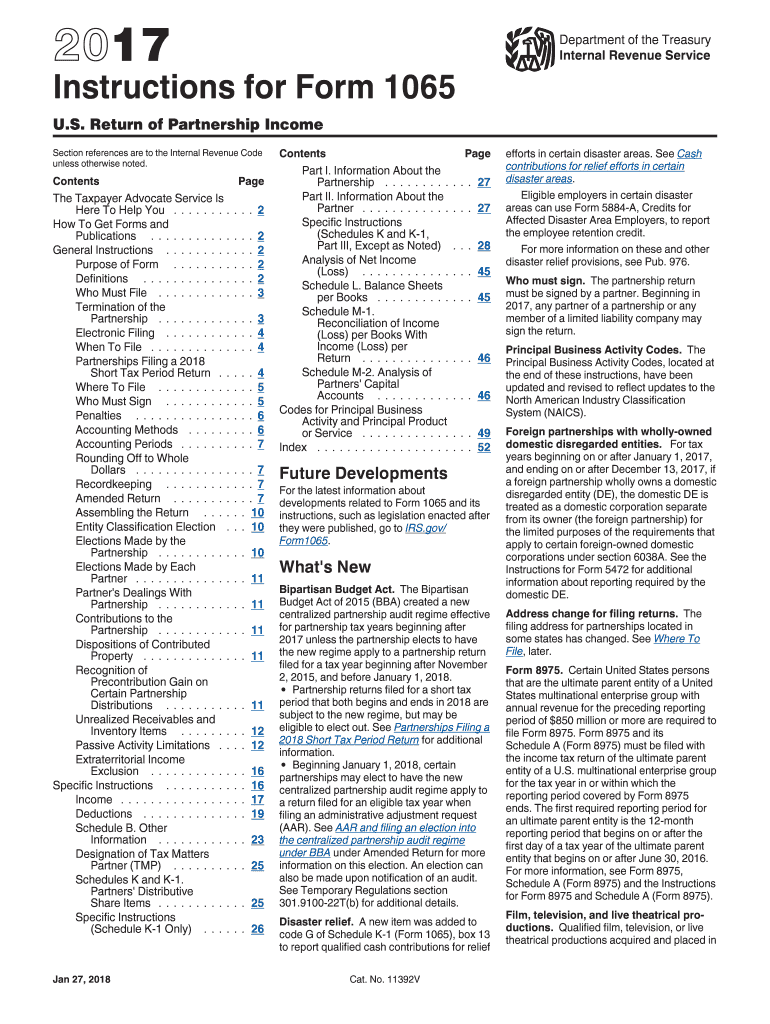

Form 1065 Schedule M-2 Instructions

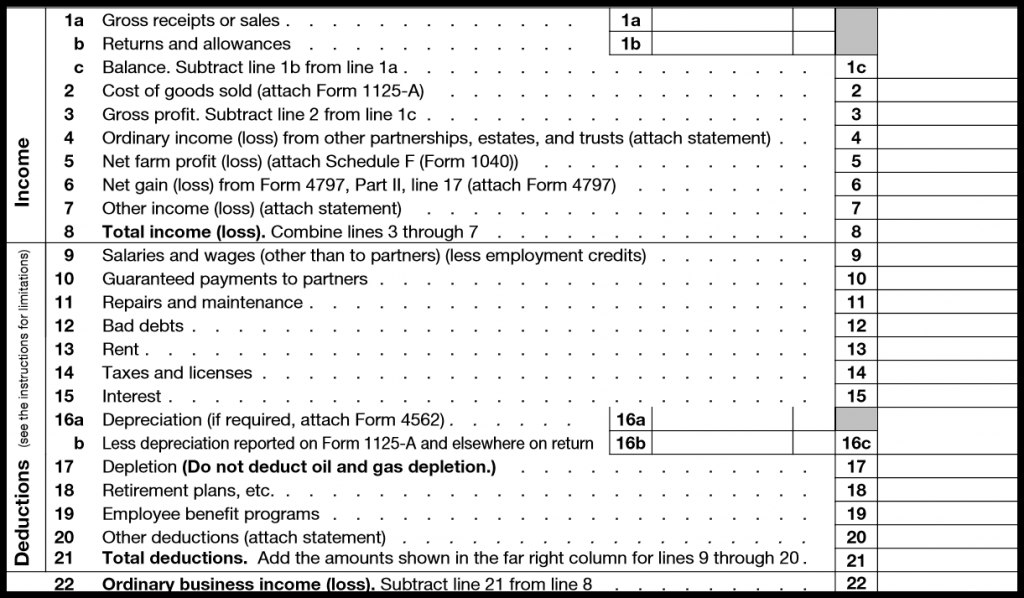

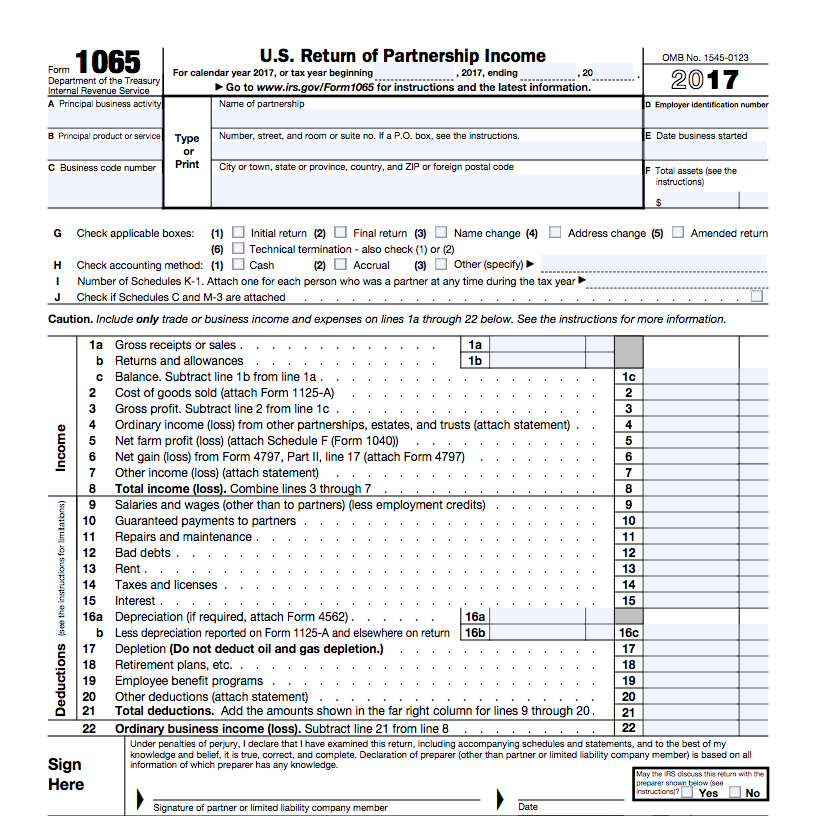

Form 1065 Schedule M-2 Instructions - Ad file partnership and llc form 1065 fed and state taxes with taxact® business. December 2021) net income (loss) reconciliation. Again, it the income or (loss). The 2022 form 1065 may also be used if: Web in form 1065, u.s. Web solved•by intuit•6•updated january 11, 2023. Return of partnership income where the partnership reports to the irs what. Analysis of partners' capital accounts.54 codes for. The partnership has a tax year of less than 12 months that begins. Part i, line 11, must equal part ii, line 26, column (a); Web solved•by intuit•6•updated january 11, 2023. The 2022 form 1065 may also be used if: It is the partner's responsibility to. Taxact® business 1065 (2022 online edition) is the easiest way to file a 1065! Web go to www.irs.gov/form1065 for instructions and the latest information. Taxact® business 1065 (2022 online edition) is the easiest way to file a 1065! Part i, line 11, must equal part ii, line 26, column (a); This line has gone through a few changes in the past years,. The partnership has a tax year of less than 12 months that begins. Part i, line 11, must equal part ii, line. This article will help provide answers to frequently asked questions regarding the partnership capital account analysis. Analysis of partners' capital accounts.54 codes for. The partnership has a tax year of less than 12 months that begins. Part i, line 11, must equal part ii, line 26, column (a); Taxact® business 1065 (2022 online edition) is the easiest way to file. Web solved•by intuit•6•updated january 11, 2023. 12 enter the total amount (not just the partnership’s share) of. The 2022 form 1065 may also be used if: Part i, line 11, must equal part ii, line 26, column (a); Part i, line 11, must equal part ii, line 26, column (a); Web www.irs.gov/form1065 for instructions and the latest information. Web in form 1065, u.s. It is the partner's responsibility to. Analysis of partners' capital accounts.54 codes for. 12 enter the total amount (not just the partnership’s share) of. The 2022 form 1065 may also be used if: The partnership has a tax year of less than 12 months that begins. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate. This line has gone through a few changes in the past. Return of partnership income where the partnership reports to the irs what. Part i, line 11, must equal part ii, line 26, column (a); Again, it the income or (loss). Part i, line 11, must equal part ii, line 26, column (a); This line has gone through a few changes in the past years,. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate. Web solved•by intuit•6•updated january 11, 2023. Web go to www.irs.gov/form1065 for instructions and the latest information. It is the partner's responsibility to. The partnership has a tax year of less than 12 months. Return of partnership income where the partnership reports to the irs what. Web go to www.irs.gov/form1065 for instructions and the latest information. Analysis of partners' capital accounts.54 codes for. This article will help provide answers to frequently asked questions regarding the partnership capital account analysis. Web according to the irs’s form 1065 instructions, if you answered yes to question 4. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate. Again, it the income or (loss). December 2021) net income (loss) reconciliation. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. This article will help provide answers to. Instead, file schedule h (form 1120), section 280h limitations for a personal. Web according to the irs’s form 1065 instructions, if you answered yes to question 4 in schedule b, you don’t have to fill out schedule l or the remaining. The 2022 form 1065 may also be used if: Again, it the income or (loss). 12 enter the total amount (not just the partnership’s share) of. The partnership has a tax year of less than 12 months that begins. Web in form 1065, u.s. This article will help provide answers to frequently asked questions regarding the partnership capital account analysis. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web solved•by intuit•6•updated january 11, 2023. Web go to www.irs.gov/form1065 for instructions and the latest information. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate. Return of partnership income where the partnership reports to the irs what. Part i, line 11, must equal part ii, line 26, column (a); Analysis of partners' capital accounts.54 codes for. This line has gone through a few changes in the past years,. December 2021) net income (loss) reconciliation. Part i, line 11, must equal part ii, line 26, column (a); It is the partner's responsibility to. Web www.irs.gov/form1065 for instructions and the latest information.Form 1065 Instructions Fill Out and Sign Printable PDF Template signNow

Form 1065 Instructions in 8 Steps (+ Free Checklist)

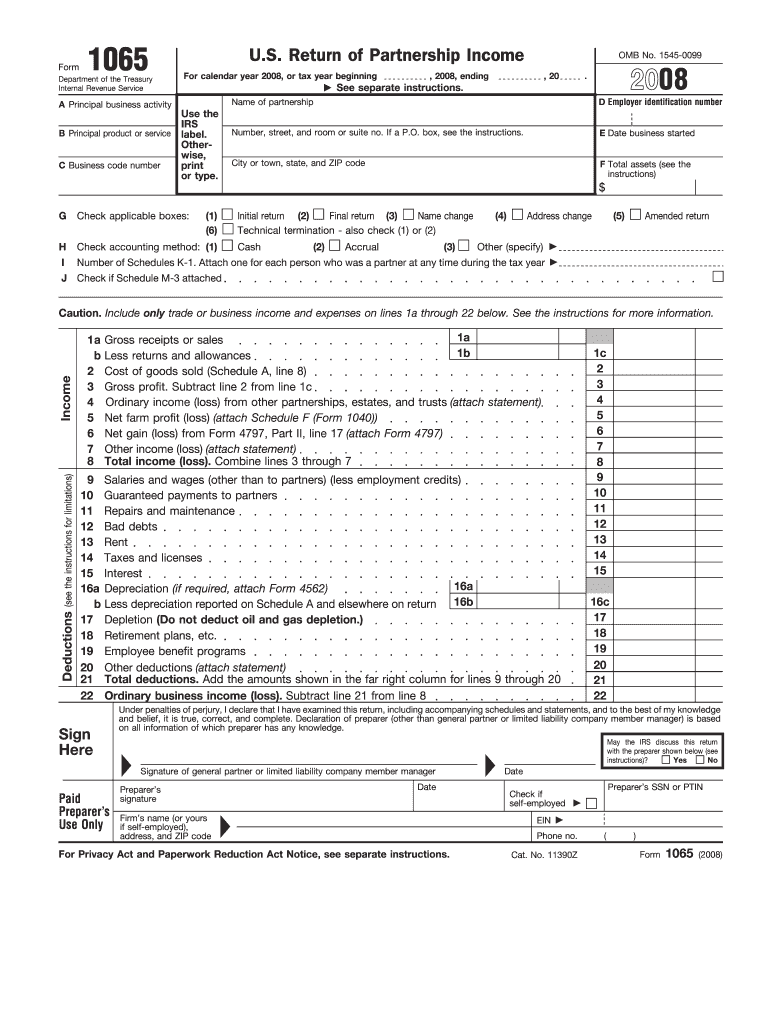

Irs 1065 2008 form Fill out & sign online DocHub

How To Fill Out Form 1065 Overview and Instructions Bench Accounting

1065 tax instructions gridlasopa

How to fill out an LLC 1065 IRS Tax form

What is Form 1120S and How Do I File It? Ask Gusto

Example form 1065 filled out docfer

IRS Form 1065 Instructions StepbyStep Guide NerdWallet (2022)

How to fill out an LLC 1065 IRS Tax form

Related Post: