Form 1045 Instructions

Form 1045 Instructions - Don't include form 1045 in the same envelope as your 2022 income tax return. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts. For individuals, estates, or trusts. You may only file by fax if you're filing form 1045 to apply for tentative refunds for changes in the nol rules under the cares act. Web file form 1045 with the internal revenue service center for the place where you live as shown in the instructions for your 2022 income tax return. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web you file form 1045. Ad access irs tax forms. Web the irs uses form 1045 to process tentative refunds for individual taxpayers. Ad access irs tax forms. Department of the treasury internal revenue service. Separate instructions and additional information are available at. Web you file form 1045. This form is to request a refund of overpayment of tax liability, and must file. Web this article will assist you with entering form 1045, application for tentative refund, in the individual module of intuit proconnect. Department of the treasury internal revenue service. Department of the treasury internal revenue service. From within your taxact return ( online ), click the tools dropdown, then click forms assistant. Web if you have certain net operating losses, tax. Web if you have certain net operating losses, tax overpayments, or business credits that you can carryback to prior tax years, you may be able to apply for a. Form 1045 is used to apply for a refund after. Easily fill out pdf blank, edit, and sign them. Department of the treasury internal revenue service. Web the irs uses form. Department of the treasury internal revenue service. Web this article will assist you with entering form 1045, application for tentative refund, in the individual module of intuit proconnect. Web file form 1045 with the internal revenue service center for the place where you live as shown in the instructions for your 2022 income tax return. Get ready for tax season. Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. Web if you have certain net operating losses, tax overpayments, or business credits that you can carryback to prior tax years, you may be able to apply for a. For individuals, estates, or trusts. Form 1045 isn't supported in proseries basic. Complete, edit or print tax forms instantly. Web the irs uses form 1045 to process tentative refunds for individual taxpayers. If you carry back any portion of an unused nol or general business credit to tax years before the 3 years preceding the 2020 tax year, you. Web up to 10% cash back individuals file a tentative refund claim on. Web this article will assist you with entering form 1045, application for tentative refund, in the individual module of intuit proconnect. Web the irs provides form 1045 so that taxpayers may file for a quick refund of previous years' tax resulting from an nol that was generated on a later year return. Complete, edit or print tax forms instantly. You. Department of the treasury internal revenue service. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year. You may only file by fax if you're filing form 1045 to apply for tentative refunds for changes in the. For purposes of column (a), if the ale member offered. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year. Web the irs uses form 1045 to process tentative refunds for individual taxpayers. From within your taxact. Web file form 1045 with the internal revenue service center for the place where you live as shown in the instructions for your 2022 income tax return. Get ready for tax season deadlines by completing any required tax forms today. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts. You. For individuals, estates, or trusts. Department of the treasury internal revenue service. If you carry back any portion of an unused nol or general business credit to tax years before the 3 years preceding the 2020 tax year, you. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts. Ad access irs tax forms. Web the irs provides form 1045 so that taxpayers may file for a quick refund of previous years' tax resulting from an nol that was generated on a later year return. Department of the treasury internal revenue service. Web complete irs instruction 1045 2020 online with us legal forms. Web if you have certain net operating losses, tax overpayments, or business credits that you can carryback to prior tax years, you may be able to apply for a. Web the irs uses form 1045 to process tentative refunds for individual taxpayers. Separate instructions and additional information are available at. For purposes of column (a), if the ale member offered. Get ready for tax season deadlines by completing any required tax forms today. Web file form 1045 with the internal revenue service center for the place where you live as shown in the instructions for your 2022 income tax return. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year. Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly. From within your taxact return ( online ), click the tools dropdown, then click forms assistant.Instructions For Form 1045 Application For Tentative Refund 2000

Instructions for Form 1045 IRS Gov Irs Fill Out and Sign Printable

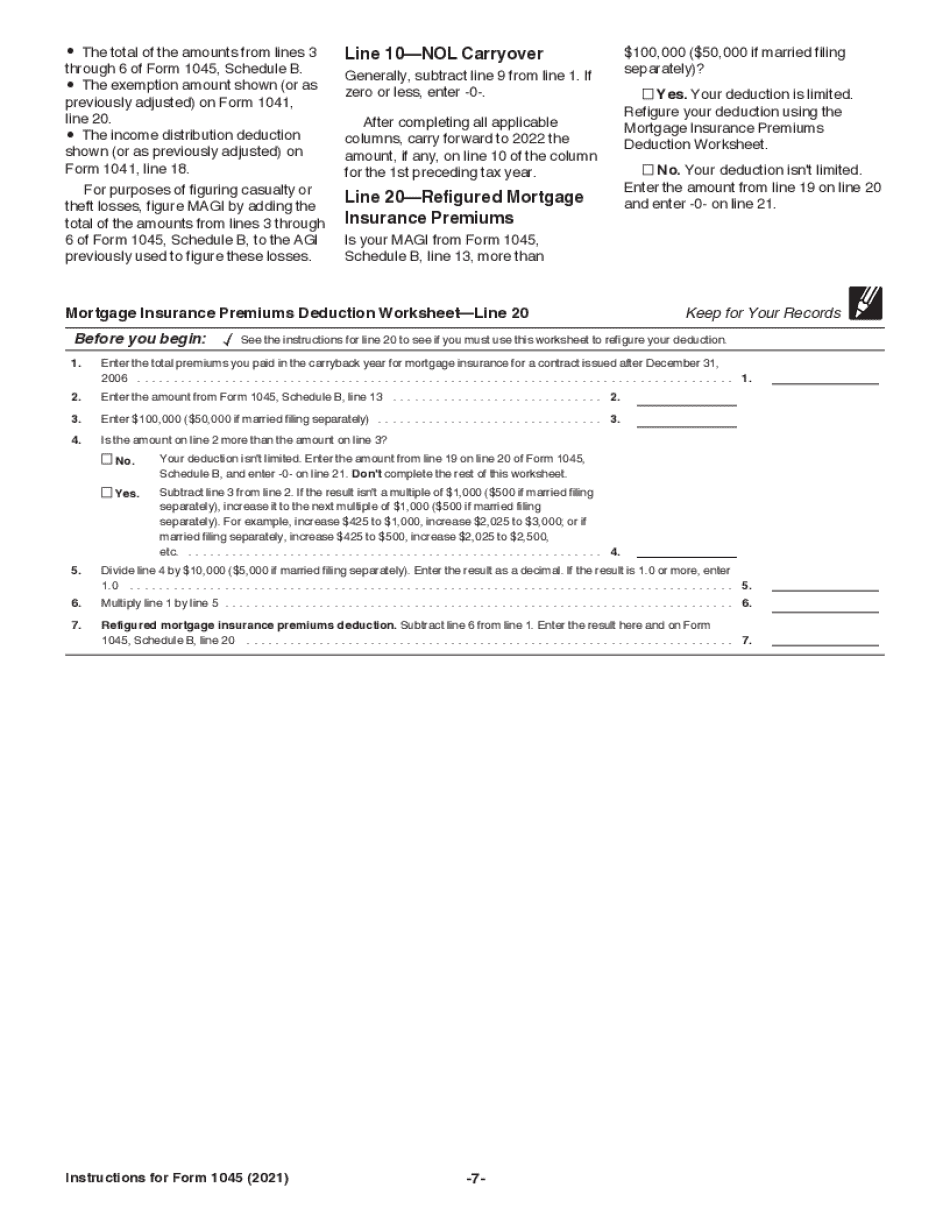

20212023 form 1045 instructions Fill online, Printable, Fillable Blank

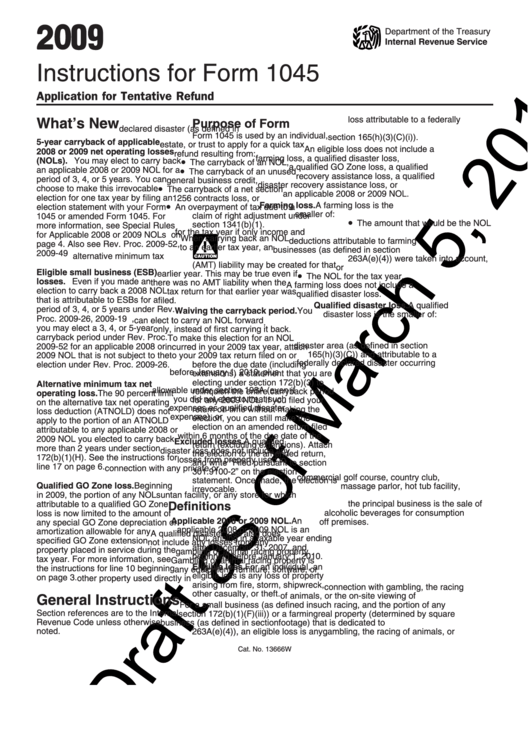

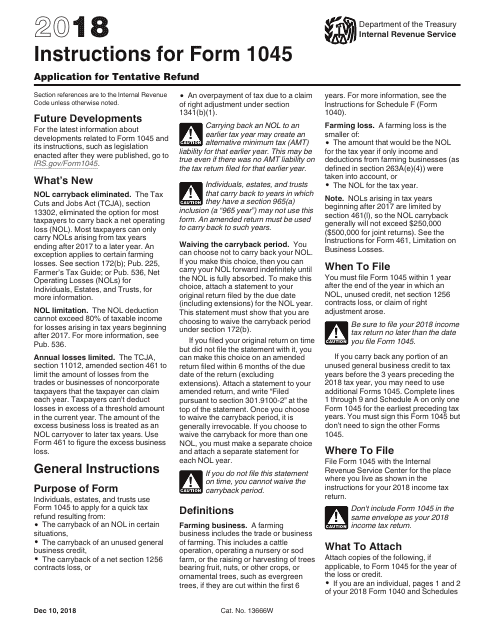

Instructions For Form 1045 Application For Tentative Refund 2009

Instructions For Form 1045 Application For Tentative Refund 2009

form 1045 instructions 20202022 Fill Online, Printable, Fillable

Publication 536 Net Operating Losses for Individuals, Estates, and

Download Instructions for IRS Form 1045 Application for Tentative

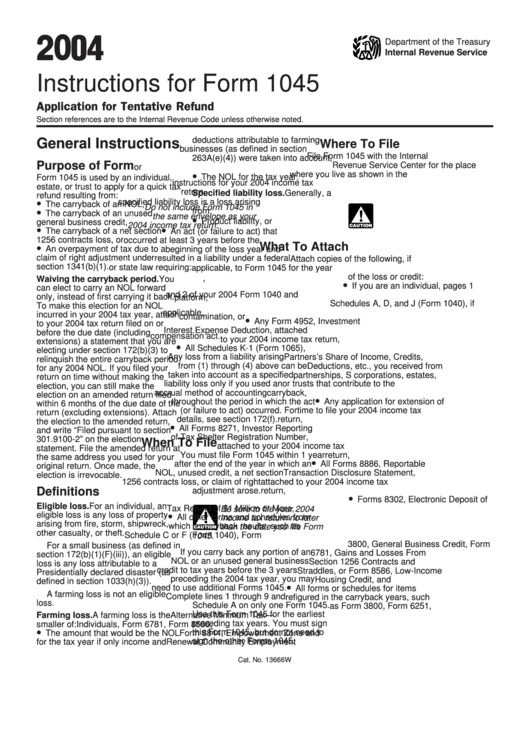

Instructions For Form 1045 2004 printable pdf download

Fillable Online tax ny Form FT945/1045I5/16Instructions for Form FT

Related Post: