Form 1042 Instructions

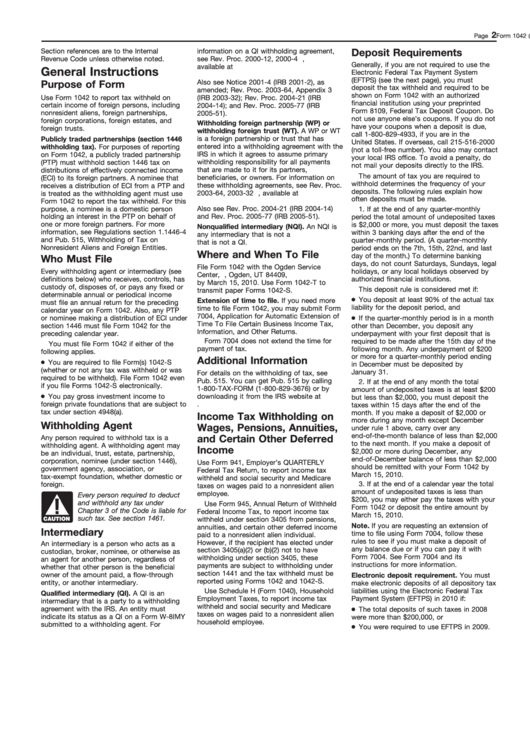

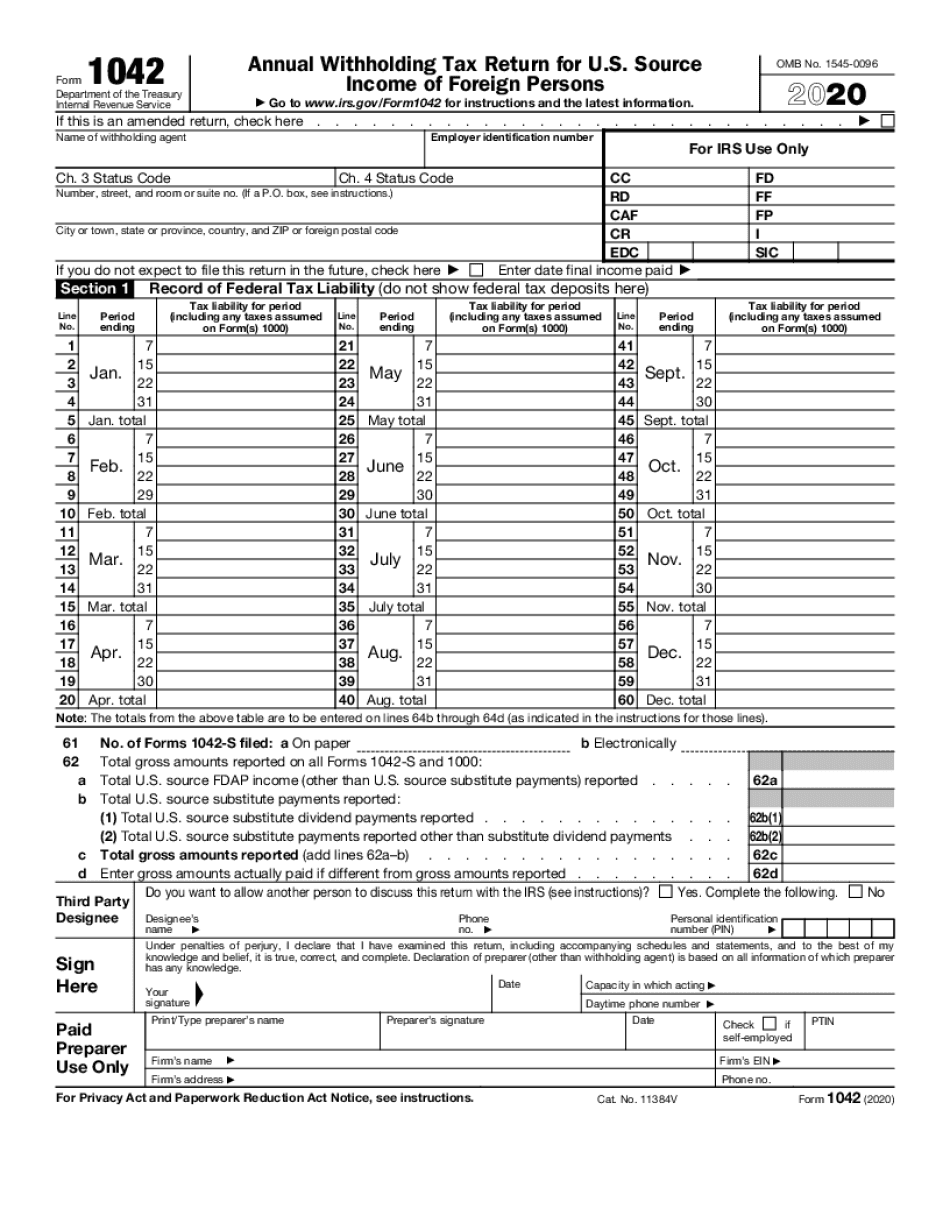

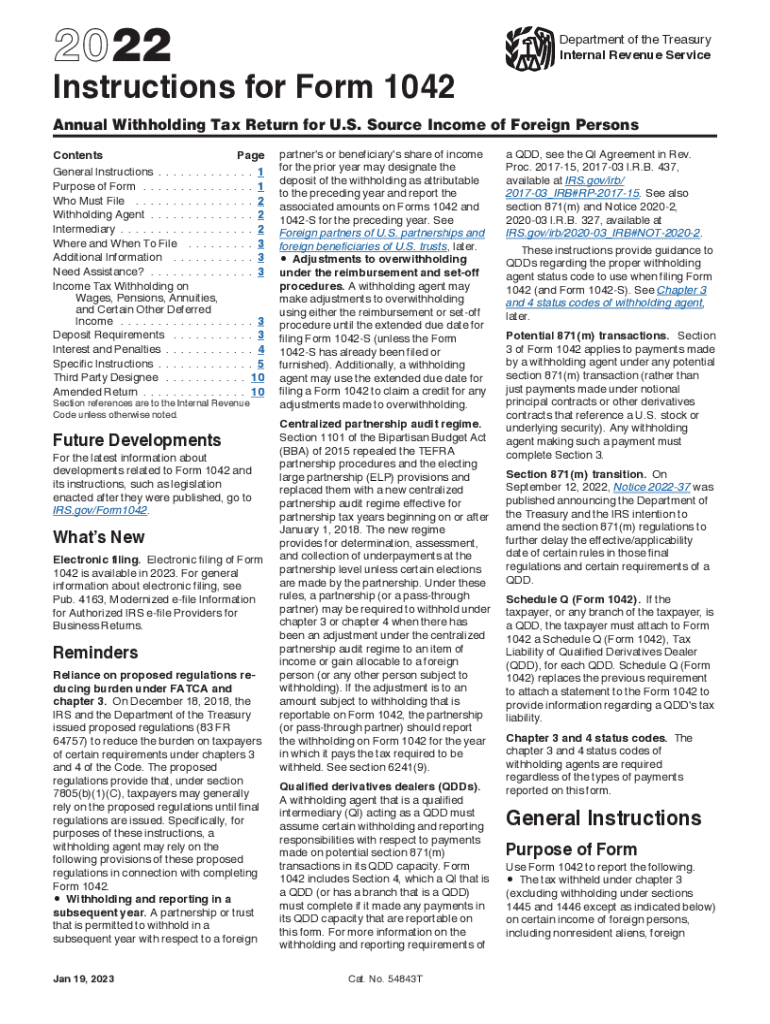

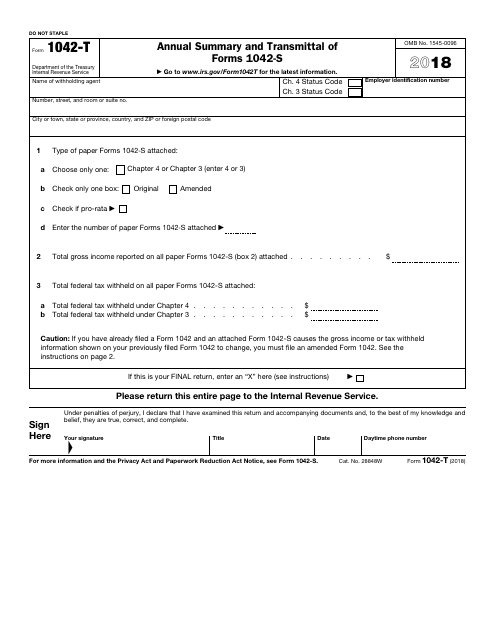

Form 1042 Instructions - Compared to the draft released nov. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Department of the treasury internal revenue service. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. A withholding agent must ensure that all required fields are completed. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Source income of foreign persons, via modernized e. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. Annual withholding tax return for u.s. A 1042 is required even if no tax was. Source income of foreign persons. Web use form 1042 to report the following. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Web every. Form 1042, also annual withholding tax return for u.s. Compared to the draft released nov. Department of the treasury internal revenue service. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the. Source income of foreign persons, via modernized e. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Annual withholding tax return for u.s. Web the form 1042 is also mailed to the same address. Web every withholding agent, whether u.s. Source income subject to withholding electronically,. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Compared to the draft released nov. Web the form 1042 is also mailed to the same address. Web you must file form 1042 if any of the following apply. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. A 1042 is required even if no tax was. Web use form 1042 to report. Form 1042, also annual withholding tax return for u.s. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships,. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. The tax withheld under chapter 3. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Withholding agents comply with their reporting and. Form 1042, also annual withholding tax return for u.s. Department of the treasury internal revenue service. A 1042 is required even if no tax was. Department of the treasury internal revenue service. Annual withholding tax return for u.s. Form 1042, also annual withholding tax return for u.s. Web every withholding agent, whether u.s. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Source income subject to withholding electronically,. Department of the treasury internal revenue service. A 1042 is required even if no tax was. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446. Web the form 1042 is also mailed to the same address. Source income of foreign persons. Form 1042, also annual withholding tax return for u.s. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships,. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Annual withholding tax return for u.s. Department of the treasury internal revenue service. Web final instructions for the 2022 form 1042 were released jan. 24 by the internal revenue service. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. Source income of foreign persons, via modernized e. A 1042 is required even if no tax was. Web you must file form 1042 if any of the following apply. Web every withholding agent, whether u.s. Source income of foreign persons. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships,. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Form 1042, also annual withholding tax return for u.s. Web use form 1042 to report the following. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income subject to withholding electronically,. Withholding agents comply with their reporting and. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the.Form 1042 General And Specific Instructions printable pdf download

Understanding your 1042S » Payroll Boston University

2020 Form 1042 Fill Out and Sign Printable PDF Template signNow

Instruction 1042 Fill Out and Sign Printable PDF Template signNow

1042t instructions 2017

IRS Form 1042T Download Fillable PDF or Fill Online Annual Summary and

Online Form 1042S 2018 Instructions Fill Out and Sign Printable PDF

Form 1042S It's Your Yale

Form Instruction 1042S Fill Online, Printable, Fillable Blank form

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Related Post: