Form 1041 Tax Software

Form 1041 Tax Software - Web up to 10% cash back documents received. See form 2441, line 8, for the 2022. Ad integrate book keeping with all your operations to avoid double entry. Income tax return for estates and trusts is generally used to report the income, gains, losses, deductions, and credits from the operation of an. 2 of 8 use only black ink and uppercase letters. After you install turbotax business and begin working on your. All other trusts need to file form 1041 (u.s. Providing expert tax solutions for every tax professional. An estate or trust that generates. The form consists of three. Web form 1041 department of the treasury—internal revenue service u.s. Web provide form 1041 filers with approved software developers information for the tax year 2021 filing season. Web 2 schedule a charitable deduction. Web which product or service you use will depend on whether you need to file an income tax return for an estate (form 1041), or an estate. Tax preparation software, such as turbotax and h&r. Providing expert tax solutions for every tax professional. Web information about form 1041, u.s. Web 2 schedule a charitable deduction. See form 2441, line 8, for the 2022. After you install turbotax business and begin working on your. Providing expert tax solutions for every tax professional. Web an estate or trust can generate income that gets reported on form 1041, united states income tax return for estates and trusts. 2 of 8 use only black ink and uppercase letters. The following links provide information on the companies that. Web an estate or trust can generate income that gets reported on form 1041, united states income tax return for estates and trusts. An estate or trust that generates. 2 of 8 use only black ink and uppercase letters. Providers listed on this webpage are approved irs. Web form 1041 is an internal revenue service (irs) income tax return filed. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. The following links provide information on the companies that have passed the internal revenue service (irs). Instructions for this form are on our. Providers listed on this webpage are approved irs. The trust's income and deductions are reported on your personal tax. Ad bloomberg tax provides intelligence across all areas of taxation. See form 2441, line 8, for the 2022. Web provide form 1041 filers with approved software developers information for the tax year 2021 filing season. However, if trust and estate. The form consists of three. Instructions for this form are on our. After you install turbotax business and begin working on your. If beneficiaries receive the income established from a trust or estate, they must pay income tax on it. The form consists of three. 2 of 8 use only black ink and uppercase letters. If beneficiaries receive the income established from a trust or estate, they must pay income tax on it. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Web there is no special tax form for living trusts; Instructions for this form are on our. Web up to 10% cash back documents. 2 of 8 use only black ink and uppercase letters. Don’t complete for a simple trust or a pooled income fund. However, if trust and estate. An estate or trust that generates. Income tax return for estates and trusts go to www.irs.gov/form1041 for instructions and the latest. $124.95 + state additional start for free download available. Automate your vendor bills with ai, and sync your banks. The following links provide information on the companies that have passed the internal revenue service (irs). However, if trust and estate. Income tax return for estates and trusts is generally used to report the income, gains, losses, deductions, and credits from. Web form 1041 department of the treasury—internal revenue service u.s. Providing expert tax solutions for every tax professional. Providers listed on this webpage are approved irs. Web 2022 ohio it 1041 rev. Everything that you need to grow, manage and protect your business. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Automate your vendor bills with ai, and sync your banks. Web information about form 1041, u.s. 2 of 8 use only black ink and uppercase letters. Don’t complete for a simple trust or a pooled income fund. Web which product or service you use will depend on whether you need to file an income tax return for an estate (form 1041), or an estate tax return (form 706). Web there is no special tax form for living trusts; Form 1041 is used by a. Instructions for this form are on our. Web provide form 1041 filers with approved software developers information for the tax year 2021 filing season. Web you'll need turbotax business to file form 1041, as the personal versions of turbotax don't support this form. Ad bloomberg tax provides intelligence across all areas of taxation. However, if trust and estate. When tax season arrives, choosing the best tax software can help streamline the filing process. Income tax return for estates and trusts is generally used to report the income, gains, losses, deductions, and credits from the operation of an.Best Tax Software For Form 1041 Freeware Base

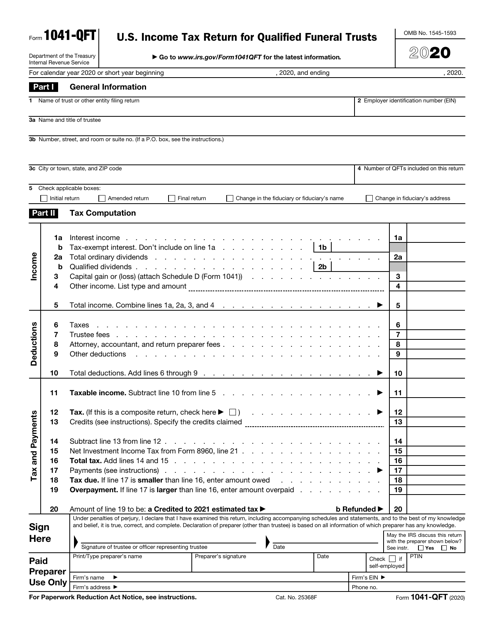

IRS Form 1041QFT Download Fillable PDF or Fill Online U.S. Tax

Best Tax Software For Form 1041 Form Resume Examples mL52wRnOXo

Best Tax Software For Form 1041 Freeware Base

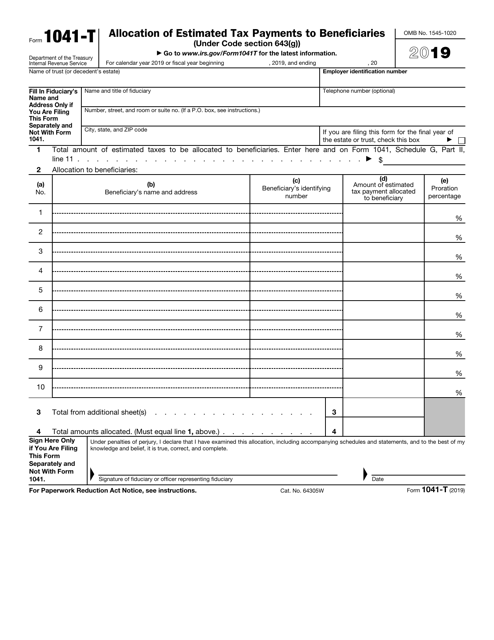

IRS Form 1041T Download Fillable PDF or Fill Online Allocation of

Best Tax Software For Form 1041 Freeware Base

1041 Schedule D Tax Worksheet

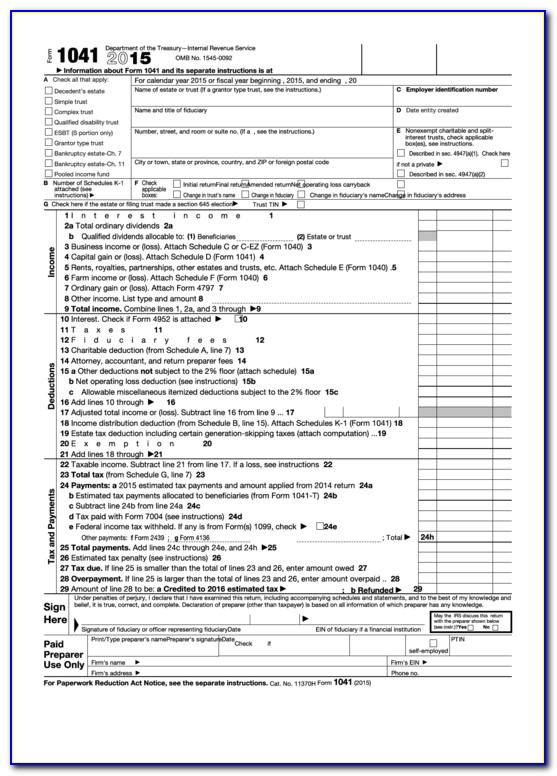

U.S. Tax Return for Estates and Trusts, Form 1041

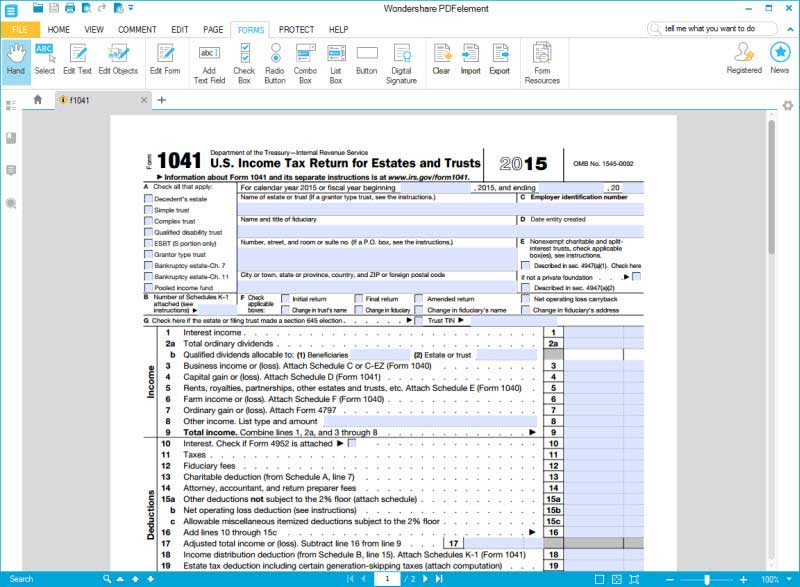

Guide for How to Fill in IRS Form 1041

Form 1041 Fill Out and Sign Printable PDF Template signNow

Related Post: