Form 1040 Nj Instructions

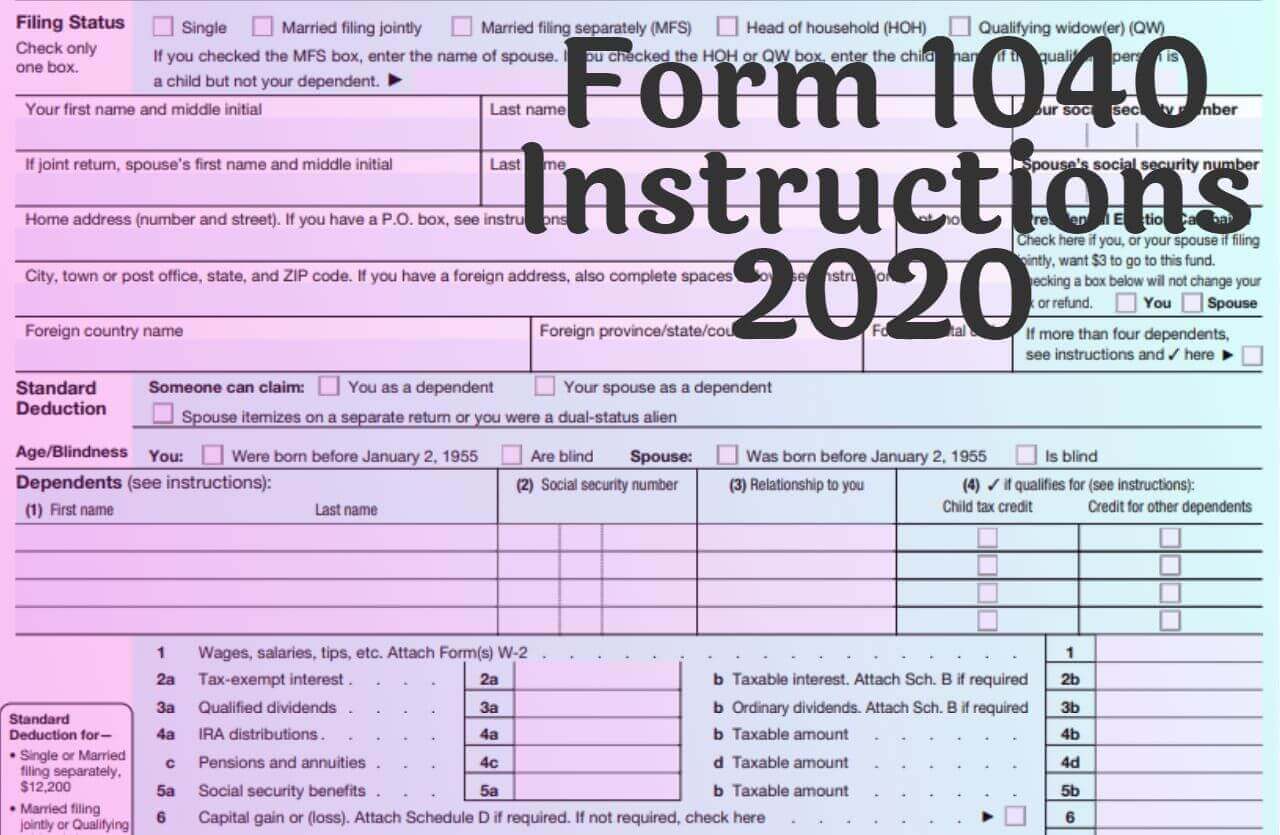

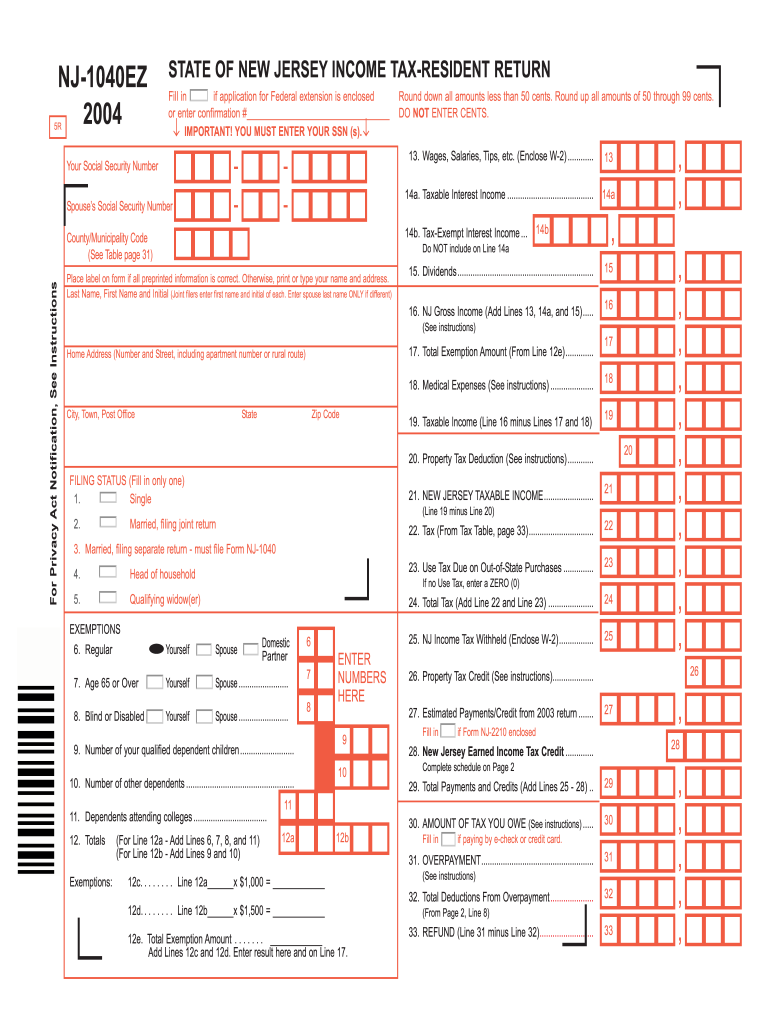

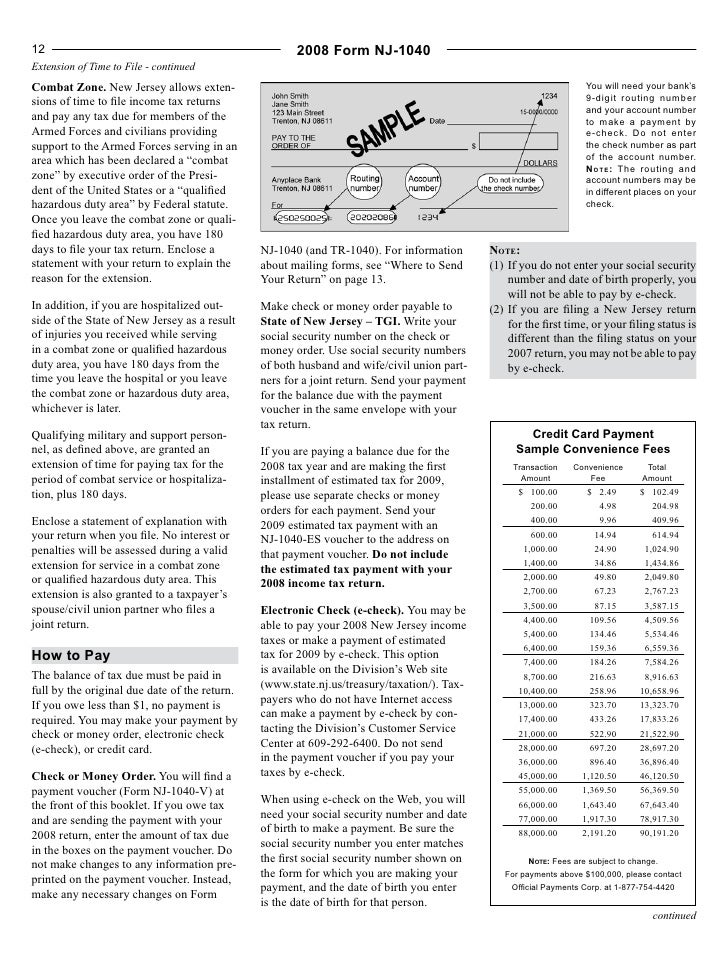

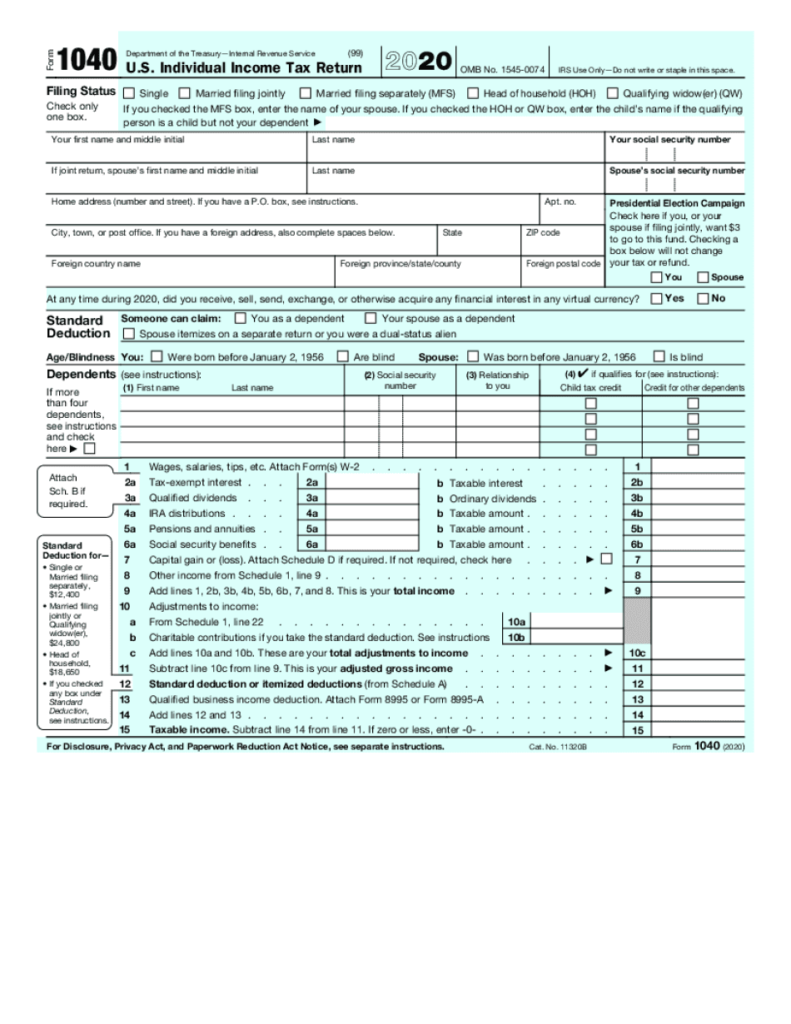

Form 1040 Nj Instructions - Web check the following items to avoid mistakes that delay returns and refunds. Questions answered every 9 seconds. Web application for extension of time to file income tax return. Fill out the requested fields. Enter your status, income, deductions and credits and estimate your total taxes. Web it’s simple and easy to follow the instructions, complete your nj tax return, and file it online. Processing of electronic (online) returns typically takes a minimum of 4 weeks. Please use the link below to. If you or someone in your family was an. Ad discover helpful information and resources on taxes from aarp. Web the standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased. How can i check the status of my refund? Ad a tax advisor will answer you now! Web for tax year 2021 and after, combat pay is not taxable in new jersey. If new jersey was your. Enter your status, income, deductions and credits and estimate your total taxes. How can i check the status of my refund? If you or someone in your family was an. Single table a married/cu partner, filing separate return step 1 step 2 step 3 enter multiply if taxable income (line 41). If new jersey was your domicile for only part. Web it’s simple and easy to follow the instructions, complete your nj tax return, and file it online. Web application for extension of time to file income tax return. Open the form in the online. If new jersey was your domicile for only part of the year and you received income from new jersey sources while you were a nonresident,.. If new jersey was your domicile for only part of the year and you received income from new jersey sources while you were a nonresident,. Ad discover helpful information and resources on taxes from aarp. Web application for extension of time to file income tax return. Web the standard deduction is adjusted for inflation every year, and for single taxpayers. This amount is the difference between the total amount taxed by. Web the following tips will help you fill out nj 1040 instructions easily and quickly: Web for tax year 2021 and after, combat pay is not taxable in new jersey. Ad a tax advisor will answer you now! Web check the following items to avoid mistakes that delay returns. This amount is the difference between the total amount taxed by. Web new jersey tax rate schedules 2021 filing status: Fill out the requested fields. Ad a tax advisor will answer you now! Single table a married/cu partner, filing separate return step 1 step 2 step 3 enter multiply if taxable income (line 41). This amount is the difference between the total amount taxed by. Web it’s simple and easy to follow the instructions, complete your nj tax return, and file it online. Web new jersey tax rate schedules 2021 filing status: It appears you don't have a pdf plugin for this browser. Do not include amounts received as combat zone compensation when reporting. Web new jersey tax rate schedules 2021 filing status: Questions answered every 9 seconds. Web application for extension of time to file income tax return. If new jersey was your domicile for only part of the year and you received income from new jersey sources while you were a nonresident,. Estimated income tax payment voucher for 2023. Web check the following items to avoid mistakes that delay returns and refunds. Web new jersey income tax individual tax instructions. This amount is the difference between the total amount taxed by. Indicate the jurisdiction as “city y,” and enter $20,000 on line 1. Web for tax year 2021 and after, combat pay is not taxable in new jersey. Find the document you want in the collection of templates. Estimated income tax payment voucher for 2023. How can i check the status of my refund? Web page last reviewed or updated: If new jersey was your domicile for only part of the year and you received income from new jersey sources while you were a nonresident,. Web for tax year 2021 and after, combat pay is not taxable in new jersey. If new jersey was your domicile for only part of the year and you received income from new jersey sources while you were a nonresident,. Single table a married/cu partner, filing separate return step 1 step 2 step 3 enter multiply if taxable income (line 41). Please use the link below to. Web the following tips will help you fill out nj 1040 instructions easily and quickly: Web the standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased. Questions answered every 9 seconds. Enter your status, income, deductions and credits and estimate your total taxes. It appears you don't have a pdf plugin for this browser. Estimated income tax payment voucher for 2023. Do not include amounts received as combat zone compensation when reporting your gross income on a. Processing of electronic (online) returns typically takes a minimum of 4 weeks. How can i check the status of my refund? Fill out the requested fields. Web new jersey income tax individual tax instructions. Web new jersey tax rate schedules 2021 filing status: Indicate the jurisdiction as “city y,” and enter $20,000 on line 1. Find the document you want in the collection of templates. Web check the following items to avoid mistakes that delay returns and refunds. If new jersey was your domicile for only part of the year and you received income from new jersey sources while you were a nonresident,.Irs 1040 Form / Tax Tuesday Are You Ready To File The New Irs 1040 Form

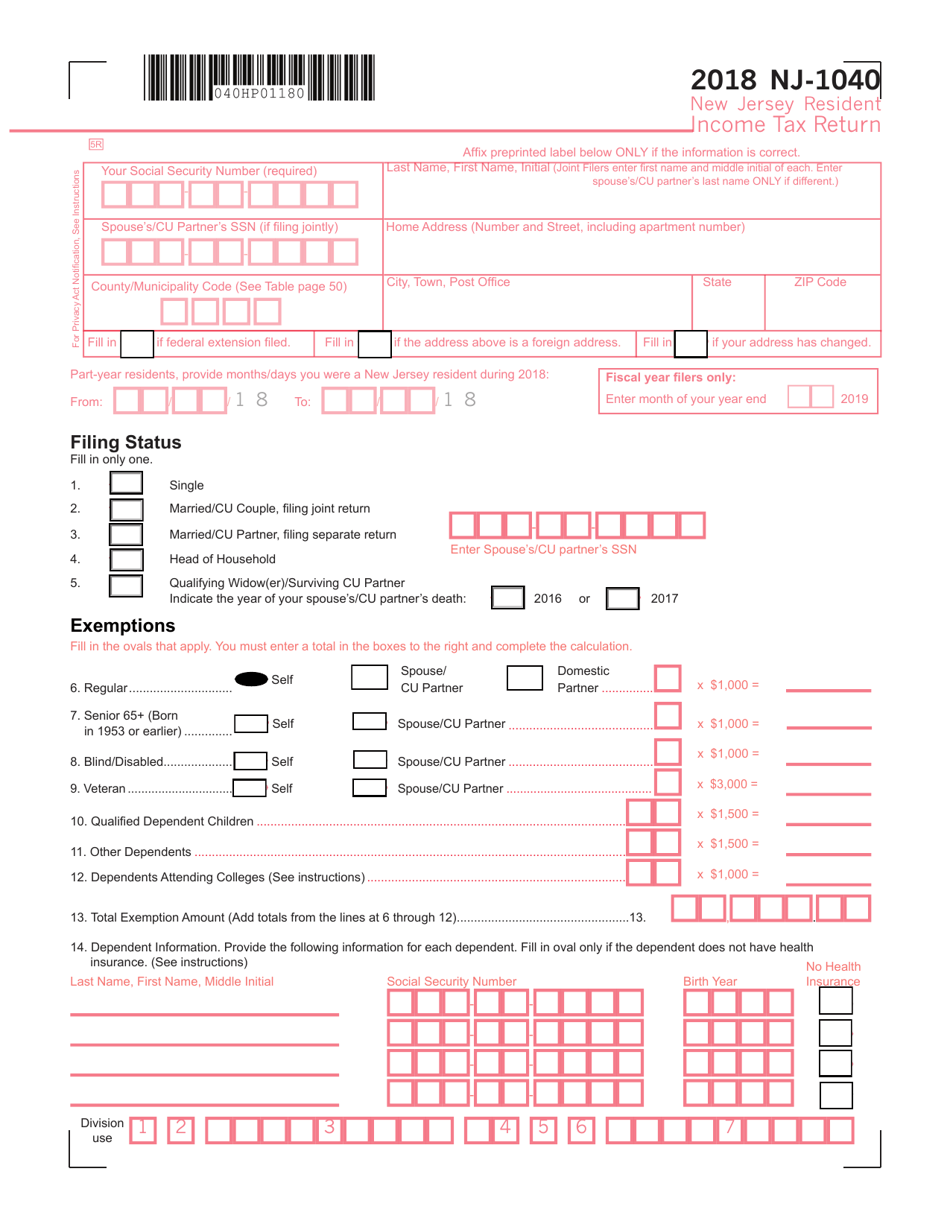

Form NJ1040 2018 Fill Out, Sign Online and Download Fillable PDF

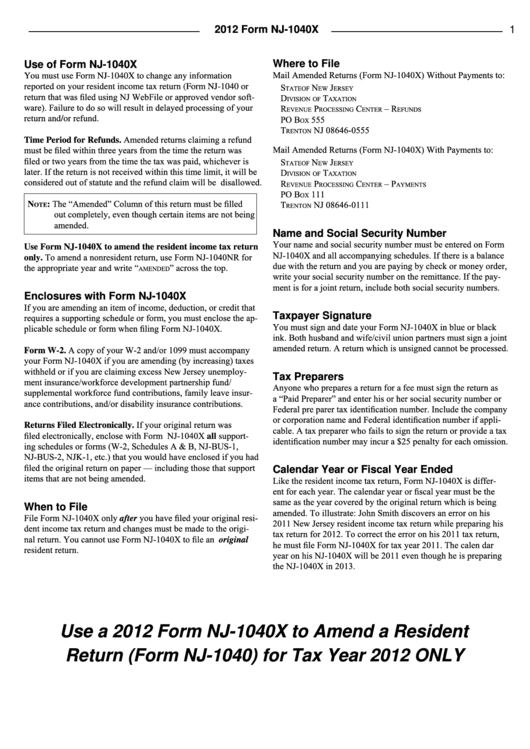

Instructions For Form Nj1040x Amended Tax Resident Return

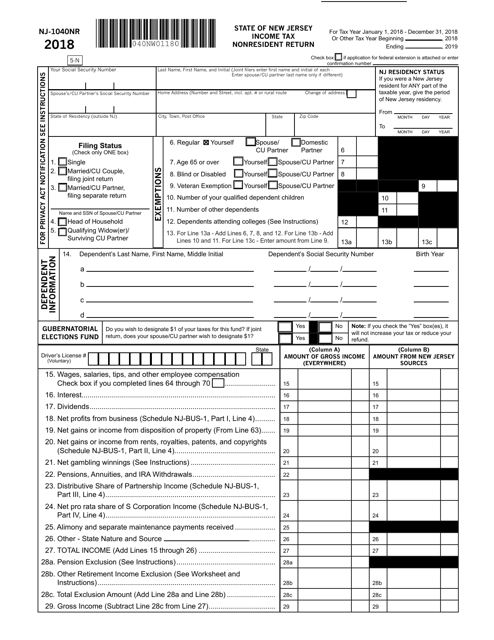

Form NJ1040NR Download Fillable PDF or Fill Online Tax

New Jersey State Tax Form Fill Out and Sign Printable PDF

Nj 1040 form 2016 pdf Fill out & sign online DocHub

Instructions for the NJ1040

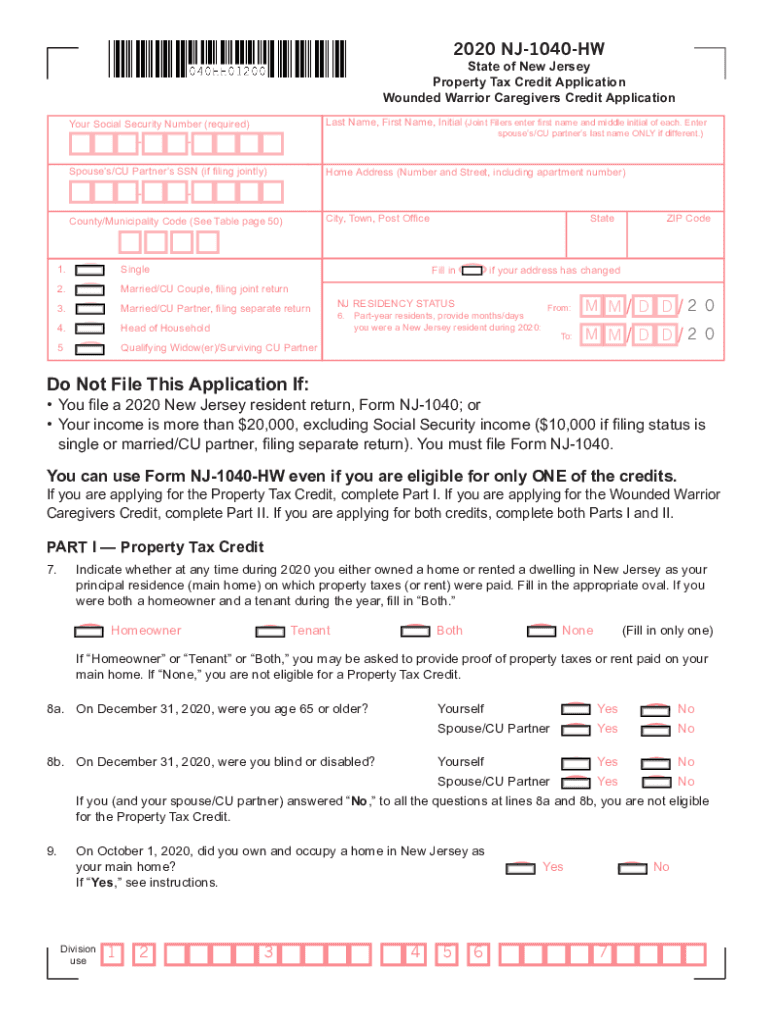

Nj 1040 hw Fill out & sign online DocHub

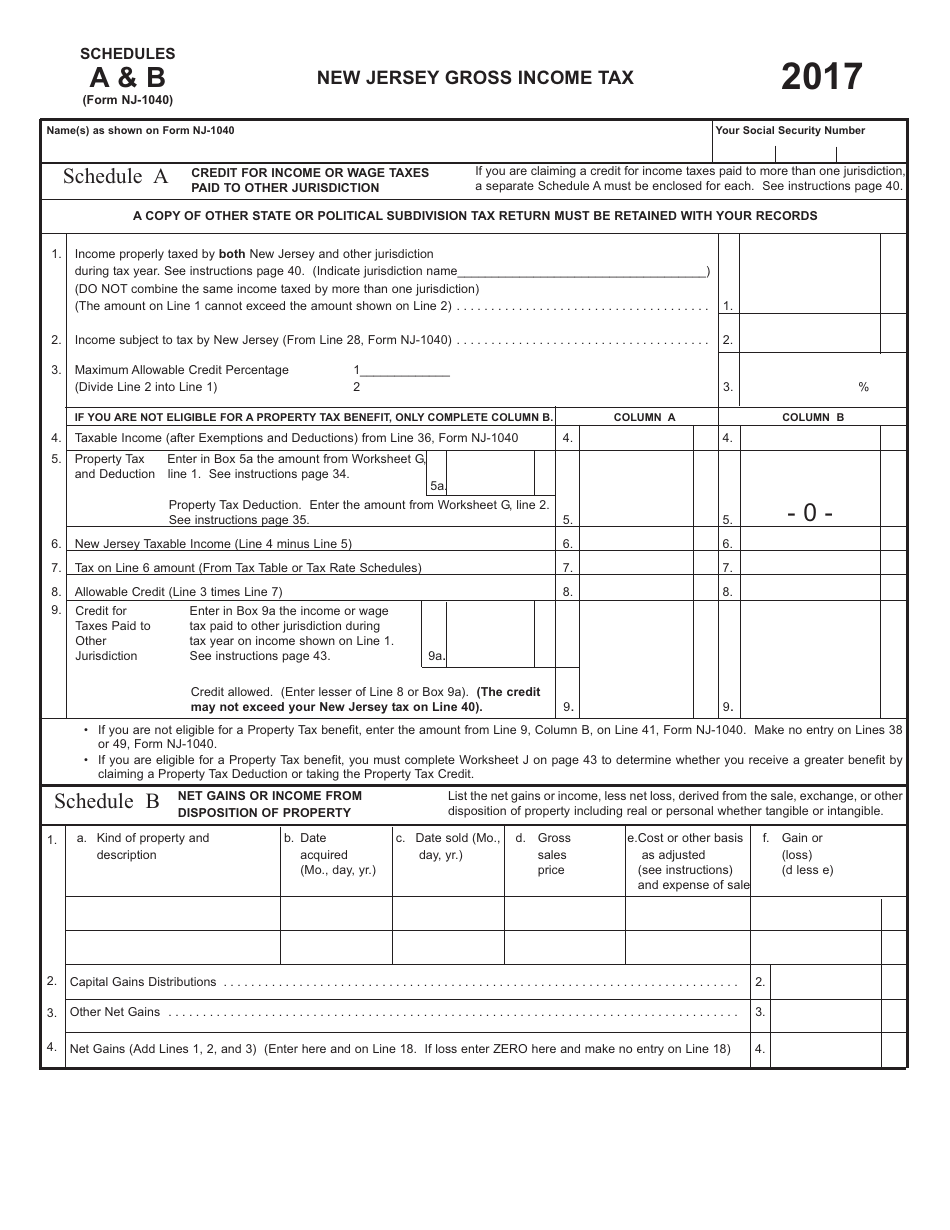

Form NJ1040 Schedule A, B 2017 Fill Out, Sign Online and Download

Nj 1040 Form 2021 Printable Printable Form 2021

Related Post: