Form 1040 Line 6A And 6B Instructions

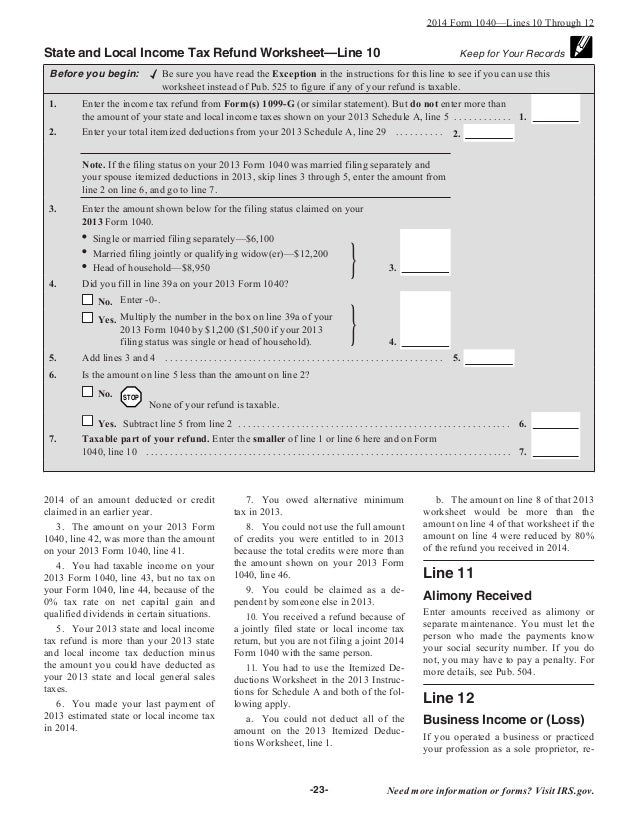

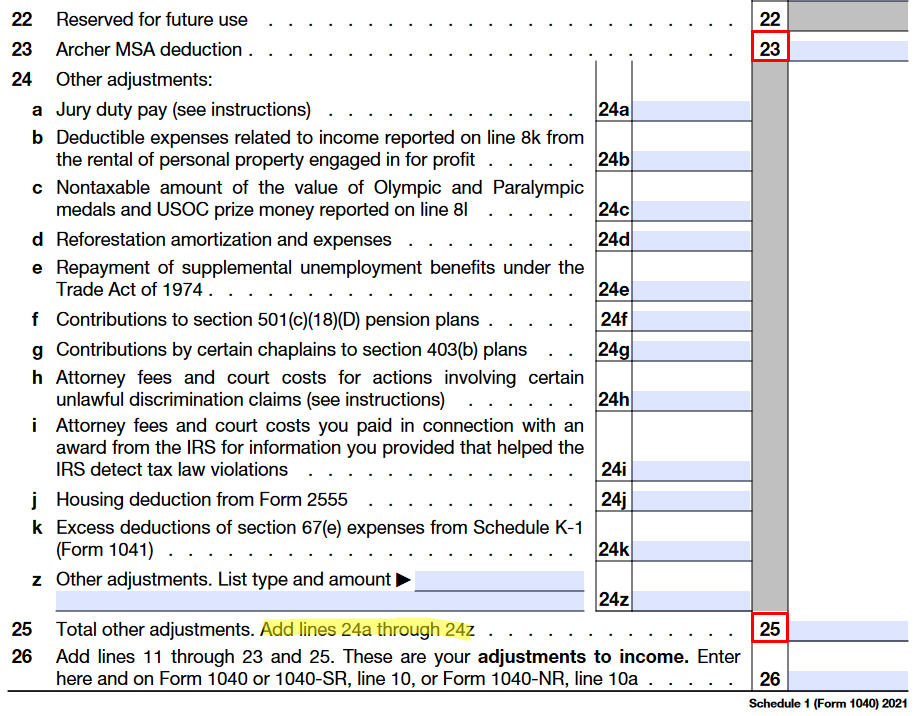

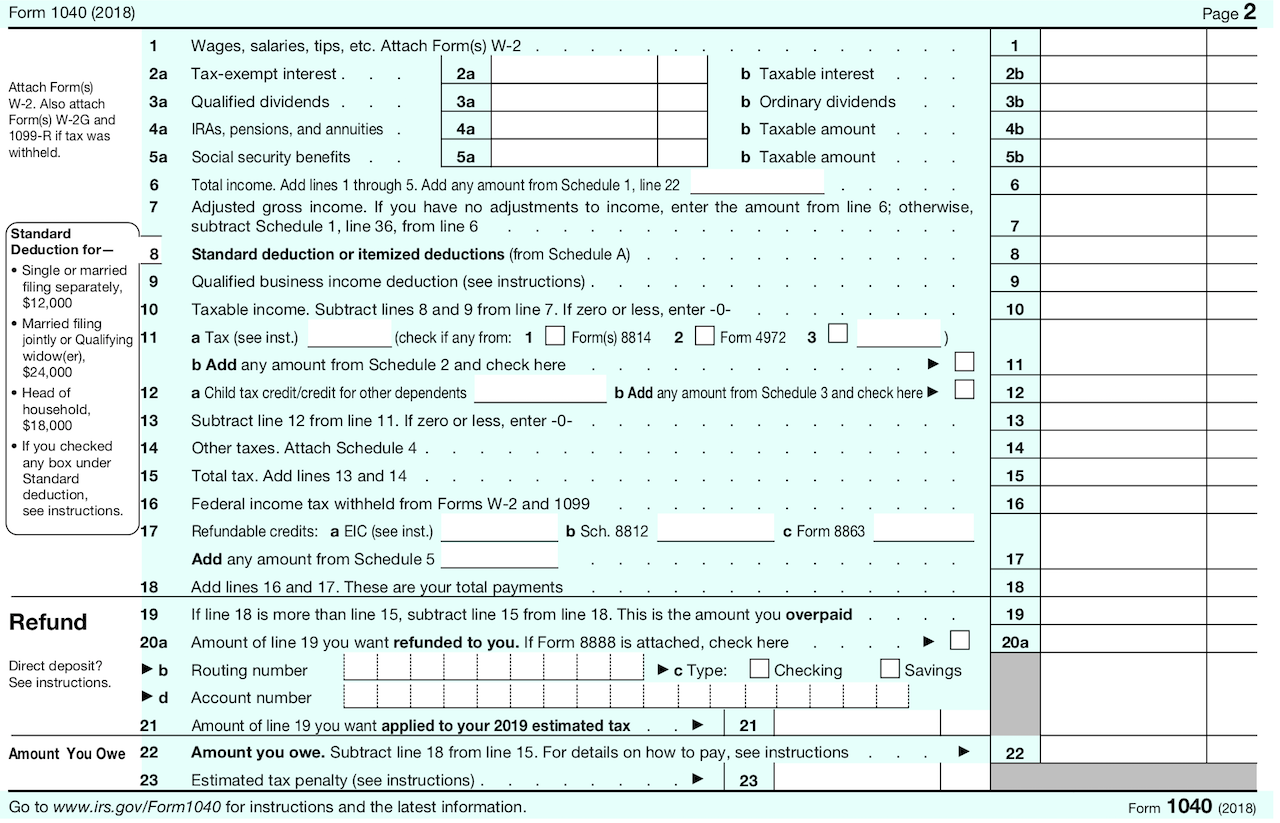

Form 1040 Line 6A And 6B Instructions - Individual tax return, lines 6a and 6b, for the taxable amount of social security benefits. If line 22 is over $117,300, see the worksheet on page 32.26 subtract line 26. Web for paperwork reduction act notice, see form 1040 instructions. Web for the latest information about developments related to schedule r (form 1040) and its instructions, such as legislation enacted after they were published, go to. (4) if qualifying child for child tax credit. Your benefits may be taxable if the total of (1). Web if you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. Web 26 if line 22 is $117,300 or less, multiply $3,400 by the total number of exemptions claimed on line 6d. Web 6a and 6b b yourself.if someone can claim you as a dependent, do not check box 6a. If married filing separately and lived apart from spouse for the. Web 6a and 6b b yourself.if someone can claim you as a dependent, do not check box 6a. Web if you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. Web notice 703 department of the treasury internal revenue service (rev. Web your taxable social security (form 1040, line 6b) can be anywhere from. October 2022) read this to see if your social security benefits may be taxable if your social security. Web for the latest information about developments related to schedule r (form 1040) and its instructions, such as legislation enacted after they were published, go to. Your benefits may be taxable if the total of (1). Web the taxact program transfers the. Irs 2021 form 1040 /1040 sr instructions. Web 26 if line 22 is $117,300 or less, multiply $3,400 by the total number of exemptions claimed on line 6d. Web for the latest information about developments related to schedule r (form 1040) and its instructions, such as legislation enacted after they were published, go to. Web the taxact program transfers the. Web your taxable social security (form 1040, line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. If married filing separately and lived apart from spouse for the. Web the taxact program transfers the amounts from the worksheets to form 1040 u.s. If line 22 is over $117,300, see the worksheet on page 32.26. Your benefits may be taxable if the total of (1). If line 22 is over $117,300, see the worksheet on page 32.26 subtract line 26. Irs 2021 form 1040 /1040 sr instructions. Web if you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. Web for the latest information about developments related to schedule. Web your taxable social security (form 1040, line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. Web the taxact program transfers the amounts from the worksheets to form 1040 u.s. Web exception in the line 5a and 5b instructions to see if you can use this worksheet instead of a publication to find. Web notice 703 department of the treasury internal revenue service (rev. Web if (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross income. Your benefits may be taxable if the total of (1). Web if you are claiming a net qualified disaster loss. Web if (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross income. October 2022) read this to see if your social security benefits may be taxable if your social security. Web your taxable social security (form 1040, line 6b) can be anywhere from. (4) if qualifying child for child tax credit. Web if you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. Social security number \(ssn\) dependents, qualifying child for child tax credit, and. Web if (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security. Web to figure it more closely to the amount that will be taxed use the (2021) actual worksheet for a closer approximation. Web if you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. (4) if qualifying child for child tax credit. Web your taxable social security (form 1040, line 6b) can be anywhere. Web 26 if line 22 is $117,300 or less, multiply $3,400 by the total number of exemptions claimed on line 6d. Social security number \(ssn\) dependents, qualifying child for child tax credit, and. Web notice 703 department of the treasury internal revenue service (rev. October 2022) read this to see if your social security benefits may be taxable if your social security. Web to figure it more closely to the amount that will be taxed use the (2021) actual worksheet for a closer approximation. Irs 2021 form 1040 /1040 sr instructions. Web for the latest information about developments related to schedule r (form 1040) and its instructions, such as legislation enacted after they were published, go to. (4) if qualifying child for child tax credit. Web 6a and 6b b yourself.if someone can claim you as a dependent, do not check box 6a. Of children on 6c who: Web your taxable social security (form 1040, line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. Individual tax return, lines 6a and 6b, for the taxable amount of social security benefits. If married filing separately and lived apart from spouse for the. Web if you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. Your benefits may be taxable if the total of (1). Web exception in the line 5a and 5b instructions to see if you can use this worksheet instead of a publication to find out if any of your benefits are taxable. Web if you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. Web the taxact program transfers the amounts from the worksheets to form 1040 u.s. None of the social security benefits are taxable. If line 22 is over $117,300, see the worksheet on page 32.26 subtract line 26.Do you need to submit a schedule 1, 2, and 3 along with your 1040 Tax

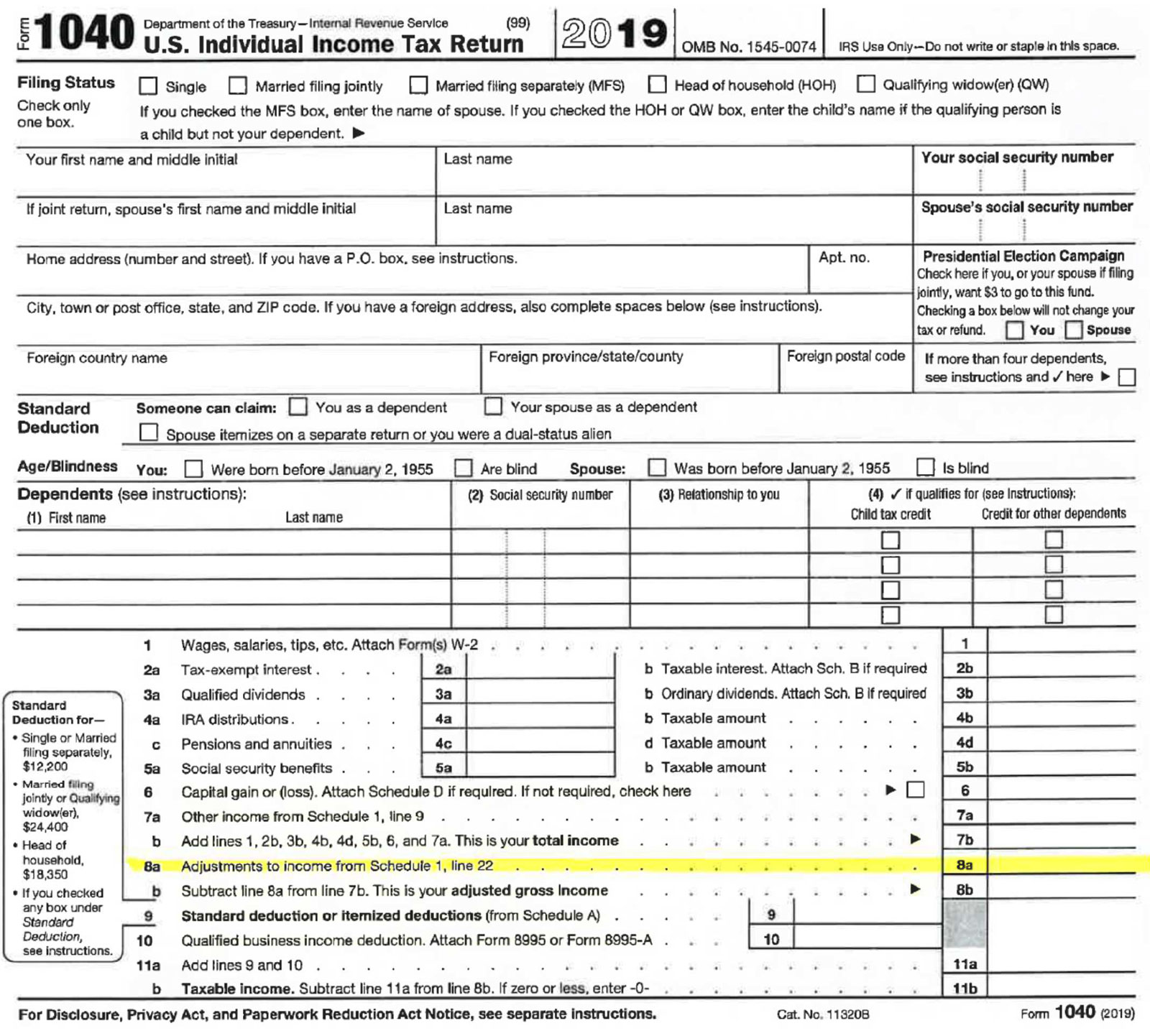

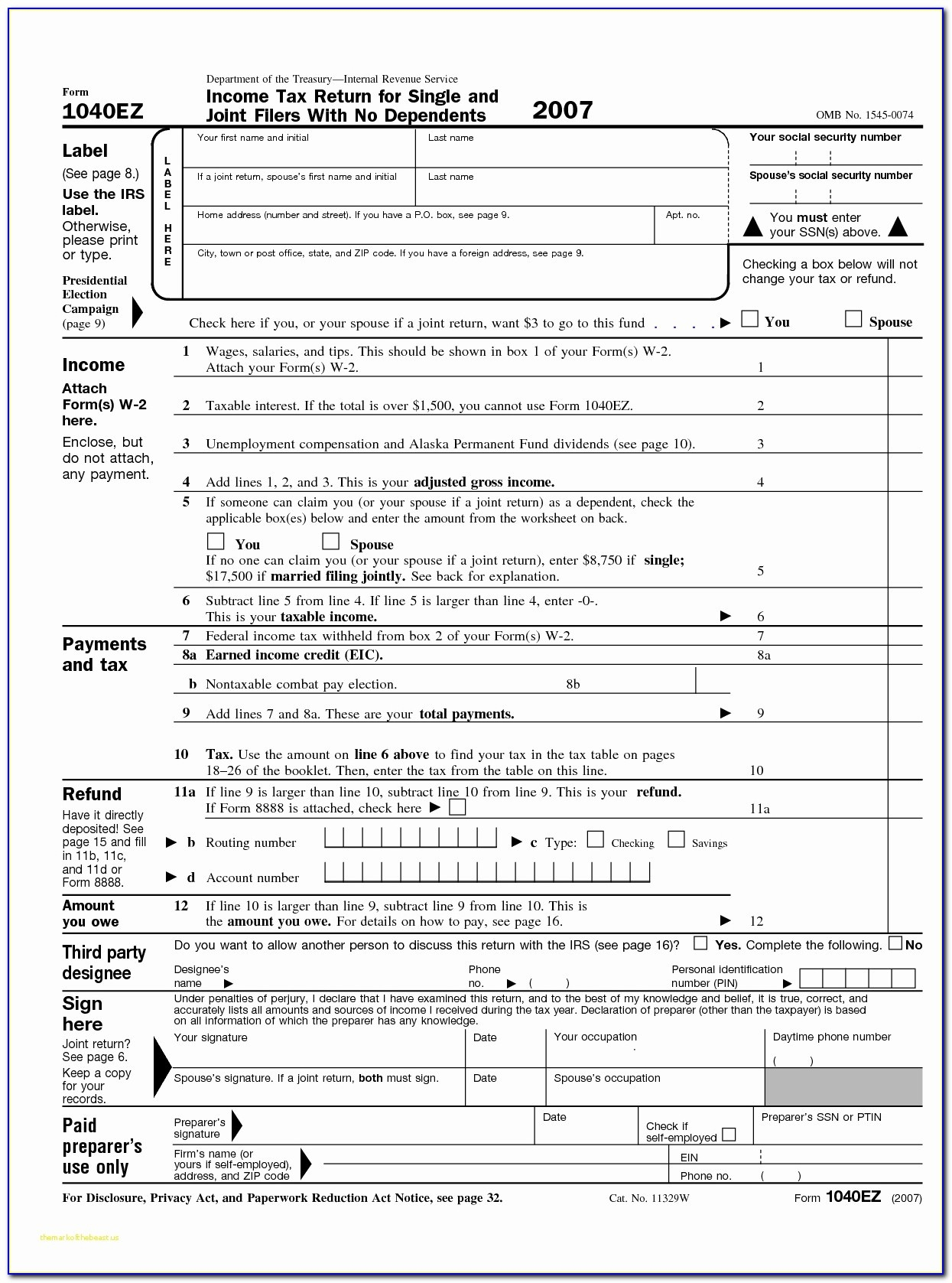

Irs 1040 Form Line 8B / Form 1040 with instructions on filling out

Cómo llenar el formulario 1040 del IRS (con imágenes)

Printable Irs Form 1040 Printable Form 2023

Form 1040 Line By Line Instructions 1040 Form Printable

IRS 8853 2019 Fill and Sign Printable Template Online US Legal Forms

2014 Federal Tax Form 1040 Instructions Tax Walls

6 Social Security Worksheet

How to Calculate Taxable Social Security (2021 Line 6b) Marotta On Money

Describes new Form 1040, Schedules & Tax Tables

Related Post: