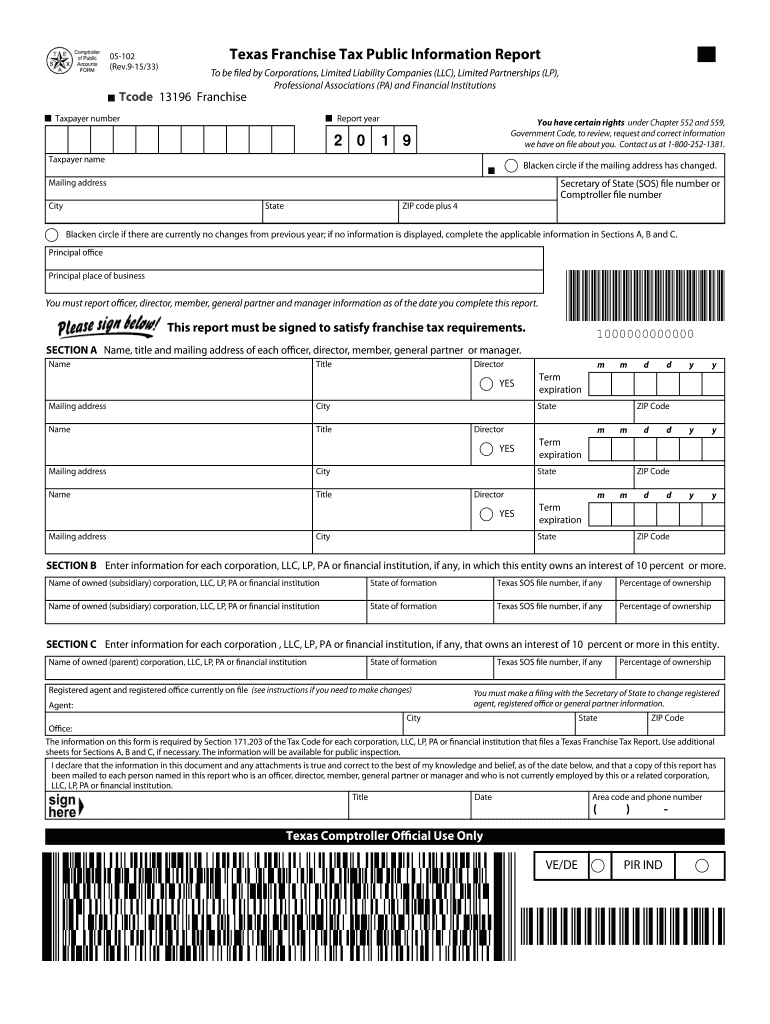

Form 05-102 Instructions

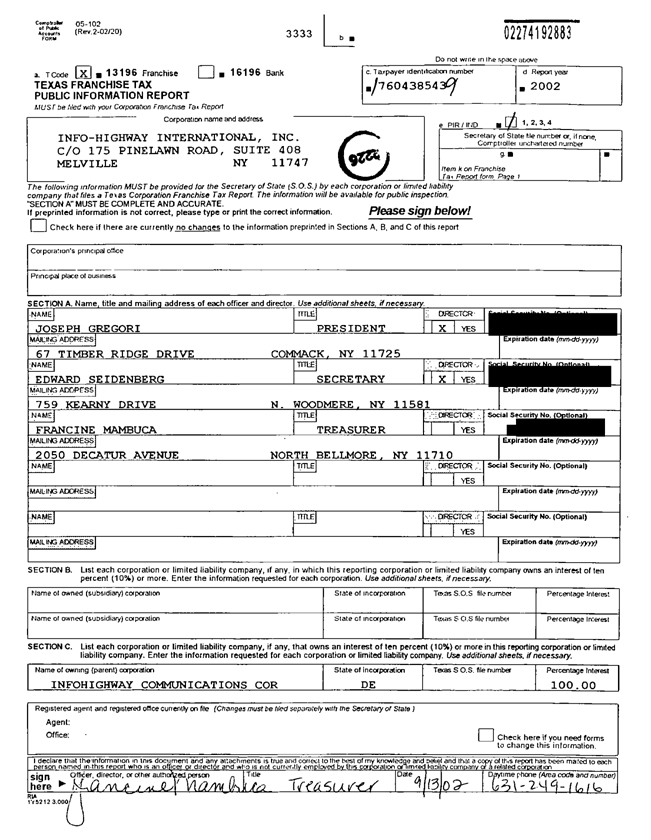

Form 05-102 Instructions - Tax blank completion can become a significant problem and severe headache if no proper guidance offered. Texas comptroller of public accounts. It is possible to produce multiple schedules. Web if you don’t owe: Web learn how the texas comptroller's office plans to achieve its mission and goals for the next four years. Web the above information is required by section 171.203 of the tax code for each corporation or limited liability company that files a texas franchise tax report. If separate filing is desired, the form must be paper filed with the taxing authority. Unless a taxable entity qualifies and chooses to file using the ez computation or no tax due report, the tax. Web section a report is completed. 1, 2016, entities legally formed as corporations, limited liability companies (llcs), limited partnerships, professional associations and financial institutions must file. The information is updated annually as part of the franchise tax report. There is no requirement or procedure for supplementing the. If separate filing is desired, the form must be paper filed with the taxing authority. Texas comptroller of public accounts. Web learn how the texas comptroller's office plans to achieve its mission and goals for the next four years. The information is updated annually as part of the franchise tax report. Web if you don’t owe: There is no requirement or procedure for supplementing the. It is possible to produce multiple schedules. Web get form 05 102 and streamline your everyday record administration discover form 05 102 and begin editing it by clicking get form. Web the above information is required by section 171.203 of the tax code for each corporation or limited liability company that files a texas franchise tax report. Web if you don’t owe: If separate filing is desired, the form must be paper filed with the taxing authority. Web learn how the texas comptroller's office plans to achieve its mission and. There is no requirement or procedure for supplementing the. The information is updated annually as part of the franchise tax report. It is possible to produce multiple schedules. 1, 2016, entities legally formed as corporations, limited liability companies (llcs), limited partnerships, professional associations and financial institutions must file. Web if you don’t owe: Unless a taxable entity qualifies and chooses to file using the ez computation or no tax due report, the tax. Web follow the simple instructions below: Web the above information is required by section 171.203 of the tax code for each corporation or limited liability company that files a texas franchise tax report. Web if you don’t owe: It is. 1, 2016, entities legally formed as corporations, limited liability companies (llcs), limited partnerships, professional associations and financial institutions must file. Unless a taxable entity qualifies and chooses to file using the ez computation or no tax due report, the tax. There is no requirement or procedure for supplementing the. Web up to $40 cash back related to form 05 102. If separate filing is desired, the form must be paper filed with the taxing authority. The information is updated annually as part of the franchise tax report. There is no requirement or procedure for supplementing the. Web up to $40 cash back related to form 05 102 instructions 2020 form 05 102 reset form 05102 (rev.915/33)print form texas franchise tax. Web if you don’t owe: 1, 2016, entities legally formed as corporations, limited liability companies (llcs), limited partnerships, professional associations and financial institutions must file. Unless a taxable entity qualifies and chooses to file using the ez computation or no tax due report, the tax. Web section a report is completed. Web make the check payable to the texas comptroller. Web follow the simple instructions below: It is possible to produce multiple schedules. Begin completing your form and include the. Web learn how the texas comptroller's office plans to achieve its mission and goals for the next four years. If separate filing is desired, the form must be paper filed with the taxing authority. There is no requirement or procedure for supplementing the. Web make the check payable to the texas comptroller. Texas comptroller of public accounts. Unless a taxable entity qualifies and chooses to file using the ez computation or no tax due report, the tax. Web franchise tax report forms should be mailed to the following address: The information is updated annually as part of the franchise tax report. Web learn how the texas comptroller's office plans to achieve its mission and goals for the next four years. Tax blank completion can become a significant problem and severe headache if no proper guidance offered. Begin completing your form and include the. Web get form 05 102 and streamline your everyday record administration discover form 05 102 and begin editing it by clicking get form. Unless a taxable entity qualifies and chooses to file using the ez computation or no tax due report, the tax. Web up to $40 cash back related to form 05 102 instructions 2020 form 05 102 reset form 05102 (rev.915/33)print form texas franchise tax public information reporttcode. Texas comptroller of public accounts. Web section a report is completed. If separate filing is desired, the form must be paper filed with the taxing authority. Web franchise tax report forms should be mailed to the following address: There is no requirement or procedure for supplementing the. Web if you don’t owe: It is possible to produce multiple schedules. Web make the check payable to the texas comptroller. 1, 2016, entities legally formed as corporations, limited liability companies (llcs), limited partnerships, professional associations and financial institutions must file. Web the above information is required by section 171.203 of the tax code for each corporation or limited liability company that files a texas franchise tax report. Web follow the simple instructions below:Form 05 102 Fill out & sign online DocHub

Fillable Online 05 102

criminal history background check form 2022 Fill out & sign online

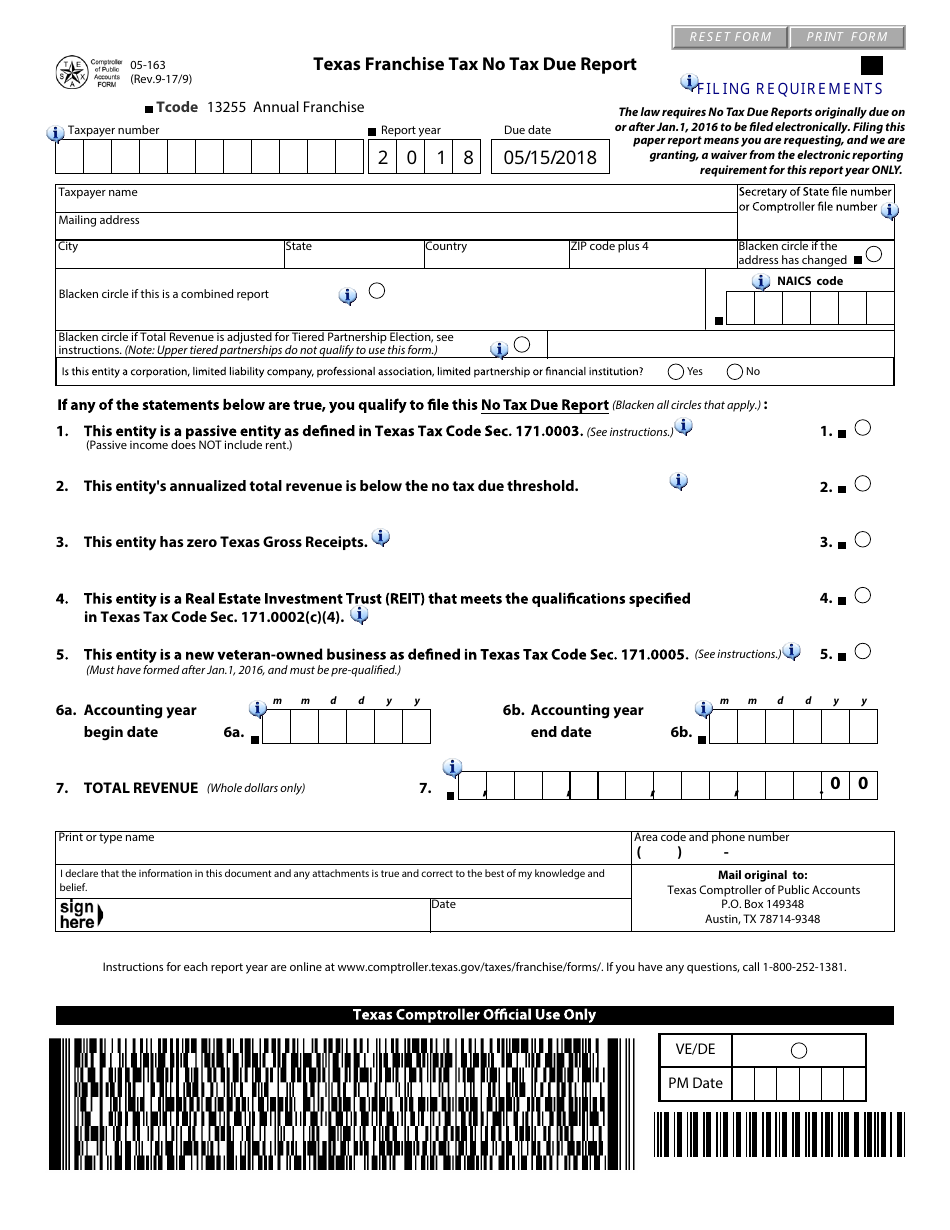

Form 05163 2018 Fill Out, Sign Online and Download Fillable PDF

Omers Form 102 Fill Out and Sign Printable PDF Template signNow

Tax Form 05 102 ≡ Fill Out Printable PDF Forms Online

Texas Form 05 102 Instructions

How To Fill Out Texas Franchise Tax Report Ez Computation

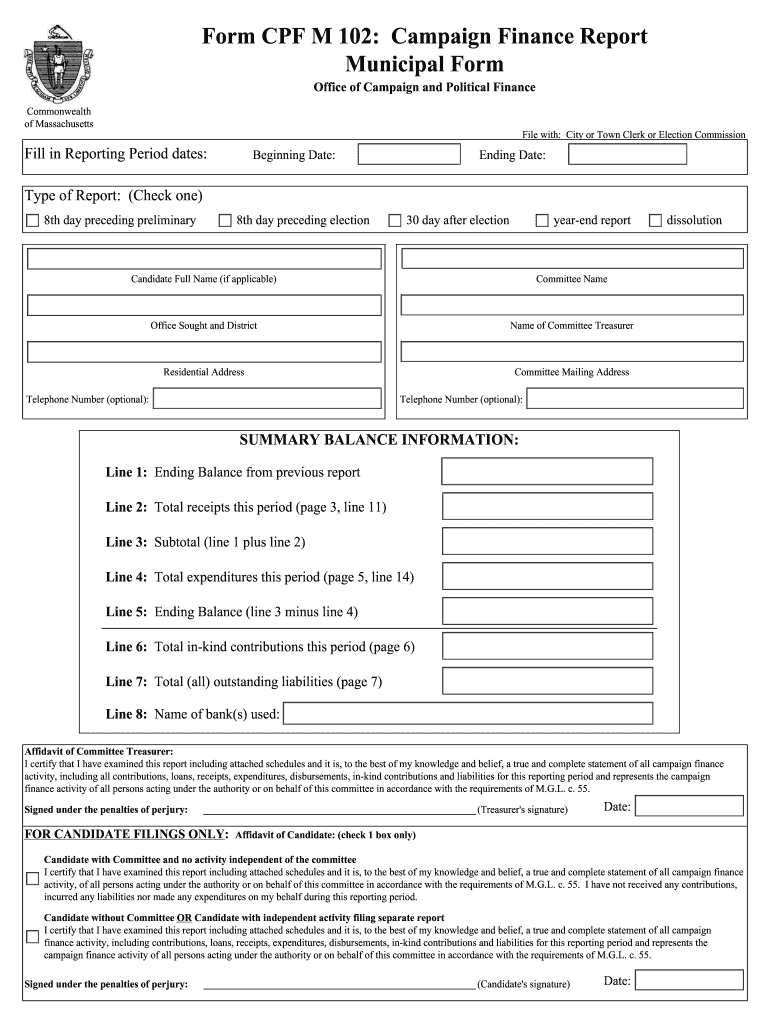

MA CPF M 102 Fill and Sign Printable Template Online US Legal Forms

FORM 05102 PDF

Related Post: