Foreign Tax Schedule A Or Form 1116

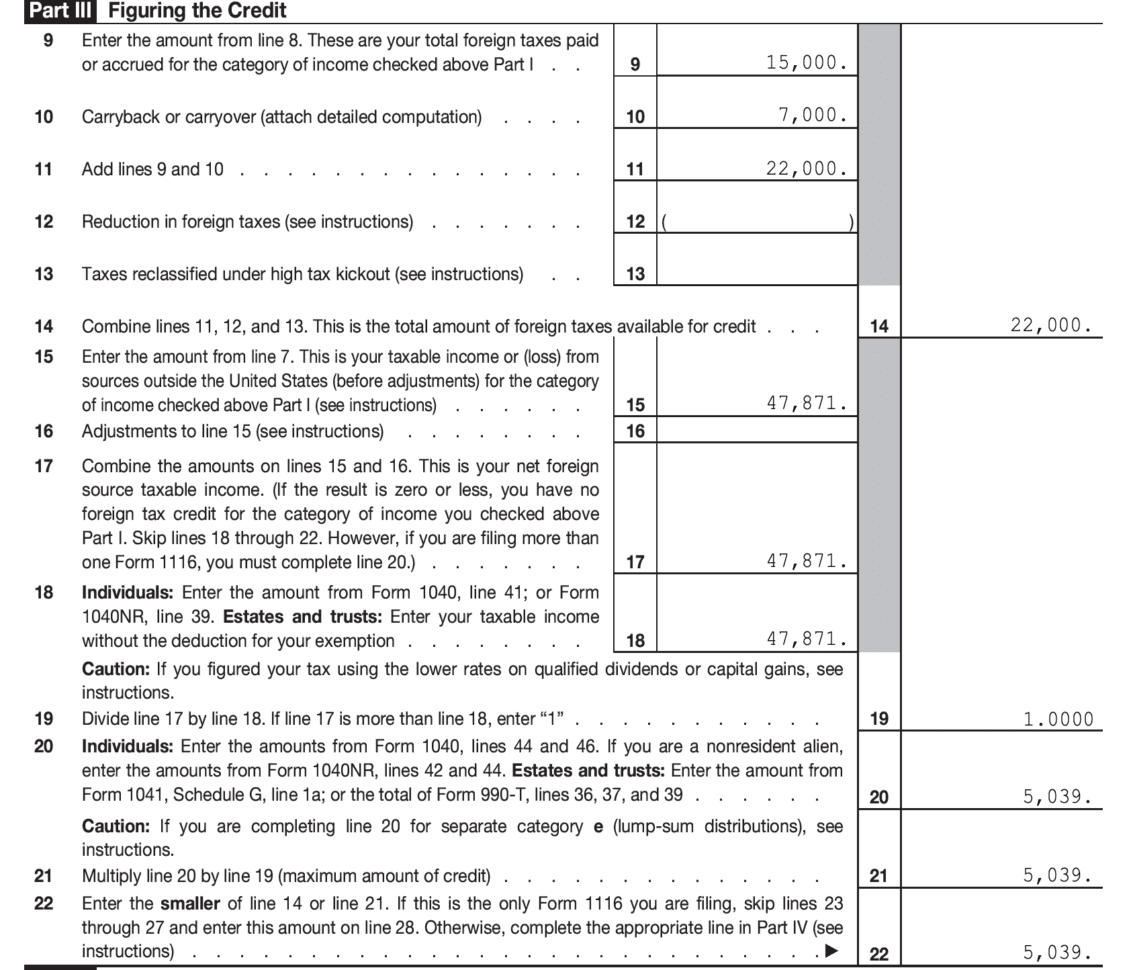

Foreign Tax Schedule A Or Form 1116 - I also use form 1116 to get credit for foreign taxes paid. The form requests the information about the country your foreign. When a us person individual earns foreign income abroad and pays foreign. Web this article will help you enter foreign taxes paid (or withheld) to calculate the foreign tax credit on schedule 3, line 48. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign. This method allows taxpayers to claim a credit for the amount of foreign taxes paid or accrued. Web go to www.irs.gov/form1116 for instructions and the latest information. Expatriates, understanding the details of the foreign tax credit and form 1116 is essential in preventing double taxation of. I finished my taxes and noticed that. Web you must complete form 1116 in order to claim the foreign tax credit on your us tax return. Use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to. Expatriates, understanding the details of the foreign tax credit and form 1116 is essential in preventing double taxation of. Web how do i move. Web there is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. When a us person individual earns foreign income abroad and pays foreign. Web form 1116 foreign tax credit calculations. Web to see when form 1116 will become available in. When a us person individual earns foreign income abroad and pays foreign. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign. Web to see when form 1116 will become available in turbotax, check form availability on this. Web for accountants working with u.s. Web there is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Web starting in tax year 2021, the irs introduced a new form 1116 schedule b to report foreign tax credit carryovers. Web entering. See schedule b (form 1116) and its instructions,. When a us person individual earns foreign income abroad and pays foreign. Web entering income for the foreign tax credit form 1116 this article will help you:enter foreign income and taxes paid on dividendenter foreign income and taxes. Ad instant download and complete your government forms, start now! Web for accountants working. I also use form 1116 to get credit for foreign taxes paid. Web starting in tax year 2021, the irs introduced a new form 1116 schedule b to report foreign tax credit carryovers. I finished my taxes and noticed that. Web you must complete form 1116 in order to claim the foreign tax credit on your us tax return. Web. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. I finished my taxes and noticed that. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. When a us person individual earns foreign income abroad and pays foreign. Web foreign income less. This method allows taxpayers to claim a credit for the amount of foreign taxes paid or accrued. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. Web deduct your foreign taxes on schedule a, like other common deductions. Form 1116 instructions for foreign tax credits: Expatriates, understanding the details of the foreign tax. Web form 1116 foreign tax credit calculations. These figures are entered on the foreign tax credit worksheet >. When a us person individual earns foreign income abroad and pays foreign. Web you must complete form 1116 in order to claim the foreign tax credit on your us tax return. Foreign tax credit (form 1116): Web form 1116 foreign tax credit calculations. Ad instant download and complete your government forms, start now! Web foreign income less amounts recaptured. Web accurately compute the credit using form 1116 calculate and report the foreign tax credit as a nonrefundable credit publication 514 form 1116 form 1116 instructions what is. Web use schedule b (form 1116) to reconcile your. Web entering foreign taxes paid and generating form 1116 foreign tax credit in proconnect solved • by intuit • 56 • updated june 14, 2023 this article will help you. Select popular legal forms & packages of any category. Web how do i move foreign taxes paid from schedule a to form 1116? Web all the allowable foreign tax credit for different income categories will be summarized on one form 1116, again, the one with the largest allowable foreign tax credit. Web entering income for the foreign tax credit form 1116 this article will help you:enter foreign income and taxes paid on dividendenter foreign income and taxes. Web accurately compute the credit using form 1116 calculate and report the foreign tax credit as a nonrefundable credit publication 514 form 1116 form 1116 instructions what is. Web to see when form 1116 will become available in turbotax, check form availability on this page. I finished my taxes and noticed that. As a result, the foreign tax. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Ad instant download and complete your government forms, start now! Both the credit and the deduction are entered in the same place. Web you must complete form 1116 in order to claim the foreign tax credit on your us tax return. In order for lacerte to. Web there is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Web starting in tax year 2021, the irs introduced a new form 1116 schedule b to report foreign tax credit carryovers. Web foreign income less amounts recaptured. When a us person individual earns foreign income abroad and pays foreign. See schedule b (form 1116) and its instructions,. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information.Casual What Is Form 1116 Explanation Statement? Proprietor Capital

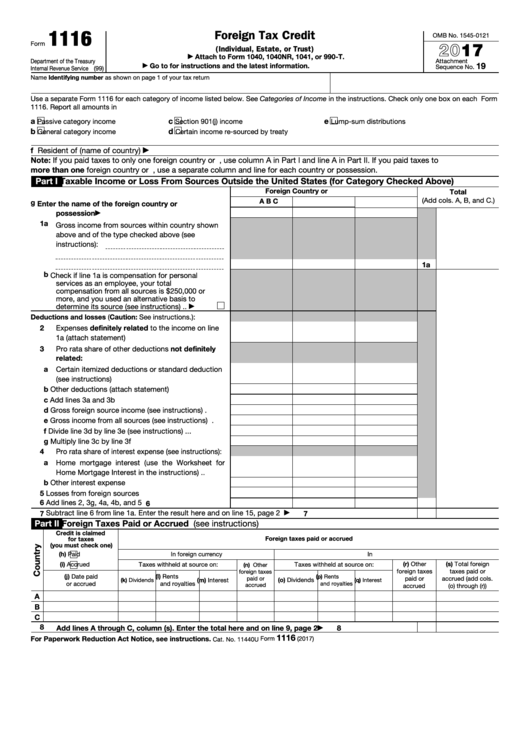

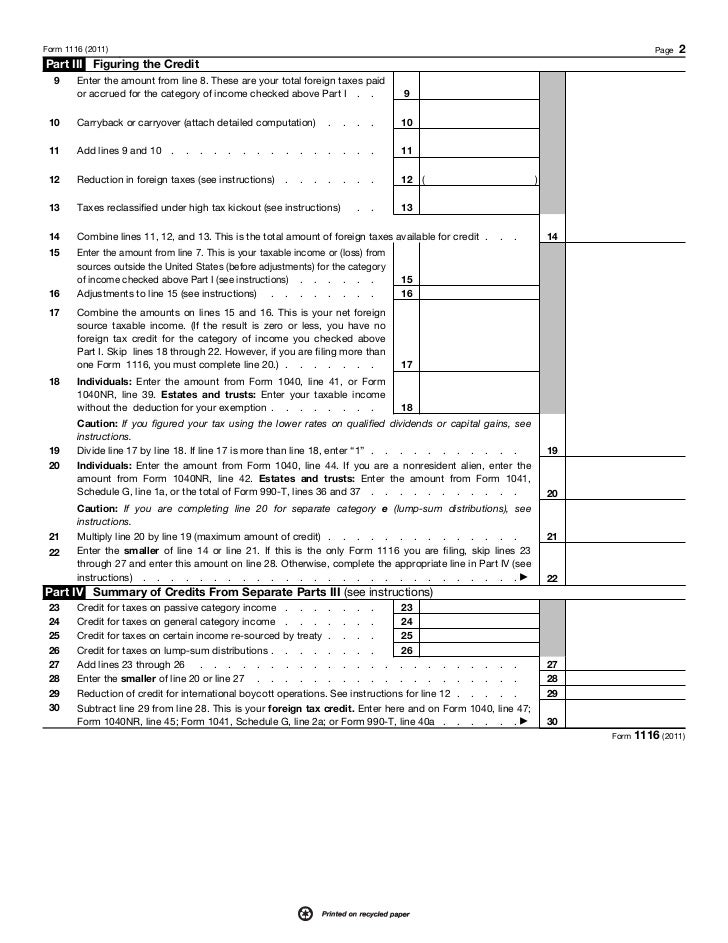

Fillable Form 1116 Foreign Tax Credit (Individual, Estate, Or Trust

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

Publication 514, Foreign Tax Credit for Individuals; Comprehensive

US Tax Abroad Expatriate Form 1116

해외금융계좌 신고 5 Form 1116 Foreign Tax Credit Sample

Foreign Tax Credit Form 1116 Explained Greenback —

Form 1116 Fill out & sign online DocHub

Foreign Tax Credit & IRS Form 1116 Explained Greenback Expat Taxes

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Related Post: