Florida Form F 1120

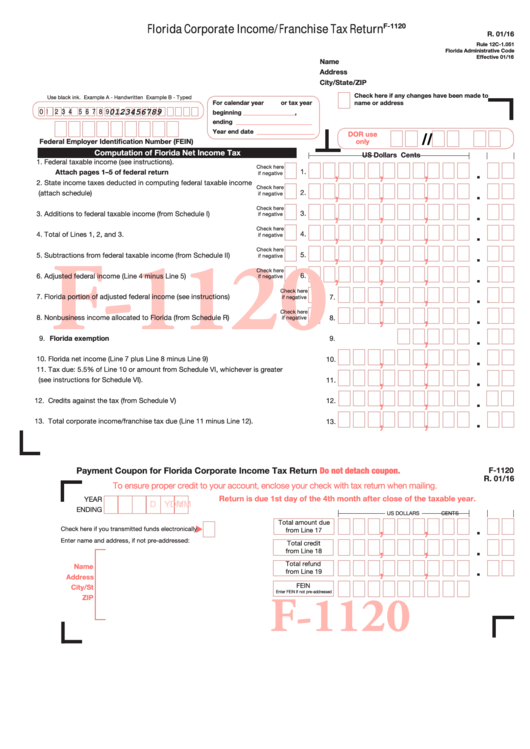

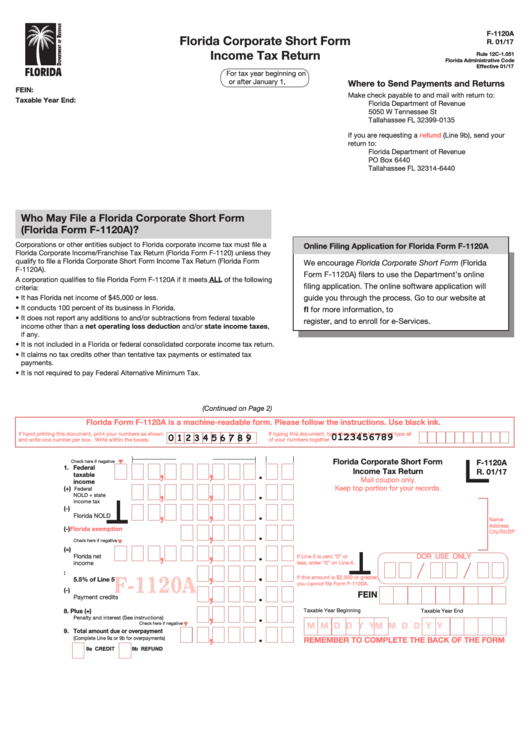

Florida Form F 1120 - Web we would like to show you a description here but the site won’t allow us. Deal with 2018 f 1120 on any device with signnow android or ios. (note that an s corporation is. Links are provided for both options. Web make checks payable to and mail to: Get ready for tax season deadlines by completing any required tax forms today. Additions to federal taxable income (from schedule i). Additions to federal taxable income (from schedule i). An extension of time will be void if: Complete, edit or print tax forms instantly. Web signnow offers you all the tools you need to generate, modify, and esign your documents swiftly without delays. Total of lines 1, 2, and 3. You must file and pay electronically if you paid $5,000 or more in tax during the state of florida’s prior. Web for all other tax year endings, the due date is on or before. You must file and pay electronically if you paid $5,000 or more in tax during the state of florida’s prior. Florida corporate short form income tax return. Additions to federal taxable income (from schedule i). For example, for a taxpayer with a tax year that ends. Deal with 2018 f 1120 on any device with signnow android or ios. Additions to federal taxable income (from schedule i). Get ready for tax season deadlines by completing any required tax forms today. Additions to federal taxable income (from schedule i). An extension of time will be void if: 01/13 to ensure proper credit to. 01/13 to ensure proper credit to. Additions to federal taxable income (from schedule i). Total of lines 1, 2, and 3. Additions to federal taxable income (from schedule i). Deal with 2018 f 1120 on any device with signnow android or ios. Additions to federal taxable income (from schedule i). Total of lines 1, 2, and 3. For example, for a taxpayer with a tax year that ends. Web we would like to show you a description here but the site won’t allow us. You must file and pay electronically if you paid $5,000 or more in tax during the state of. 01/13 to ensure proper credit to. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. (note that an s corporation is. Get ready for tax season deadlines by completing any required tax forms today. Total of lines 1, 2, and 3. Links are provided for both options. Total of lines 1, 2, and 3. 01/13 to ensure proper credit to. Web we would like to show you a description here but the site won’t allow us. You must file and pay electronically if you paid $5,000 or more in tax during the state of florida’s prior. 01/13 to ensure proper credit to. Web signnow offers you all the tools you need to generate, modify, and esign your documents swiftly without delays. Web make checks payable to and mail to: For example, for a taxpayer with a tax year that ends. You must file and pay electronically if you paid $5,000 or more in tax during the. An extension of time will be void if: Web make checks payable to and mail to: Web signnow offers you all the tools you need to generate, modify, and esign your documents swiftly without delays. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of. For example, for a taxpayer with a tax year that ends. Complete, edit or print tax forms instantly. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. Web make checks payable to and mail to: Total of lines 1, 2, and. Total of lines 1, 2, and 3. You must file and pay electronically if you paid $5,000 or more in tax during the state of florida’s prior. Total of lines 1, 2, and 3. Web signnow offers you all the tools you need to generate, modify, and esign your documents swiftly without delays. Additions to federal taxable income (from schedule i). Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. Deal with 2018 f 1120 on any device with signnow android or ios. Links are provided for both options. Web make checks payable to and mail to: 01/13 to ensure proper credit to. Complete, edit or print tax forms instantly. Total of lines 1, 2, and 3. Get ready for tax season deadlines by completing any required tax forms today. Additions to federal taxable income (from schedule i). An extension of time will be void if: For example, for a taxpayer with a tax year that ends. It has florida net income of $45,000 or. (note that an s corporation is. Additions to federal taxable income (from schedule i). Florida corporate short form income tax return.Form F1120A Fill Out, Sign Online and Download Printable PDF

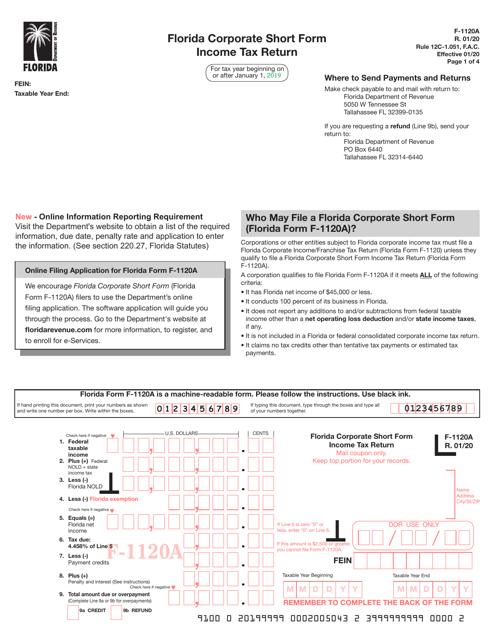

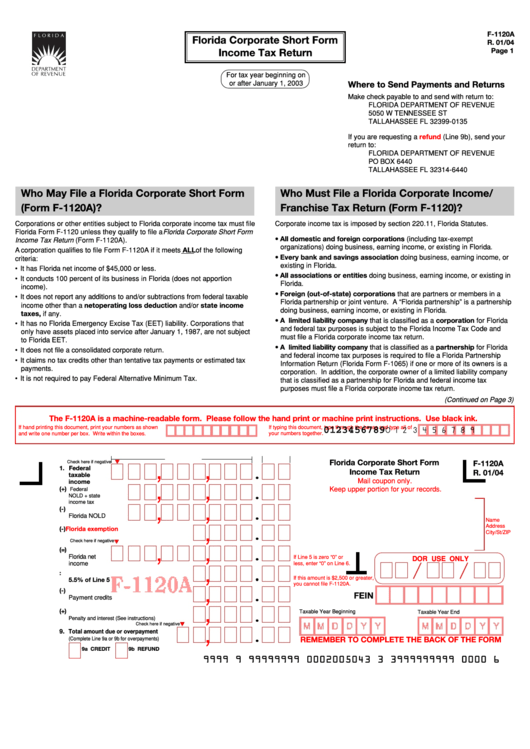

Form F1120a Florida Corporate Short Form Tax Return printable

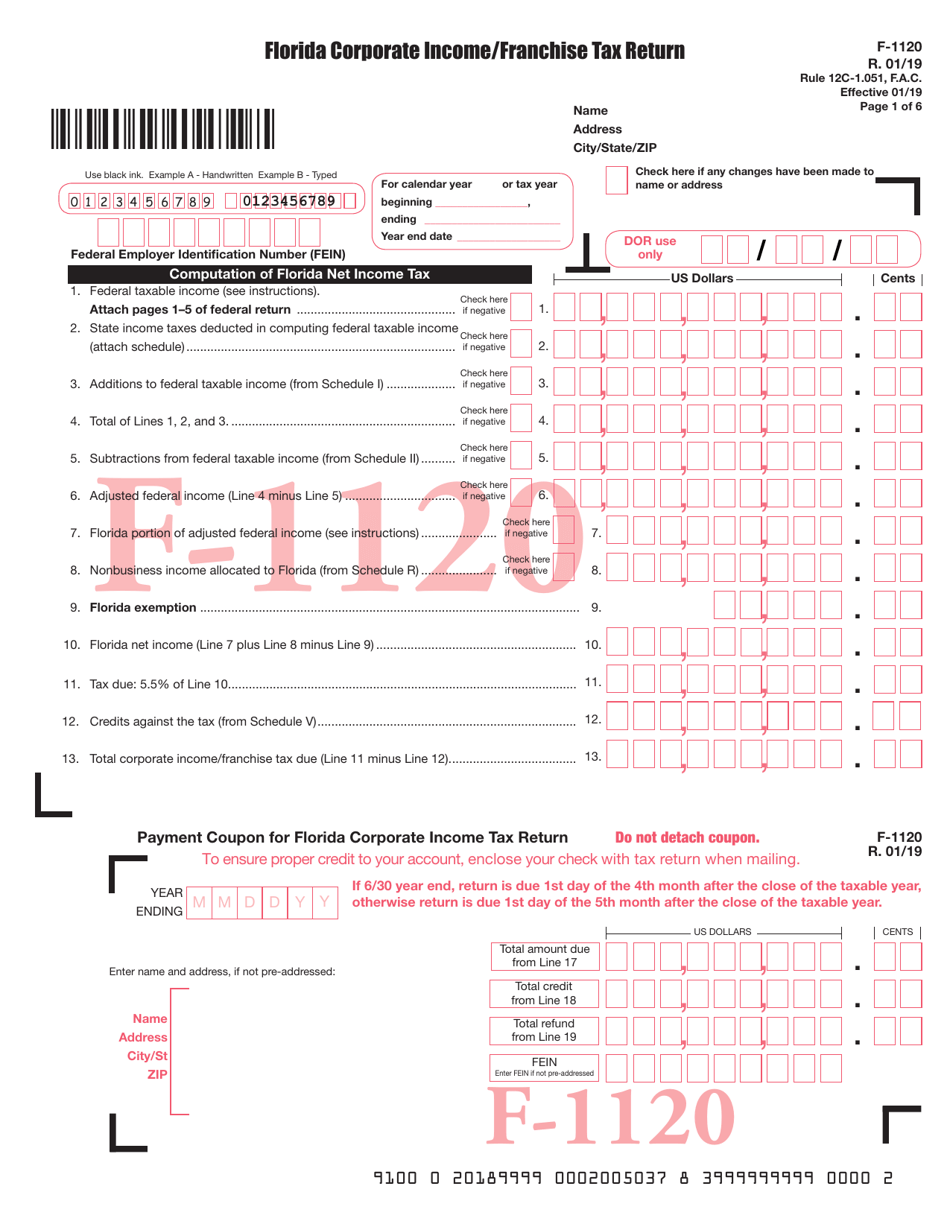

Form F1120 Fill Out, Sign Online and Download Printable PDF, Florida

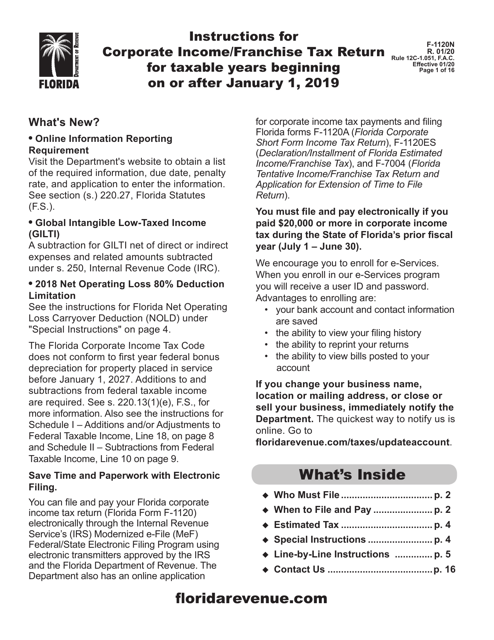

Download Instructions for Form F1120 Florida Corporate

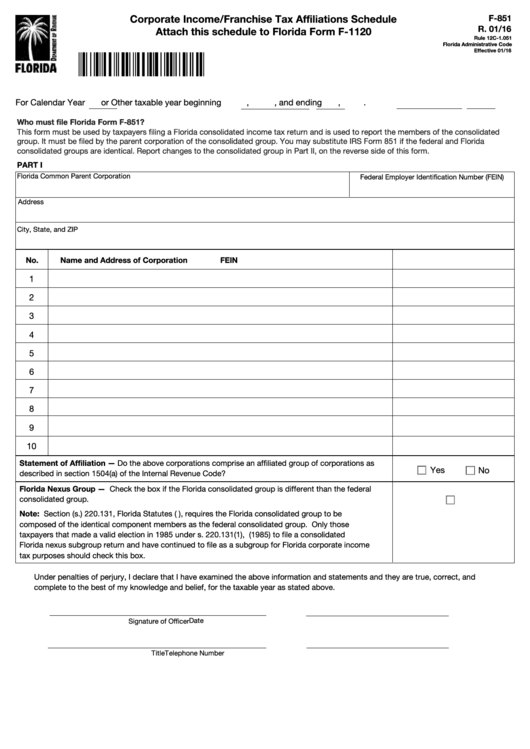

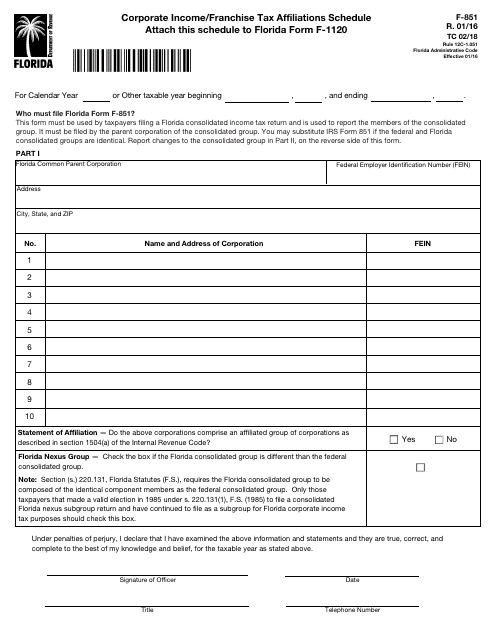

Fillable Form F851 Corporate Tax Affiliations

Form F1120 Schedule F851 Download Fillable PDF or Fill Online

F1120a Florida Corporate Franchise Tax Return printable pdf

Fillable Form F1120 Florida Corporate Tax Return

Form F1120a Florida Corporate Short Form Tax Return printable

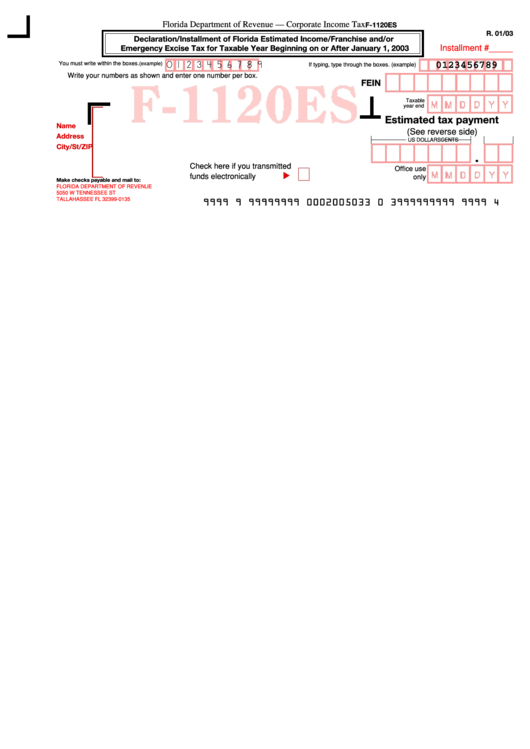

Form F1120es Declaration/installment Of Florida Estimated

Related Post: