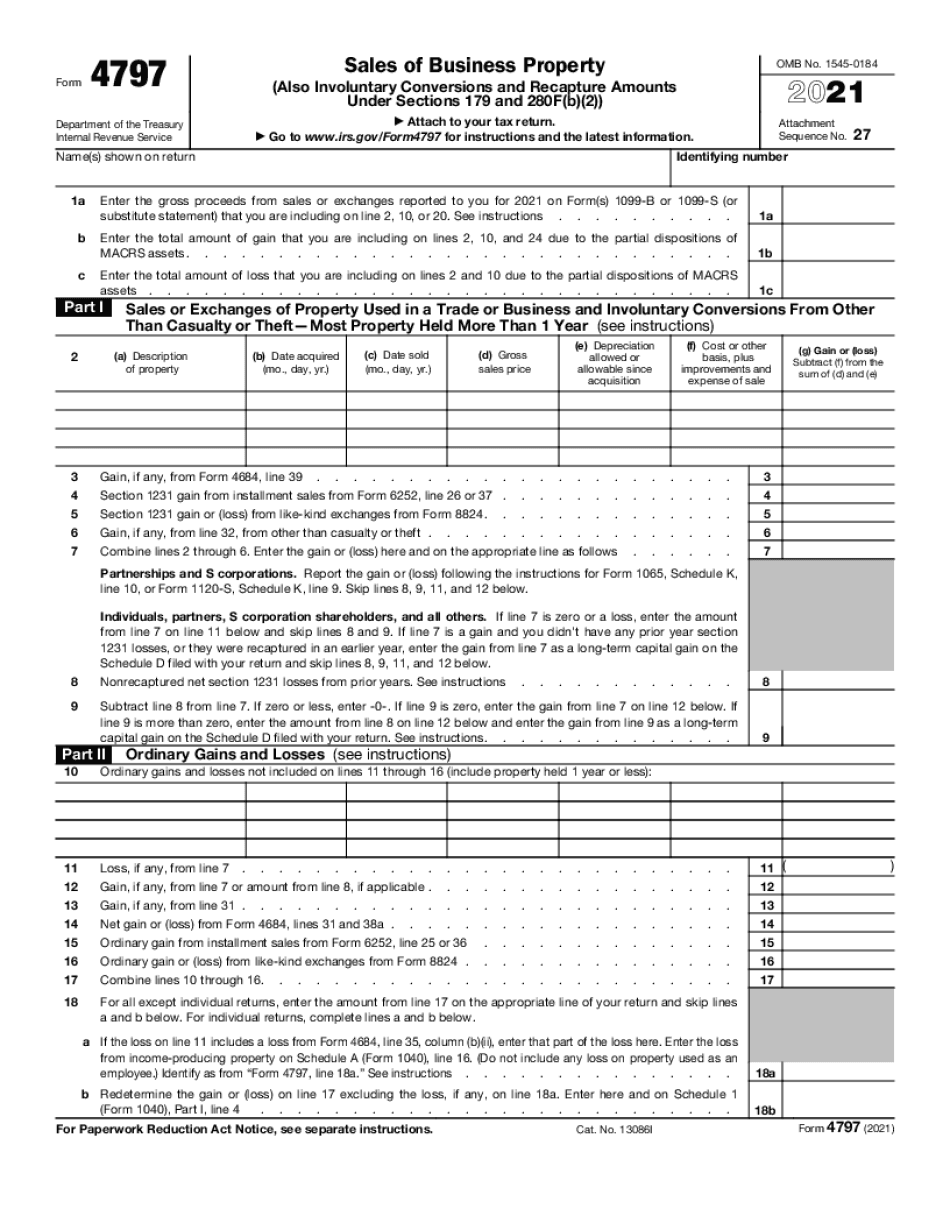

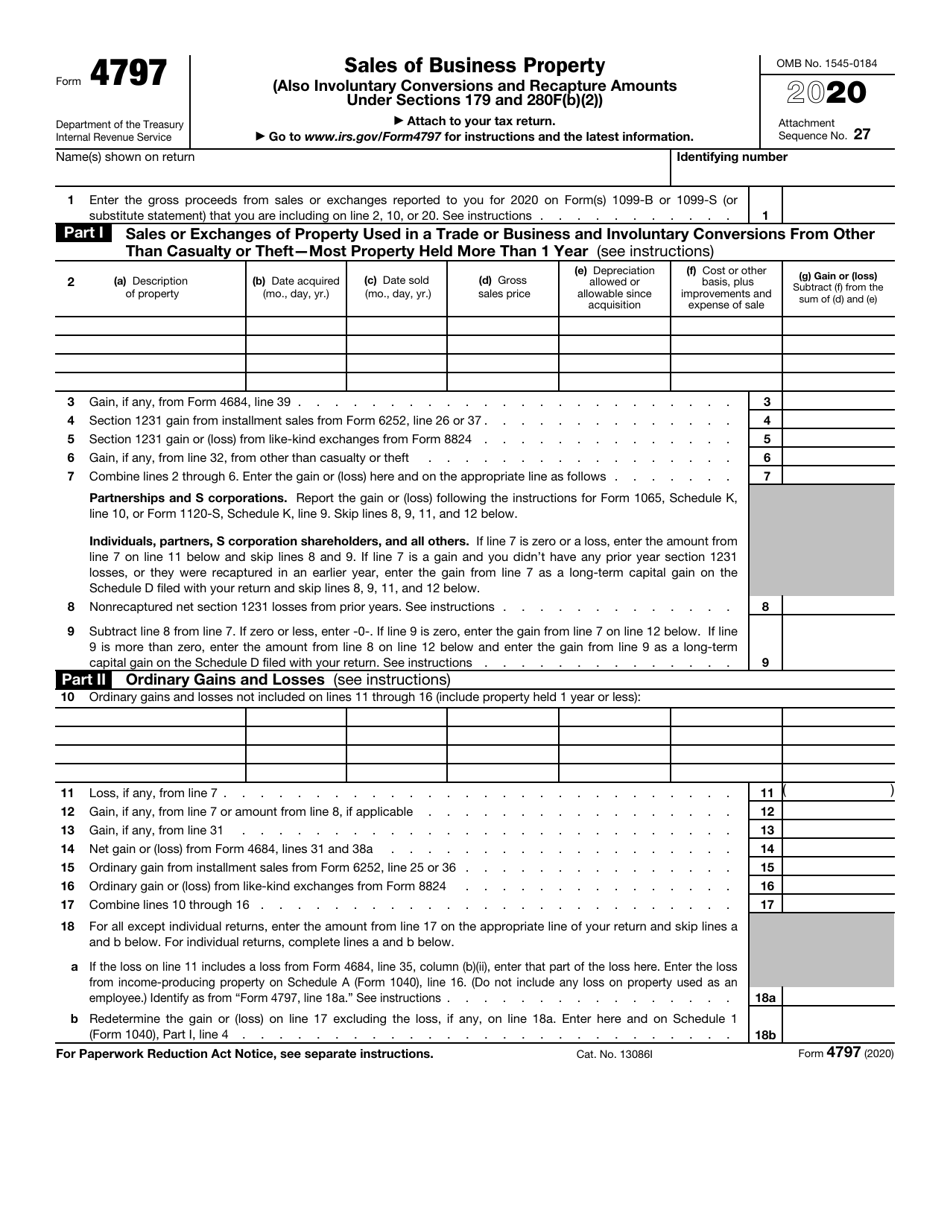

Federal Form 4797

Federal Form 4797 - Web according to the irs, you should use your 4797 form to report all of the following: Web form 4797 sales of business property reports the sale of business property. Part i of form 4797 can be used to record section 1231 transactions that are not. Ad get a nonprofit federal id number today. Web to add form 4797 to your return: Select take to my tax return, search for 4797, sale of business property (use this exact phrase) and then choose the jump to. Property used in your trade or business; Web we last updated the sales of business property in december 2022, so this is the latest version of form 4797, fully updated for tax year 2022. Get ready for tax season deadlines by completing any required tax forms today. Fast, easy & secure application. Web form 4797 sales of business property reports the sale of business property. The sale or exchange of property. Property used in your trade or business; Web what are the different property types (form 4797)? Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or. Get ready for tax season deadlines by completing any required tax forms today. Web to add form 4797 to your return: Ad get a nonprofit federal id number today. Part i of form 4797 can be used to record section 1231 transactions that are not. Select take to my tax return, search for 4797, sale of business property (use this. Select take to my tax return, search for 4797, sale of business property (use this exact phrase) and then choose the jump to. Web to add form 4797 to your return: Web what are the different property types (form 4797)? Ad get a nonprofit federal id number today. Fast, easy & secure application. Ad get a nonprofit federal id number today. Web form 4797 sales of business property reports the sale of business property. The involuntary conversion of property and. Use form 4797 to report: Fast, easy & secure application. Use form 4797 to report the following. The involuntary conversion of property and. Complete and file form 4797: To enter the sale of business property in taxact so that it is reported on form 4797: Real property used in your trade or business; Get ready for tax season deadlines by completing any required tax forms today. •the sale or exchange of: Web what are the different property types (form 4797)? Ad get a nonprofit federal id number today. Part i of form 4797 can be used to record section 1231 transactions that are not. Complete and file form 4797: Get ready for tax season deadlines by completing any required tax forms today. Ad get a nonprofit federal id number today. Use form 4797 to report: Web you must report the full amount of depreciation, allowed or allowable , up to the date of disposal when reporting the asset’s disposal on the federal form 4797,. Web to add form 4797 to your return: Ad get a nonprofit federal id number today. Part i of form 4797 can be used to record section 1231 transactions that are not. Use form 4797 to report the following. Select take to my tax return, search for 4797, sale of business property (use this exact phrase) and then choose the. Real property used in your trade or business; Fast, easy & secure application. To enter the sale of business property in taxact so that it is reported on form 4797: Fast, easy & secure application. Property used in your trade or business; Web form 4797 sales of business property reports the sale of business property. Part i of form 4797 can be used to record section 1231 transactions that are not. Web according to the irs, you should use your 4797 form to report all of the following: Use form 4797 to report the following. Real property used in your trade or. Fast, easy & secure application. Property used in your trade or business; •the sale or exchange of: Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Part i of form 4797 can be used to record section 1231 transactions that are not. Ad access irs tax forms. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Select take to my tax return, search for 4797, sale of business property (use this exact phrase) and then choose the jump to. Ad get a nonprofit federal id number today. Get ready for tax season deadlines by completing any required tax forms today. Web you must report the full amount of depreciation, allowed or allowable , up to the date of disposal when reporting the asset’s disposal on the federal form 4797, in order to. Use form 4797 to report the following. The sale or exchange of: Use form 4797 to report: To enter the sale of business property in taxact so that it is reported on form 4797: Web we last updated the sales of business property in december 2022, so this is the latest version of form 4797, fully updated for tax year 2022. Web according to the irs, you should use your 4797 form to report all of the following: Web follow the instructions for federal form 4797 under “disposition by a partnership or s corporation of section 179 property” to report the transaction on the partnership tax. Web form 4797 sales of business property reports the sale of business property. Web you must report the full amount of depreciation, allowed or allowable, up to the date of disposal when reporting the asset’s disposal on the federal form 4797 sales of.IRS Form 4797 Instructions Sales of Business Property

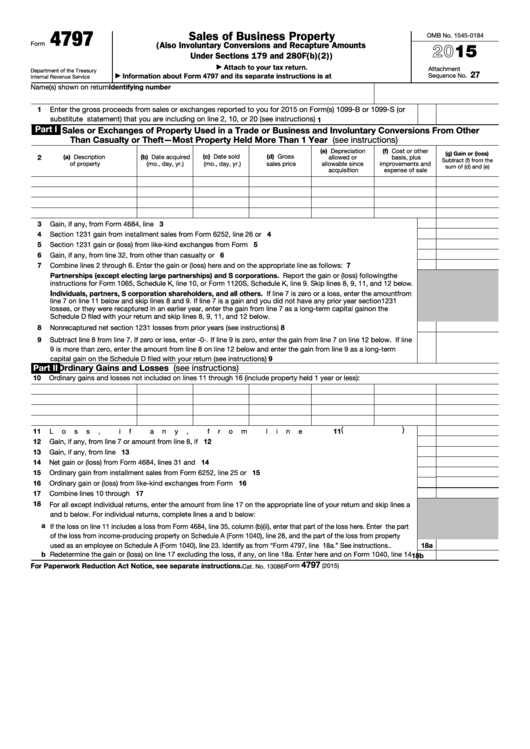

Fillable Form 4797 Sales Of Business Property 2015 printable pdf

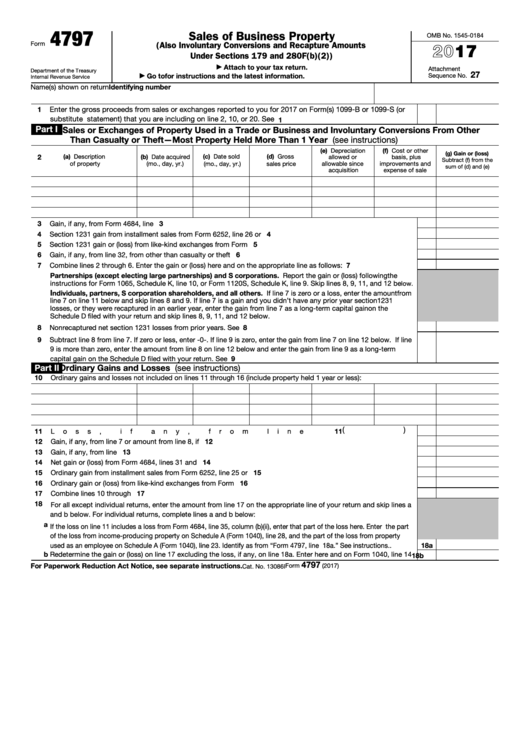

Fillable Form 4797 Sales Of Business Property 2016 printable pdf

Irs form 4797 instructions 2015 Fill out & sign online DocHub

IRS Form 4797 Download Fillable PDF or Fill Online Sales of Business

Formulário 4797 Vendas de Propriedades Comerciais Economia e Negocios

Publication 544 Sales and Other Dispositions of Assets; Example

A Not So Unusual Disposition Reported on IRS Form 4797 Center for

Form 4797 The Basics

IRS 4797 2019 Fill and Sign Printable Template Online US Legal Forms

Related Post:

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)