Federal Form 1116 Instructions

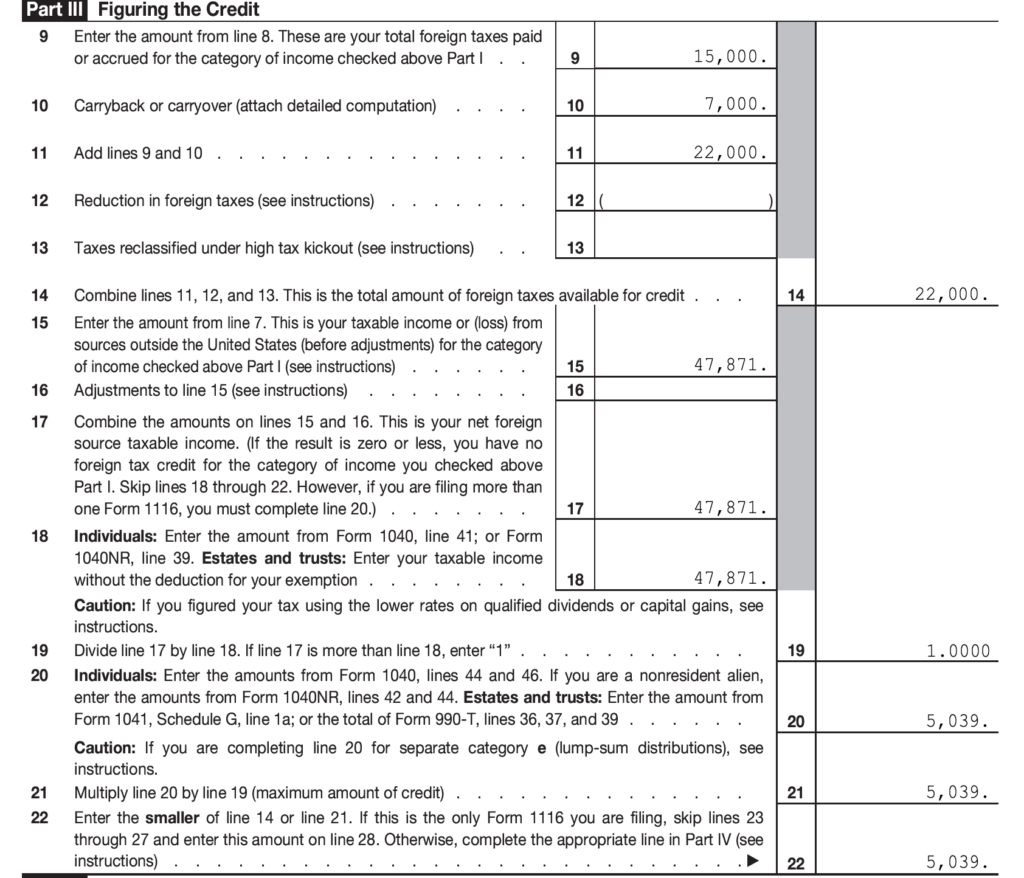

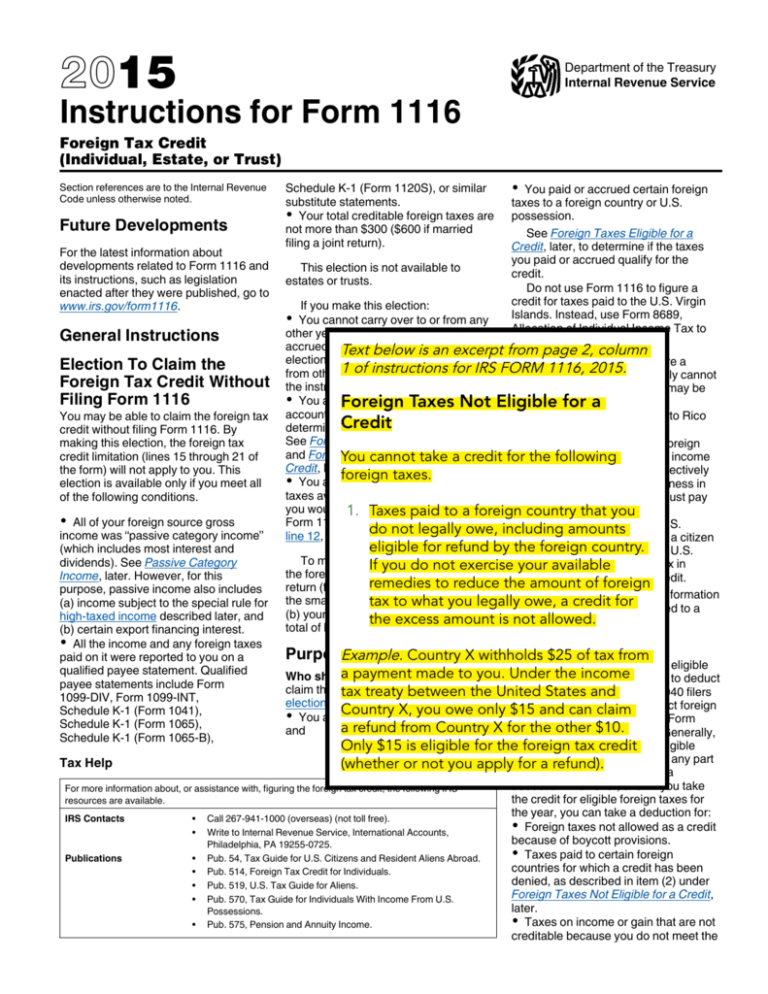

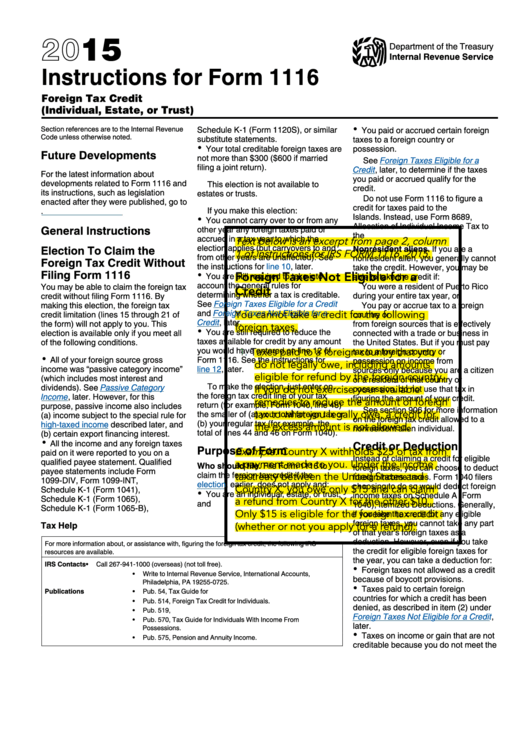

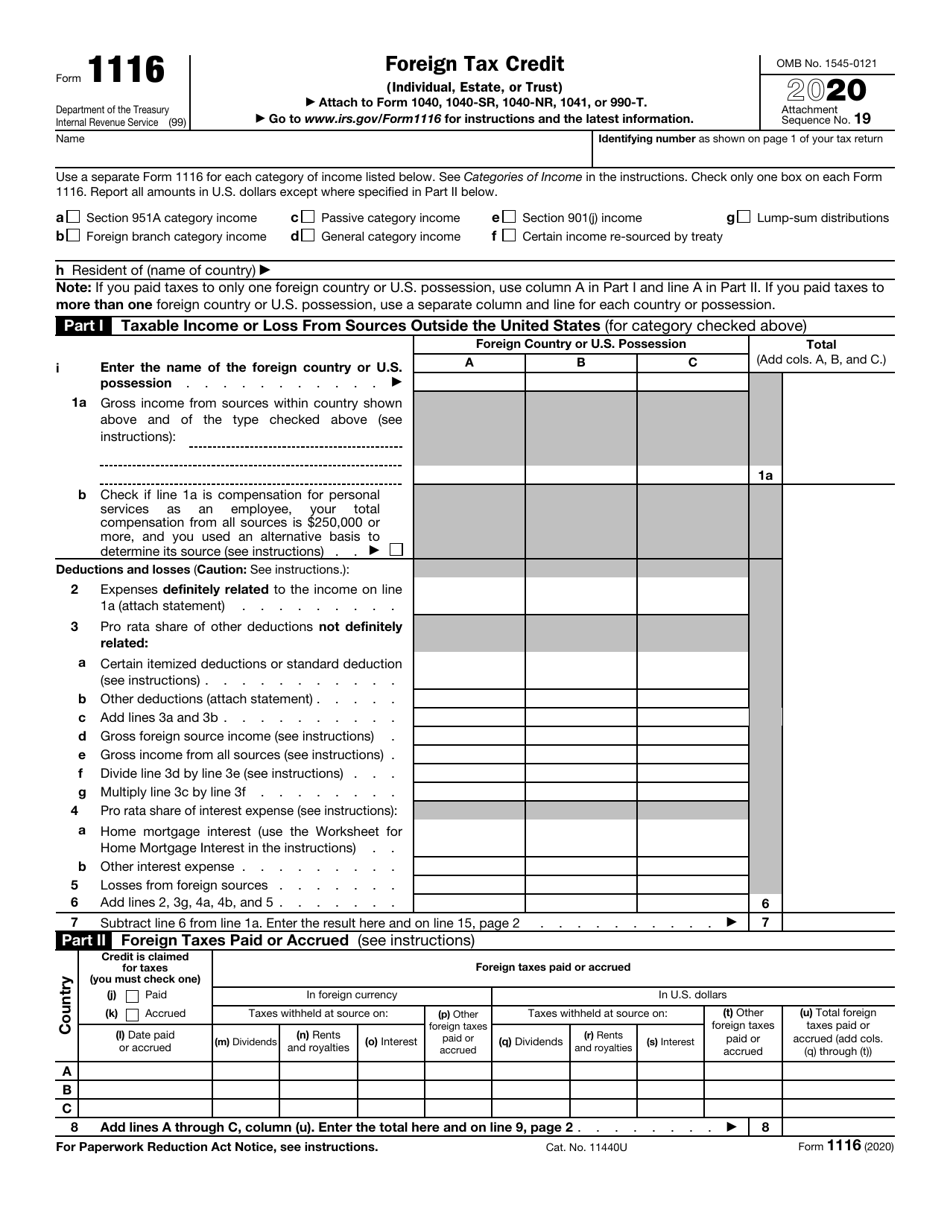

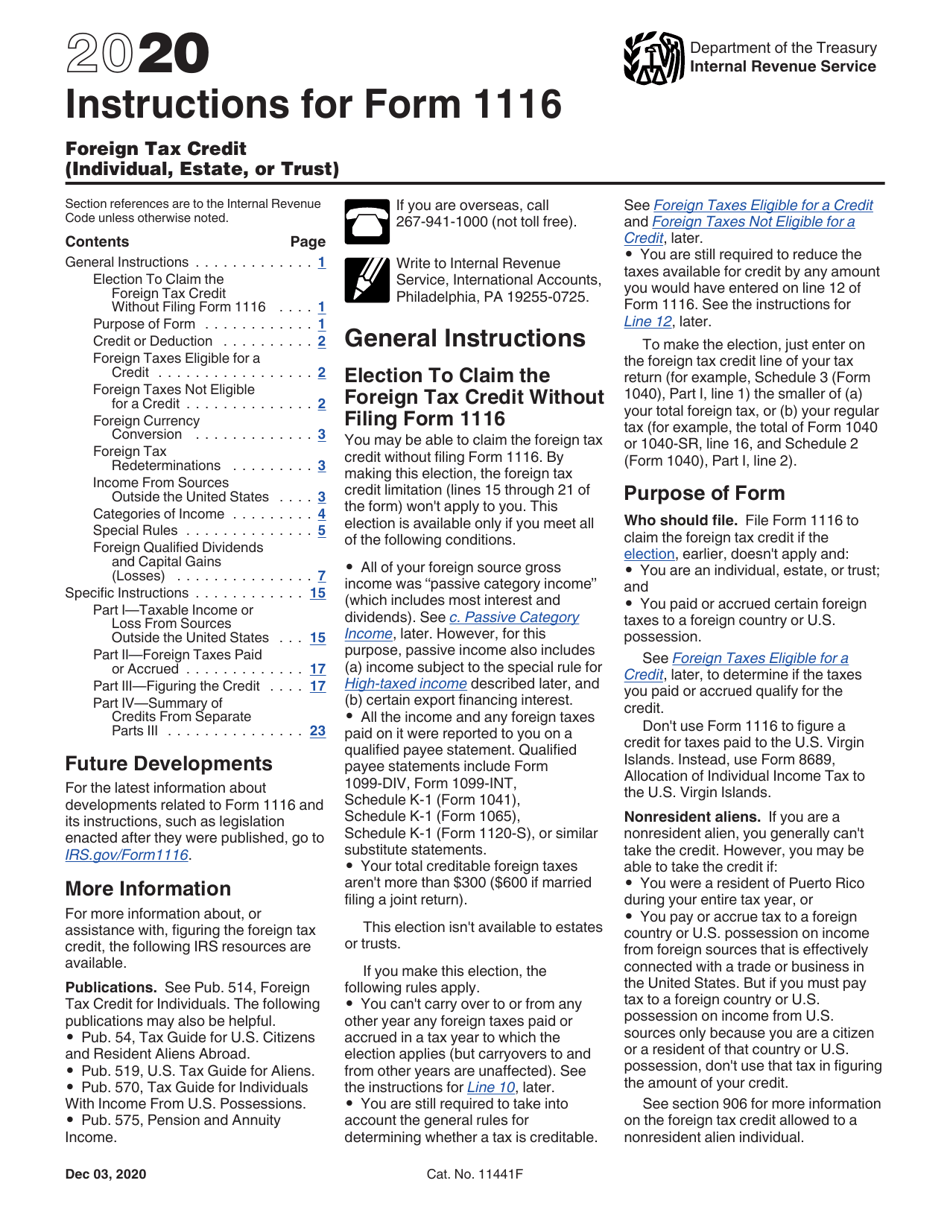

Federal Form 1116 Instructions - You must also still file form 1116 to claim the credit for other foreign taxes you paid or accrued. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Web you will not be subject to the foreign tax credit limit and will be able to claim the foreign tax credit without using form 1116 if the following requirements are met. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Line 18 of federal form 1116 foreign tax credit instructs that if you figured your tax using the lower rates on qualified dividends or. Web per irs instructions for form 1116, on page 16: See the instructions for line 12, later. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116. Web form 1116 is one tax form every u.s. Election to claim the foreign tax credit without filing form 1116. Department of the treasury internal revenue service (99) foreign tax credit. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. Web you will not be subject to the foreign tax credit limit and will be able to claim the foreign tax credit without using form 1116 if the following requirements are met. For. Line 18 of federal form 1116 foreign tax credit instructs that if you figured your tax using the lower rates on qualified dividends or. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. See the instructions for line 12, later. There is a new. Web you will not be subject to the foreign tax credit limit and will be able to claim the foreign tax credit without using form 1116 if the following requirements are met. Foreign taxes eligible for a credit. A credit for foreign taxes can be claimed only for foreign tax. Web use form 1116 to claim the foreign tax credit. Web you can use the $100 of unused foreign tax credits to reduce your tax bill on the prior and subsequent returns, leaving $25 of excess limit to be used in the future. Department of the treasury internal revenue service (99) foreign tax credit. Form 1116 can be complex, and it’s crucial to follow the instructions provided by the irs. Use form 2555 to claim. Here’s a simplified overview of the. For more information on how to complete your form 1116 and form 1118. Form 1116 can be complex, and it’s crucial to follow the instructions provided by the irs carefully. Web form 1116 is used to claim the foreign tax credit to reduce your us income tax liability, dollar. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116. Line 18 of federal form 1116 foreign tax credit instructs that if you figured your tax using the lower rates on qualified dividends or. Web form 1116 is used to claim the foreign tax credit. Department of the treasury internal revenue service. Web entering foreign taxes paid and generating form 1116 foreign tax credit in proconnect solved • by intuit • 56 • updated june 14, 2023 this article will help you. A credit for foreign taxes can be claimed only for foreign tax. Web use form 1116 to claim the foreign tax credit (ftc). For more information on how to complete your form 1116 and form 1118. Web you can use the $100 of unused foreign tax credits to reduce your tax bill on the prior and subsequent returns, leaving $25 of excess limit to be used in the future. To make the election, just enter on the foreign tax credit line of your. Here’s a simplified overview of the. Web form 1116 instructions. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Use form 2555 to claim. Web you will not be subject to the foreign tax credit limit and will be able to claim the foreign tax credit without using form. Web form 1116 is one tax form every u.s. A credit for foreign taxes can be claimed only for foreign tax. Election to claim the foreign tax credit without filing form 1116. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Web you will. See the instructions for line 12, later. Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022. Election to claim the foreign tax credit without filing form 1116. Web you can use the $100 of unused foreign tax credits to reduce your tax bill on the prior and subsequent returns, leaving $25 of excess limit to be used in the future. To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i,. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Web file form 1116 to not allowed on foreign income not payee statements include form claim the foreign tax credit if the subject to u.s. Web form 1116 is used to claim the foreign tax credit to reduce your us income tax liability, dollar for dollar for income tax paid to a foreign country. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. A credit for foreign taxes can be claimed only for foreign tax. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. For more information on how to complete your form 1116 and form 1118. Web per irs instructions for form 1116, on page 16: Foreign taxes eligible for a credit. Expat should learn to love, because it’s one of two ways americans working overseas can lower their u.s. Department of the treasury internal revenue service (99) foreign tax credit. Here’s a simplified overview of the. Web form 1116 is one tax form every u.s. You must also still file form 1116 to claim the credit for other foreign taxes you paid or accrued.Foreign Tax Credit & IRS Form 1116 Explained Greenback Expat Taxes

Instructions for Form 1116

Form 1116Foreign Tax Credit

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

Form 1116 part 1 instructions

2015 Instructions For Form 1116 printable pdf download

IRS Form 1116 Download Fillable PDF or Fill Online Foreign Tax Credit

Foreign Tax Credit Your Guide to the Form 1116 SDG Accountant

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Related Post: