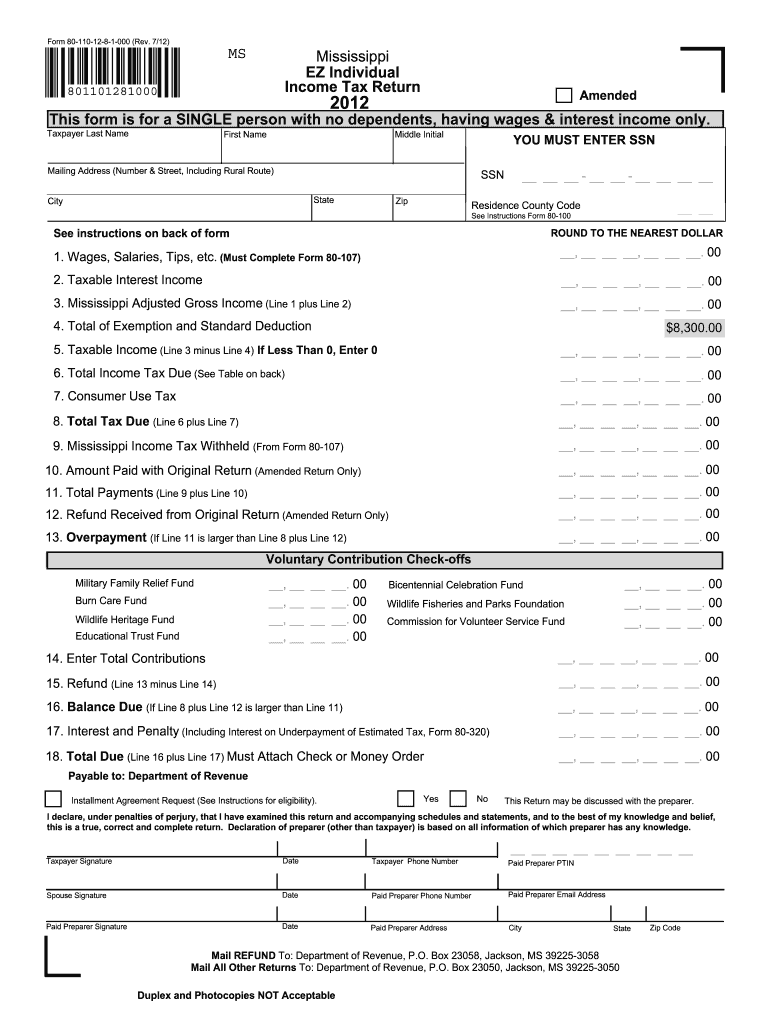

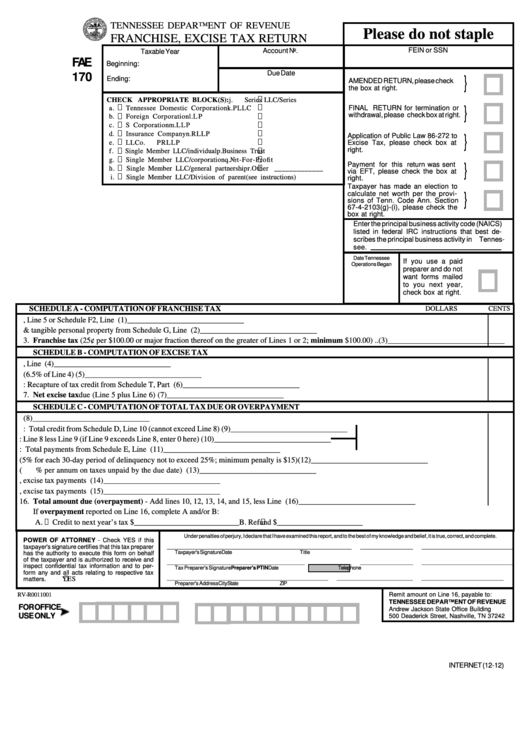

F&E Form 170 Tax Return

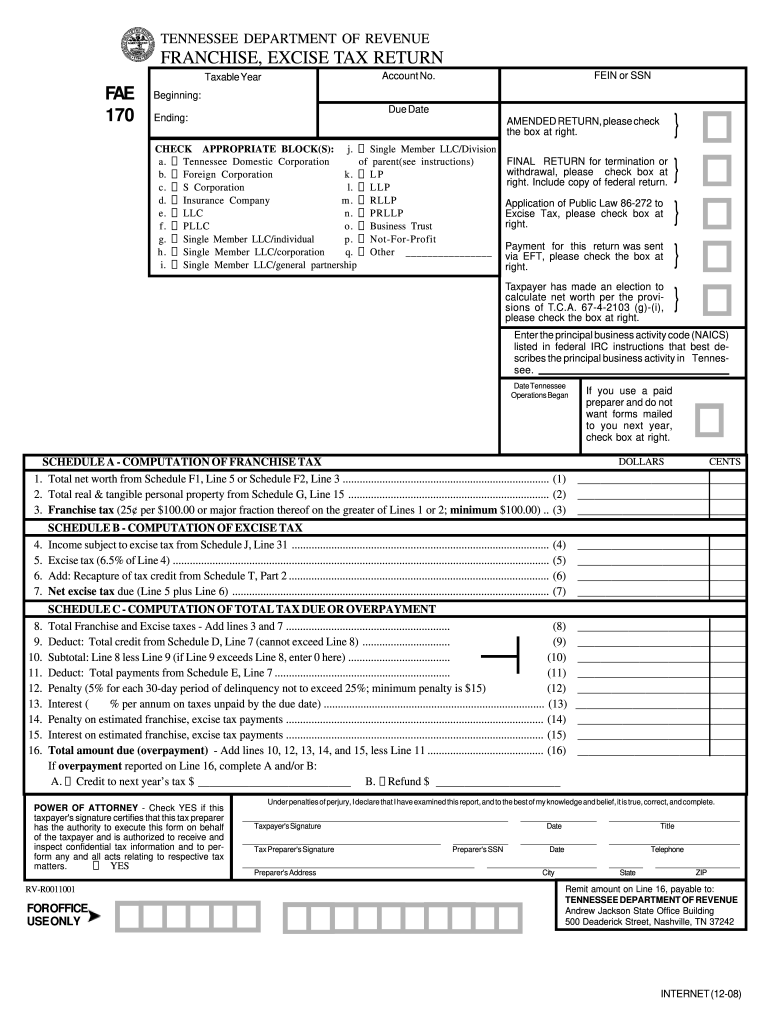

F&E Form 170 Tax Return - This form is for income earned in tax year 2022, with tax. Web 170 dollars cents tennessee department of revenue franchise, excise tax return taxable year fein or ssn beginning: The beginning and ending period of the return being filed must be. * annualized tax = (tax. The following entity types may be required to file the franchise and excise tax return: Web taxpayers who qualify for an exception from the electronic filing requirement may submit a paper form fae173 to request an extension. Web march 12, 2021 09:13. Tennessee franchise, excise fae 170 tax return. Web in the top portion of the front page of the tax return, the following items must be completed by the taxpayer: Web tennessee fae 170 (franchise and excise tax return). Tennessee franchise, excise fae 170 tax return. Web tax may file only page 1 of this return and omit pages 2 through 6. Corporation subchapter s corporation limited liability company. This form is for income earned in tax year 2022, with tax. Web tennessee fae 170 (franchise and excise tax return). The beginning and ending period of the return being filed must be. Tennessee franchise, excise fae 170 tax return. Web march 12, 2021 09:13. Complete, edit or print tax forms instantly. Web form fae 170, consolidated net worth election registration application. The franchise and excise tax return is due on the 15th day of the fourth month following. Web 170 dollars cents tennessee department of revenue franchise, excise tax return taxable year fein or ssn beginning: Ad access irs tax forms. Web march 12, 2021 09:13. * annualized tax = (tax. Ad access irs tax forms. If the partnership is inactive in tennessee,. Web the excise tax is based on net earnings or income for the tax year. Web use this screen to enter information for form fae 170, franchise excise tax return. * annualized tax = (tax. The minimum franchise tax of $100 is payable if you are incorporated, domesticated, qualified, or otherwise. Complete the short period return worksheets and retain them for your. Web tax may file only page 1 of this return and omit pages 2 through 6. This form is for income earned in tax year 2022, with tax. If the partnership is inactive. Enter the beginning and ending dates of the period covered by this return. Form fae 170 is due 3 1/2 months after the entity’s. * annualized tax = (tax. Web taxpayers who qualify for an exception from the electronic filing requirement may submit a paper form fae173 to request an extension. Complete irs tax forms online or print government tax. Complete irs tax forms online or print government tax documents. Form fae 170 is due 3 1/2 months after the entity’s. Complete the short period return worksheets and retain them for your. For detailed information on creating llc activities, click the processing 1040 tennessee. Web use this screen to enter information for form fae 170, franchise excise tax return. Standard and special apportionment forms available. Web the excise tax is based on net earnings or income for the tax year. If the partnership is inactive in tennessee,. 56 tennessee tax exempt form templates are collected for any of your needs. The beginning and ending period of the return being filed must be. The franchise and excise tax return is due on the 15th day of the fourth month following. Ad access irs tax forms. Web in the top portion of the front page of the tax return, the following items must be completed by the taxpayer: Web entities liable for these taxes will compute and pay the tax on one form filed. Tennessee franchise, excise fae 170 tax return. If the partnership is inactive in tennessee,. The franchise and excise tax return is due on the 15th day of the fourth month following. 56 tennessee tax exempt form templates are collected for any of your needs. The beginning and ending period of the return being filed must be. This form is for income earned in tax year 2022, with tax. For detailed information on creating llc activities, click the processing 1040 tennessee. 56 tennessee tax exempt form templates are collected for any of your needs. The following entity types may be required to file the franchise and excise tax return: Web 170 dollars cents tennessee department of revenue franchise, excise tax return taxable year fein or ssn beginning: Ad easy guidance & tools for c corporation tax returns. Form fae 170 is due 3 1/2 months after the entity’s. Web form fae 170, consolidated net worth election registration application. Web the excise tax is based on net earnings or income for the tax year. Corporation subchapter s corporation limited liability company. Complete, edit or print tax forms instantly. Ad access irs tax forms. The minimum franchise tax of $100 is payable if you are incorporated, domesticated, qualified, or otherwise. Complete irs tax forms online or print government tax documents. Web entities liable for these taxes will compute and pay the tax on one form filed with the state of tennessee (form fae 170). Web tennessee fae 170 (franchise and excise tax return). Web taxpayers who qualify for an exception from the electronic filing requirement may submit a paper form fae173 to request an extension. Web tax may file only page 1 of this return and omit pages 2 through 6. If the partnership is inactive in tennessee,. Web march 12, 2021 09:13.What Does A State Tax Form Look Like Fill and Sign Printable Template

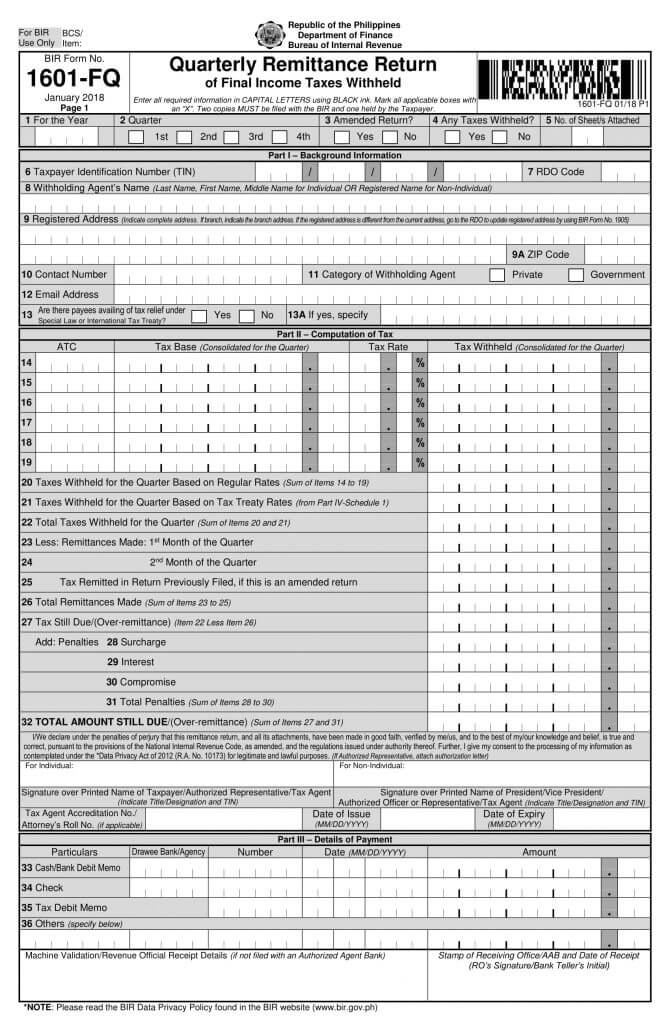

What You Need to Know About The New BIR Forms Taxumo Blog

Fae 170 Fill Online, Printable, Fillable, Blank pdfFiller

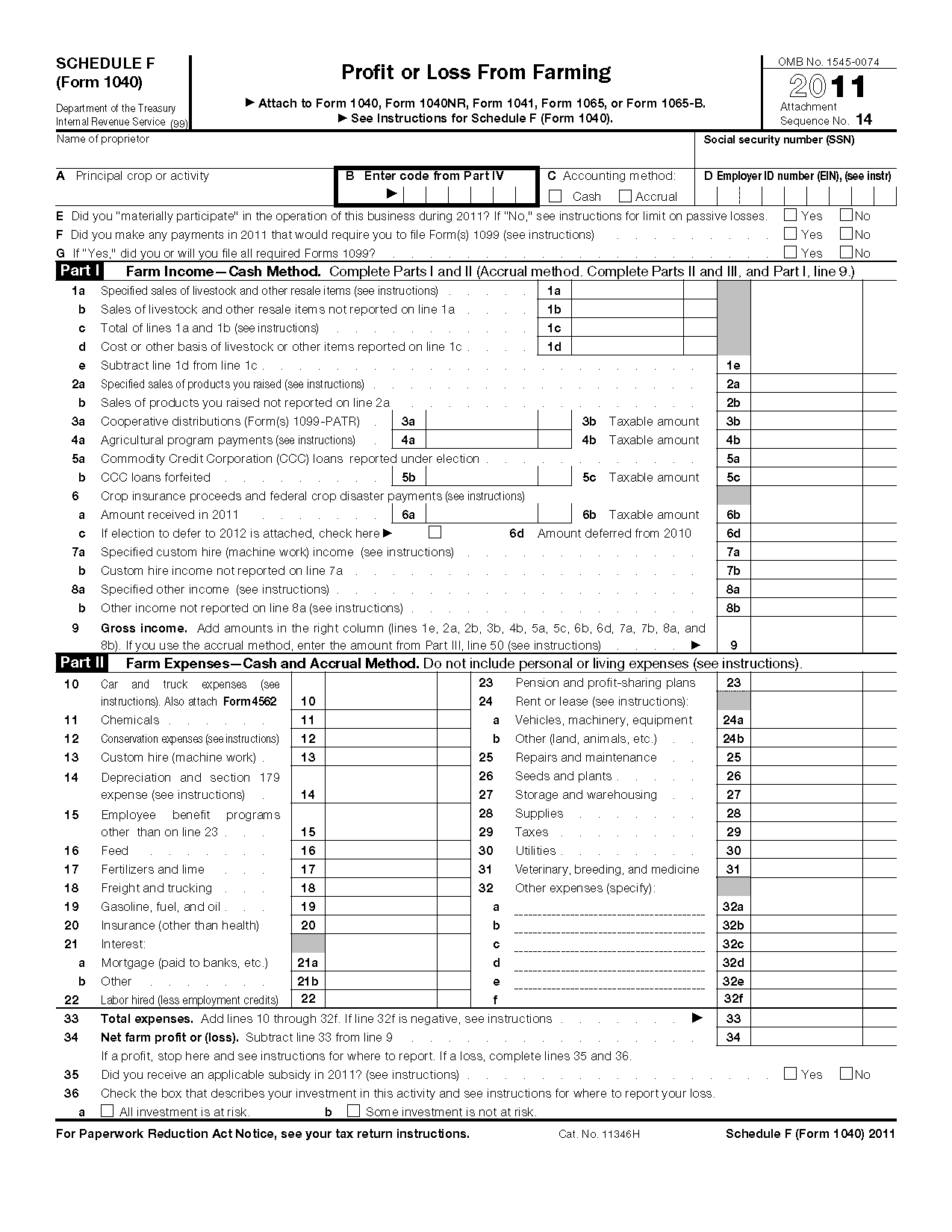

Schedule F Form 1040 Profit Or LoSS From Farming 1040 Form Printable

Form Fae 170 Franchise, Excise Tax Return printable pdf download

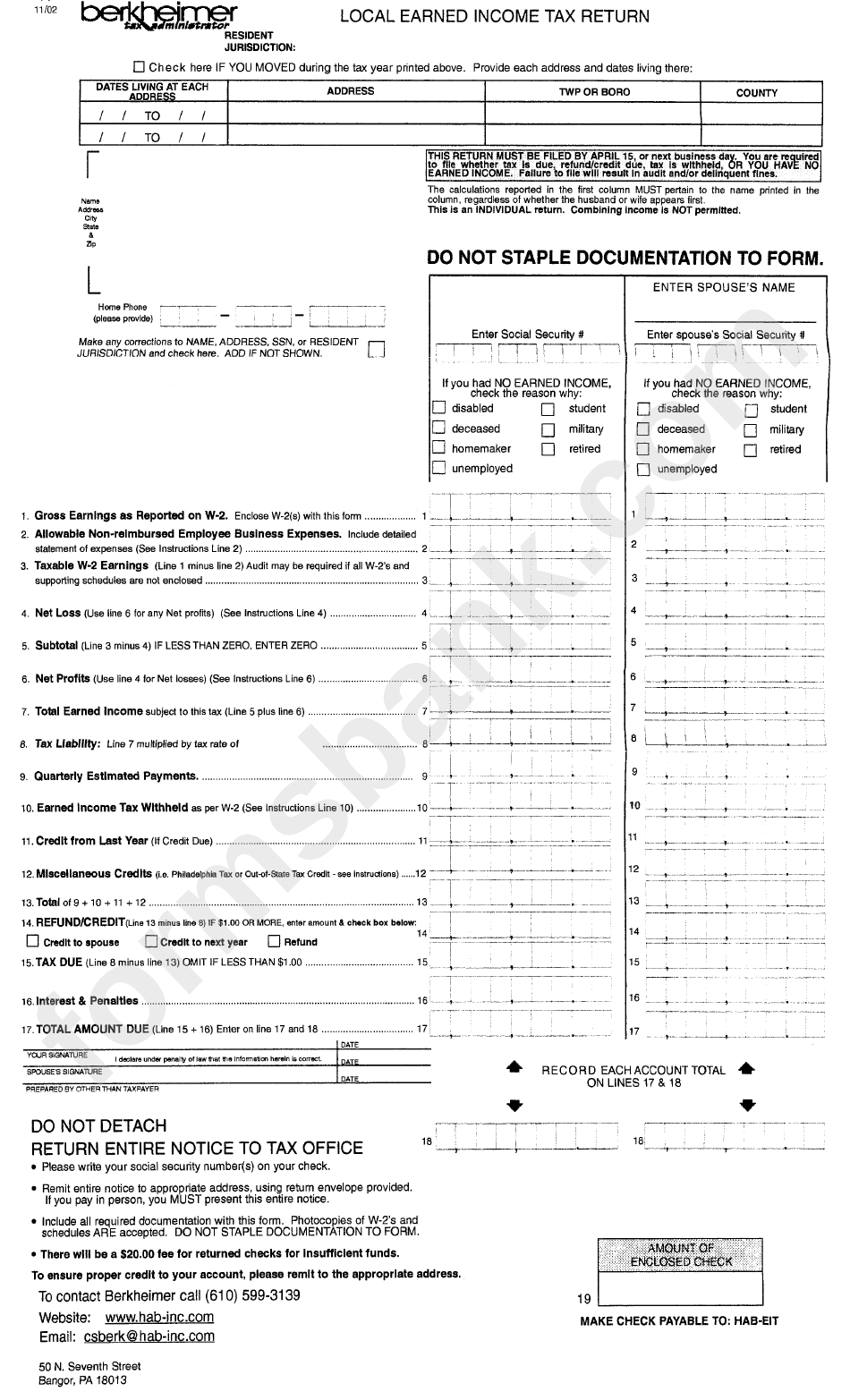

Local Earned Tax Return Form Berkheimer Tax Administrator

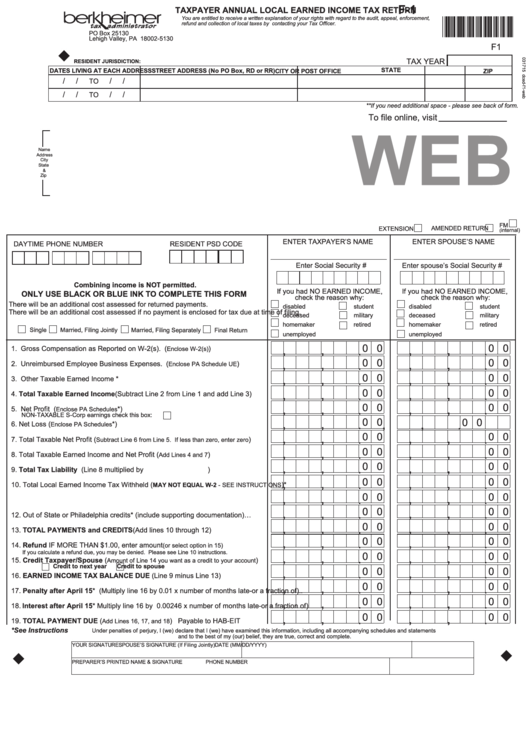

Fillable Form F1 Taxpayer Annual Local Earned Tax Return

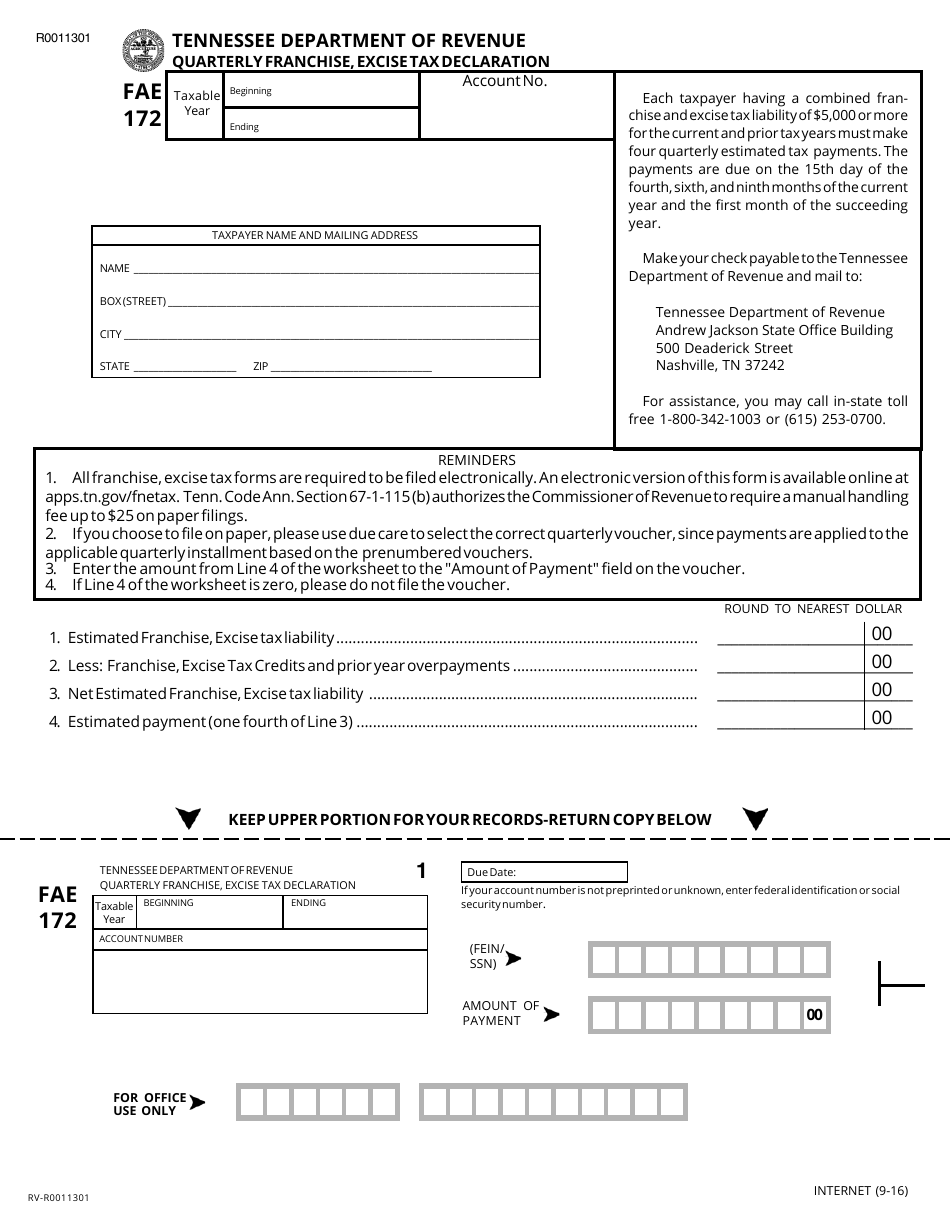

Form FAE172 Fill Out, Sign Online and Download Printable PDF

Ssurvivor Irs Form 2210 Ai Instructions

Why Most U.S. Citizens Residing Overseas Haven’t a Clue about the

Related Post: