Employer's Quarterly Tax And Wage Report Form

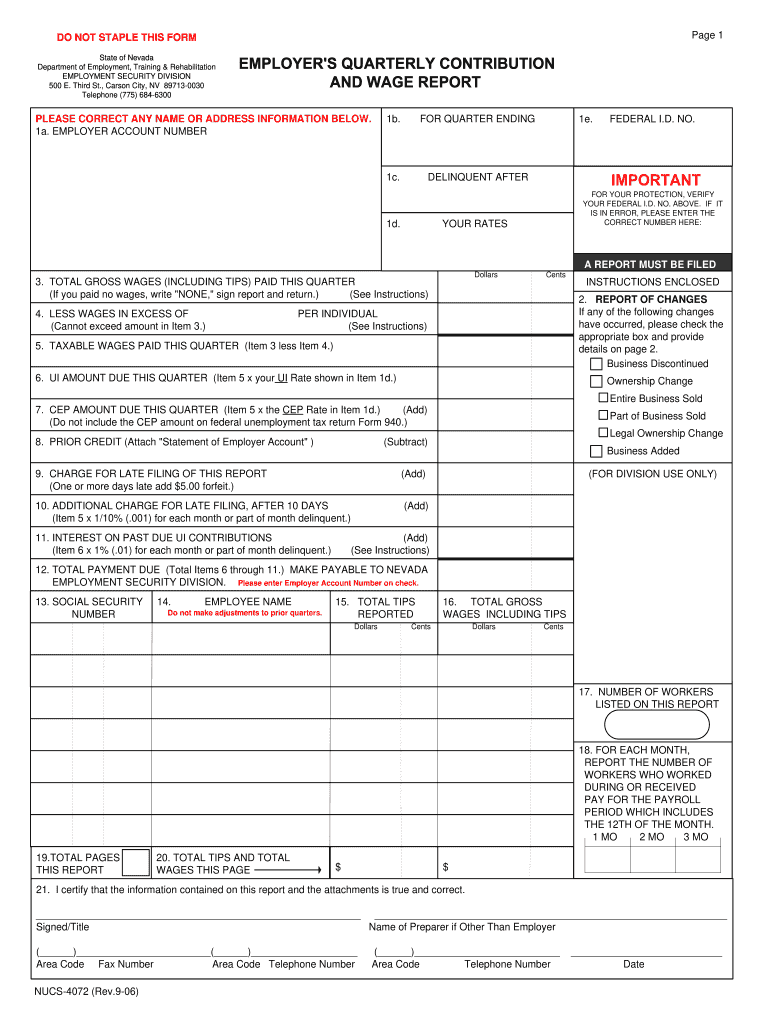

Employer's Quarterly Tax And Wage Report Form - 9 10 if some of the. Pay your team and access hr and benefits with the #1 online payroll provider. Quarterly tax, wage report, and payment information for employers. Employers are required to file their quarterly wage and tax reports electronically when reporting. Web employer’s quarterly federal tax return form 941 for 2023: Web make sure your employer number is shown on all copies being sent. Web annual tax and wage report which domestic employers must file. Web the montana department of labor & industry has provided preliminary versions of the 2024 prevailing wage rates. Part i enter your dol account number, the report. Of your tax and wage information. Learn about unemployment taxes and benefits. 9 10 if some of the. Web reporting taxes and wages. Ad produce critical tax reporting requirements faster and more accurately. March 2023) employer’s quarterly federal tax return department of the treasury — internal. Employers are required to file their quarterly wage and tax reports electronically when reporting. 9 10 if some of the. Web reporting taxes and wages. Web annual tax and wage report which domestic employers must file. Learn about unemployment taxes and benefits. This free service provides four options for filing: Once the missing quarterly tax return is processed, you will be assessed penalty and interest. Employers are required to file their quarterly wage and tax reports electronically when reporting. Form id 253, form number ncui101, english. Web file tax and wage reports and make payments. March 2023) employer’s quarterly federal tax return department of the treasury — internal. Tax and wage reports may be filed using the preferred electronic filing. Part i enter your dol account number, the report. Of your tax and wage information. Web the montana department of labor & industry has provided preliminary versions of the 2024 prevailing wage rates. Of your tax and wage information. Web annual tax and wage report which domestic employers must file. Web requirements for electronic filing of quarterly tax and wage reports. Form 941 is used by employers. Employers are required to file their quarterly wage and tax reports electronically when reporting. Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no. Web the uts system allows employers with 1,000 or fewer employees to file wage reports via the internet. Click the link to see the form instructions. Form 941 is used by employers. Tax due (item 15) computation to calculate. Quarterly tax, wage report, and payment information for employers. Web annual tax and wage report which domestic employers must file. 9 10 if some of the. Once the missing quarterly tax return is processed, you will be assessed penalty and interest. Web employer's quarterly tax and wage report. Ad produce critical tax reporting requirements faster and more accurately. Part i enter your dol account number, the report. Web reporting taxes and wages. Web the montana department of labor & industry has provided preliminary versions of the 2024 prevailing wage rates. Form 941 is used by employers. Web the montana department of labor & industry has provided preliminary versions of the 2024 prevailing wage rates. Pay your team and access hr and benefits with the #1 online payroll provider. Of your tax and wage information. Tax due (item 15) computation to calculate the tax due, enter the tax. Web reporting taxes and wages. Form 941 is used by employers. Quarterly tax, wage report, and payment information for employers. Web annual tax and wage report which domestic employers must file. Part i enter your dol account number, the report. Web make sure your employer number is shown on all copies being sent. Learn about unemployment taxes and benefits. Quarterly tax, wage report, and payment information for employers. Web reporting taxes and wages. Part i enter your dol account number, the report. March 2023) employer’s quarterly federal tax return department of the treasury — internal. Of your tax and wage information. Ad produce critical tax reporting requirements faster and more accurately. Web qualified employers may defer quarterly taxes of $5.00 or less until january 31st of the following year. Web the montana department of labor & industry has provided preliminary versions of the 2024 prevailing wage rates. Web employer's quarterly tax and wage report. Web file tax and wage reports and make payments. Tax and wage reports may be filed using the preferred electronic filing. Web 9 if all of the taxable futa wages you paid were excluded from state unemployment tax, multiply line 7 by 0.054 (line 7 × 0.054 = line 9). Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web the uts system allows employers with 1,000 or fewer employees to file wage reports via the internet. On november 9th, at 10:00 a.m, the. Web employer’s quarterly federal tax return form 941 for 2023: Once the missing quarterly tax return is processed, you will be assessed penalty and interest. Uploading a file (excel or. Tax due (item 15) computation to calculate the tax due, enter the tax.Nevada Employer's Quarterly Contribution and Wage Report Guidelines

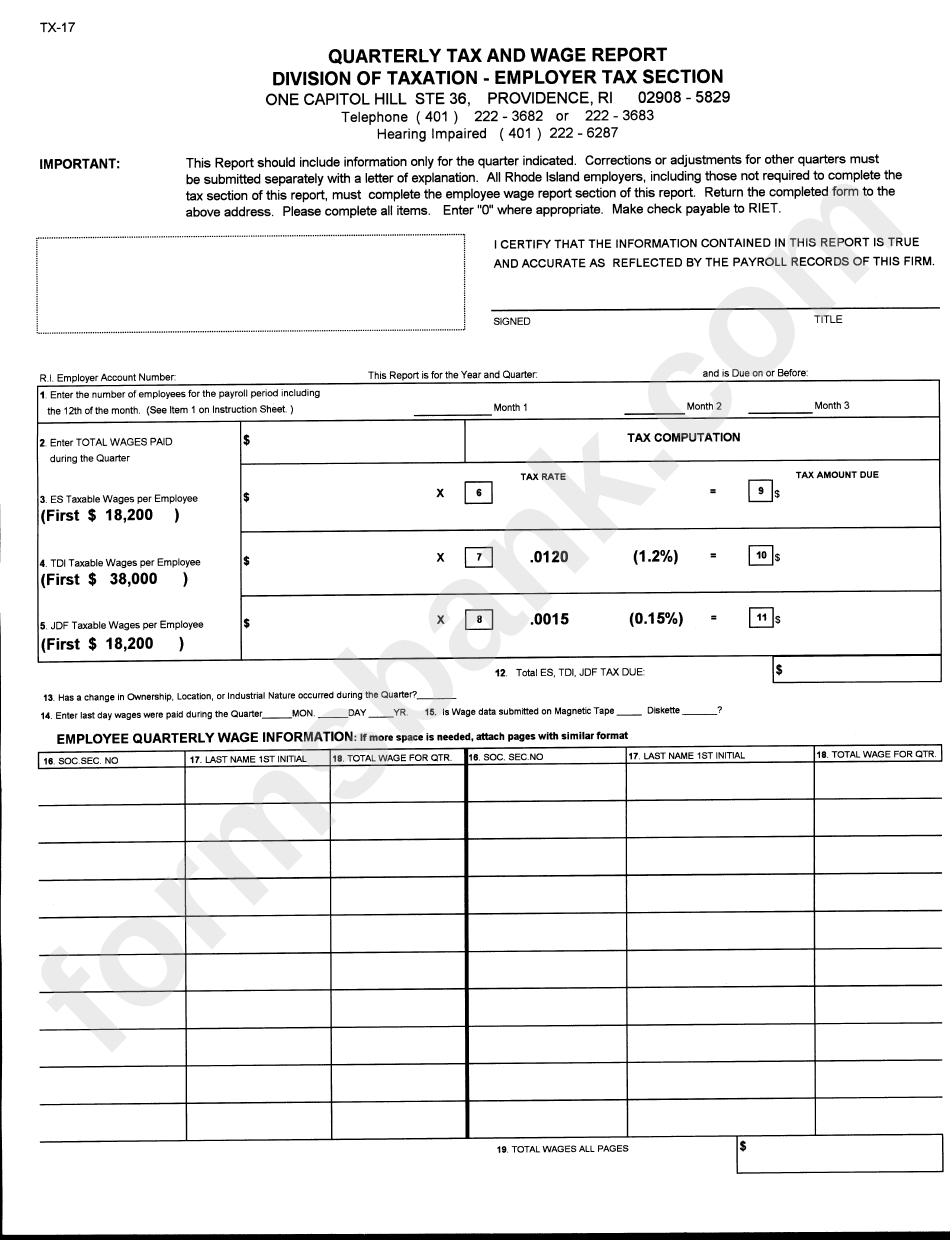

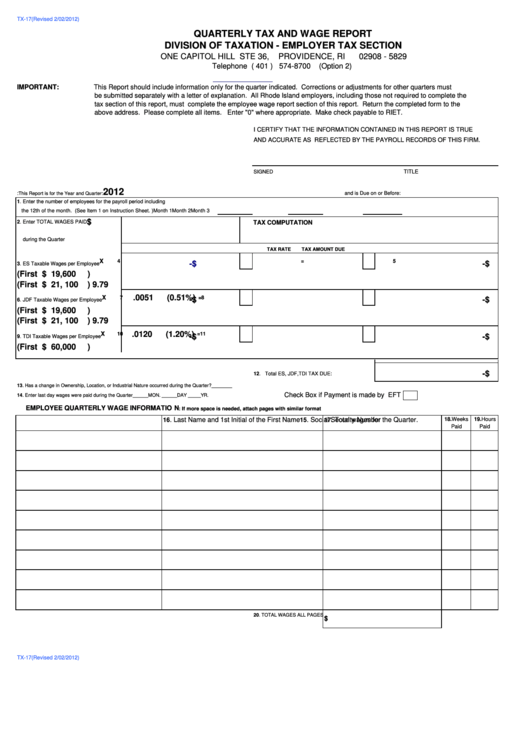

Fillable Form Tx17 Quarterly Tax And Wage Report printable pdf download

Form NCUI685 Download Printable PDF or Fill Online Adjustment to

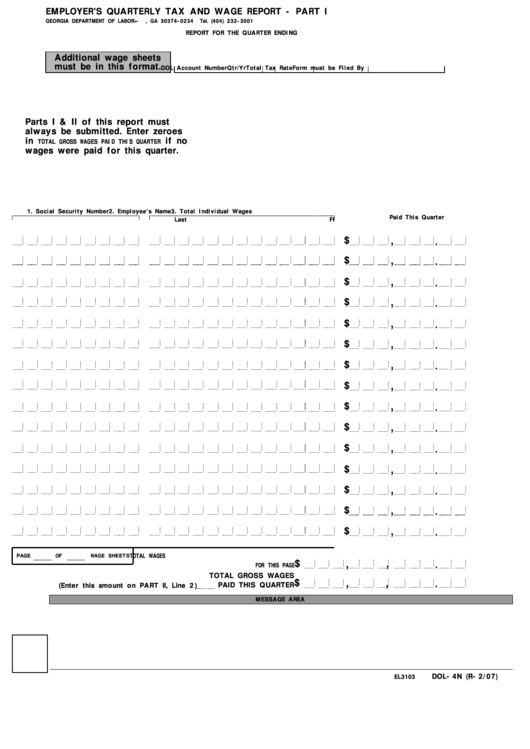

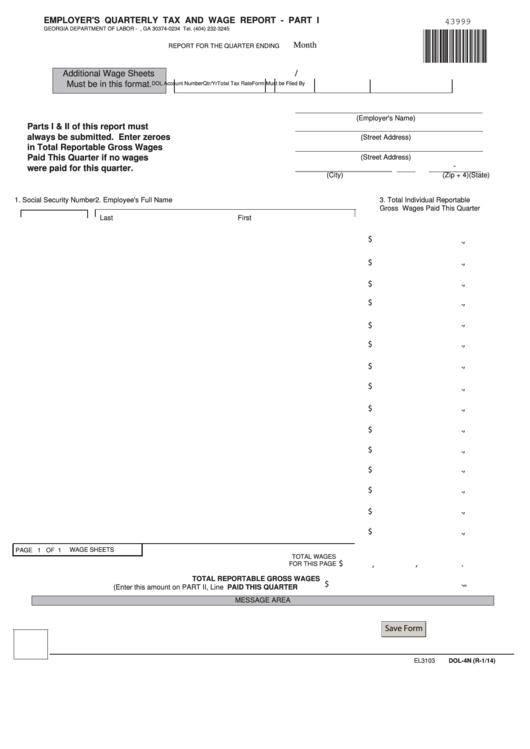

Form Dol4n Employer'S Quarterly Tax And Wage Report

Fillable Form Tx17 Quarterly Tax And Wage Report 2012 printable

Form Dol4n Employer'S Quarterly Tax And Wage Report

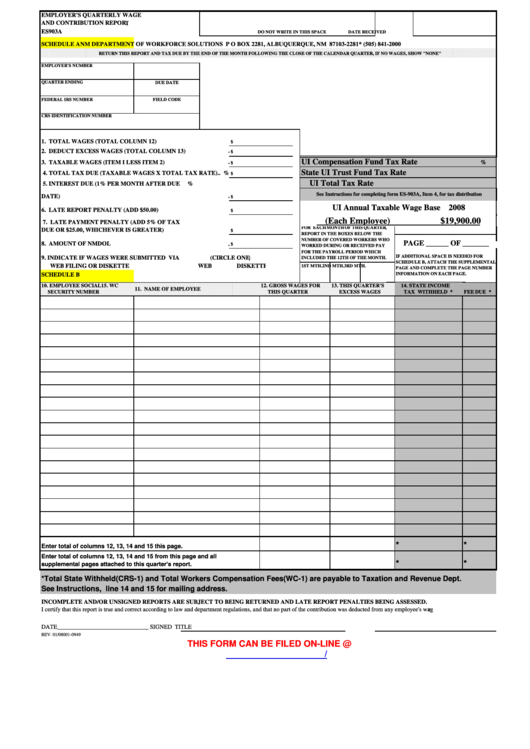

Employer'S Quarterly Wage And Contribution Report printable pdf download

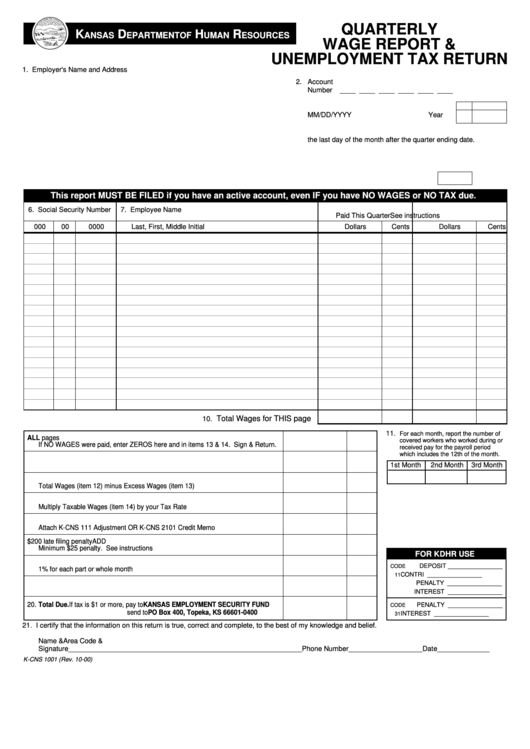

Fillable Form KCns 1001 Quarterly Wage Report & Unemployment Tax

For paperfiling and documentation purposes a PDF report, Employer's

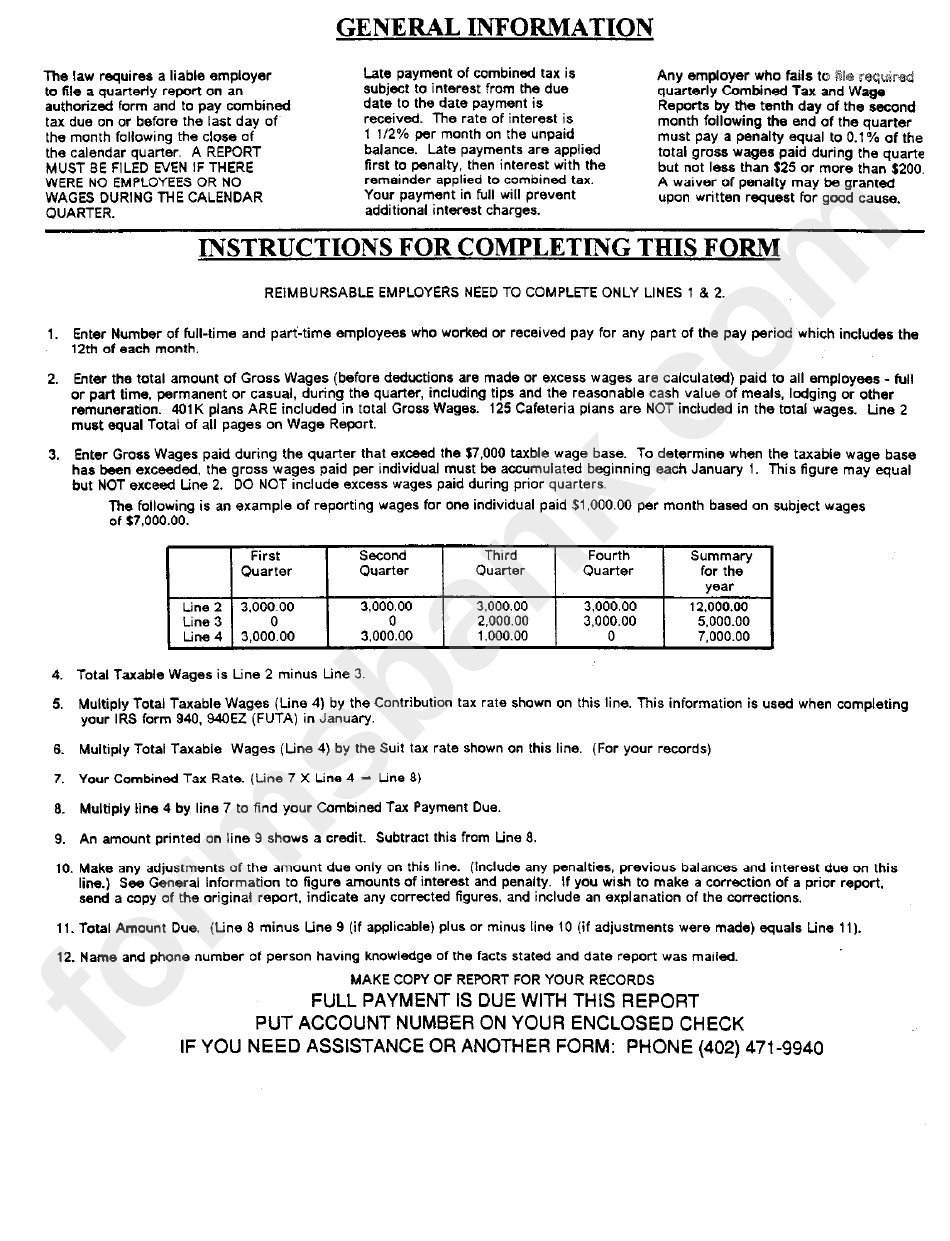

Employer'S Quarterly Combined Tax And Wage Report Form printable pdf

Related Post:

1.jpg)