Draft Kings Tax Form

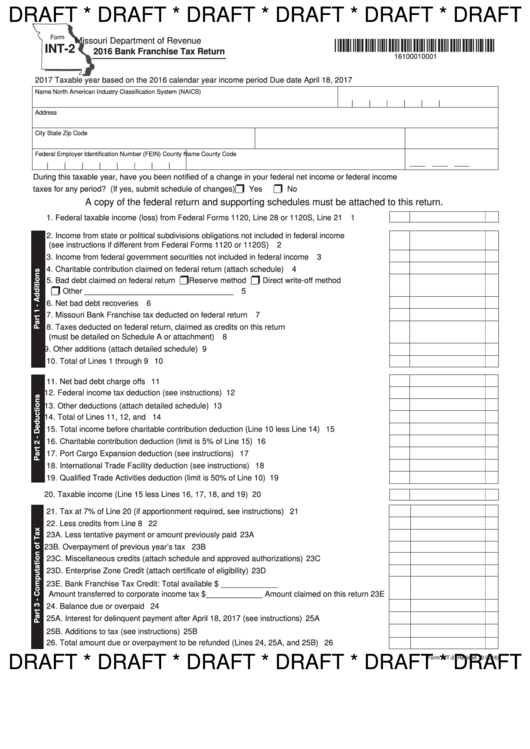

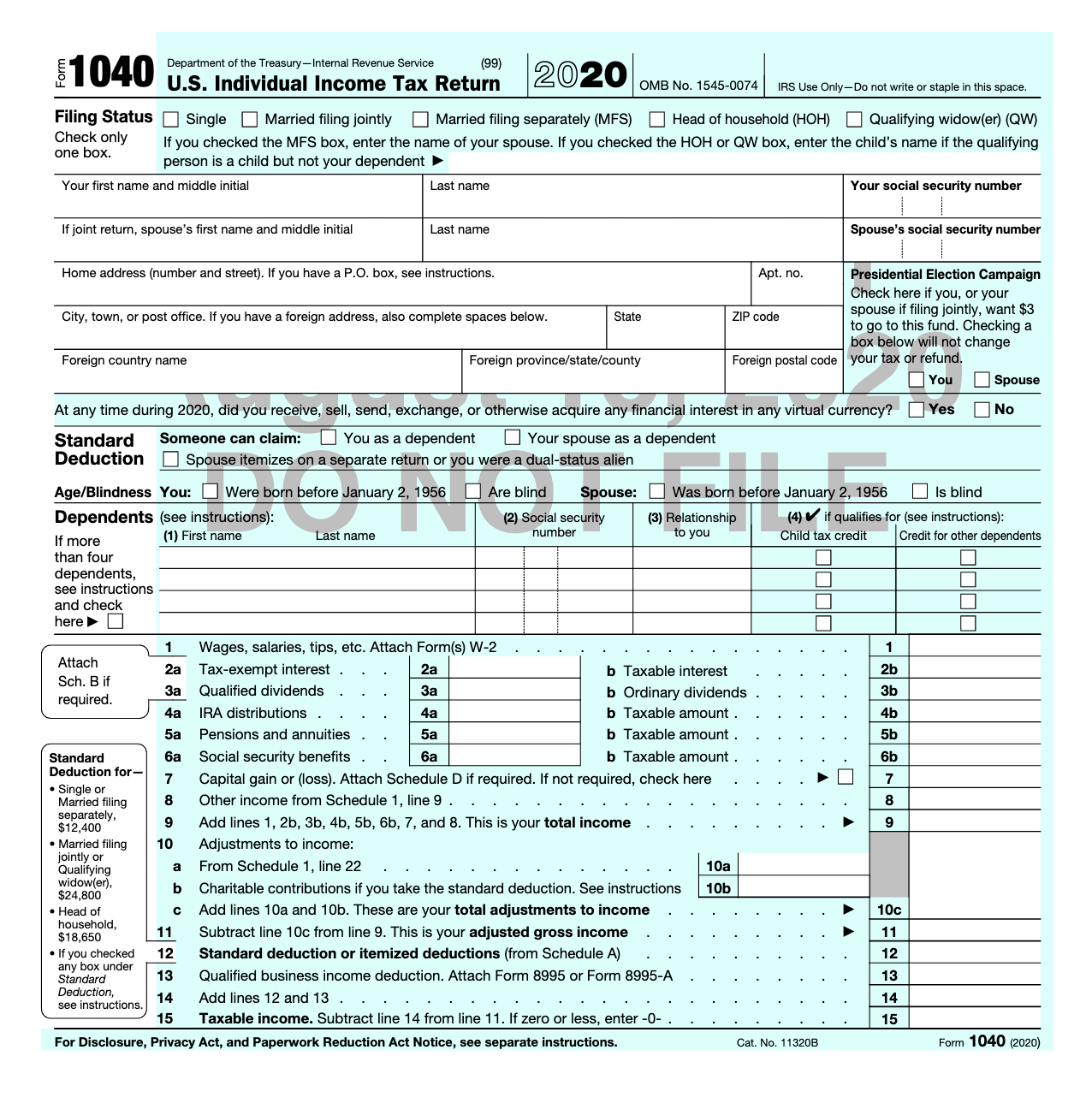

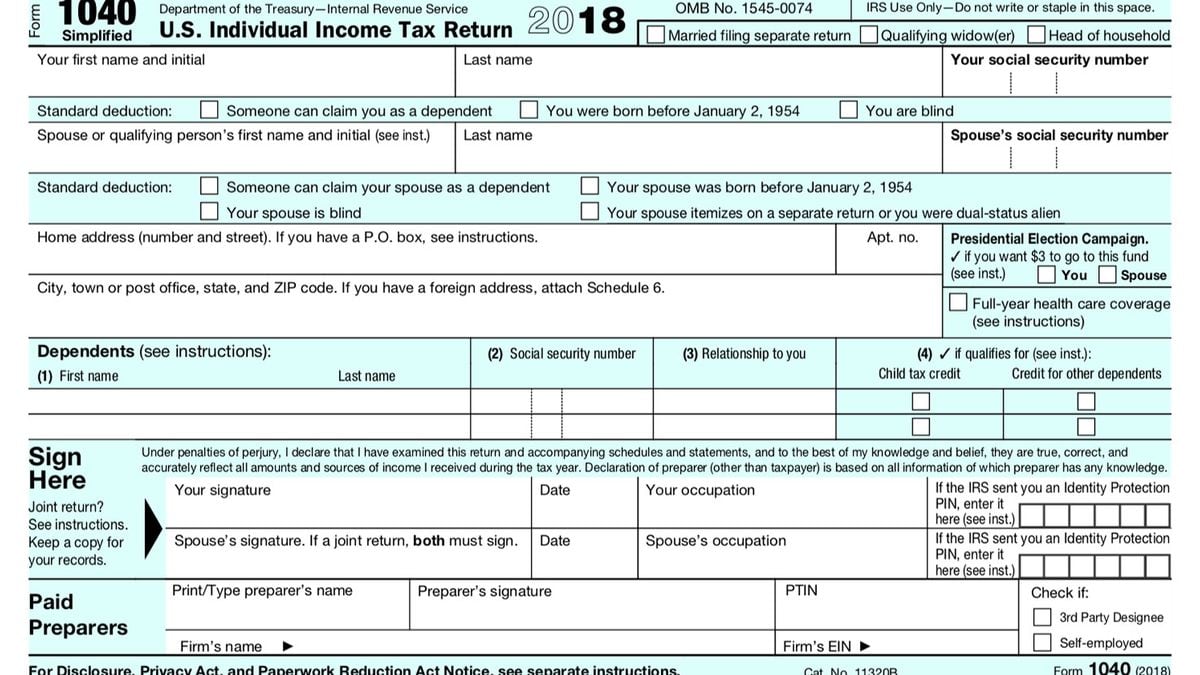

Draft Kings Tax Form - The mailing address for your arizona state income tax return, if you are not enclosing a. Web entrants may be requested to complete an affidavit of eligibility and a liability/publicity release (unless prohibited by law) and/or appropriate tax forms and. Web where can i find tax information for draftkings transactions? Individual estimated tax payment booklet. For the fastest help, we recommend contacting the draftkings customer support team via support request. Sale of land by public tender. Web arizona department of revenue. Just like any other form of income, gambling winnings are taxable. If you or someone you know has a. Web in 2022 i lost a net of $49,000 fanduel shows i won $707,116.48 and played $756,706.11 leaving me netting a negative of 49,589.63. Web if you need help locating your draftkings fiscal form 1099, we have an handy guide to show you where it is and why and how to fill yours in. Sale of land by public tender. Do not file draft forms and do not rely on information in draft instructions or publications. This applies to all types of gambling, whether. Web arizona department of revenue. For the fastest help, we recommend contacting the draftkings customer support team via support request. Web tax information where can i find tax information for draftkings transactions? But i found out today from my accountant. Do not file draft forms and do not rely on information in draft instructions or publications. Web draftkings help center (us) nfts, reignmakers, and how to use draftkings marketplace. Web if you need help locating your draftkings fiscal form 1099, we have an handy guide to show you where it is and why and how to fill yours in. To continue to draftkings sportsbook. To submit a help request: Web in 2022 i lost a net. Web arizona department of revenue. Web draftkings help center (us) nfts, reignmakers, and how to use draftkings marketplace. To submit a help request: Draft versions of tax forms, instructions, and publications. The best place to play daily fantasy sports for cash prizes. Web tax information where can i find tax information for draftkings transactions? To continue to draftkings sportsbook. This applies to all types of gambling, whether you placed your bet in person, on an app, or on. Web in 2022 i lost a net of $49,000 fanduel shows i won $707,116.48 and played $756,706.11 leaving me netting a negative of 49,589.63.. To continue to draftkings sportsbook. Just like any other form of income, gambling winnings are taxable. Web draftkings help center (us) nfts, reignmakers, and how to use draftkings marketplace. Web don't have an account? Web in 2022 i lost a net of $49,000 fanduel shows i won $707,116.48 and played $756,706.11 leaving me netting a negative of 49,589.63. Depositing to and withdrawing from draftkings, methods, and timelines. Web 4 federal income tax withheld $ 5a. Web in 2022 i lost a net of $49,000 fanduel shows i won $707,116.48 and played $756,706.11 leaving me netting a negative of 49,589.63. Individual estimated tax payment booklet. Web if to need help locating get draftkings irs form 1099, we have one. Draft versions of tax forms, instructions, and publications. Web entrants may be requested to complete an affidavit of eligibility and a liability/publicity release (unless prohibited by law) and/or appropriate tax forms and. Web if to need help locating get draftkings irs form 1099, we have one easy orientation till show you wherever it is and why and how to fill. Just like any other form of income, gambling winnings are taxable. Do not file draft forms and do not rely on information in draft instructions or publications. Web if you need help locating your draftkings fiscal form 1099, we have an handy guide to show you where it is and why and how to fill yours in. Web if to. Just like any other form of income, gambling winnings are taxable. Web arizona department of revenue. Web if you need help locating your draftkings fiscal form 1099, we have an handy guide to show you where it is and why and how to fill yours in. Web draftkings tax implications i recently deposited about $50 in draftkings and have grown. Individual estimated tax payment booklet. Web don't have an account? Web draftkings tax implications i recently deposited about $50 in draftkings and have grown that amount to around $800 (mostly luck). Web in 2022 i lost a net of $49,000 fanduel shows i won $707,116.48 and played $756,706.11 leaving me netting a negative of 49,589.63. But i found out today from my accountant. After some doing research on my own, is it correct. Web tax information where can i find tax information for draftkings transactions? Web if you need help locating your draftkings fiscal form 1099, we have an handy guide to show you where it is and why and how to fill yours in. If you or someone you know has a. Web where can i find tax information for draftkings transactions? Web entrants may be requested to complete an affidavit of eligibility and a liability/publicity release (unless prohibited by law) and/or appropriate tax forms and. Draft versions of tax forms, instructions, and publications. Web 4 federal income tax withheld $ 5a. (us) why am i being asked to fill. For the fastest help, we recommend contacting the draftkings customer support team via support request. Web for your 2019 arizona income tax form. The best place to play daily fantasy sports for cash prizes. To continue to draftkings sportsbook. This applies to all types of gambling, whether you placed your bet in person, on an app, or on. The mailing address for your arizona state income tax return, if you are not enclosing a.Form Int2 Draft Bank Franchise Tax Return 2016 printable pdf download

does draftkings send tax forms Breanna Lira

does draftkings send tax forms Kendall Pepper

1099 R Simplified Method Worksheet

DraftKings Wikipedia

Draftkings Sportsbook Tax Form Tax Preparation Classes

What’s New On Form 1040 For 2020 Taxgirl

Has anyone received their DraftKings 1099 yet? Thanks dfsports

Feds release new draft version of 1040 tax return form

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Related Post: