Dc Nonresident Tax Form

Dc Nonresident Tax Form - For taxable income over $10,000 but not over $30,000, the rate is $500 plus 7.5% of the excess over $10,000. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers: You can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the. Web if you work in dc and live in any other state, you're not subject to dc income tax. An explanatory note published on 9 october 2023 describes the value added tax (vat) on digital services rules and announces the implementation of a new. Type of property address #1. You qualify as a nonresident if: I was told i have to file a non resident return for dc, for an internship. Ad get ready for tax season deadlines by completing any required tax forms today. On or before april 18, 2022. 1101 4th street, sw, suite 270 west,. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers. For taxable income over $10,000 but not over $30,000, the rate is $500 plus 7.5% of the excess over $10,000. Upon request of your employer, you must file this. Web registration and exemption tax. Ad get ready for tax season deadlines by completing any required tax forms today. Web for the first $10,000 of taxable income, the rate is 5.0%. If the due date for filing a. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in. Monday. You are not required to file a dc return if you are a nonresident of dc unless you are claiming a. Get ready for tax season deadlines by completing any required tax forms today. If the due date for filing a. Upon request of your employer, you must file this. Web for the first $10,000 of taxable income, the rate. You qualify as a nonresident if: Sales and use tax forms. Upon request of your employer, you must file this. Ad get ready for tax season deadlines by completing any required tax forms today. Web for tax year 2020 the filing deadline is april 15, 2021, unless otherwise directed by the internal revenue service (irs). On or before april 18, 2022. Ad get ready for tax season deadlines by completing any required tax forms today. Web if you work in dc and live in any other state, you're not subject to dc income tax. Upon request of your employer, you must file this. If the due date for filing. You must complete and attach a copy. For taxable income over $10,000 but not over $30,000, the rate is $500 plus 7.5% of the excess over $10,000. Type of property address #1. I was told i have to file a non resident return for dc, for an internship. If the due date for filing a. Monday to friday, 9 am to 4 pm, except district holidays. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers: I paid for turbo tax to prepare a dc return, but the form is not included. You qualify as a nonresident if:. For taxable income over $10,000 but not over. Get ready for tax season deadlines by completing any required tax forms today. An explanatory note published on 9 october 2023 describes the value added tax (vat) on digital services rules and announces the implementation of a new. List the type and location of any dc real property you own. Web individual income tax forms and instructions for single and. 1101 4th street, sw, suite 270 west,. Web registration and exemption tax forms. On or before april 18, 2022. I was told i have to file a non resident return for dc, for an internship. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers: Get ready for tax season deadlines by completing any required tax forms today. An explanatory note published on 9 october 2023 describes the value added tax (vat) on digital services rules and announces the implementation of a new. Web registration and exemption tax forms. List the type and location of any dc real property you own. 1101 4th street, sw,. Web where can i get tax forms? Upon request of your employer, you must file this. Web for the first $10,000 of taxable income, the rate is 5.0%. Web for tax year 2020 the filing deadline is april 15, 2021, unless otherwise directed by the internal revenue service (irs). Ad get ready for tax season deadlines by completing any required tax forms today. If the due date for filing a. An explanatory note published on 9 october 2023 describes the value added tax (vat) on digital services rules and announces the implementation of a new. You qualify as a nonresident if: Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers: If the due date for filing a. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in. I was told i have to file a non resident return for dc, for an internship. On or before april 18, 2022. You qualify as a nonresident if: Monday to friday, 9 am to 4 pm, except district holidays. On or before april 18, 2023. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Get ready for tax season deadlines by completing any required tax forms today. List the type and location of any dc real property you own. You can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the.DC D4A 2016 Fill out Tax Template Online US Legal Forms

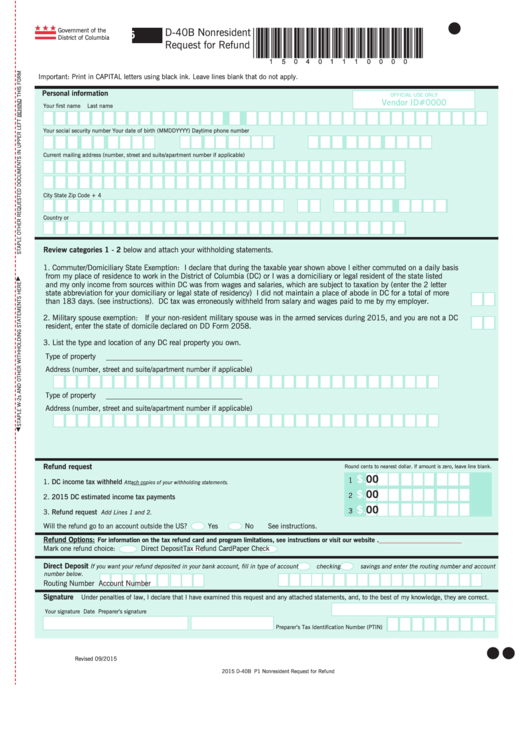

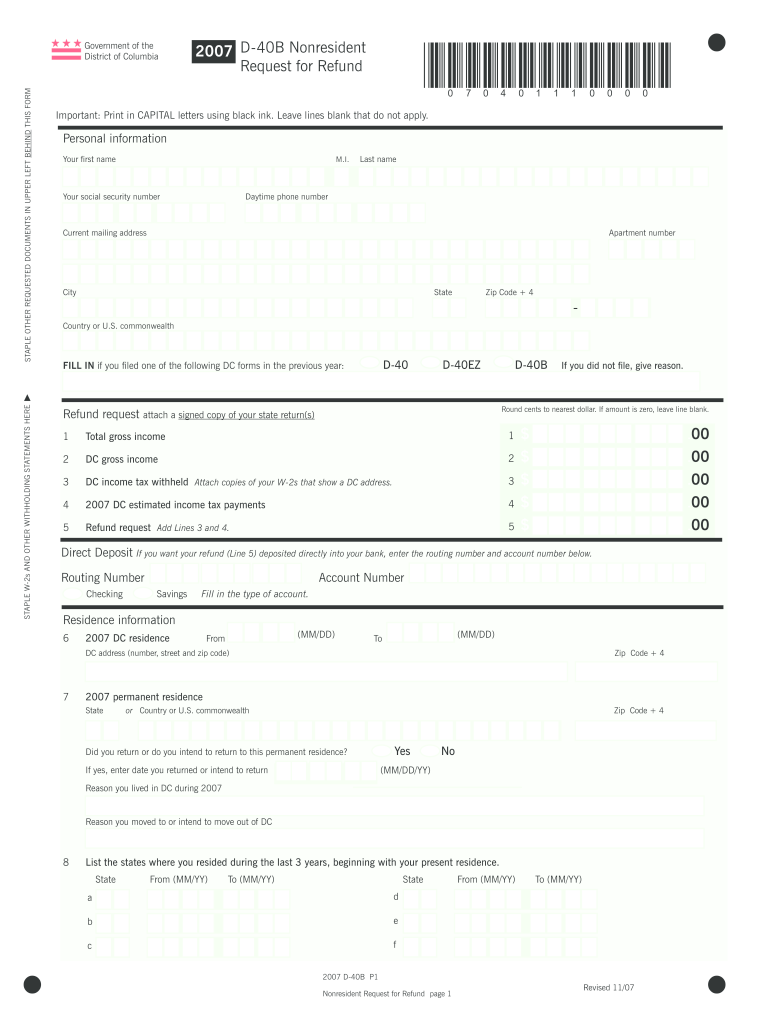

D40b Nonresident Request For Refund printable pdf download

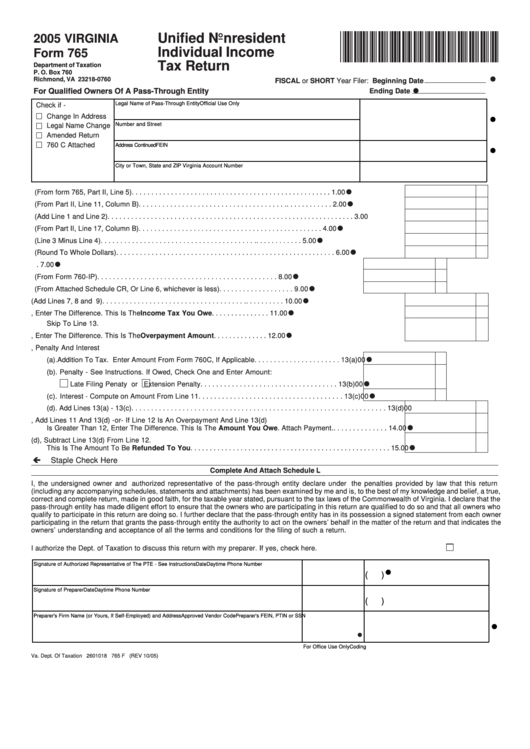

Form 765 Unified Nonresident Individual Tax Return 2005

Form 20002X Download Fillable PDF or Fill Online Nonresident Amended

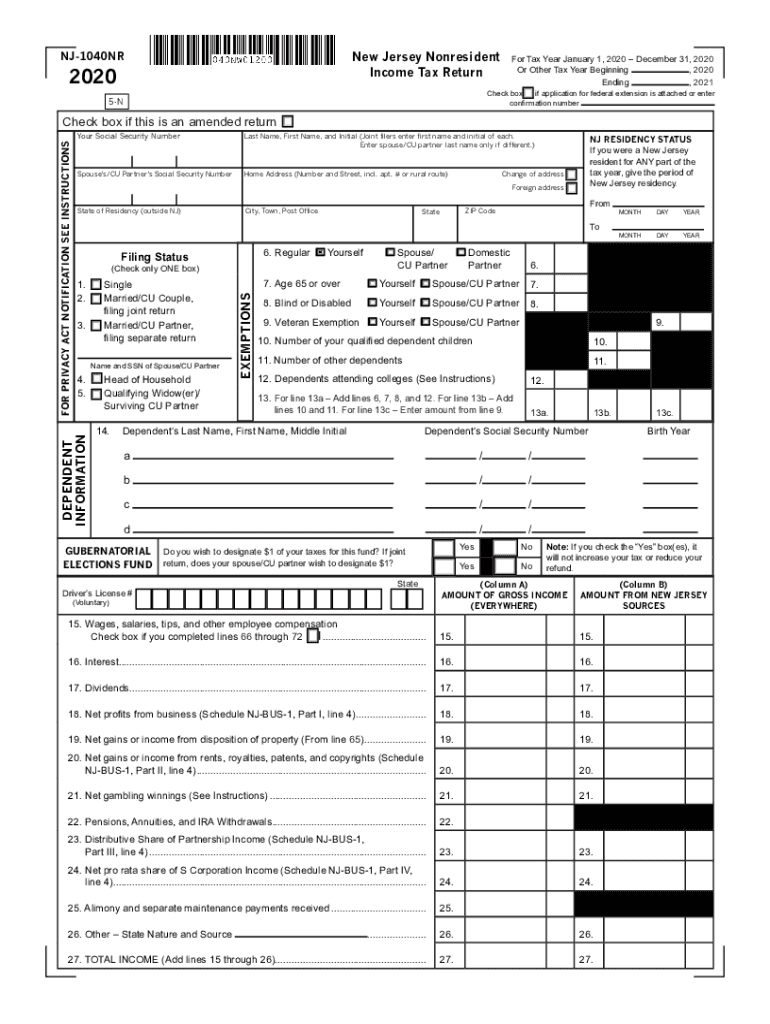

New Jersey Nonresident Form Fill Out and Sign Printable PDF Template

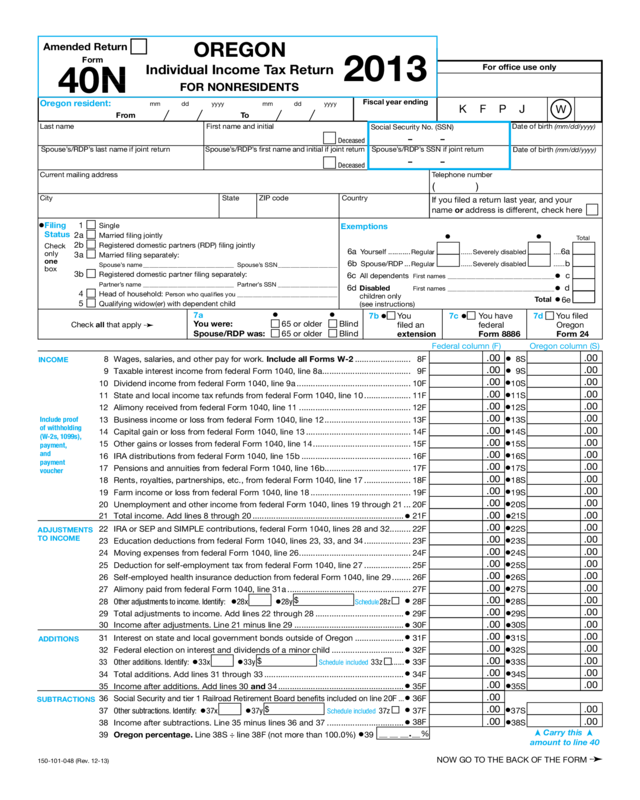

Form 40N, Nonresident Individual Tax Return Edit, Fill, Sign

D40B Nonresident Request for Refund The District of Columbia dc

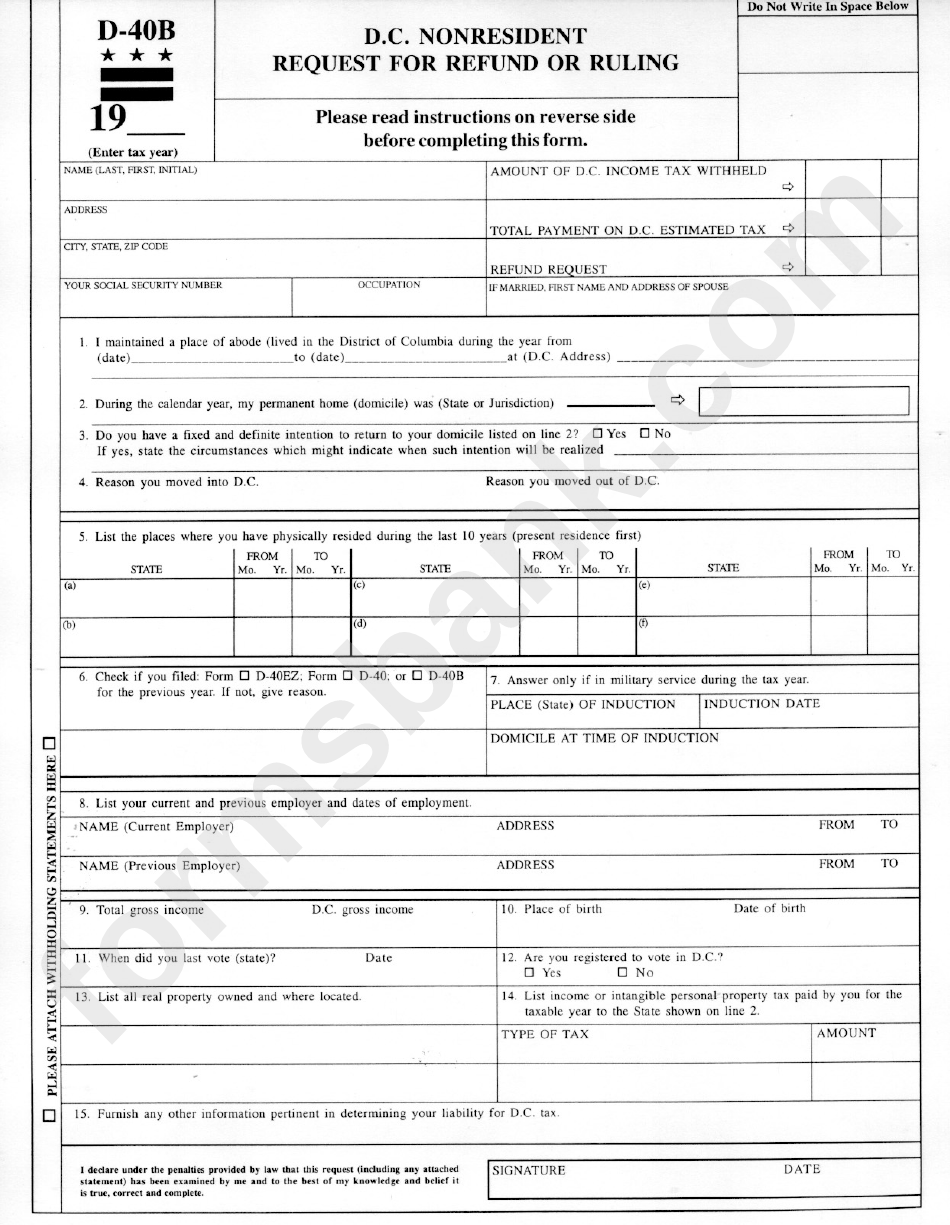

Fillable Form D40b Nonresident Request For Refund Or Ruling

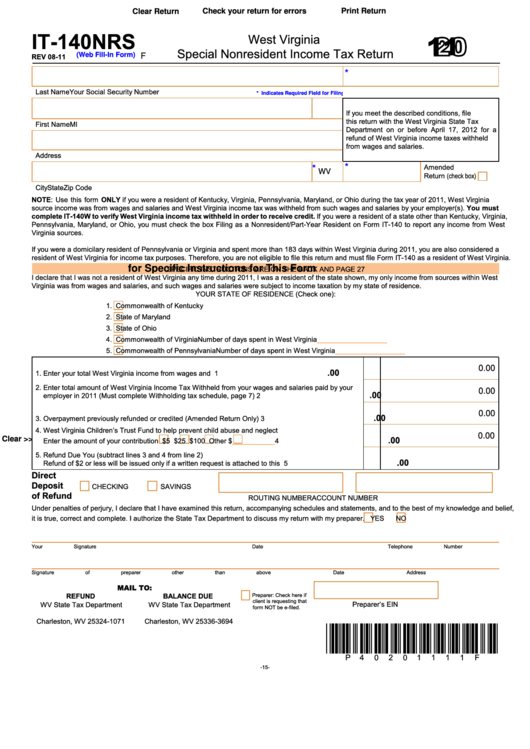

Fillable Form It140nrs West Virginia Special Nonresident Tax

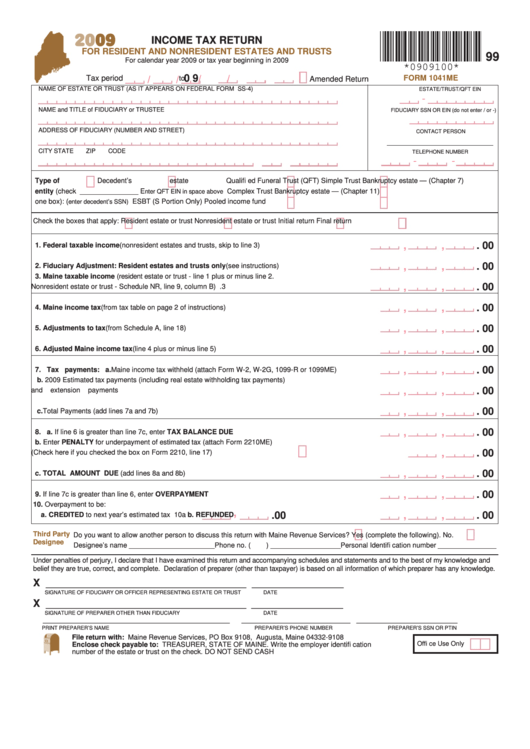

Form 1041me Tax Return For Resident And Nonresident Estates

Related Post: