Dave Ramsey Debt Snowball Form

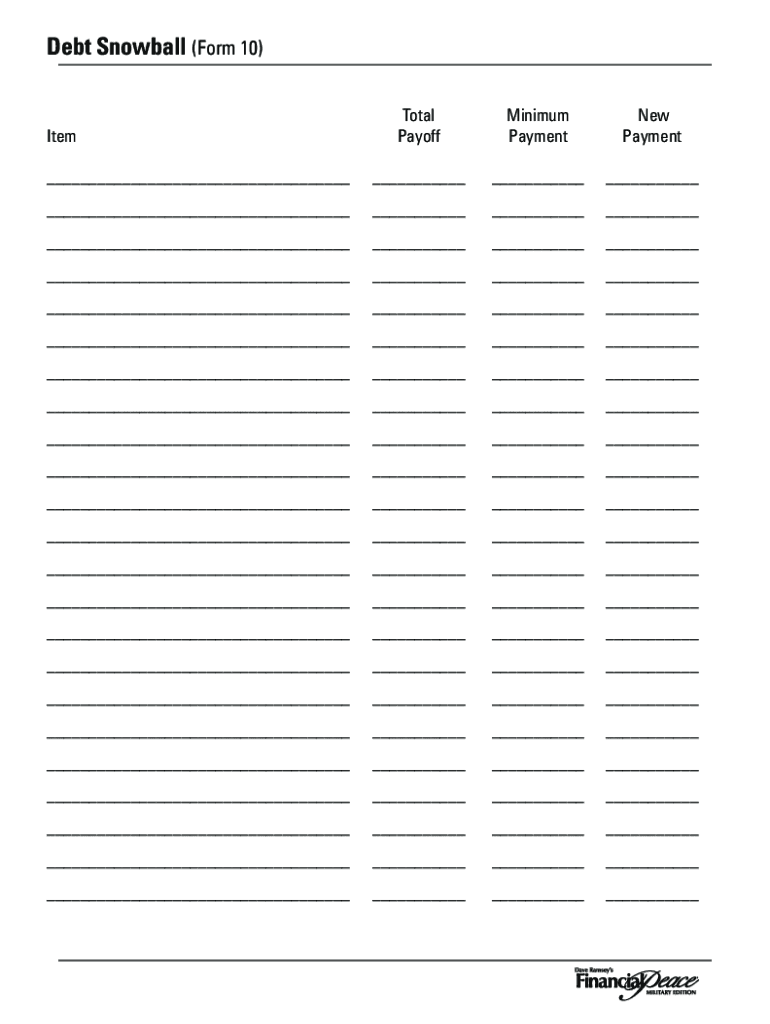

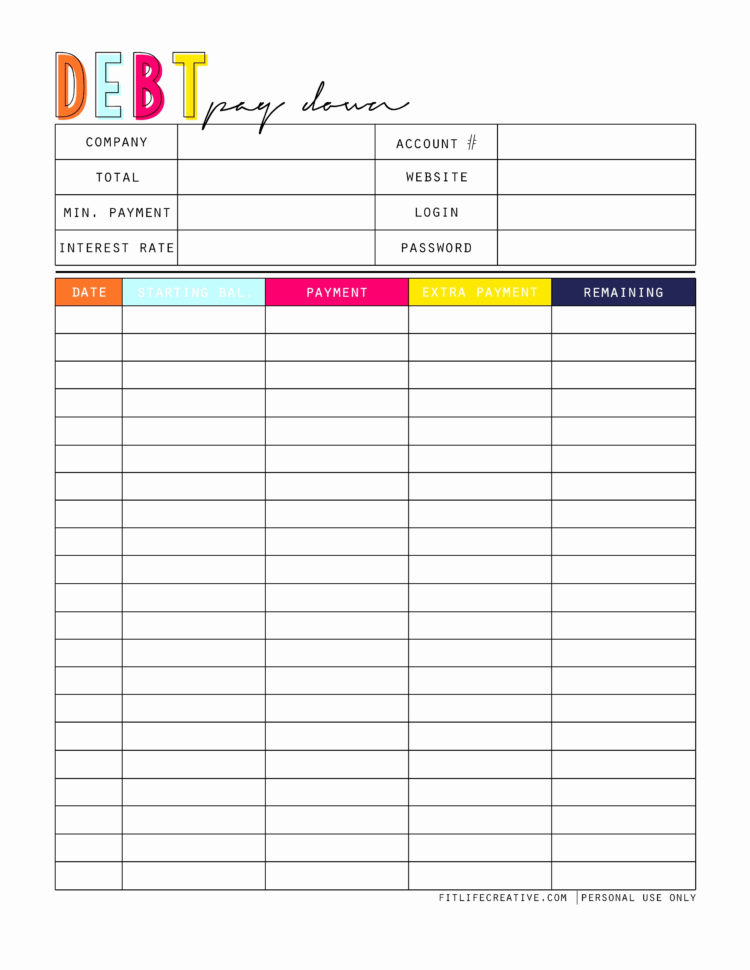

Dave Ramsey Debt Snowball Form - Web author and radio host dave ramsey, a proponent of the debt snowball method, concedes that an analysis of math and interest leans toward paying the highest interest debt first. Web the dave ramsey debt snowball method is a debt repayment strategy developed by personal finance expert dave ramsey. Pay the minimum payment for all your debts except for the smallest one. Compare interest rates and repayment options. The method involves paying off all. Simple & secure online application. We are not a loan company, we do not lend money. We are not a loan company, we do not lend money. Web ramsey generally offers simple advice when it comes to investing. Web 2 days agoi recommend folks have 10 to 12 times their annual income in life insurance coverage. Ad uslegalforms.com has been visited by 100k+ users in the past month Pay the minimum payment for all your debts except for the smallest one. Web once debt a is paid off, you roll the $100 payment toward debt b, thus creating the “snowball” effect. Compare interest rates and repayment options. Get your debt snowball rolling. Compare interest rates and repayment options. Web author and radio host dave ramsey, a proponent of the debt snowball method, concedes that an analysis of math and interest leans toward paying the highest interest debt first. Ad get your finances back on track with debt consolidation from our trusted lenders. Ad uslegalforms.com has been visited by 100k+ users in the. Get your debt snowball rolling. Ad uslegalforms.com has been visited by 100k+ users in the past month Ad get your finances back on track with debt consolidation from our trusted lenders. We are not a loan company, we do not lend money. Web 3 months ago updated. Simple & secure online application. Compare interest rates and repayment options. Get a free customized plan for your money. Ad amazon.com has been visited by 1m+ users in the past month Simple & secure online application. Beyond setting up that emergency fund and getting out of debt, he suggests investing in good. Ad stop collection calls, reduce stress & save money with a debt management plan. That means you’d need between $800,000 and $960,000 in coverage, while. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. Compare interest. Ad let us help you find an expert you can trust with your finances. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. It only takes 3 minutes! Ad stop collection calls, reduce stress & save money with a debt management plan. Compare interest rates and repayment options. Web author and radio host dave ramsey, a proponent of the debt snowball method, concedes that an analysis of math and interest leans toward paying the highest interest debt first. Get your debt snowball rolling. List all of your debts smallest to largest, and use this sheet to mark them off one by one. We are not a loan company,. This is the fun one! Pay the minimum payment for all your debts except for the smallest one. List all of your debts smallest to largest, and use this sheet to mark them off one by one. Compare interest rates and repayment options. Web the dave ramsey debt snowball method is a debt repayment strategy developed by personal finance expert. We are not a loan company, we do not lend money. Web 2 days agoi recommend folks have 10 to 12 times their annual income in life insurance coverage. Compare interest rates and repayment options. Get a free customized plan for your money. Web the ramsey show highlights. Ad get your finances back on track with debt consolidation from our trusted lenders. The method involves paying off all. Suppose you have five debts: This is the fun one! Simple & secure online application. Get your debt snowball rolling. That means you’d need between $800,000 and $960,000 in coverage, while. Web how debt snowball operates. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. It only takes 3 minutes! Web this is based on the principles of dave ramsey’s total money makeover book and financial peace university. Ad get your finances back on track with debt consolidation from our trusted lenders. Simple & secure online application. How to use the debt snowball worksheets. Ad let us help you find an expert you can trust with your finances. Ad stop collection calls, reduce stress & save money with a debt management plan. Ad get your finances back on track with debt consolidation from our trusted lenders. Web author and radio host dave ramsey, a proponent of the debt snowball method, concedes that an analysis of math and interest leans toward paying the highest interest debt first. Compare interest rates and repayment options. Ad uslegalforms.com has been visited by 100k+ users in the past month Suppose you have five debts: Ad stop collection calls, reduce stress & save money with a debt management plan. The debt snowball method is the best way to get out of debt. Web once debt a is paid off, you roll the $100 payment toward debt b, thus creating the “snowball” effect. Ad amazon.com has been visited by 1m+ users in the past monthIt's easy to pay off debt quickly with Dave Ramsey's debt snowball

Dave Ramsey Debt Snowball Spreadsheet Calculator Credit Card Etsy Ireland

Debt Snowball Printable Dave Ramsey Debt Snowball Tracking Etsy

Dave Ramsey Debt Snowball Worksheets —

Debt Snowball Worksheet Printable Form Fill Out and Sign Printable

Download Dave Ramsey Debt Snowball Gantt Chart Excel Template

Debt Snowball Worksheet {Free Printable} Debt snowball worksheet

Debt Snowball Printable Dave Ramsey Debt Snowball Tracking Etsy

The Dave Ramsey Debt Snowball Simplified My Worthy Penny Dave

Ramsey Snowball Spreadsheet for Dave Ramsey Debt Snowball Spreadsheet

Related Post: