Ct Form Os 114

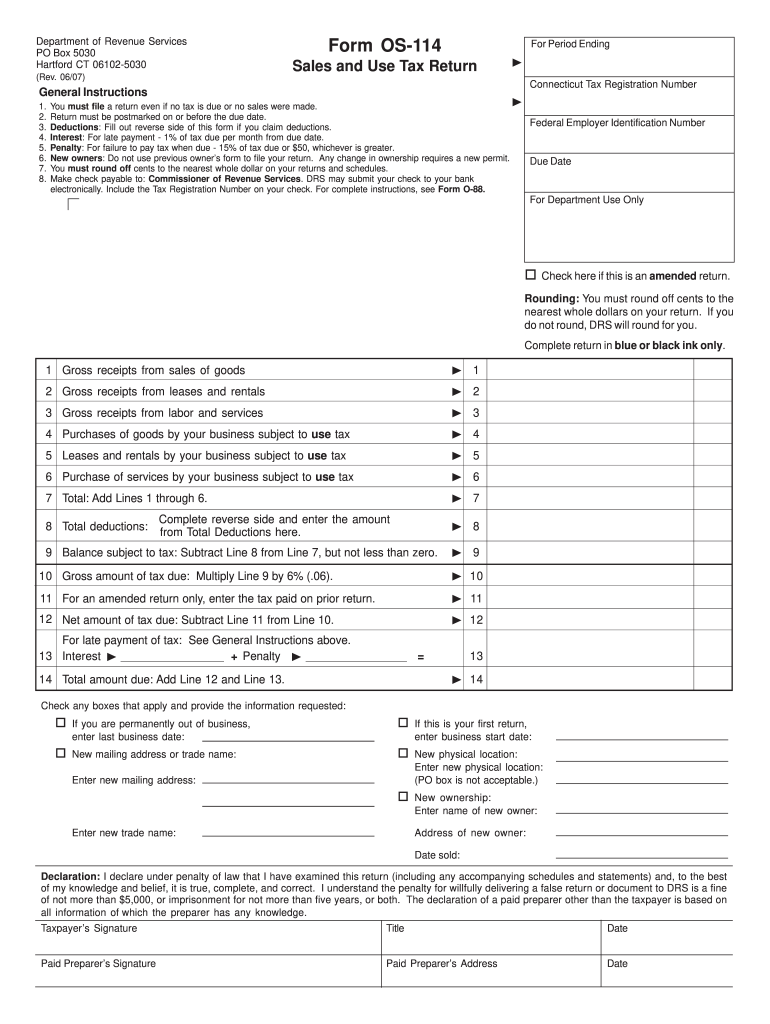

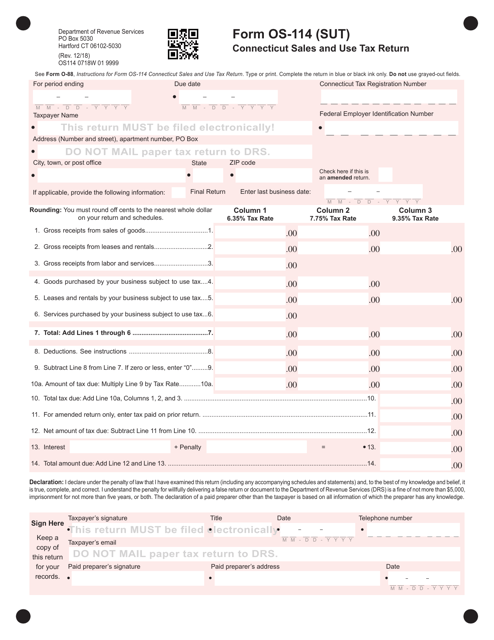

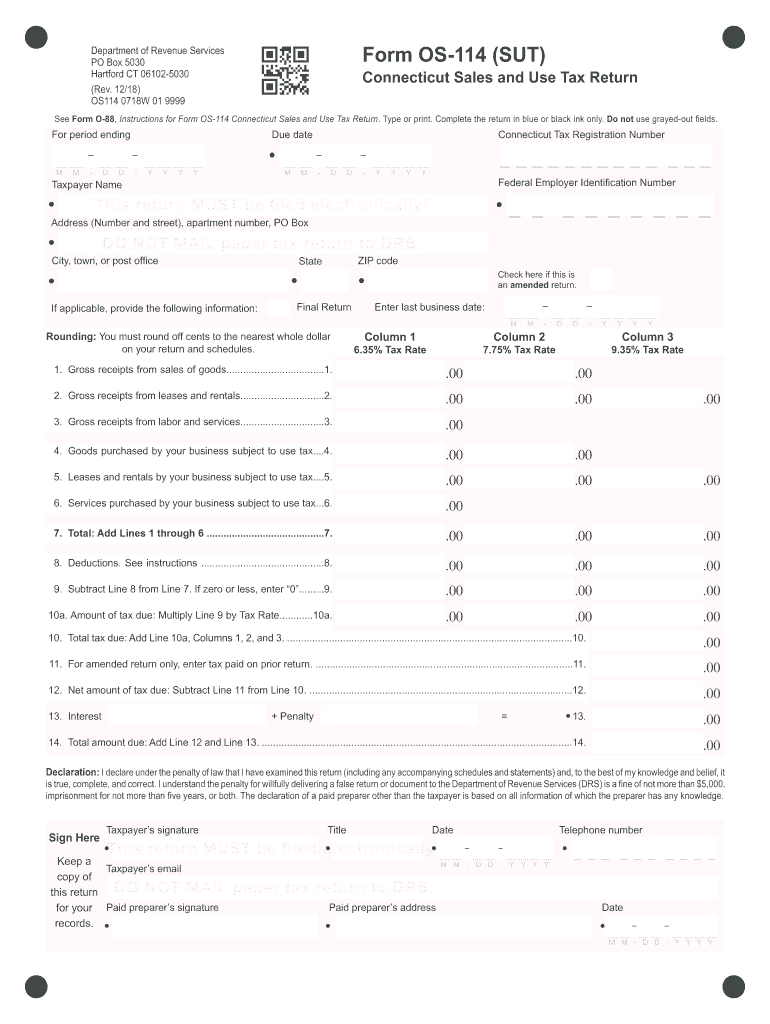

Ct Form Os 114 - Upload the ct os 114 fillable form. 09/20) os114 0819w 01 9999 see form o. Save your changes and share ct tax form os 114. 07/11) for period ending connecticut tax registration. To request a waiver from the electronic filing requirements visit. Visit portal.ct.gov/tsc to file your return electronically using the. Write the word final across the top. Web form os‑114, connecticut sales and use tax return, must be filed and paid electronically using myconnect. Both taxable and nontaxable sales must be. Complete the return in blue or black ink only. Write the word final across the top. Write the last date of your. Visit portal.ct.gov/tsc to file your return electronically using the. Web businesses must complete and file form os‐114 to report all sales activity in connecticut, even if no sales were made or no tax is due. Complete the return in blue or black ink only. Web search bar for ct.gov. Visit portal.ct.gov/tsc to file your return electronically using the. 02/22) os114 0819w 02 9999 if applicable, provide the following information: Upload the ct os 114 fillable form. The connecticut sales and use tax return is included in new york sales tax preparer for our user's convenience. Visit portal.ct.gov/tsc to file your return electronically using the. The connecticut sales and use tax return is included in new york sales tax preparer for our user's convenience. Drs myconnect allows taxpayers to electronically file, pay, and. Complete the return in blue or black ink only. Connecticut state department of revenue. Write the last date of your. Visit portal.ct.gov/tsc to file your return electronically using the. Upload the ct os 114 fillable form. The connecticut sales and use tax return is included in new york sales tax preparer for our user's convenience. Drs myconnect allows taxpayers to electronically file, pay, and. Complete the return in blue or black ink only. Visit portal.ct.gov/tsc to file your return electronically using the. Upload the ct os 114 fillable form. Drs myconnect allows taxpayers to electronically file, pay, and. Complete the return in blue or black ink only. Both taxable and nontaxable sales must be. Visit portal.ct.gov/tsc to file your return electronically using the. 07/11) for period ending connecticut tax registration. Deduct the total of all exempt sales from gross receipts. To request a waiver from the electronic filing requirement visit. Save or instantly send your ready documents. Edit & sign ct sales tax forms from anywhere. Web search bar for ct.gov. Complete the return in blue or black ink only. Write the word final across the top. Complete the return in blue or black ink only. Complete the return in blue or black ink only. Deduct the total of all exempt sales from gross receipts. Web businesses must complete and file form os‐114 to report all sales activity in connecticut, even if no sales were made or no tax is due. Web search bar for ct.gov. Complete the return in blue or black ink only. 09/20) os114 0819w 01 9999 see form o. The return may be fi led electronically through the department of revenue. Drs myconnect allows taxpayers to electronically file, pay, and. Complete the return in blue or black ink only. Deduct the total of all exempt sales from gross receipts. Visit portal.ct.gov/tsc to file your return electronically using the. The connecticut sales and use tax return is included in new york sales tax preparer for our user's convenience. Complete the return in blue or black ink only. Write the last date of your. The connecticut sales and use tax return is included in new york sales tax preparer for our user's convenience. 07/11) for period ending connecticut tax registration. 02/22) os114 0819w 02 9999 if applicable, provide the following information: Complete the return in blue or black ink only. To request a waiver from the electronic filing requirement visit. Write the last date of your. Save your changes and share ct tax form os 114. Complete the return in blue or black ink only. Upload the ct os 114 fillable form. 07/11) for period ending connecticut tax registration. Edit & sign ct sales tax forms from anywhere. Web businesses must complete and file form os‐114 to report all sales activity in connecticut, even if no sales were made or no tax is due. 09/20) os114 0819w 01 9999 see form o. Web search bar for ct.gov. Write the word final across the top. Drs myconnect allows taxpayers to electronically file, pay, and. Connecticut state department of revenue. For receipts subject to the 6% tax rate, multiply the remaining balance by 94.3% (.943). Web form os‑114, connecticut sales and use tax return, must be filed and paid electronically using myconnect. Both taxable and nontaxable sales must be.Ct Os 114 Fillable Form Fill Online, Printable, Fillable, Blank

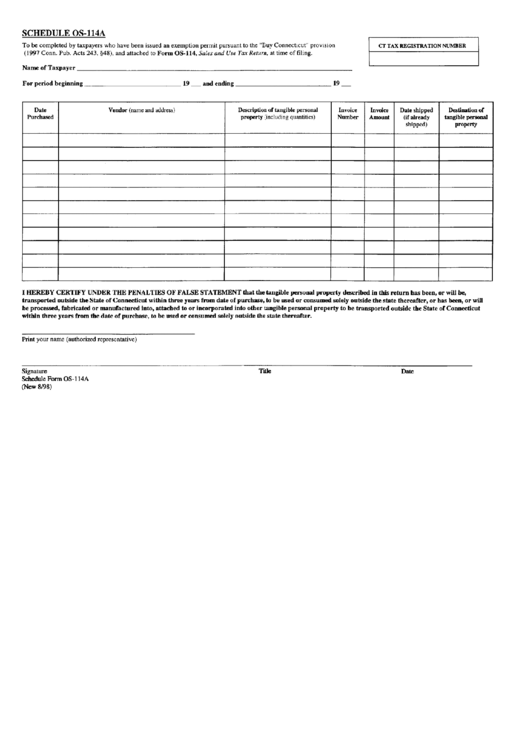

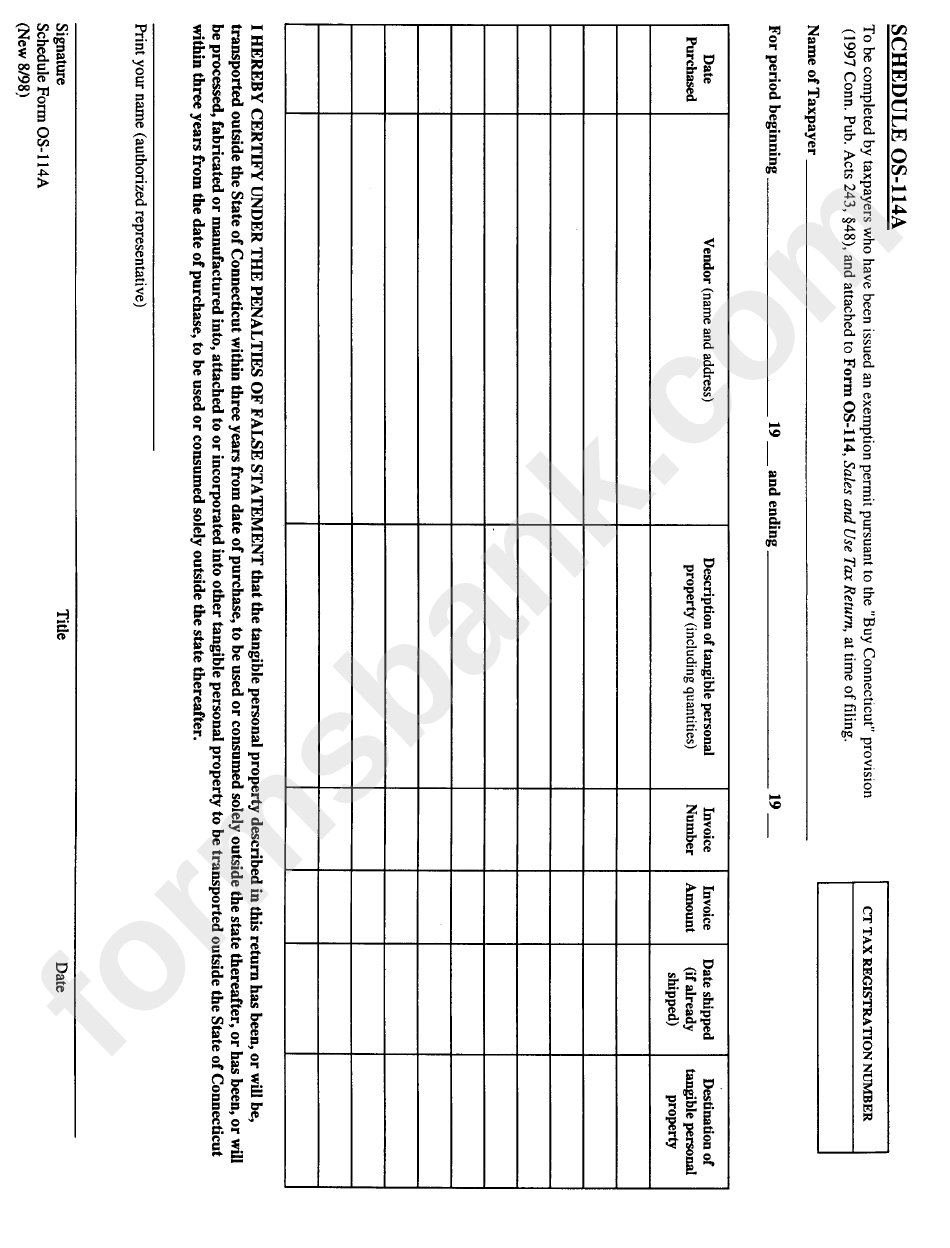

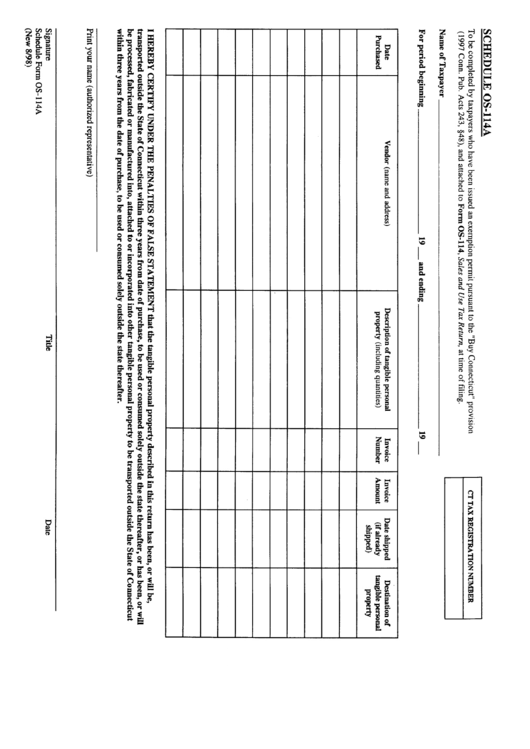

Fillable Schedule Form Os114a Connecticut Tax Form printable pdf

Form Os114a Sales And Use Tax Return printable pdf download

Form OS114 (SUT) Fill Out, Sign Online and Download Printable PDF

Form Os114a Sales And Use Tax Return printable pdf download

Ct Sales And Use Tax Form Os 114 Instructions Form Resume Examples

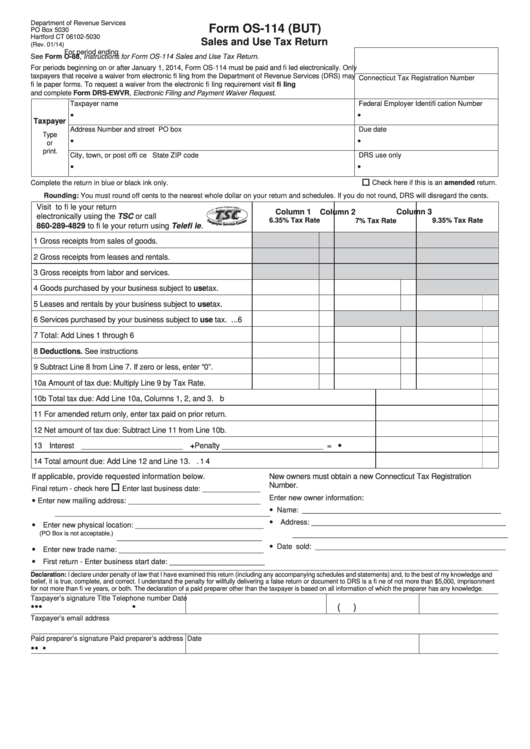

Form Os114 (But) Sales And Use Tax Return 2014 printable pdf download

Irs Forms Amended Return Form Resume Examples vq1PBEA3kR

Ct Sales And Use Tax Form Os 114 Instructions Form Resume Examples

CT DRS OS114 2018 Fill out Tax Template Online US Legal Forms

Related Post: