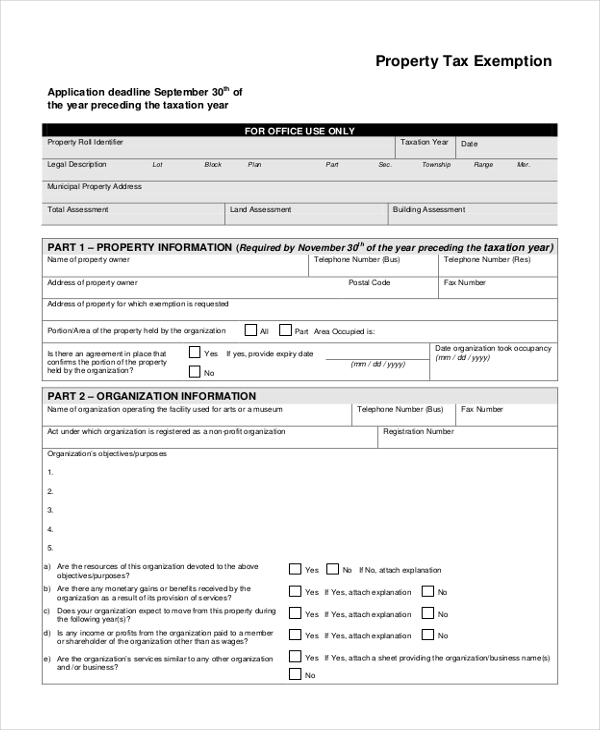

Colorado Property Tax Exemption Form

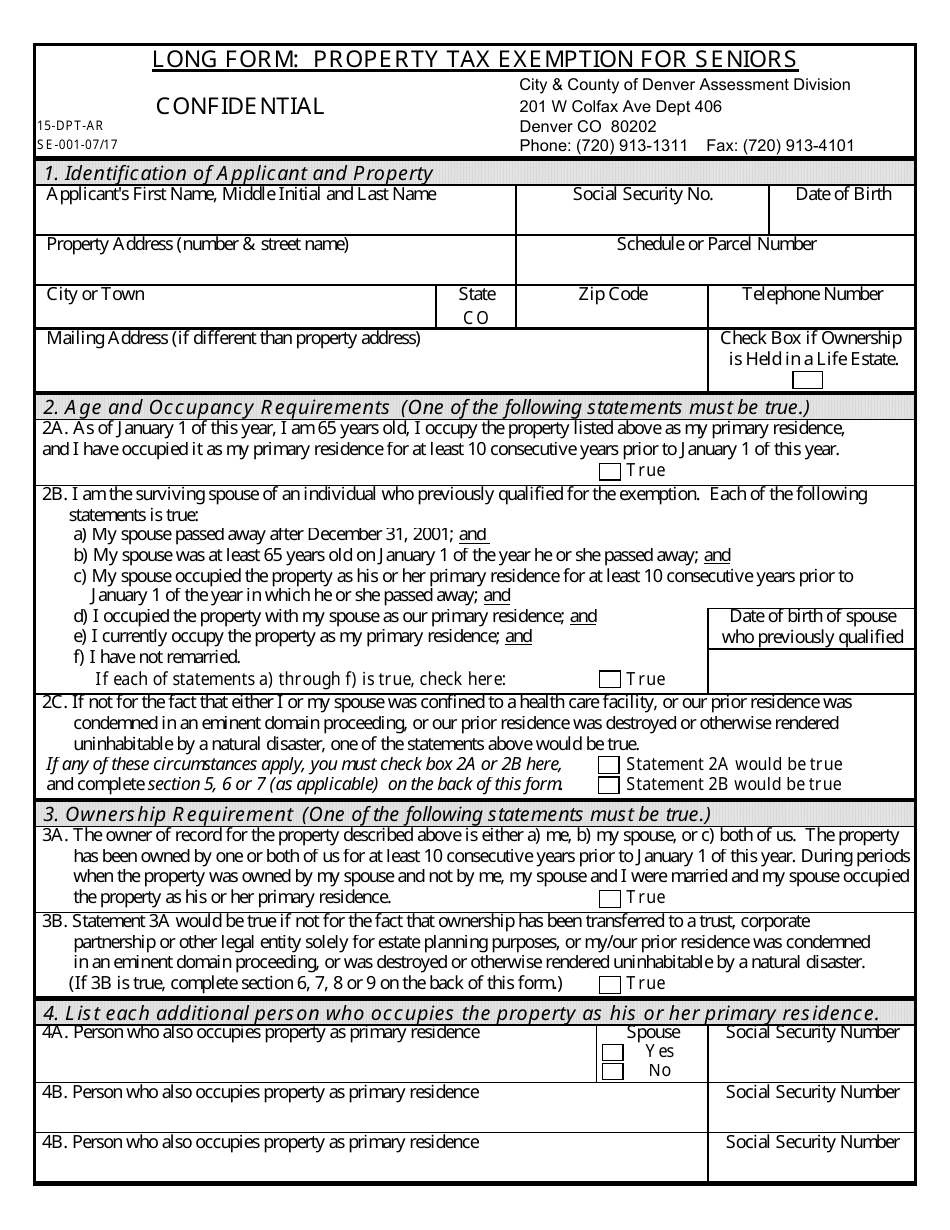

Colorado Property Tax Exemption Form - Ad signnow.com has been visited by 100k+ users in the past month The long form is for surviving. Streamline the entire lifecycle of exemption certificate management. Web the property tax, rent, heat (ptc) rebate is now available to colorado residents based on income including people with disabilities and older adults to help with their property. Colorado department of revenue subject: The form can be used by applicants who meet each of the following requirements. The attached short form is intended for qualifying seniors who meet each of the requirements stated above,. Late filing fee waiver request. Web form for at least 3 years. Applications are also available at the following colorado. Web the qualifications, application form (form 104ptc) and instructions for completing the application are available online. You may have been approved for the exemption by applying in a prior year. Remedies for recipients of notice of forfeiture of right to claim exemption. Web form for at least 3 years. Senior citizen short form instructions 2023. Senior citizen long form instructions 2023. The form can be used by applicants who meet each of the following requirements. Web the following declarations are available: Web the qualifications, application form (form 104ptc) and instructions for completing the application are available online. Web the exemption should appear on your property tax statement from your county assessor. The form can be used by applicants who meet each of the following requirements. Ad signnow.com has been visited by 100k+ users in the past month The 2023 deadline has passed please visit your local county assessors website for the current property tax exemption application. Dr 0715 application for exempt entity certificate author: The long form is for surviving. The form can be used by applicants who meet each of the following requirements. Web the qualifications, application form (form 104ptc) and instructions for completing the application are available online. The 2023 deadline has passed please visit your local county assessors website for the current property tax exemption application. Ad collect and report on exemption certificates quickly to save your. Application form senior property tax exemption.pdf 305.4 kb. The following documents must be submitted with. Senior property tax exemption long form. Web the exemptions section is responsible for determining qualification for exemption from property taxation for properties that are owned and used for religious, charitable, and. Streamline the entire lifecycle of exemption certificate management. Web the colorado constitution establishes a property tax exemption for qualifying senior citizens, surviving spouses of senior citizens who previously qualified, and for disabled. The long form is for surviving. Currently, the tax benefit is offered to people at least 65 years. Web senior property tax exemption short form. Web hh would make a significant change to the colorado’s “senior. Senior citizen short form instructions 2023. Web for qualifying seniors, this exemption reduces the property tax on the primary residence by exempting 50% of the first $200,000 in market value. Web the property tax, rent, heat (ptc) rebate is now available to colorado residents based on income including people with disabilities and older adults to help with their property. Web. The short form is for applicants who meet the basic eligibility requirements. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Complete the application for sales tax exemption for colorado organizations ( dr 0715 ). Web the property tax, rent, heat (ptc) rebate is now available to colorado residents based on income including people with. Senior citizen long form instructions 2023. Web senior property tax exemption short form. Senior citizen short form instructions 2023. Web application for property tax exemption. Senior citizen long form application 2023. The application deadline for the attached short form is july 15. Web form for at least 3 years. Streamline the entire lifecycle of exemption certificate management. Remedies for recipients of notice of forfeiture of right to claim exemption. Senior property tax exemption long form. You may have been approved for the exemption by applying in a prior year. Streamline the entire lifecycle of exemption certificate management. Dr 0715 application for exempt entity certificate author: Ad collect and report on exemption certificates quickly to save your company time and money. Web for qualifying seniors, this exemption reduces the property tax on the primary residence by exempting 50% of the first $200,000 in market value. Application form senior property tax exemption.pdf 305.4 kb. Web the exemption should appear on your property tax statement from your county assessor. The 2023 deadline has passed please visit your local county assessors website for the current property tax exemption application. Web the exemptions section is responsible for determining qualification for exemption from property taxation for properties that are owned and used for religious, charitable, and. Senior property tax exemption long form. Complete the application for sales tax exemption for colorado organizations ( dr 0715 ). Web the expanded deferral program does not exempt taxes; Web hh would make a significant change to the colorado’s “senior homestead” property tax exemption. Senior citizen short form instructions 2023. The form can be used by applicants who meet each of the following requirements. The attached short form is intended for qualifying seniors who meet each of the requirements stated above,. It is a loan to assist coloradans with the payment of property taxes if an application is submitted and the. The application deadline for the attached short form is july 15. Web senior property tax exemption short form. The following documents must be submitted with.FREE 10+ Sample Tax Exemption Forms in PDF MS Word

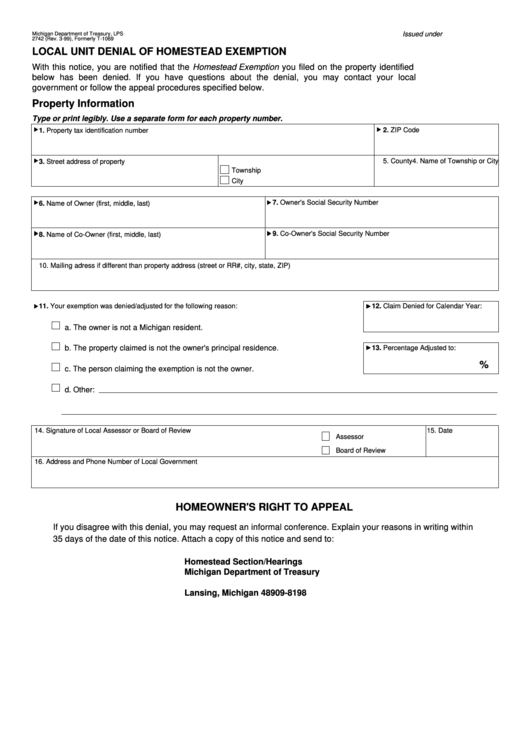

Form Lps 2742 Local Unit Denial Of Homestead Exemption printable pdf

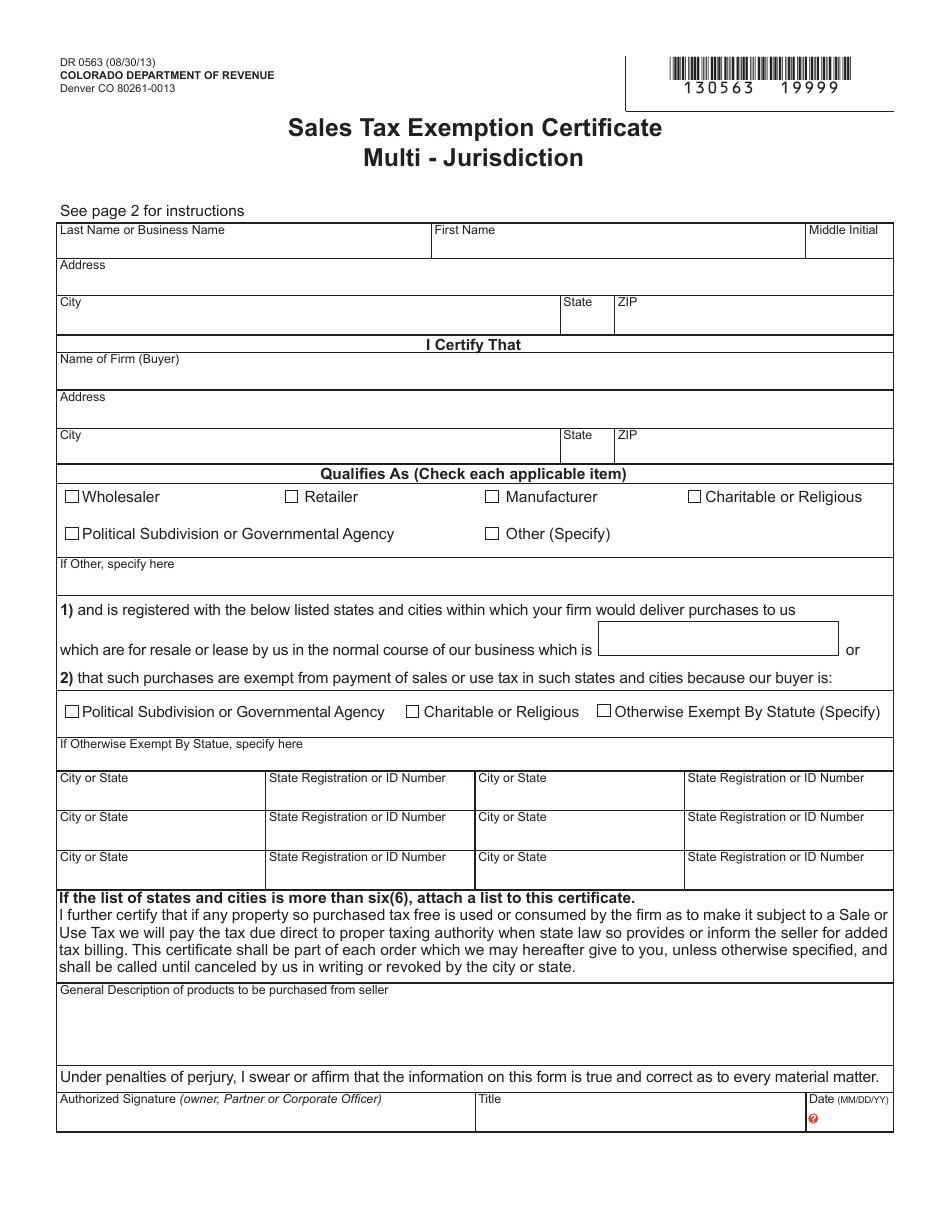

Form DR0563 Fill Out, Sign Online and Download Fillable PDF, Colorado

Form 15DPTAR Fill Out, Sign Online and Download Printable PDF

FREE 10+ Sample Tax Exemption Forms in PDF

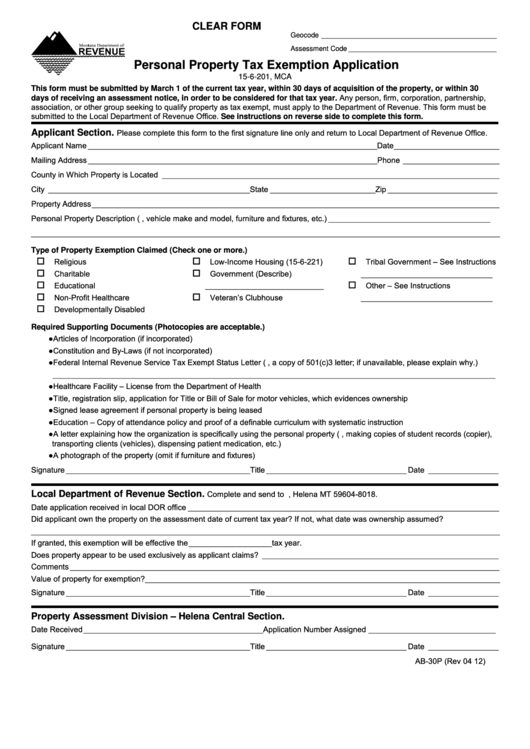

Fillable Form Ab 30p Personal Property Tax Exemption Application

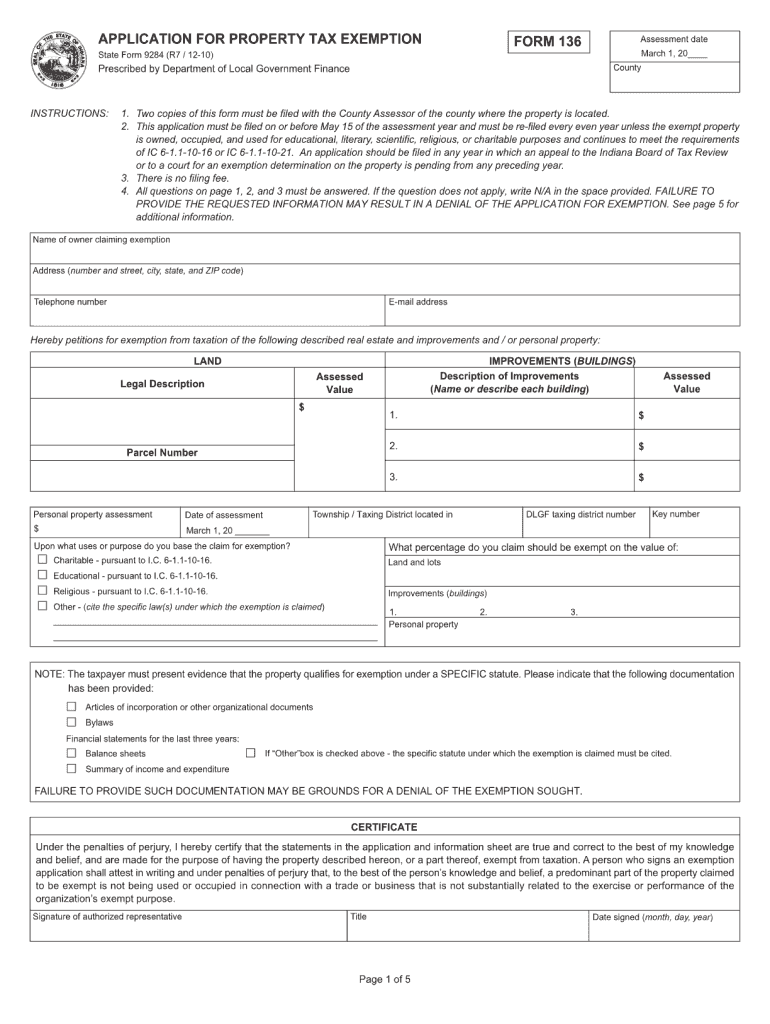

Application for property tax exemption form 136 2010 Fill out & sign

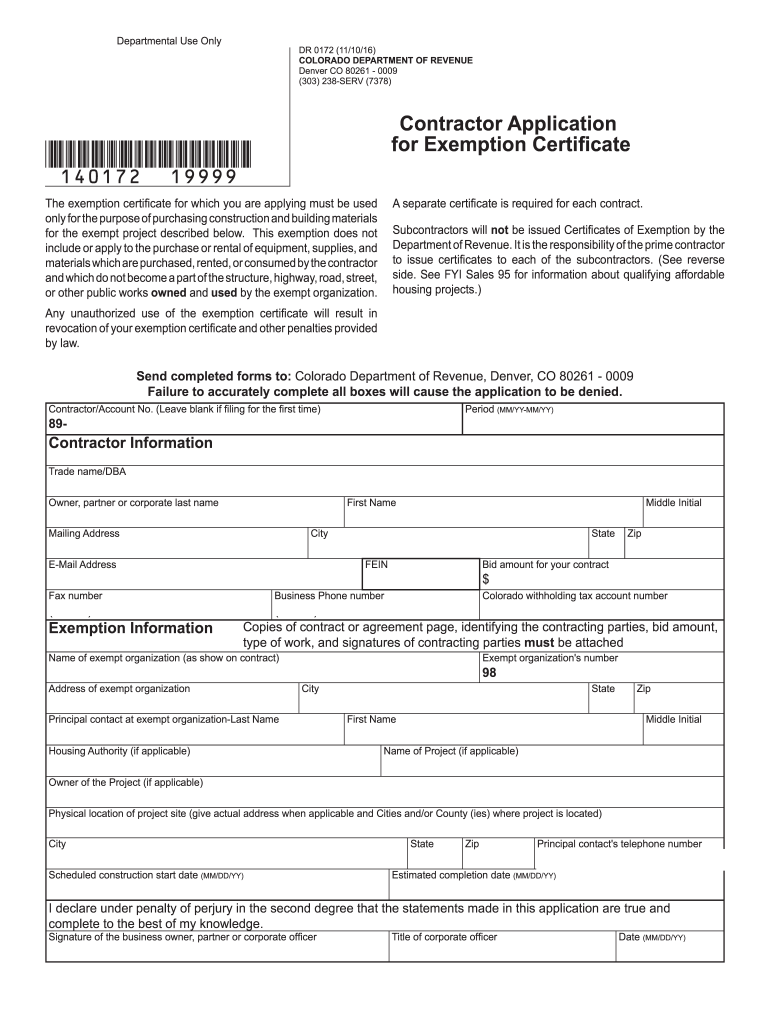

Colorado Sales Tax Exemption Form For Contractors

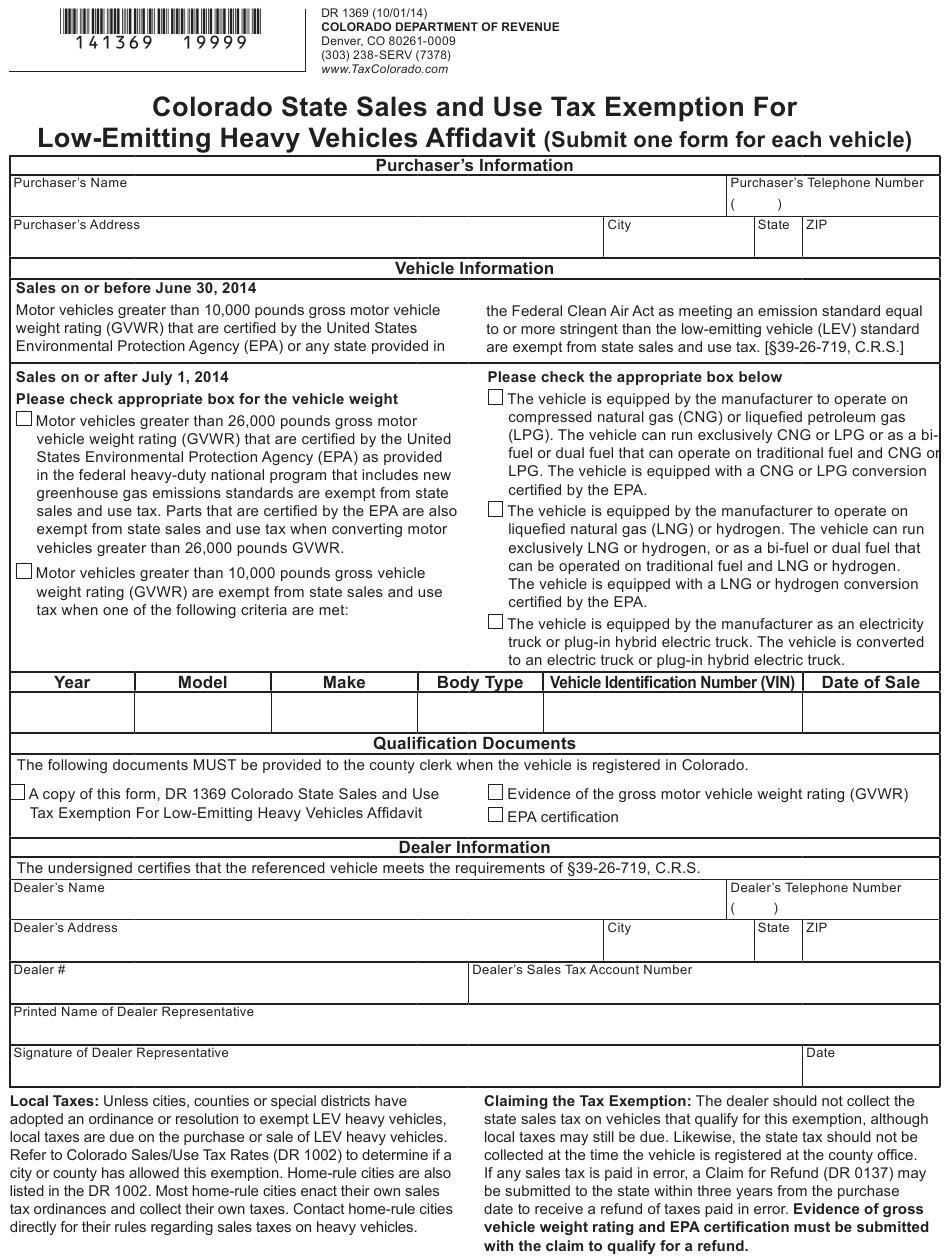

Colorado Sales And Use Tax Exemption Form

FREE 10+ Sample Tax Exemption Forms in PDF

Related Post: