Colorado Form 104Ad Instructions

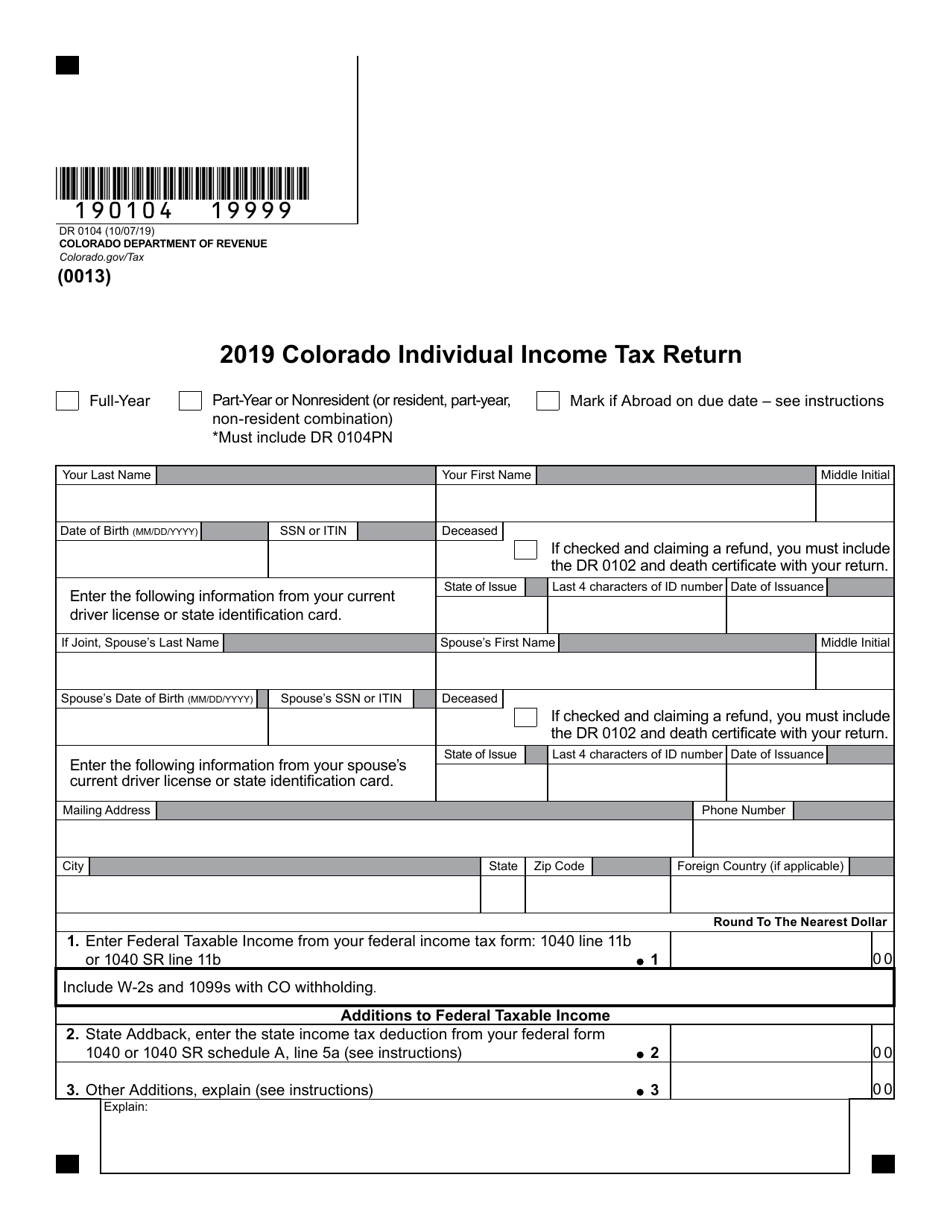

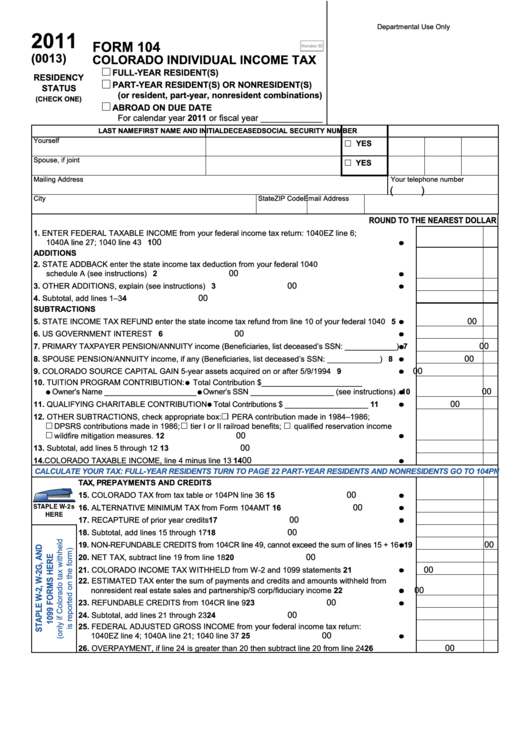

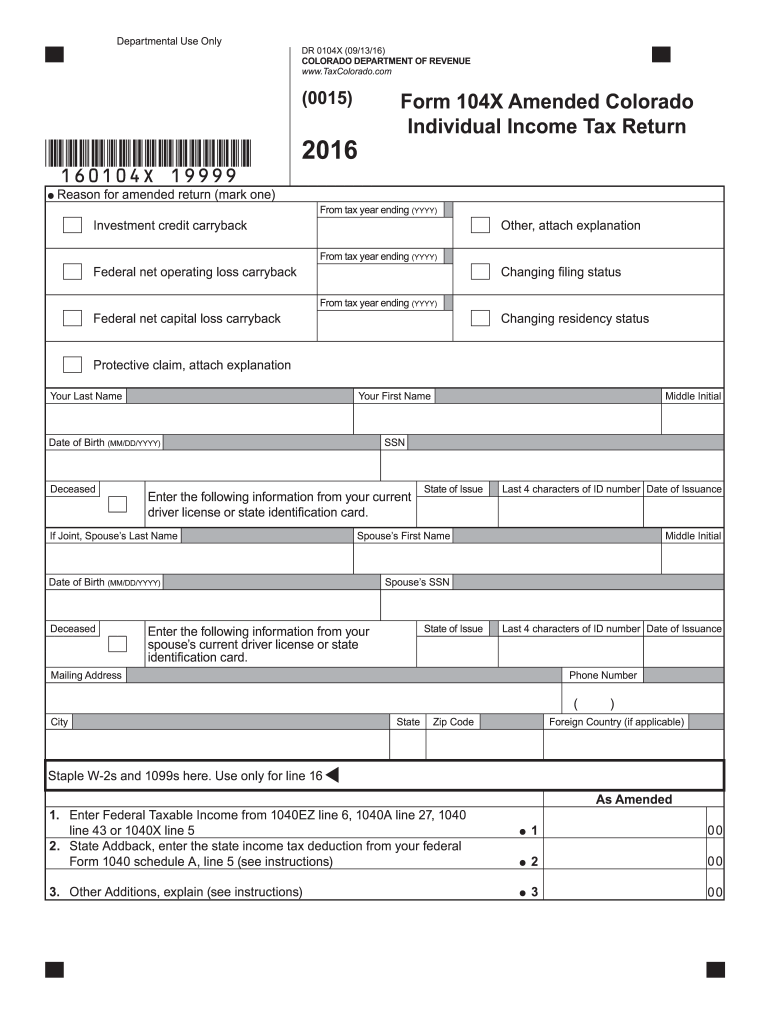

Colorado Form 104Ad Instructions - Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. Web find colorado form 104 instructions at esmart tax today. Complete, edit or print tax forms instantly. These subtractions will change your colorado taxable income. Use this schedule to report any subtractions from your federal taxable income. Get ready for tax season deadlines by completing any required tax forms today. Web we would like to show you a description here but the site won’t allow us. Tax refund refer to your federal income tax return to complete this line. Complete, edit or print tax forms instantly. If you did not complete federal. Web enter federal taxable income from your federal income tax form: Use this schedule to report any subtractions from your federal taxable income. Web find colorado form 104 instructions at esmart tax today. Web you must use the amended return form that corresponds to the tax year you are amending or your amended return cannot be processed. Complete, sign, print. Use this schedule to report any subtractions from your federal taxable income. Web printable colorado income tax form 104 instructions. Use the dr 0104x, amended colorado. If you did not complete federal. Web 104 book 2022 booklet includes: Download blank or fill out online in pdf format. Line 1 state income tax refund refer to your federal income tax return to. Web find colorado form 104 instructions at esmart tax today. Web enter federal taxable income from your federal income tax form: These subtractions will change your colorado taxable income. Web if claiming a subtraction and filing by paper, you must submit this schedule with your return. Web enter federal taxable income from your federal income tax form: Use the dr 0104x, amended colorado. See full instructions on page 11 in the dr 0104 booklet. These subtractions will change your colorado taxable income. 2021 subtractions from income schedule. You may file by mail with paper forms or efile online (contains forms dr. Instructions | dr 0104 | related forms tax.colorado.gov this book includes: Web if claiming a subtraction and filing by paper, you must submit this schedule with your return. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Line 1 state income tax refund refer to your federal income tax return to. See full instructions on page 11 in the dr 0104 booklet. Use this schedule to report any subtractions from your federal taxable income. If claiming a subtraction and filing by paper, you must submit this schedule with your return. Web if claiming a subtraction and filing by paper, you must submit this schedule with your return. Web 2022 colorado individual income tax return. Get ready for tax season deadlines by completing any required tax forms today. Web 104 book 2022 booklet includes: Line 1 state income tax refund refer to your federal income tax return to. Complete, edit or print tax forms instantly. Instructions | dr 0104 | related forms tax.colorado.gov this book includes: See full instructions on page 11 in the dr 0104 booklet. Web enter federal taxable income from your federal income tax form: Tax refund refer to your federal income tax return to complete this line. Line 1 state income tax refund refer to your federal income tax return to. Download blank or fill out online in pdf format. Web if you use this schedule to claim any subtractions from your income, you must submit it with the dr 0104. If you did. Instructions | dr 0104 | related forms tax.colorado.gov this book includes: See full instructions on page 11 in the dr 0104 booklet. Line 1 state income tax refund refer to your federal income tax return to. Use this schedule to report any subtractions from your federal taxable income. Use this schedule to report any. Instructions | dr 0104 | related forms tax.colorado.gov this book includes: Ydr 01042022 colorado individual income tax. Web enter federal taxable income from your federal income tax form: Web we would like to show you a description here but the site won’t allow us. Web find colorado form 104 instructions at esmart tax today. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. You may file by mail with paper forms or efile online (contains forms dr. Web you must use the amended return form that corresponds to the tax year you are amending or your amended return cannot be processed. Tax refund refer to your federal income tax return to complete this line. Web if claiming a subtraction and filing by paper, you must submit this schedule with your return. Complete, edit or print tax forms instantly. Web if you use this schedule to claim any subtractions from your income, you must submit it with the dr 0104. These subtractions will change your colorado taxable income. Download blank or fill out online in pdf format. Use this schedule to report any subtractions from your federal taxable income. See full instructions on page 11 in the dr 0104 booklet. Get ready for tax season deadlines by completing any required tax forms today. Web 2022 colorado individual income tax return. Complete, sign, print and send your tax documents easily with us legal forms. If you did not complete federal.Form DR0104 Download Fillable PDF or Fill Online Colorado Individual

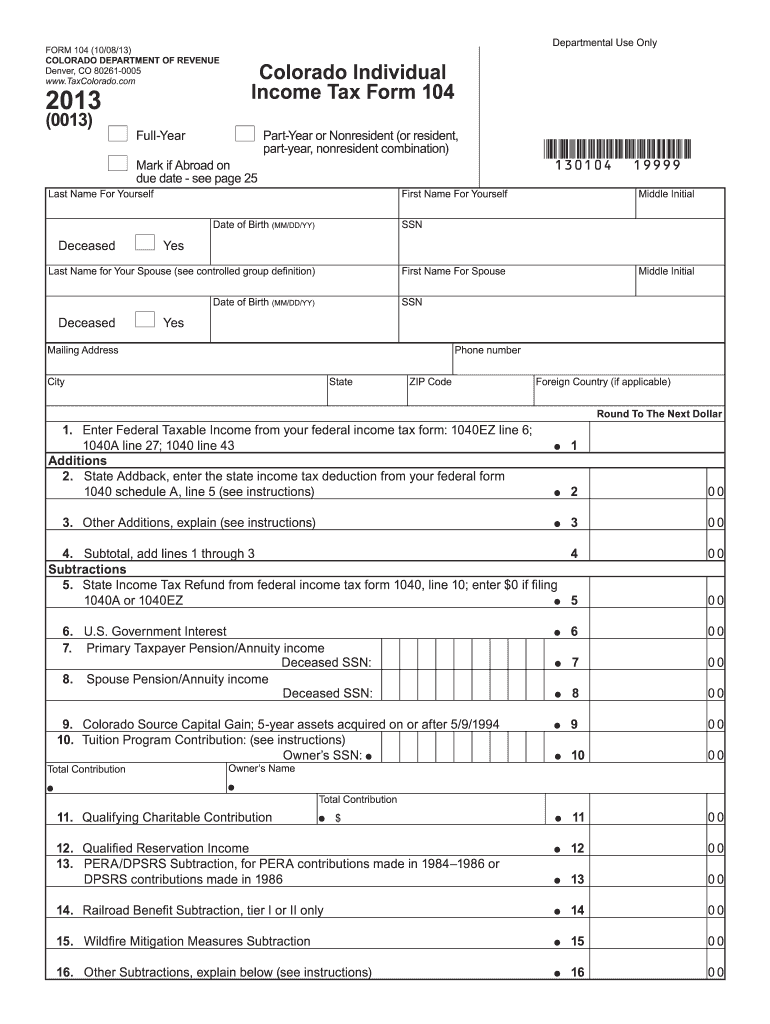

2013 104 colorado form Fill out & sign online DocHub

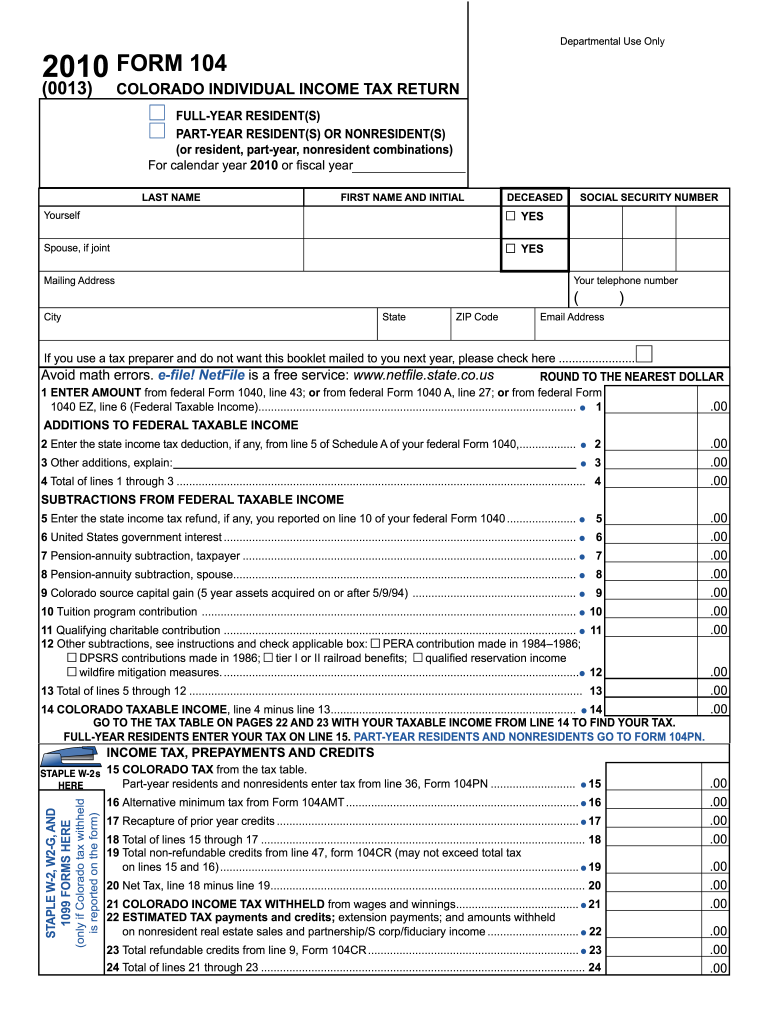

Printable Colorado Tax Form 104 Fill Online, Printable

Individual Tax Form 104 Colorado Free Download

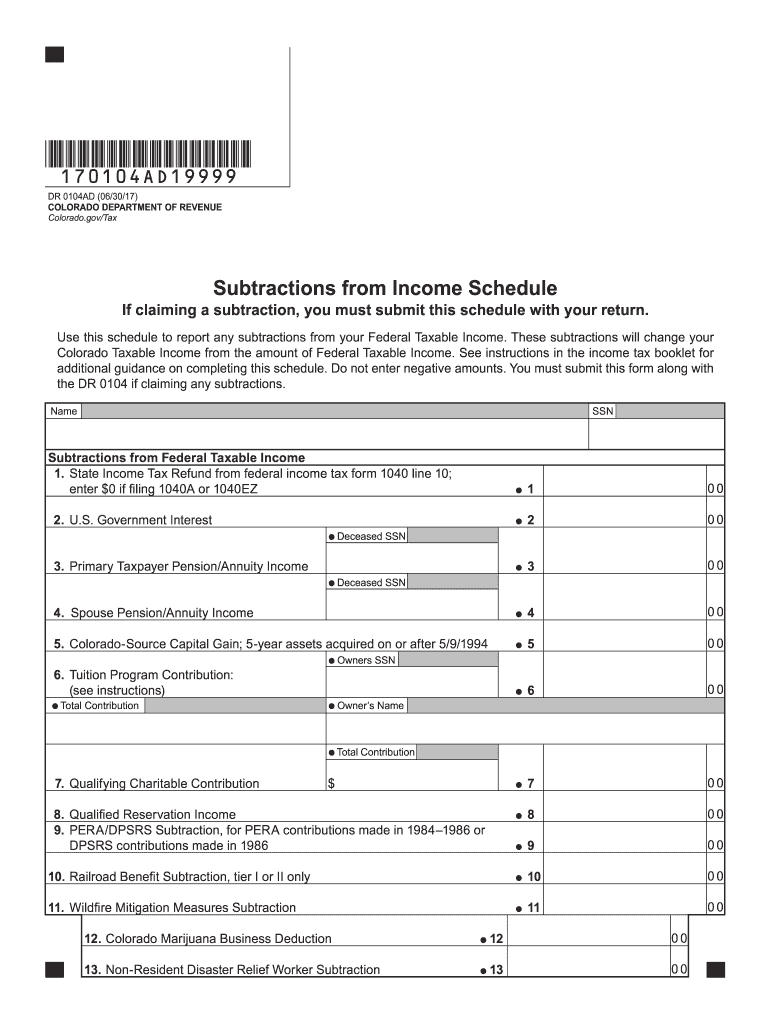

Colorado form 104ad Fill out & sign online DocHub

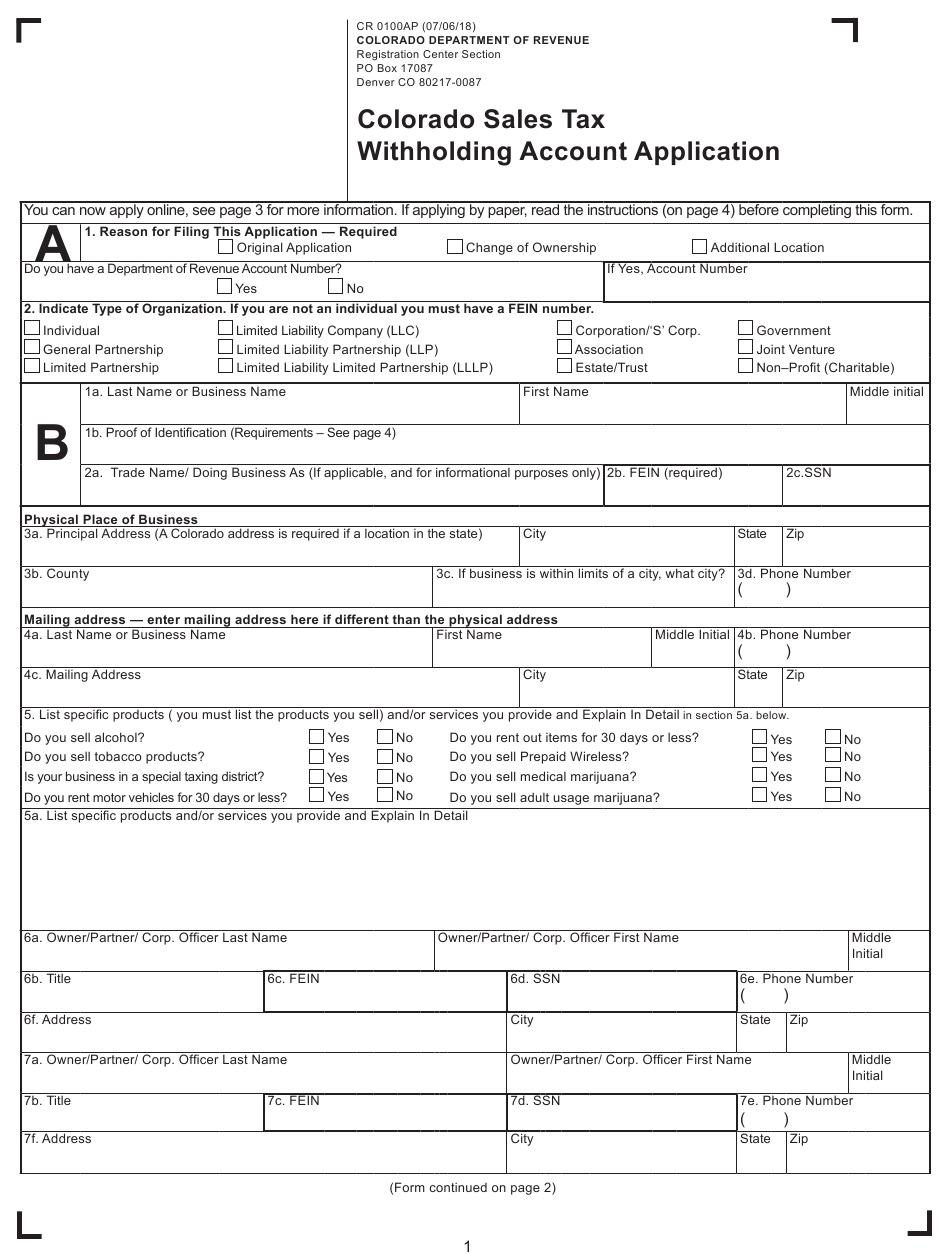

Colorado Withholding Form 2022 W4 Form

Form 104 Colorado Individual Tax 2011 printable pdf download

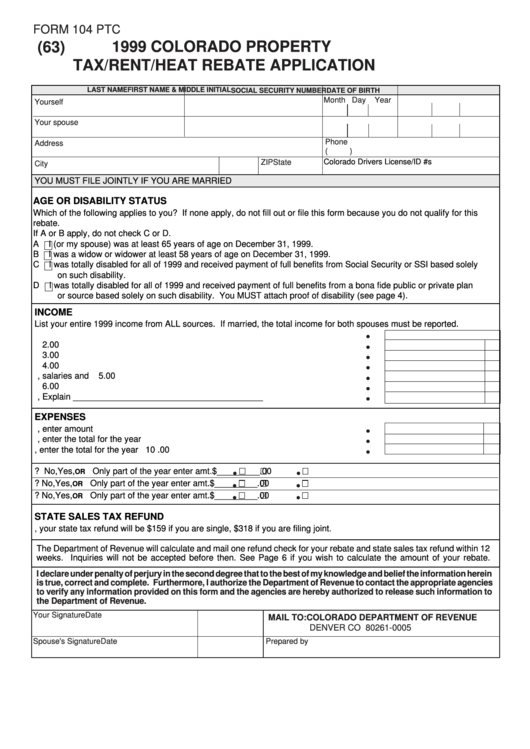

Form 104 Ptc Colorado Property Tax/rent/heat Rebate Application

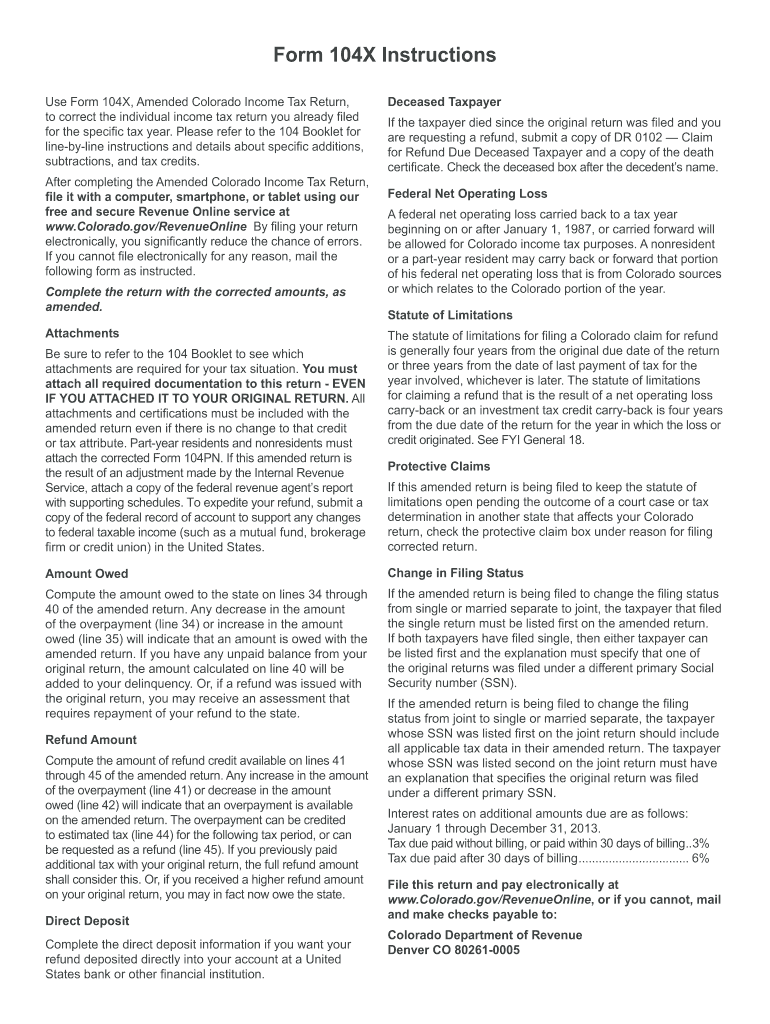

Colorado Form 104x Fill Out and Sign Printable PDF Template signNow

Colorado Form 104x Fill Out and Sign Printable PDF Template signNow

Related Post: