Capital Loss Carryover Form

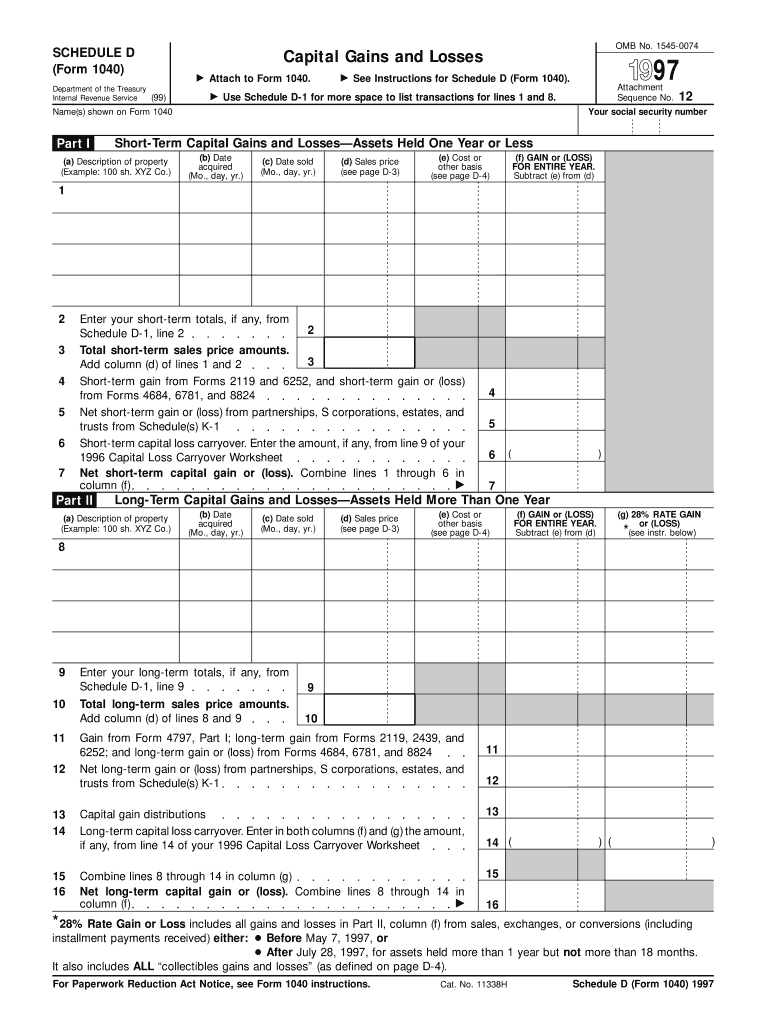

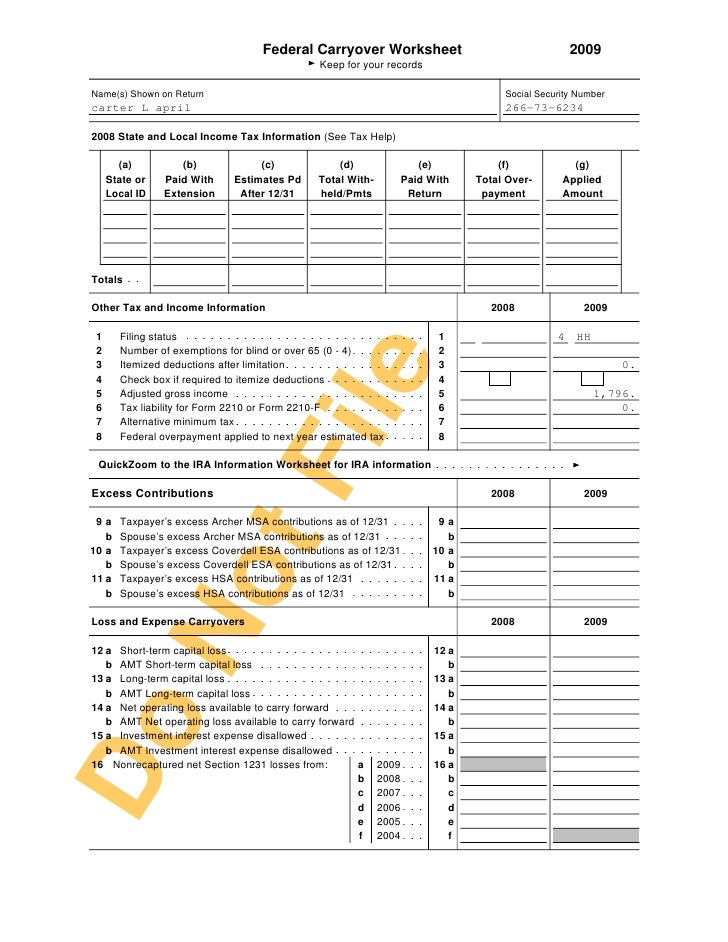

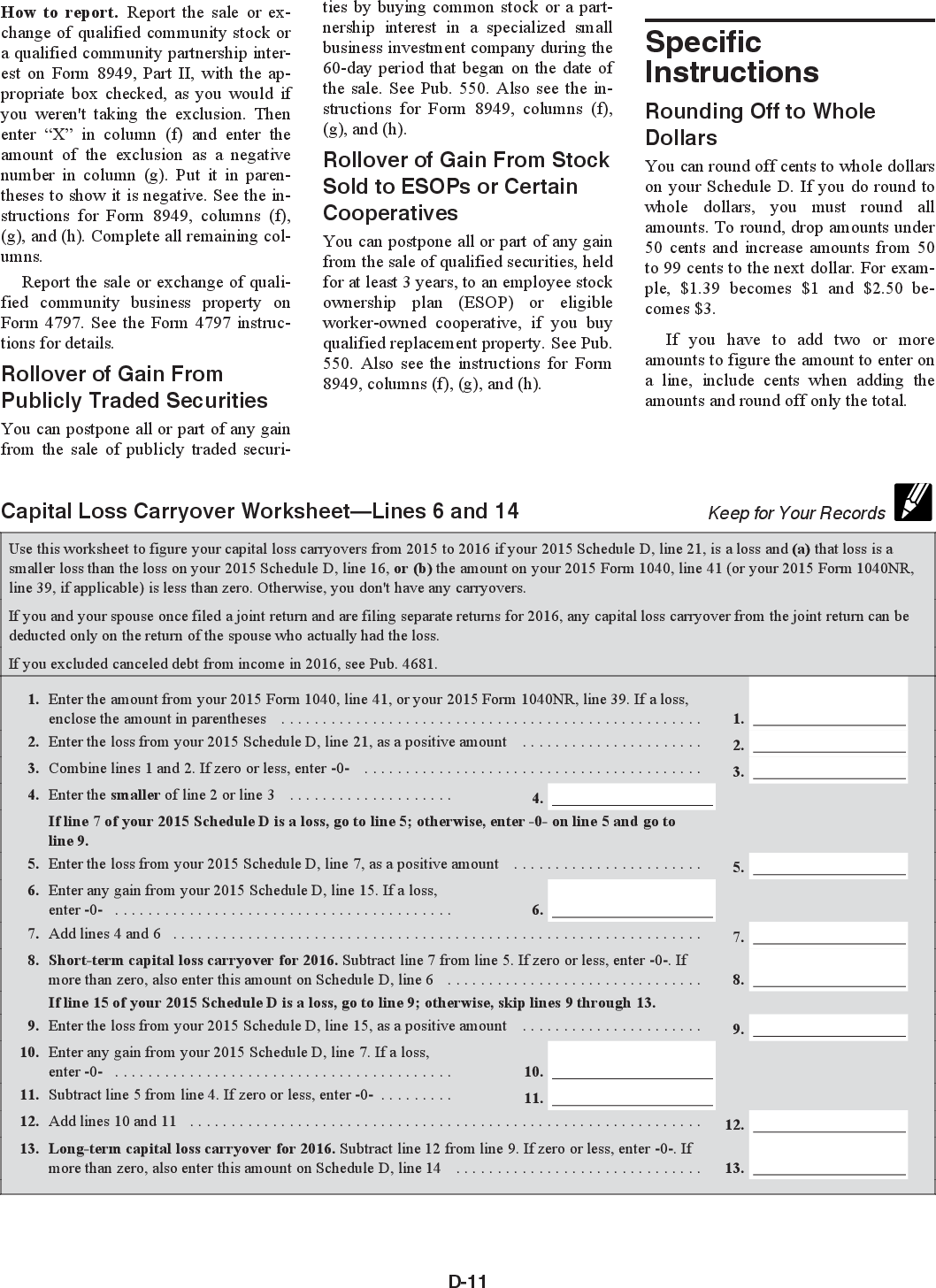

Capital Loss Carryover Form - Web solved•by turbotax•2060•updated 2 weeks ago. Carryover losses on your investments are first used to offset the current year capital gains if any. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss carryover. Web claiming capital loss carryover involves filling out specific tax forms. If you want to figure your carryover. Web the irs allows you to deduct $3,000 from your taxable income if your capital losses exceed your capital gains. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. Select carryovers/misc info from the left navigation panel.; Web entering a capital loss carryover in the individual module. If you sold property at a gain (other than publicly traded stocks or securities) and you will receive a payment in a. These tax benefits can significantly. Select carryovers/misc info from the left navigation panel.; Solved • by turbotax • 2139 • updated january 13, 2023 if you transferred last year's turbotax return over, you don't. Web capital loss carryover. Solved • by turbotax • 2139 • updated january 13, 2023 if you transferred last year's turbotax return over, you don't. Go to screen 17, dispositions.; Capital losses beyond $3,000 can be rolled over to. Complete form 8949 before you complete line. If you sold stock or mutual funds at a loss, you can use the loss to offset capital. Web capital loss carryover worksheet—schedule d (form 1040) (2020) use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a. Web how do i enter my capital loss carryover? Web the irs allows you to deduct $3,000 from your taxable income if your capital losses exceed your capital gains. Ad blackrock.com. Select carryovers/misc info from the left navigation panel.; Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a. Web entering a capital loss carryover in the individual module. Web for any year (including the final year) in which capital losses exceed. Capital losses beyond $3,000 can be rolled over to. Web the irs allows you to deduct $3,000 from your taxable income if your capital losses exceed your capital gains. If you want to figure your carryover. Carryover losses on your investments are first used to offset the current year capital gains if any. Web 2022 instructions for schedule dcapital gains. Web claiming capital loss carryover involves filling out specific tax forms. Web capital loss carryover is the capital loss that can be carried forward to future years and used to offset capital gains or as a deduction against ordinary income. Ad blackrock.com has been visited by 10k+ users in the past month Web capital loss carryover worksheet—schedule d (form 1040). Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a. Web capital loss carryover is the capital loss that can be carried forward to future years and used to offset capital gains or as a deduction against ordinary income. Web 2022. Use the capital loss carryover. Ad blackrock.com has been visited by 10k+ users in the past month Web capital loss carryover is the capital loss that can be carried forward to future years and used to offset capital gains or as a deduction against ordinary income. Web the current year carryover loss from the prior year is on schedule d. Ad blackrock.com has been visited by 10k+ users in the past month Web capital loss carryover is the capital loss that can be carried forward to future years and used to offset capital gains or as a deduction against ordinary income. Web the current year carryover loss from the prior year is on schedule d line 6 & 14. Web. Complete form 8949 before you complete line. Web 2022 540nr d instructions. Web claiming capital loss carryover involves filling out specific tax forms. Web capital loss carryover worksheet—schedule d (form 1040) (2020) use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a. Web use this worksheet to figure your capital. Web it applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment. On the income page the 2021 column shows the carryover to 2022 (not your. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Select carryovers/misc info from the left navigation panel.; Web capital loss carryover is the capital loss that can be carried forward to future years and used to offset capital gains or as a deduction against ordinary income. Web entering a capital loss carryover in the individual module. You can deduct up to $3,000. Capital losses beyond $3,000 can be rolled over to. Web solved•by turbotax•2060•updated 2 weeks ago. Use the capital loss carryover. Ad blackrock.com has been visited by 10k+ users in the past month If you sold property at a gain (other than publicly traded stocks or securities) and you will receive a payment in a. Complete form 8949 before you complete line. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss carryover. These tax benefits can significantly. These instructions explain how to complete schedule d (form 1040). Carryover losses on your investments are first used to offset the current year capital gains if any. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. Solved • by turbotax • 2139 • updated january 13, 2023 if you transferred last year's turbotax return over, you don't.1997 Form 1040 (Schedule D). Capital Gains and Losses irs Fill out

Capital Loss Carryover Worksheet slidesharedocs

Carryover Worksheet Turbotax

️Amt Nol Carryover Worksheet Free Download Gmbar.co

What Is A Federal Carryover Worksheet

20182023 Form IRS Capital Loss Carryover Worksheet Fill Online

Capital Loss Carryover Worksheet PDF Form FormsPal

Capital Loss Carryover Definition, Rules, and Example

Capital Loss Carryover Worksheet Example Educational worksheets, Tax

California Capital Loss Carryover Worksheet

Related Post: