Can I File Form 1041 Electronically

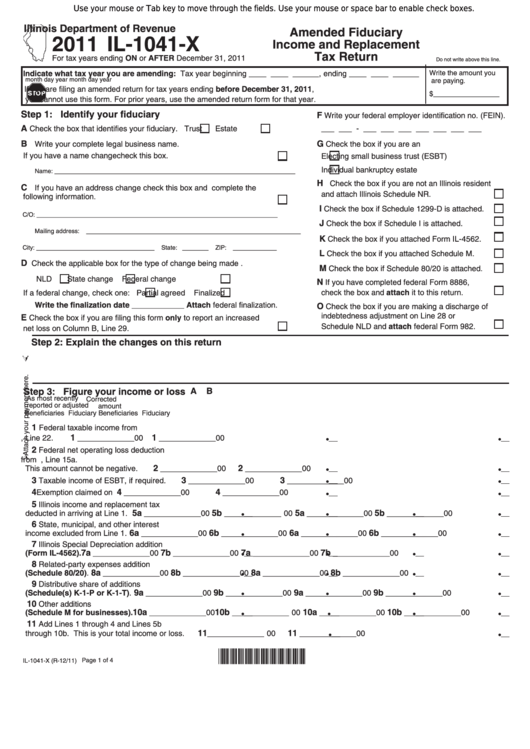

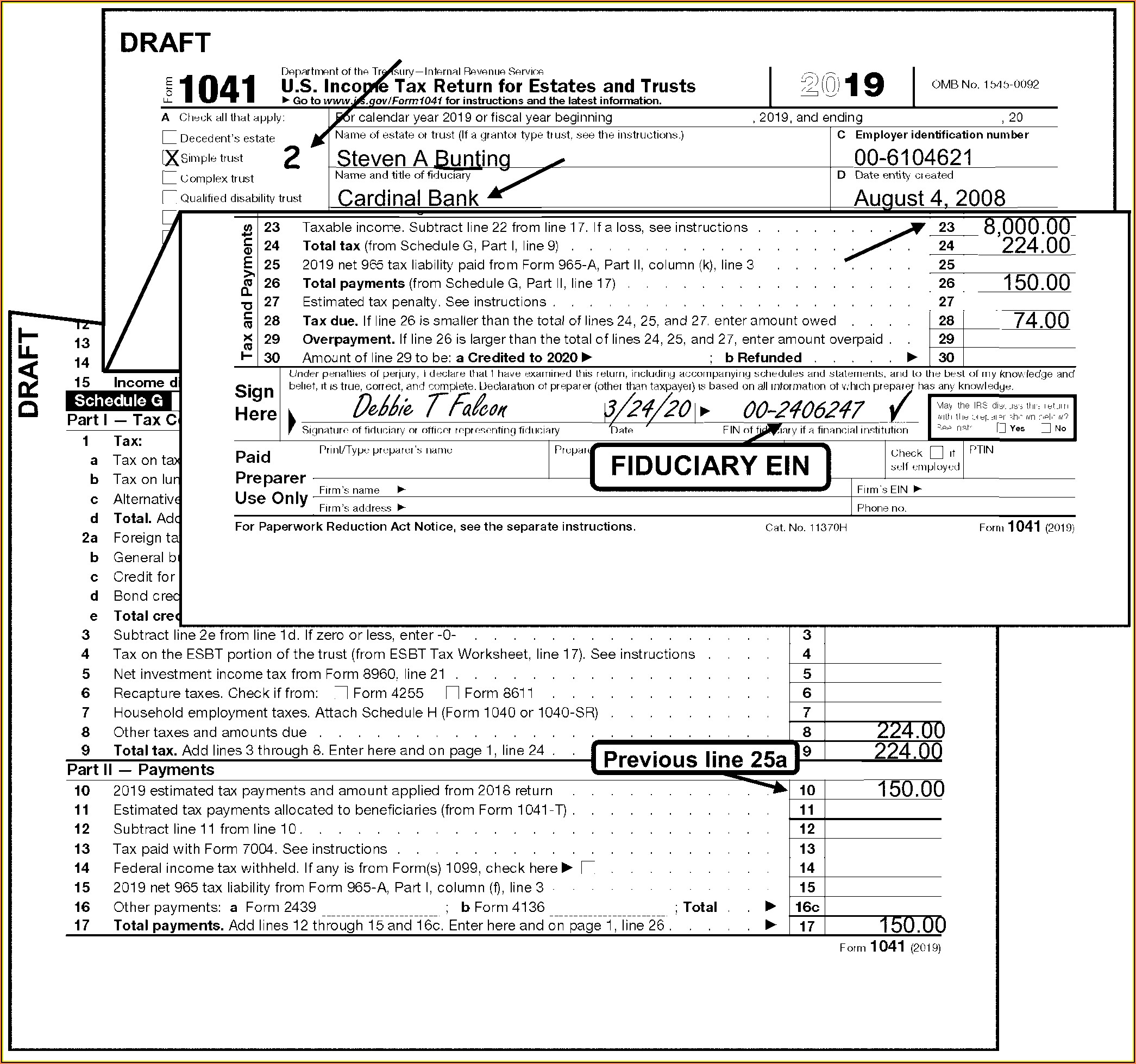

Can I File Form 1041 Electronically - Web however, due to the safety measures brought into action considering the virus outbreak, the irs is encouraging filers to choose the electronic filing method to report. And if the estate or trust sells. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Employers engaged in a trade or business who. Ad gusto.com has been visited by 10k+ users in the past month For filing deadlines and other information related to 1041. Ad easy guidance & tools for c corporation tax returns. Income tax return for estates and trusts can be electronically filed starting with tax year 2011. In addition to prior tax years,. Web solved•by intuit•348•updated april 28, 2023. You'll need turbotax business to file form 1041, as the personal versions of turbotax don't support this form. Web however, due to the safety measures brought into action considering the virus outbreak, the irs is encouraging filers to choose the electronic filing method to report. Page last reviewed or updated: Form 1041 is used by a. Employee's withholding certificate form. Web internal revenue service. Ultratax cs 2013 user bulletins. Web the 2024 filing season serves as a pilot for direct file, and the purpose is to learn about the direct file service itself and the needs of taxpayers who use it. Form 1041 is used by a. Web can i file form 1041 electronically? The following is a list of forms available in ultratax/1041 that are not included in the electronic file, but allow the return to be filed electronically because the forms are. Web can i file form 1041 electronically? Page last reviewed or updated: For filing deadlines and other information related to 1041. You'll need turbotax business to file form 1041, as. Income tax return for estates and trusts can be electronically filed starting with tax year 2011. Web however, due to the safety measures brought into action considering the virus outbreak, the irs is encouraging filers to choose the electronic filing method to report. Form 1041 is used by a. This page provides information on companies that. Gather information needed to. Ad easy guidance & tools for c corporation tax returns. Page last reviewed or updated: Web just like personal tax returns, the estate or trust can report deductions on the 1041 for things like the payment of taxes and the fees paid to the fiduciary, which is usually the trustee or the person who administers the estate. Income tax return. Form 941 asks for the total amount of. In processing year 2023, mef will accept form 1041 tax years 2020, 2021, and 2022. Web electronic filing faqs (1041) alerts and notices. Income tax return for estates and trusts can be electronically filed starting with tax year 2011. Page last reviewed or updated: Web solved•by turbotax•646•updated may 24, 2023. Web the 2024 filing season serves as a pilot for direct file, and the purpose is to learn about the direct file service itself and the needs of taxpayers who use it. Income tax return for estates and trusts can be electronically filed starting with tax year 2011. Income tax return for estates and. In processing year 2023, mef will accept form 1041 tax years 2020, 2021, and 2022. Form 1041 is used by a. Employee's withholding certificate form 941; You'll need turbotax business to file form 1041, as the personal versions of turbotax don't support this form. Ad easy guidance & tools for c corporation tax returns. Web electronic filing faqs (1041) alerts and notices. Gather information needed to complete form 941. Web 7 rows notes. Web just like personal tax returns, the estate or trust can report deductions on the 1041 for things like the payment of taxes and the fees paid to the fiduciary, which is usually the trustee or the person who administers the. Ad easy guidance & tools for c corporation tax returns. Web internal revenue service. Ad gusto.com has been visited by 10k+ users in the past month Form 941 asks for the total amount of. Web however, due to the safety measures brought into action considering the virus outbreak, the irs is encouraging filers to choose the electronic filing method to. Web the 2024 filing season serves as a pilot for direct file, and the purpose is to learn about the direct file service itself and the needs of taxpayers who use it. Mef can accept the current and prior two tax years. Web electronic filing faqs (1041) alerts and notices. Usually, a personal representative or an executor will file this form for the deceased person. Page last reviewed or updated: Employee's withholding certificate form 941; Ad easy guidance & tools for c corporation tax returns. Income tax return for estates and trusts can be electronically filed starting with tax year 2011. Page last reviewed or updated: Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Ad gusto.com has been visited by 10k+ users in the past month Web 7 rows notes. Income tax return for estates and trusts can be electronically filed starting with tax year 2011. Web however, due to the safety measures brought into action considering the virus outbreak, the irs is encouraging filers to choose the electronic filing method to report. This page provides information on companies that. In addition to prior tax years,. Ultratax cs 2013 user bulletins. Ad easy guidance & tools for c corporation tax returns. Getting started with ultratax cs. Form 941 asks for the total amount of.Fillable Form Il1041X Amended Fiduciary And Replacement Tax

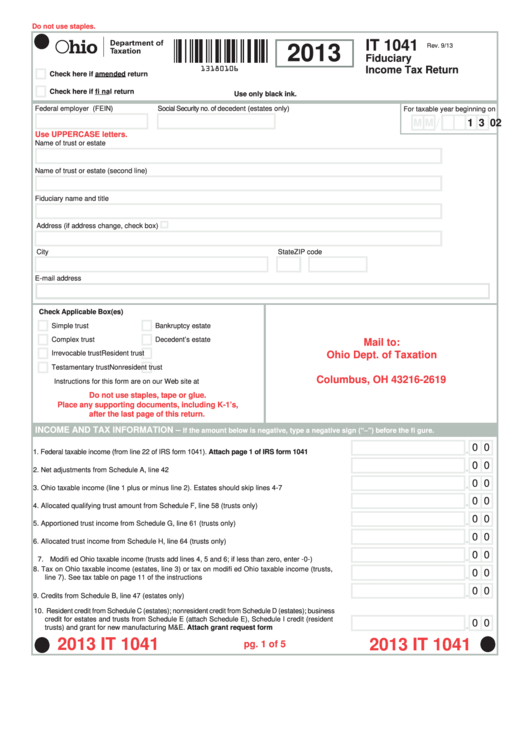

Fillable Form It 1041 Fiduciary Tax Return 2013 printable

Irs Forms 1041 Form Resume Examples 4x2v8xlY5l

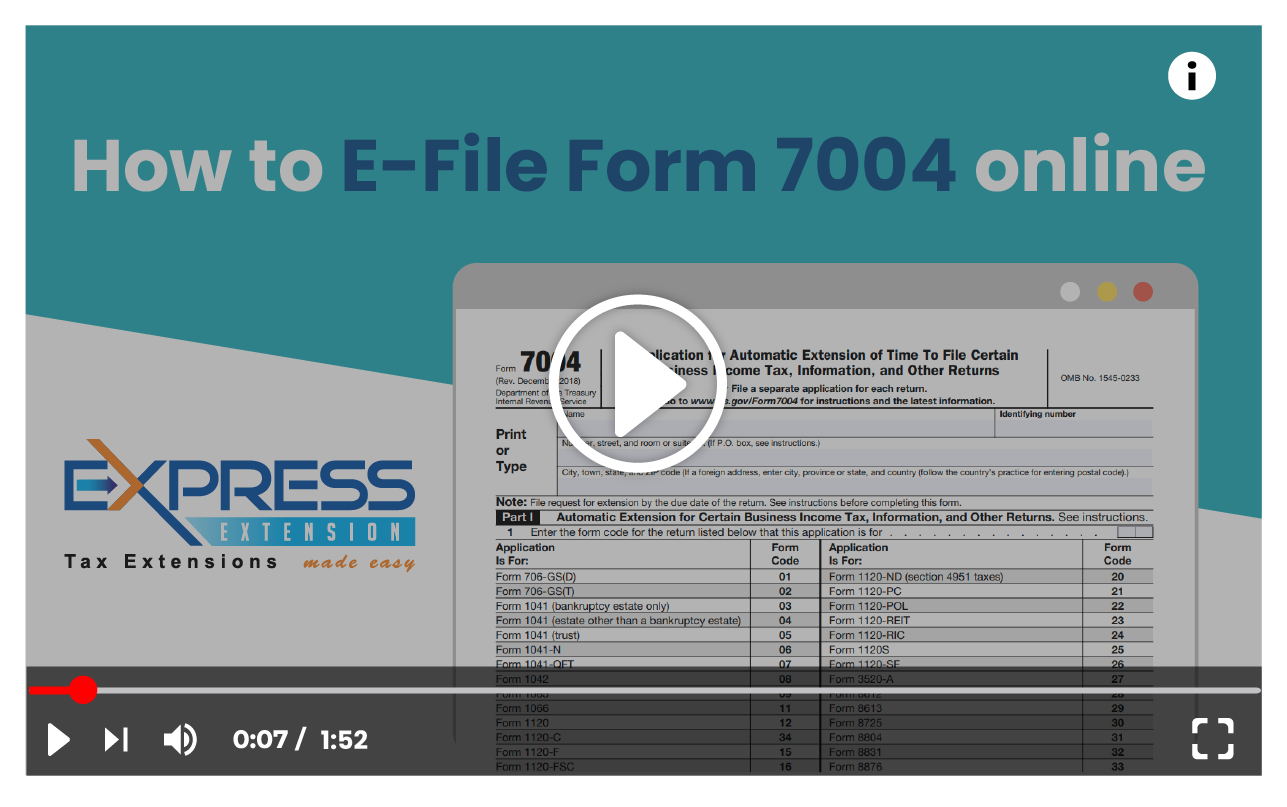

File Form 1041 Extension Online Estates & Trusts Tax Extension

Fillable Online irs irs form 1041t Fax Email Print pdfFiller

Form 1041 Extension Due Date 2019 justgoing 2020

Online IRS Form 1041 2019 Fillable and Editable PDF Template

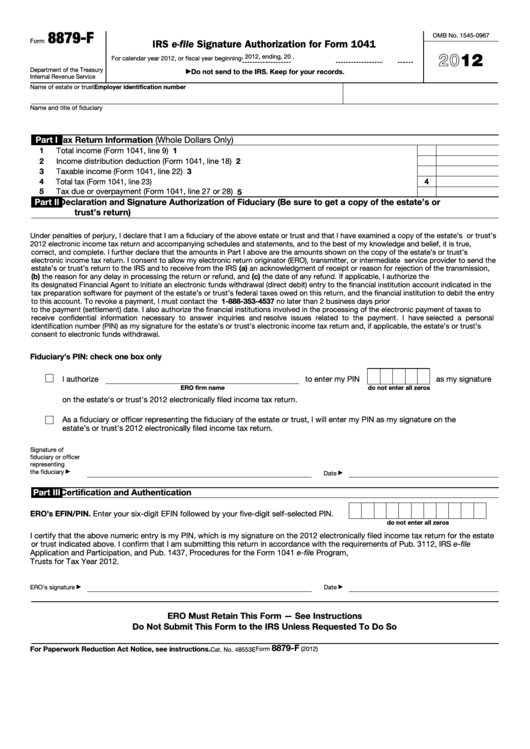

Fillable Irs EFile Signature Authorization For Form 1041 printable pdf

What Expenses Are Deductible On Form 1041 Why Is

Using Form 1041 for Filing Taxes for the Deceased H&R Block

Related Post: