California Withholding Tax Form

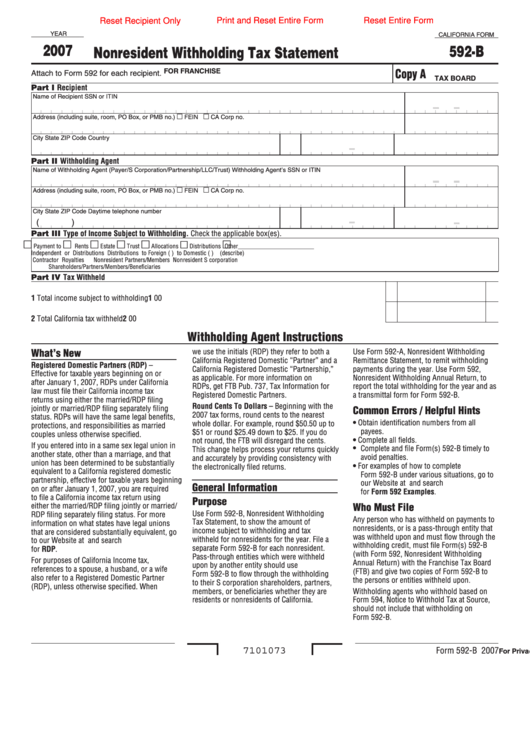

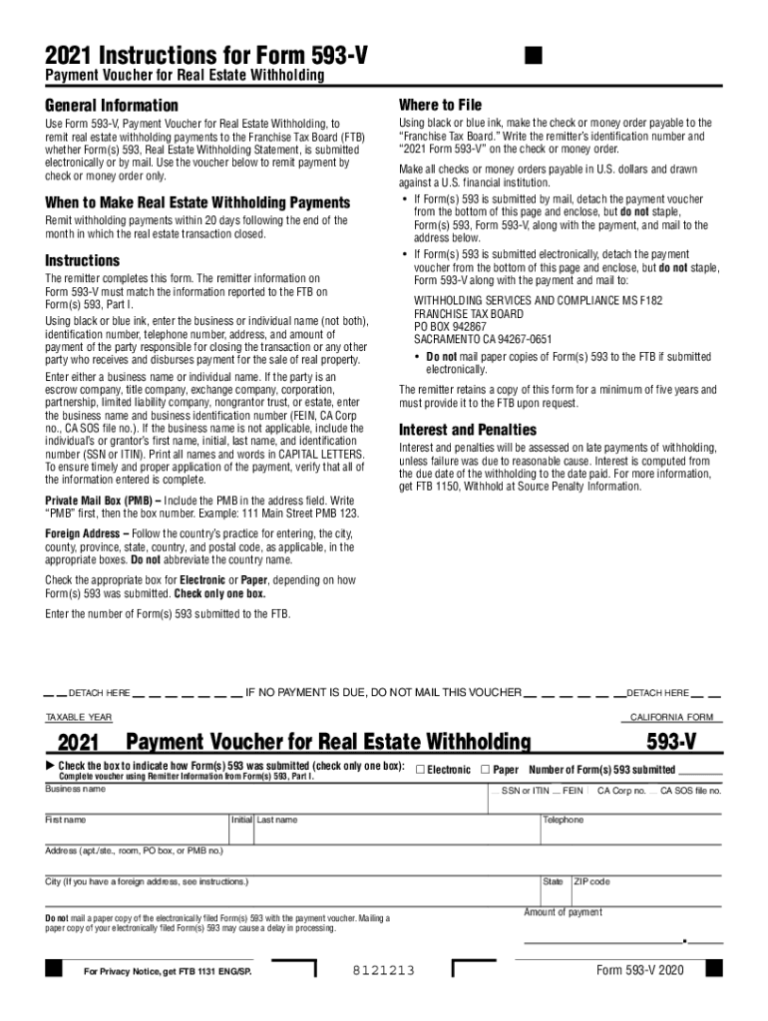

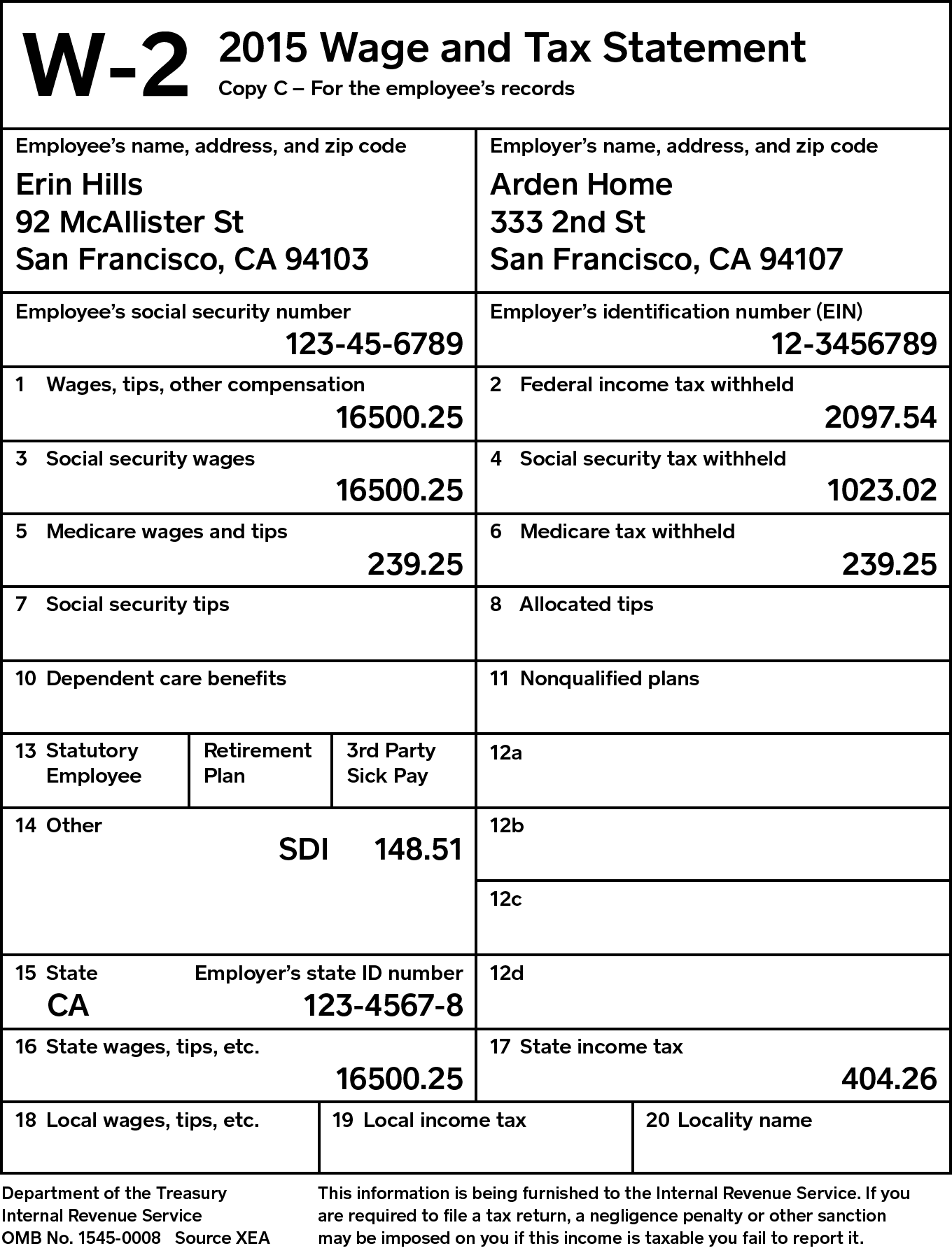

California Withholding Tax Form - Tax guide for local jurisdictions and districts. Form 592 includes a schedule of payees section, on side 2, that. To determine the applicable tax rate for. Employee withholding amount required for remittal: Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Its purpose is to provide. Any remitter (individual, business entity, trust, estate, or. Web california edd form de 4 is an employee withholding allowance certificate issued by the california employment development department (edd). Web the california state controller’s office publishes current tax rates on their website in the form of tax withholding tables. Web tax withholding election form (mycalpers 1289), sign and submit it to calpers as soon as possible. Irs further postpones tax deadlines for most california. Because your tax situation may change from year to year, you may want to. Web your california personal income tax may be underwithheld if you do not file this de 4 form. Web california extends due date for california state tax returns. Ad pdffiller.com has been visited by 1m+ users in the. Tax guide for local jurisdictions and districts. Web simplified income, payroll, sales and use tax information for you and your business Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed.. Its purpose is to provide. Web the california state controller’s office publishes current tax rates on their website in the form of tax withholding tables. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Employee withholding amount required for remittal: We consistently offer best in class solutions to. The ftb so far is the only california tax agency that has provided blanket relief for filing returns and paying taxes within its. Because your tax situation may change from year to year, you may want to. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. You must. Any remitter (individual, business entity, trust, estate, or. Form 592 includes a schedule of payees section, on side 2, that. Web california edd form de 4 is an employee withholding allowance certificate issued by the california employment development department (edd). Ad join us and see why tax pros have come to us for the latest tax updates for over 40. Irs further postpones tax deadlines for most california. You must file a de 4 to determine the appropriate california pit withholding. To determine the applicable tax rate for. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Know the current contribution rates, withholding schedules, and meals and lodging. Employee withholding amount required for remittal: Form 592 includes a schedule of payees section, on side 2, that. Ad pdfquick.com has been visited by 10k+ users in the past month You must file a de 4 to determine the appropriate california pit withholding. Any remitter (individual, business entity, trust, estate, or. Because your tax situation may change from year to year, you may want to. Any remitter (individual, business entity, trust, estate, or. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Ad pdfquick.com has been visited by 10k+ users in the past month A seller/transferor that qualifies for. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Employee withholding amount required for remittal: Any remitter (individual, business entity, trust, estate, or. You must file a de 4 to determine the appropriate california pit withholding. Tax guide for local jurisdictions and districts. Ad pdffiller.com has been visited by 1m+ users in the past month Any remitter (individual, business entity, trust, estate, or. Web california extends due date for california state tax returns. The ftb so far is the only california tax agency that has provided blanket relief for filing returns and paying taxes within its. We consistently offer best in class solutions. Web california edd form de 4 is an employee withholding allowance certificate issued by the california employment development department (edd). To determine the applicable tax rate for. Web the california state controller’s office publishes current tax rates on their website in the form of tax withholding tables. The ftb so far is the only california tax agency that has provided blanket relief for filing returns and paying taxes within its. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Web forms & publications; Ad pdfquick.com has been visited by 10k+ users in the past month Know the current contribution rates, withholding schedules, and meals and lodging values. Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Because your tax situation may change from year to year, you may want to. We consistently offer best in class solutions to you & your client's tax problems. Form 592 includes a schedule of payees section, on side 2, that. Employee withholding amount required for remittal: Its purpose is to provide. Web simplified income, payroll, sales and use tax information for you and your business Ad pdffiller.com has been visited by 1m+ users in the past month Web tax withholding election form (mycalpers 1289), sign and submit it to calpers as soon as possible. You must file a de 4 to determine the appropriate california pit withholding. Irs further postpones tax deadlines for most california. Web payroll tax deposit (de 88) is used to report and pay unemployment insurance (ui), employment training tax (ett), state disability insurance (sdi) withholding, and.Ftb 589 Fill out & sign online DocHub

Form myCalPERS1289 Download Fillable PDF or Fill Online Tax

Ca State Withholding Form 2022

How To Fill Out State Withholding Form California

California Employee Withholding Form 2022 2023

CA FTB 592F 2021 Fill out Tax Template Online US Legal Forms

1+ California State Tax Withholding Forms Free Download

De 4 California State Tax Withholding Form

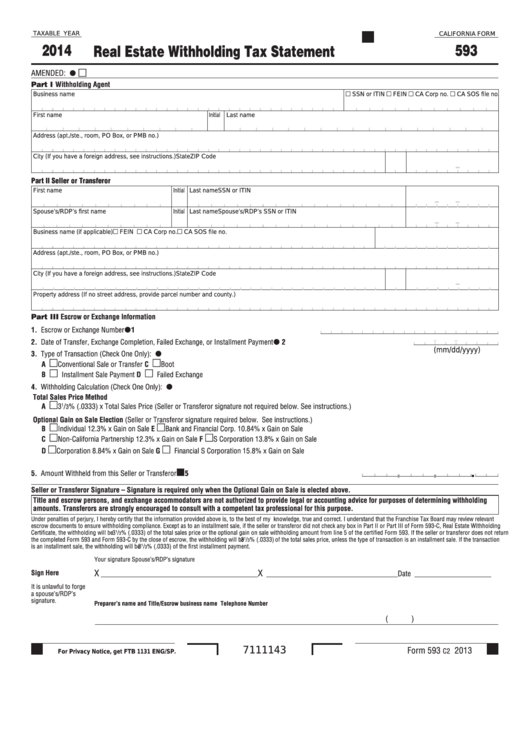

California Tax Withholding Form Escrow

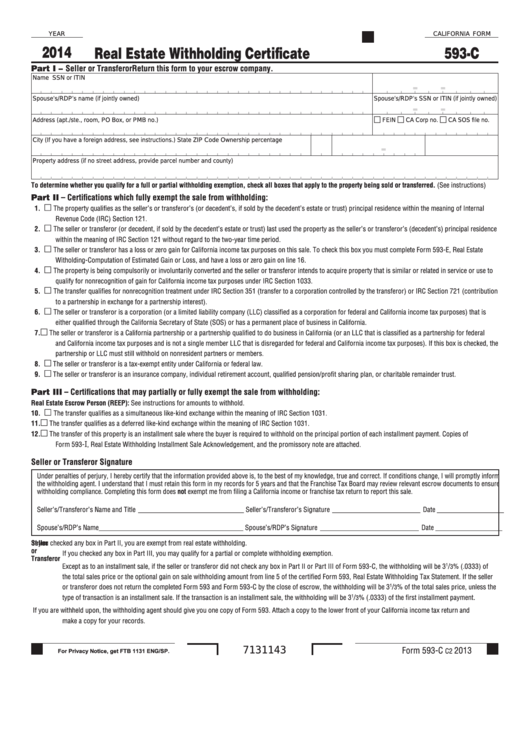

Fillable California Form 593C Real Estate Withholding Certificate

Related Post: