California State Withholding Form

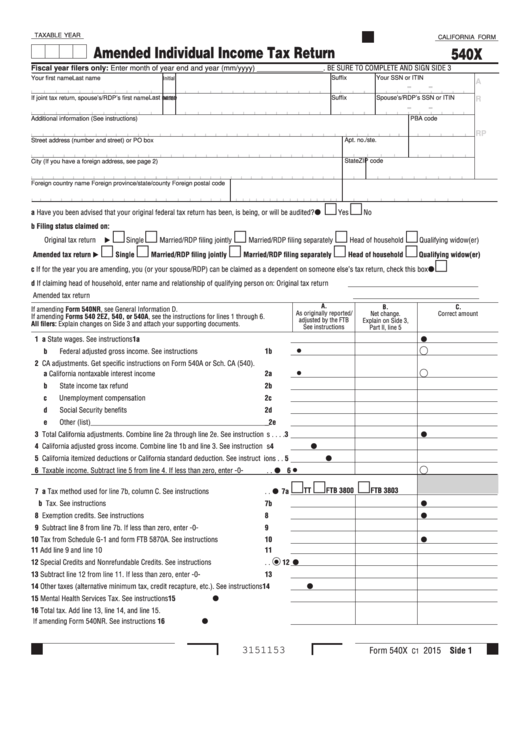

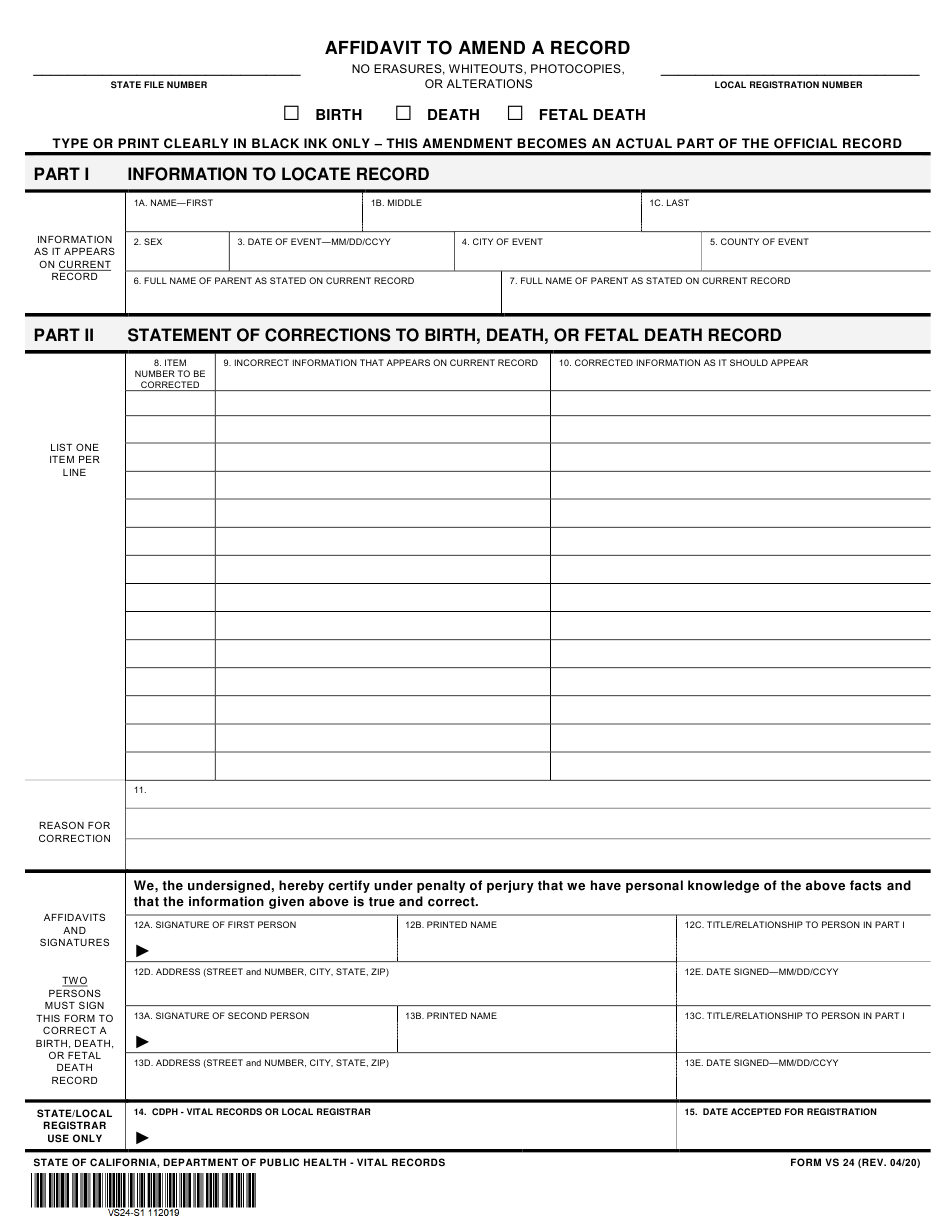

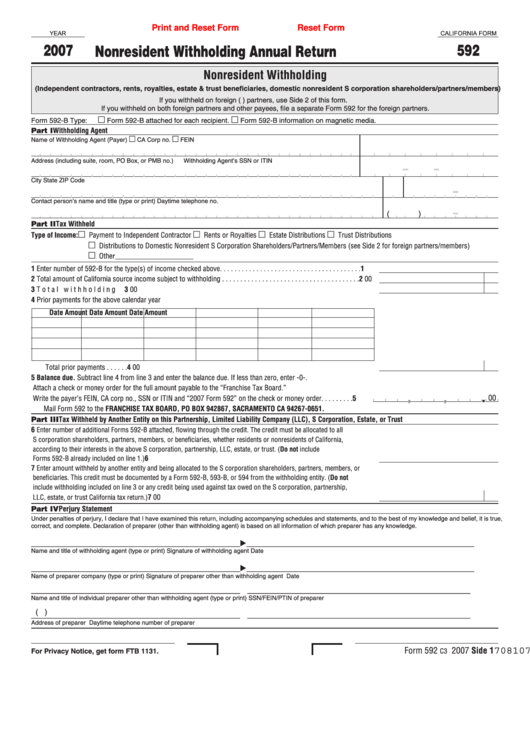

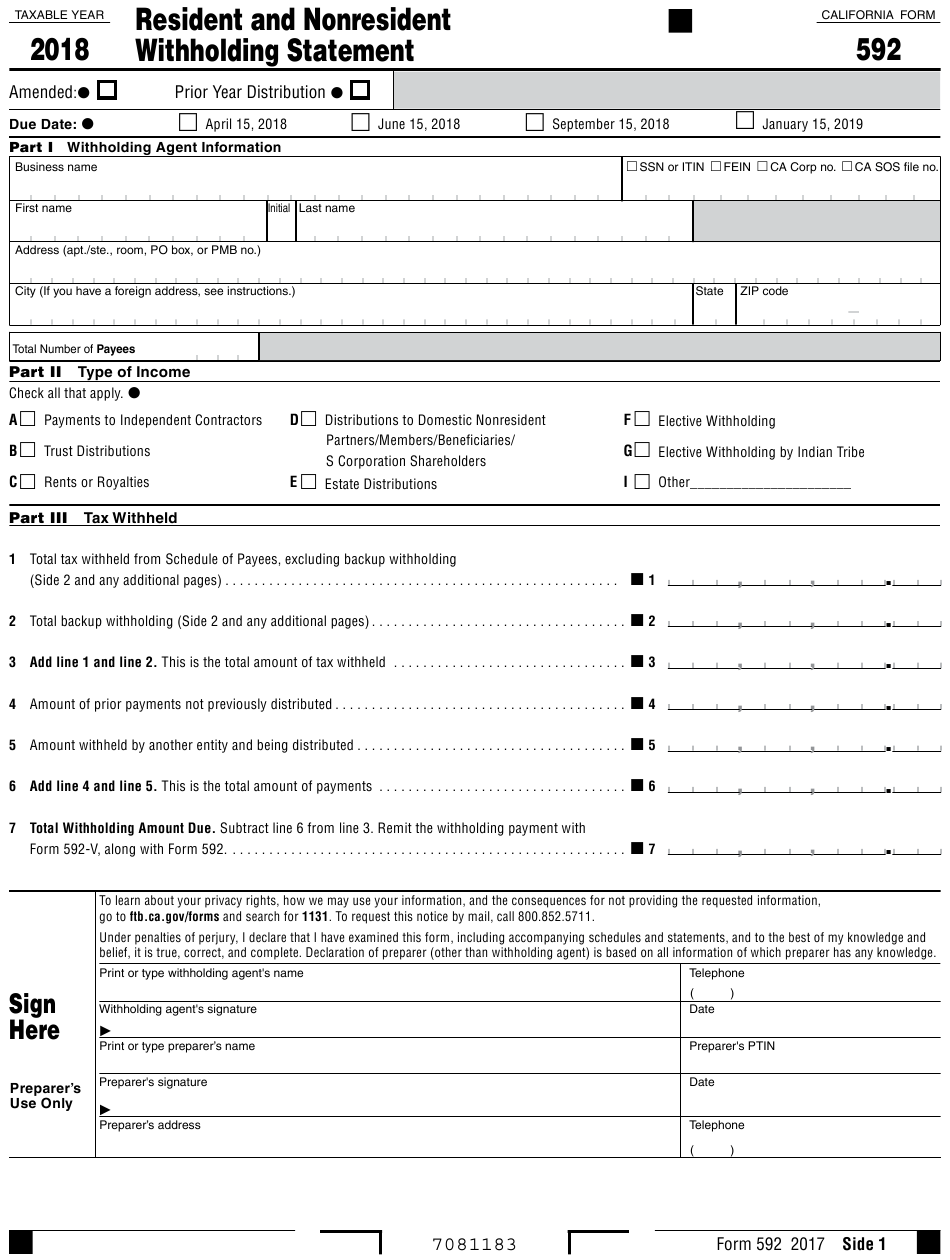

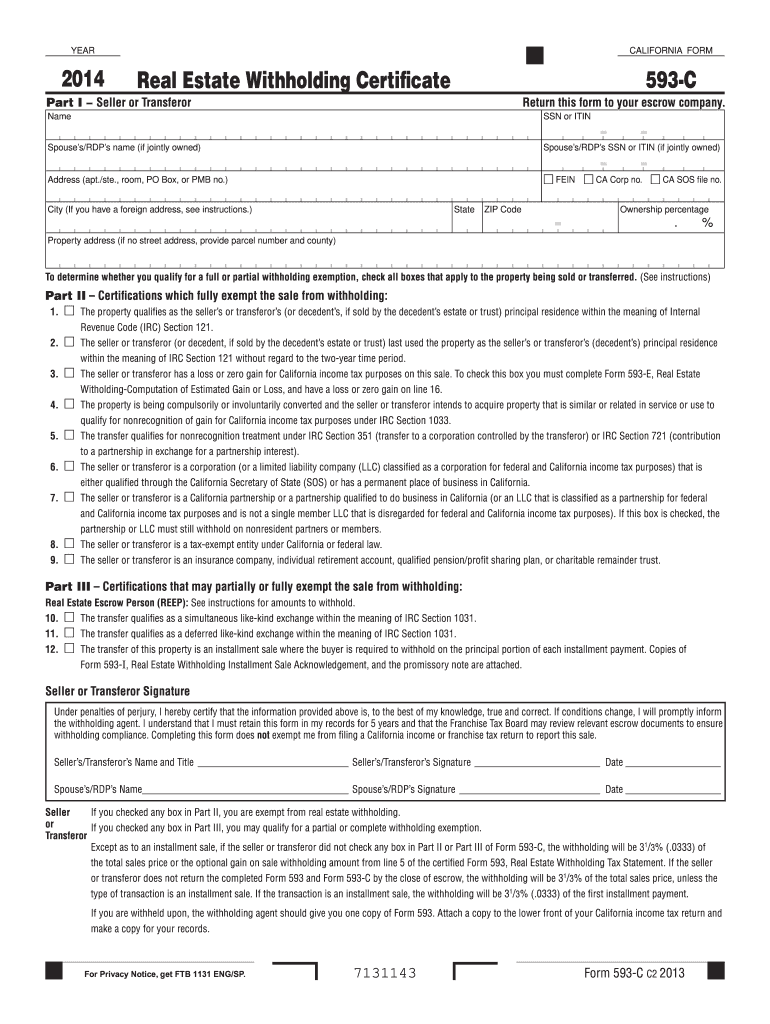

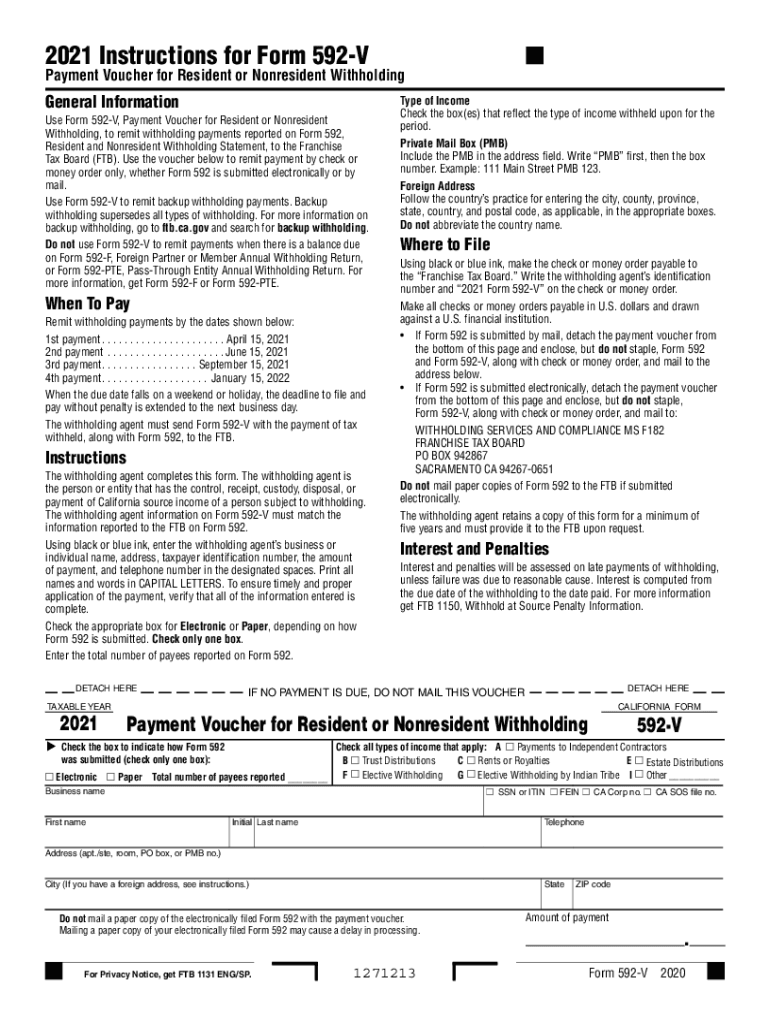

California State Withholding Form - A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Web to do so, the payee fles with the payer a. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. For state withholding, use the worksheets. Any remitter (individual, business entity, trust, estate, or. For state withholding, use the worksheets on this form. Web simplified income, payroll, sales and use tax information for you and your business Form 592 includes a schedule of payees section, on. Employee's withholding certificate form 941; Web simplified income, payroll, sales and use tax information for you and your business Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Web california provides. Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. For state withholding, use the worksheets. Web compare the state income tax withheld with your estimated total. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. The de 4p allows you to: For state withholding, use the worksheets. Employee's withholding certificate form 941; Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Divide the annual california income tax withholding by 26 to obtain the biweekly california. Total number of allowances you’re claiming (use worksheet a. Form 592 includes a schedule of payees section, on. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. After your de 4 takes effect, compare the state income tax. After your de 4 takes effect, compare the state income tax withheld with your estimated total annual tax. Tax withholding election form (mycalpers 1289), sign and submit it to. Divide the annual california income tax withholding by 26 to obtain the biweekly california. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Employee's withholding certificate. The de 4p allows you to: Web to do so, the payee fles with the payer a. Web amount of federal and california state income tax to withhold from your benefit payments. Web compare the state income tax withheld with your estimated total annual tax. Web california provides two methods for determining the amount of wages and salaries to be. Web california provides two methods for determining the amount of wages and salaries to be withheld for state pit: The form helps your employer. Total number of allowances you’re claiming (use worksheet a. Web compare the state income tax withheld with your estimated total annual tax. Divide the annual california income tax withholding by 26 to obtain the biweekly california. Divide the annual california income tax withholding by 26 to obtain the biweekly california. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Web to do so, the payee fles with the payer a. Web filling out the california withholding form de 4 is an. Any remitter (individual, business entity, trust, estate, or. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. Divide the annual california income tax withholding by 26 to obtain the. Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. Web complete this form so that your employer can withhold the correct california state income tax from your. Any remitter (individual, business entity, trust, estate, or. Web amount of federal and california state income tax to withhold from your benefit payments. Divide the annual california income tax withholding by 26 to obtain the biweekly california. Tax withholding election form (mycalpers 1289), sign and submit it to. Form 590 does not apply to payments of backup withholding. Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. Total number of allowances you’re claiming (use worksheet a. The irs welcomed any state to participate in the pilot in a letter. A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. After your de 4 takes effect, compare the state income tax withheld with your estimated total annual tax. Form 592 includes a schedule of payees section, on. For state withholding, use the worksheets. The form helps your employer. The de 4p allows you to: Web compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this form. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web california provides two methods for determining the amount of wages and salaries to be withheld for state pit:State Tax Withholding Form California

Filing California State Withholding Form

California Withholding Tax Form 592

California State Tax Withholding Worksheet Appointments Gettrip24

California State Withholding Form 401k Distributions

Filing California State Withholding Form

1+ California State Tax Withholding Forms Free Download

California Tax Withholding Form 2022

Form 593 C REval Estate Withholding Certificate California Fill Out

California State Withholding Allowances Form

Related Post: