California Form 592 B

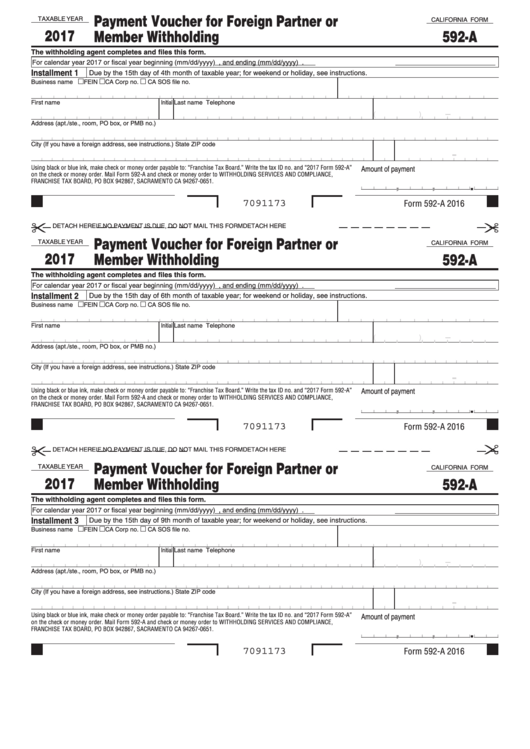

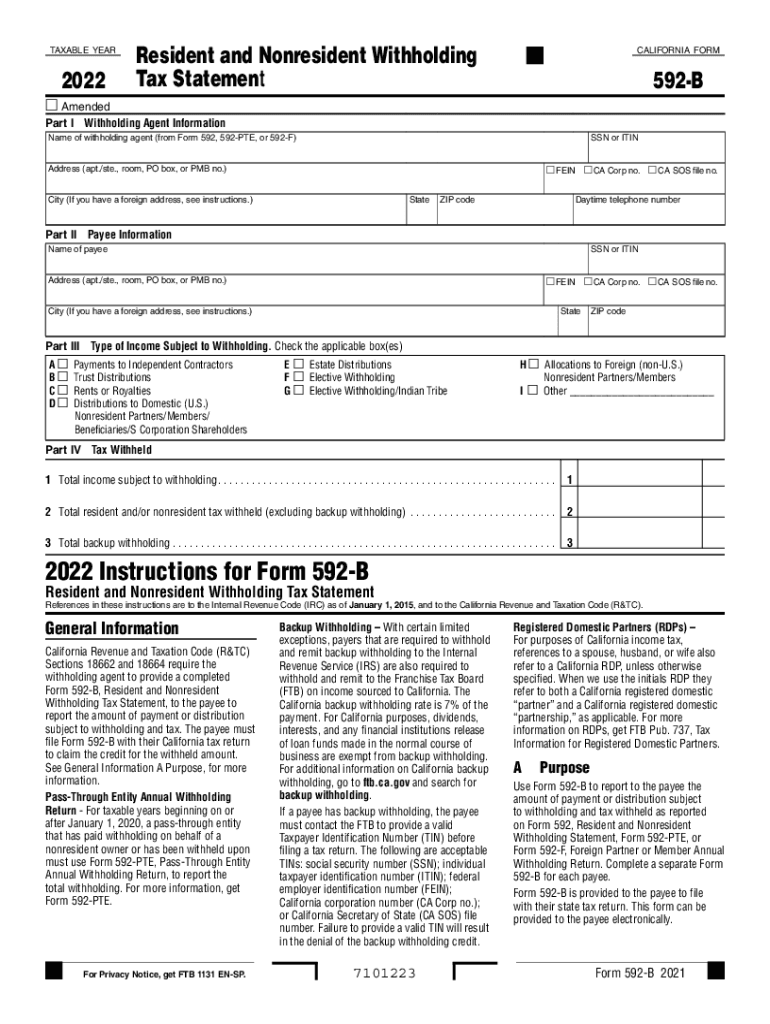

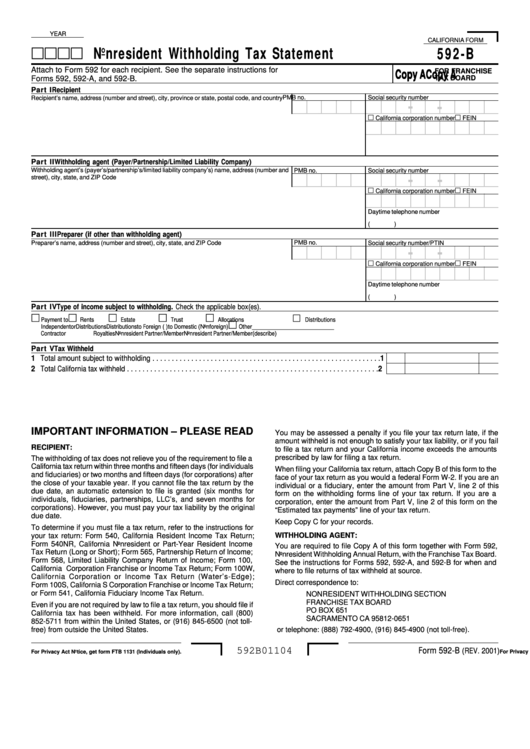

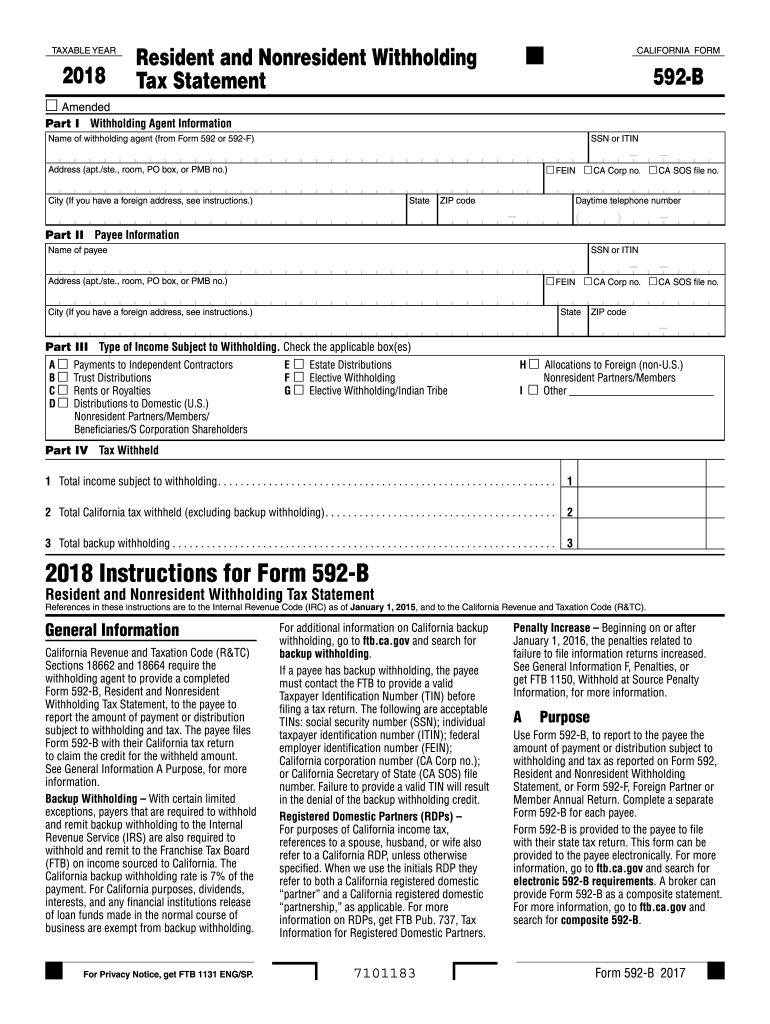

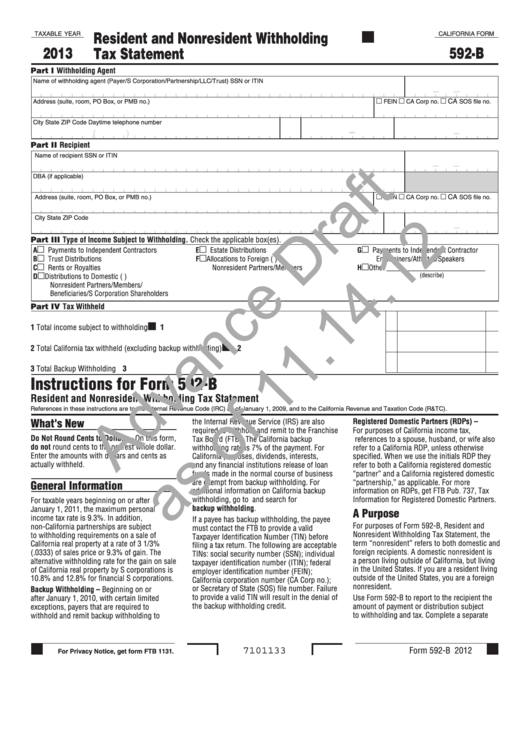

California Form 592 B - Web file form 592 to report withholding on domestic nonresident individuals. Business name ssn or itin fein ca corp no. Business name ssn or itin fein ca corp no. Go to the input return tab and select state & Generally a taxpayer receives this. From the input return tab, go to state and local ⮕ part. Part ii type of income. Web 2022 ca form 592, resident and nonresident withholding statement. Items of income that are subject to withholding are payments to independent contractors, recipients of. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web file form 592 to report withholding on domestic nonresident individuals. Web resident and nonresident withholding statement. Web 2021 592 pte instructions. • april 18, 2023 june 15, 2023 september 15, 2023 january 16, 2024. Partnership or limited liability company (llc) california source. Ad signnow.com has been visited by 100k+ users in the past month • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. For more information, go to. Web resident and nonresident withholding statement. Generally a taxpayer receives this. D x fein d ca corp no. Generally a taxpayer receives this. For more information, go to. • april 18, 2023 june 15, 2023 september 15, 2023 january 16, 2024. Partnership or limited liability company (llc) california source. Part ii type of income. We will update this page with a new version of the form for 2024 as soon as it is made available. • april 18, 2023 june 15, 2023 september 15, 2023 january 16, 2024. Partnership or limited liability company (llc) california source. Web this form is for income earned in tax year 2022, with tax. Web forms and publications search | california franchise tax board. Web resident and nonresident withholding statement. From the input return tab, go to state and local ⮕ part. Business name ssn or itin fein ca corp no. Business name ssn or itin fein ca corp no. Ad signnow.com has been visited by 100k+ users in the past month • april 18, 2023 june 15, 2023 september 15, 2023 january 16, 2024. From the input return tab, go to state and local ⮕ part. Web resident and nonresident withholding statement. Business name ssn or itin fein ca corp no. For more information, go to. Generally a taxpayer receives this. Business name ssn or itin fein ca corp no. This form can be provided to the payee electronically. Web resident and nonresident withholding statement 2022 form 592 resident and nonresident withholding statement resident and nonresident withholding statement taxable. • april 18, 2023 june 15, 2023 september 15, 2023 january 16, 2024. Web forms and publications search | california franchise tax board. 2019 resident and nonresident withholding tax statement. Web resident and nonresident withholding statement. This form can be provided to the payee electronically. 1065 california (ca) california partners are taxed based on the amount of the cash and property distributions. D x fein d ca corp no. Web 2022 ca form 592, resident and nonresident withholding statement. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web resident and nonresident withholding statement 2022 form. D x fein d ca corp no. Items of income that are subject to withholding are payments to independent contractors, recipients of. From the input return tab, go to state and local ⮕ part. Return to forms and publications. Partnership or limited liability company (llc) california source. This form can be provided to the payee electronically. Web 2022 ca form 592, resident and nonresident withholding statement. Business name ssn or itin fein ca corp no. Items of income that are subject to withholding are payments to independent contractors, recipients of. • april 18, 2023 june 15, 2023 september 15, 2023 january 16, 2024. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web file form 592 to report withholding on domestic nonresident individuals. With their state tax return. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. We will update this page with a new version of the form for 2024 as soon as it is made available. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. D x fein d ca corp no. 2019 resident and nonresident withholding tax statement. Partnership or limited liability company (llc) california source. From the input return tab, go to state and local ⮕ part. Ad signnow.com has been visited by 100k+ users in the past month Return to forms and publications. 1065 california (ca) california partners are taxed based on the amount of the cash and property distributions. Web 2021 592 pte instructions. Part ii type of income.Fillable California Form 592A Payment Voucher For Foreign Partner Or

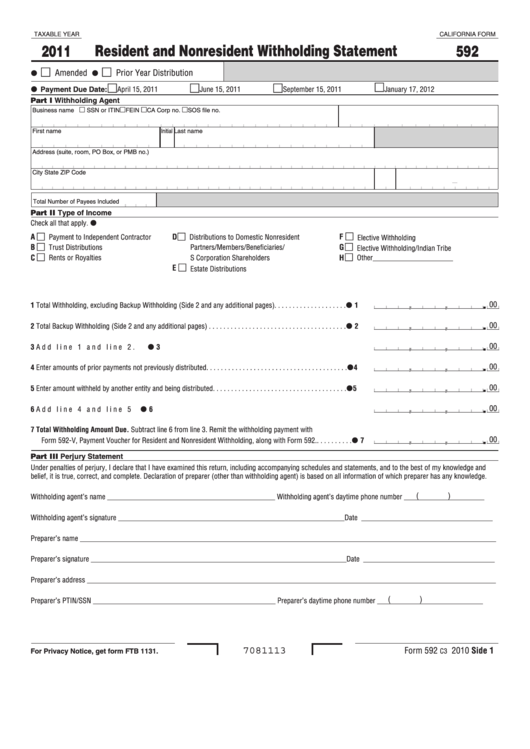

Fillable California 592 Form Resident And Nonresident Withholding

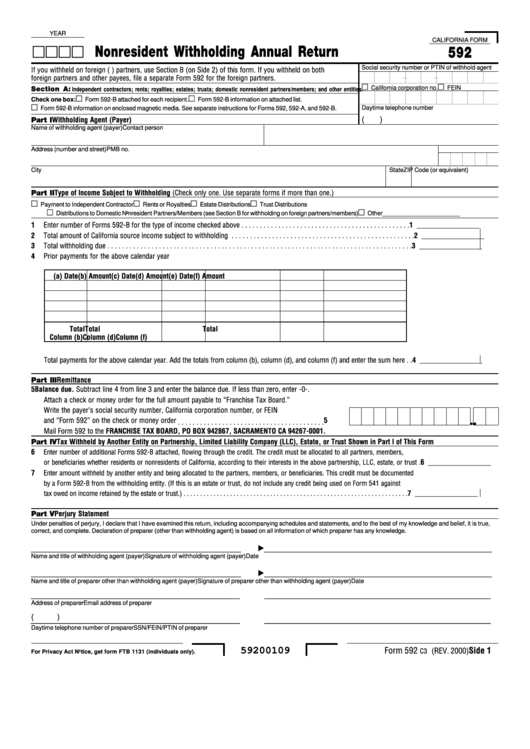

California Form 592 Nonresident Withholding Annual Return printable

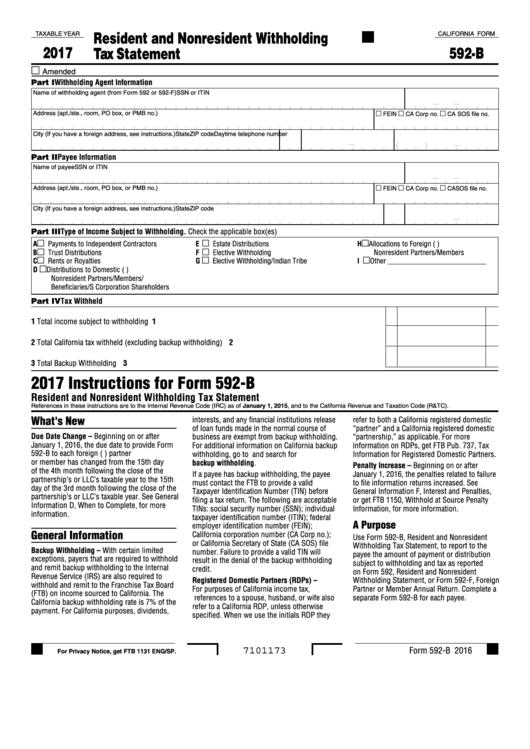

Fillable California Form 592B Resident And Nonresident Withholding

California Form 592 B ≡ Fill Out Printable PDF Forms Online

California Form 592 Draft Resident And Nonresident Withholding

592 B Fill Out and Sign Printable PDF Template signNow

Form 592B Nonresident Withholding Tax Statement 2001 printable pdf

2018 Form CA FTB 592B Fill Online, Printable, Fillable, Blank pdfFiller

California Form 592B Draft Resident And Nonresident Withholding Tax

Related Post: