California Estimated Tax Payments Form

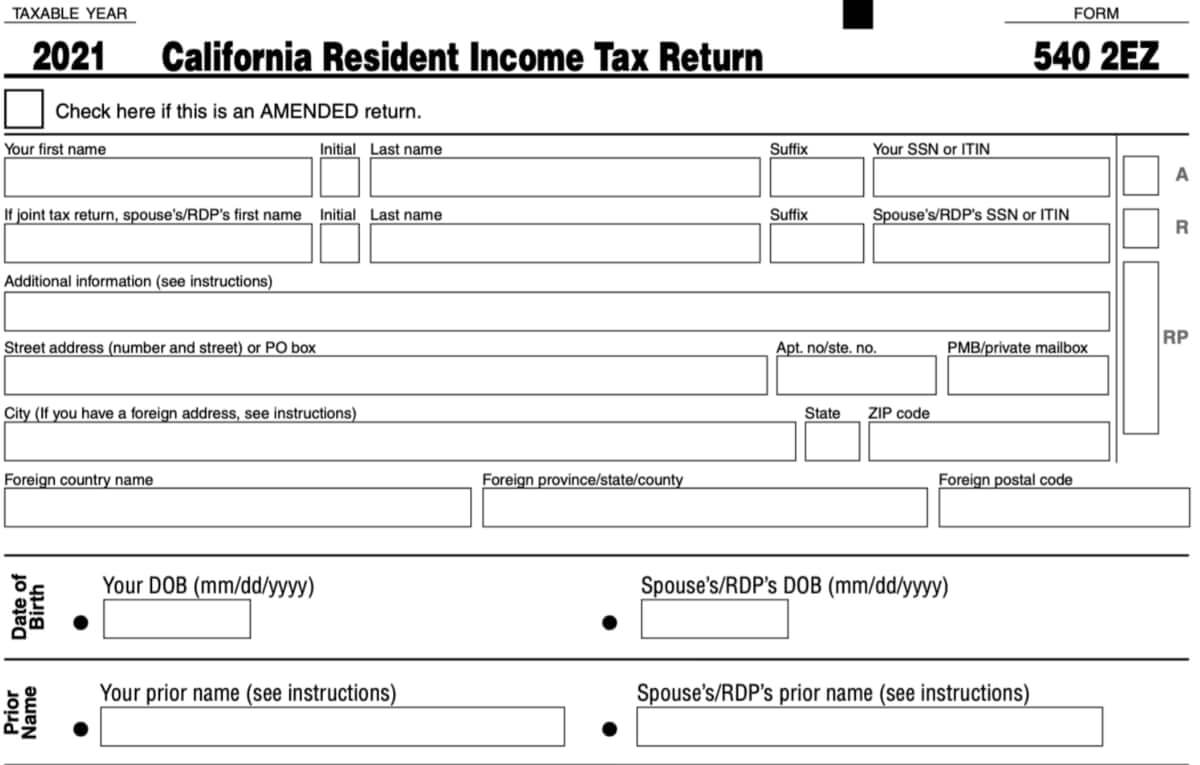

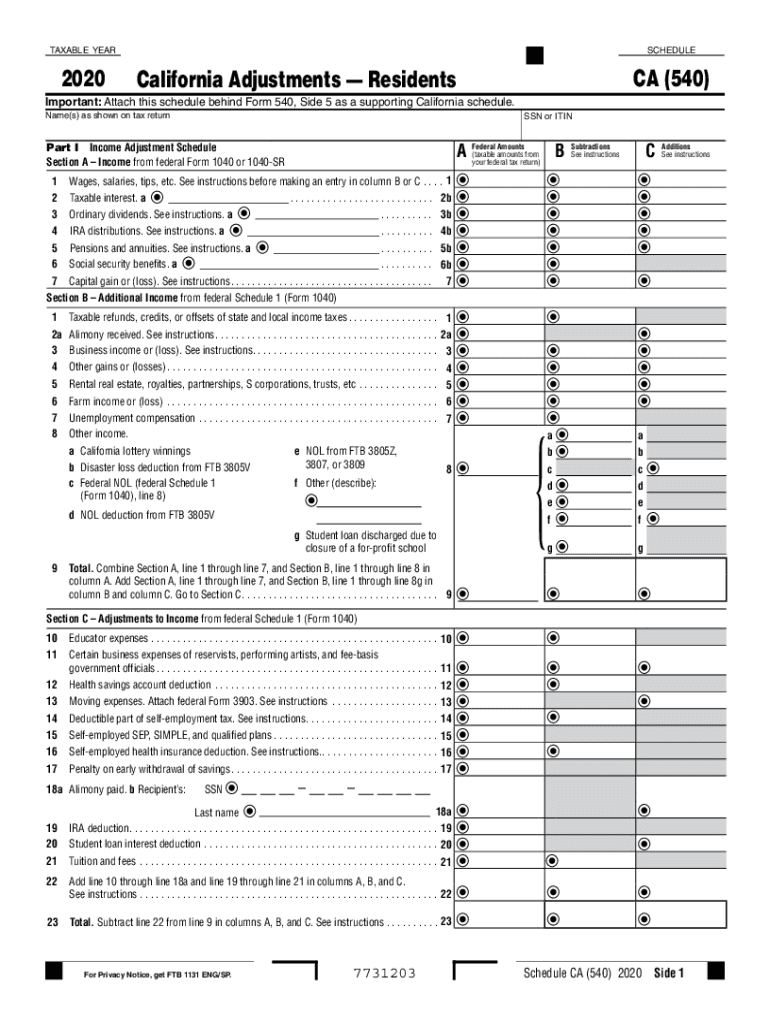

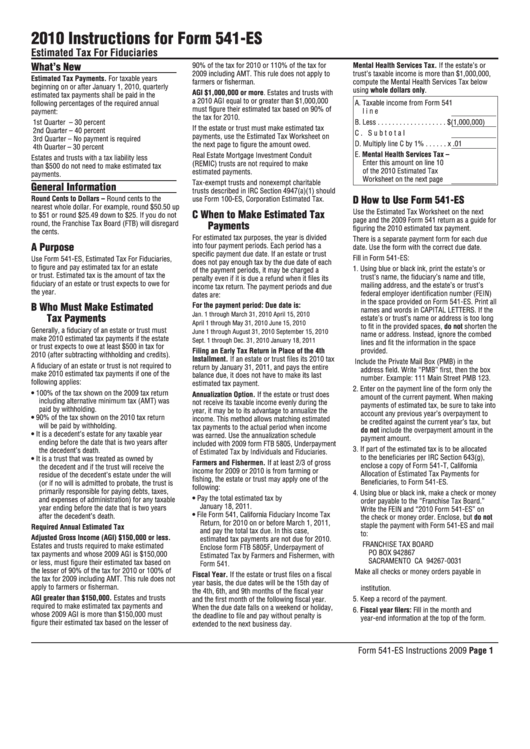

California Estimated Tax Payments Form - Most individuals and businesses in california will now have. Web the irs said monday that californians in 55 of the state's 58 counties would not have to pay their 2022 taxes or 2023 estimated taxes until nov. This is how much you will have. Web generally, you must make estimated tax payments if you expect to owe at least $500 ($250 if married/rdp filing separately) in tax for 2020 (after subtracting withholding and. Fiscal year filers, enter year ending month: Select this quarterly payment type when you do not have tax withheld or not enough tax withheld from wages or income as you earn it (form 540. Generally, you must make estimated tax payments if in 2022 you expect to owe at least: 30% due (january 1 to march 31): Web estimated tax for individuals. Reduce complexity by outsourcing the preparation and filing of sales tax returns to sovos. Most individuals and businesses in california will now have. Download or email 540 2ez & more fillable forms, register and subscribe now! Web simplified income, payroll, sales and use tax information for you and your business Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. Web individuals who are. Web 2022 fourth quarter estimated tax payments due for individuals. 90% of the current year’s tax 2. Web the irs said monday that californians in 55 of the state's 58 counties would not have to pay their 2022 taxes or 2023 estimated taxes until nov. Fiscal year filers, enter year ending month: Web the dates for california are the same. So, for example, if you had an estimated. Web individuals who are required to make estimated tax payments, and whose 2022 california adjusted gross income is more than $150,000 (or $75,000 if married/rdp filing. Most individuals and businesses in california will now have. $250 if married/rdp filing separately and, you expect your withholding and credits to be less than the. Web simplified income, payroll, sales and use tax information for you and your business Web generally, you must make estimated tax payments if you expect to owe at least $500 ($250 if married/rdp filing separately) in tax for 2020 (after subtracting withholding and. Web estimated tax for individuals. Web individuals who are required to make estimated tax payments, and whose. Most individuals and businesses in california will now have. This is how much you will have. Web the following four due dates are imperative to note as a california resident that is required to pay estimated taxes: Web individuals who are required to make estimated tax payments, and whose 2020 california adjusted gross income is more than $150,000 (or $75,000. Web individuals who are required to make estimated tax payments, and whose 2022 california adjusted gross income is more than $150,000 (or $75,000 if married/rdp filing. 100% of the prior year’s tax (including. Individual tax return form 1040 instructions; Web estimated tax payments are due by the 15th day of the 4th, 6th, 9th and 12th months of the corporation's. Web the following four due dates are imperative to note as a california resident that is required to pay estimated taxes: Web b who must make estimated tax payments generally, you must make estimated tax payments if you expect to owe at least $500 ($250 if married/ rdp filing separately) in. 100% of the prior year’s tax (including. Web form. Web estimated tax for individuals. 16, 2023, to file and pay their 2022 state taxes to avoid penalties. Web 2022 fourth quarter estimated tax payments due for individuals. Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. Web sign in to make a tax deposit payment or schedule estimated. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web quarterly estimated tax payments (initially due on april 18, june 15 and sept. Web estimated tax for individuals. Fiscal year filers, enter year ending month: Individual tax return form 1040 instructions; If you are self employed or do not have. Web the irs tax deadline extension for people in california also applies to 2022 estimated payments of federal income tax. Web per the irs, most individuals and businesses in california have until nov. Most individuals and businesses in california will now have. Estimate your tax forgiveness today! Web sign in to make a tax deposit payment or schedule estimated payments with the electronic federal tax payment system (eftps) enrollment required to use. 100% of the prior year’s tax (including. $250 if married/rdp filing separately and, you expect your withholding and credits to be less than the smallerof one of the following: Web the california franchise tax board confirmed that most californians have until nov. Ad our tax preparers will ensure that your tax returns are complete, accurate and on time. Web per the irs, most individuals and businesses in california have until nov. Web quarterly estimated tax payments (initially due on april 18, june 15 and sept. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from. Web individuals who are required to make estimated tax payments, and whose 2020 california adjusted gross income is more than $150,000 (or $75,000 if married/rdp filing. Select this quarterly payment type when you do not have tax withheld or not enough tax withheld from wages or income as you earn it (form 540. Web generally, you must make estimated tax payments if you expect to owe at least $500 ($250 if married/rdp filing separately) in tax for 2020 (after subtracting withholding and. Web individuals who are required to make estimated tax payments, and whose 2022 california adjusted gross income is more than $150,000 (or $75,000 if married/rdp filing. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. 16 to file their 2022 federal returns and pay any tax due. Fiscal year filers, enter year ending month: Web b who must make estimated tax payments generally, you must make estimated tax payments if you expect to owe at least $500 ($250 if married/ rdp filing separately) in. 16, 2023, to file and pay their 2022 state taxes to avoid penalties. If the due date falls on a weekend or a legal holiday, the. If you are self employed or do not have. Web for tax years 2017 and earlier, a separate transmission must be made for each quarterly payment using the estimated payments wizard.Form 5402EZ California 2022 2023 State And Local Taxes Zrivo

Ca tax rate schedule 2017 Fill out & sign online DocHub

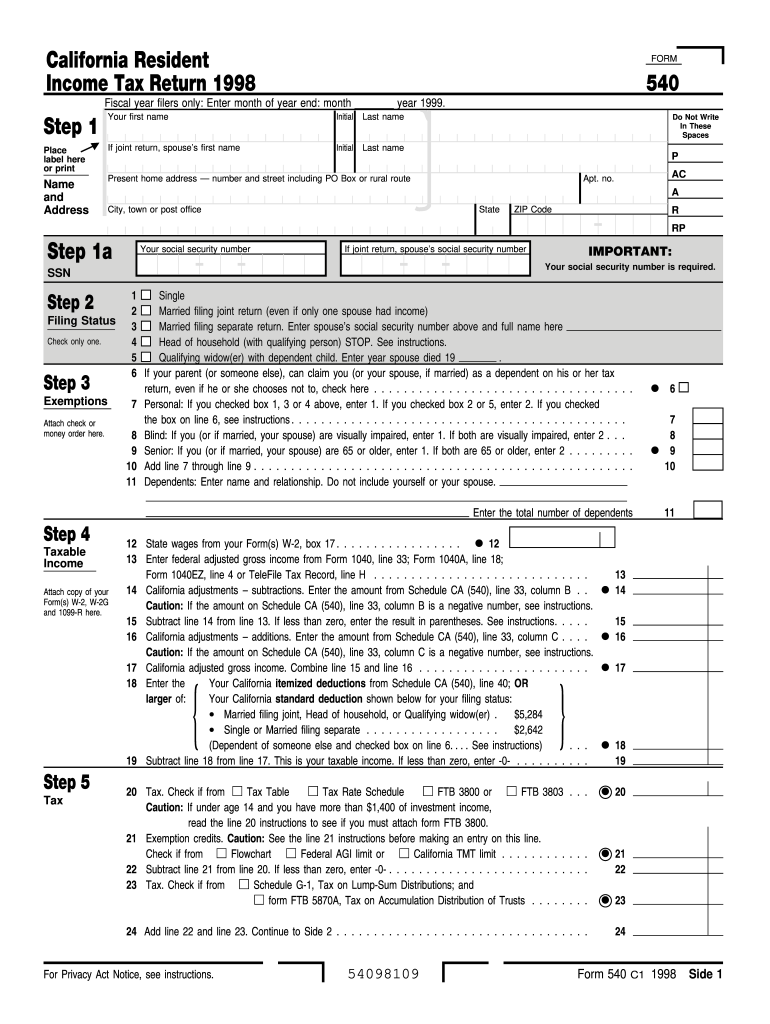

1998 Form 540 California Resident Tax Return Fill out & sign

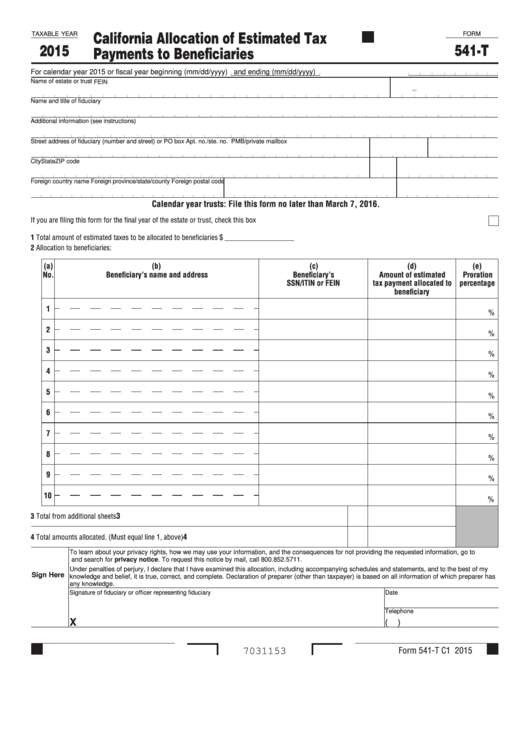

Fillable Form 541T California Allocation Of Estimated Tax Payments

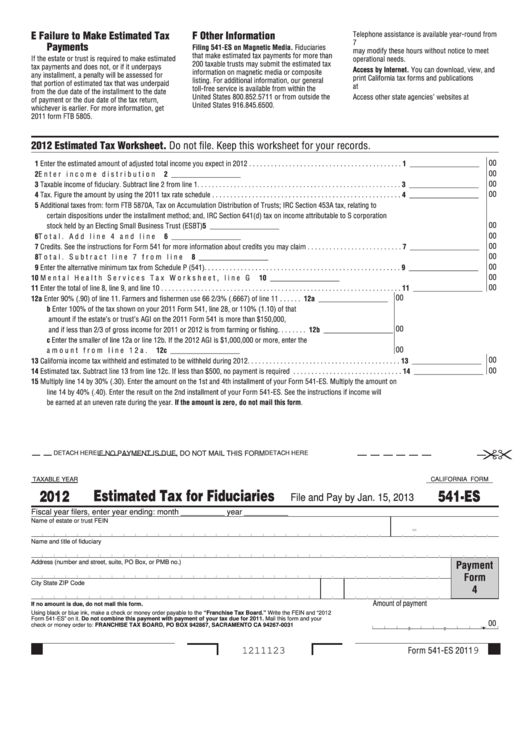

California Form 541Es Estimated Tax For Fiduciaries 2012 printable

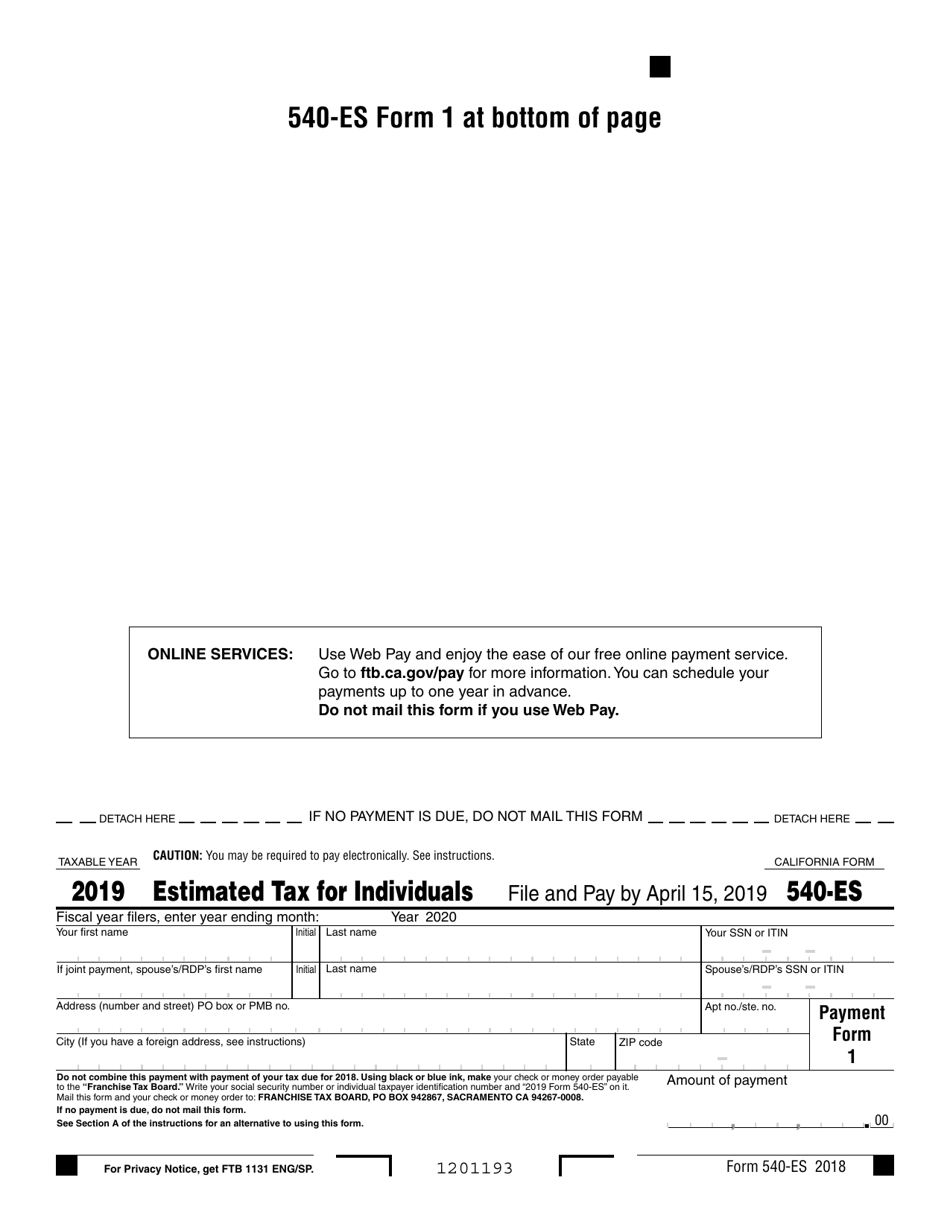

Form 540ES Download Fillable PDF or Fill Online Estimated Tax for

Federal Benefits Payment California Estimated Tax Payments

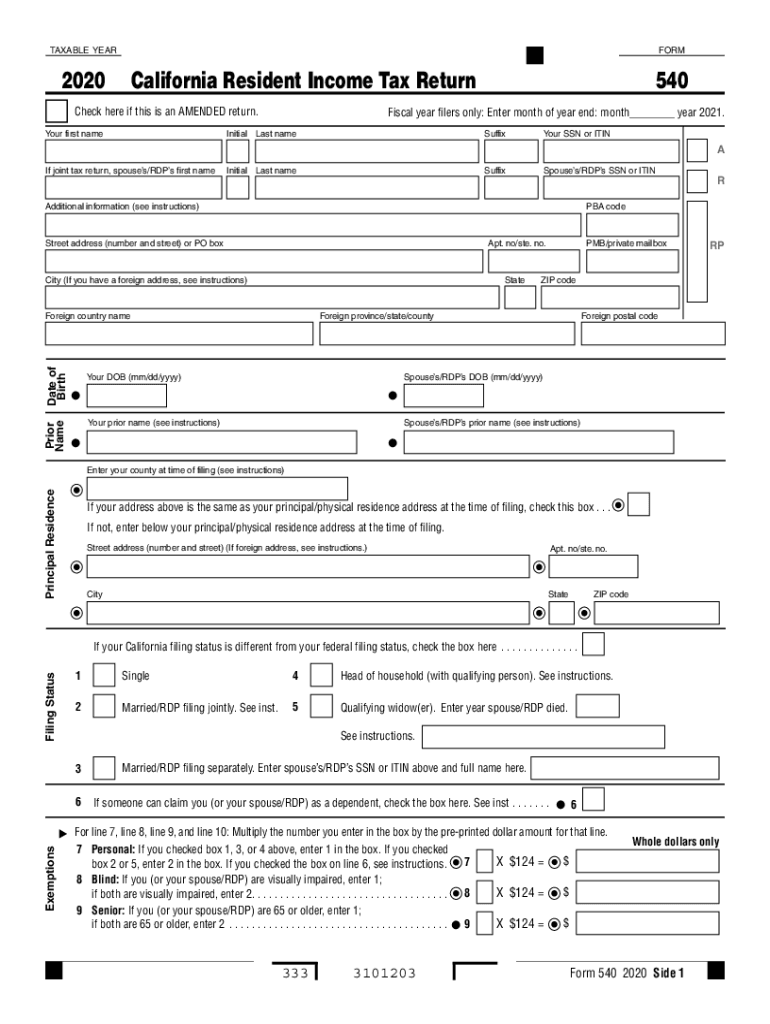

2020 Form CA FTB 540Fill Online, Printable, Fillable, Blank pdfFiller

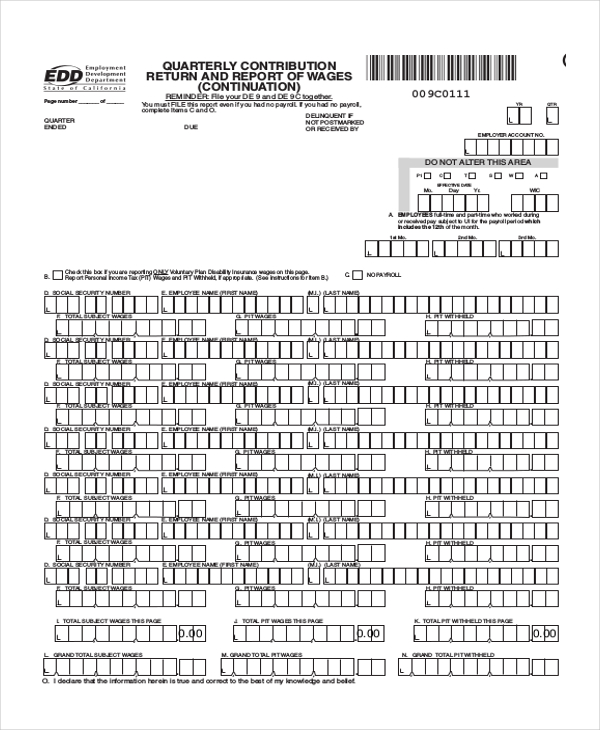

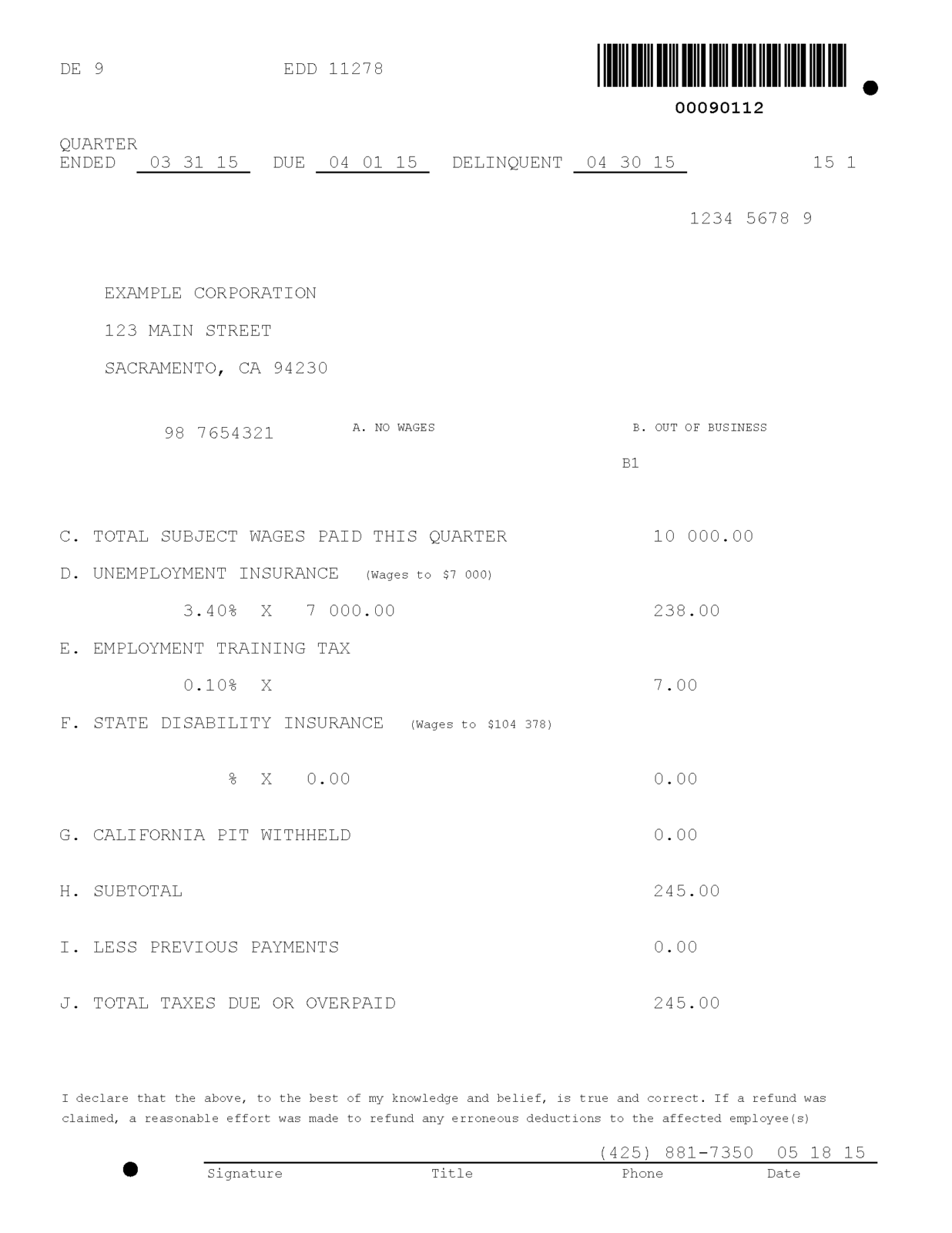

FREE 8+ Sample Payroll Tax Forms in PDF Excel MS Word

California Payroll Tax Forms in Five Minutes

Related Post: