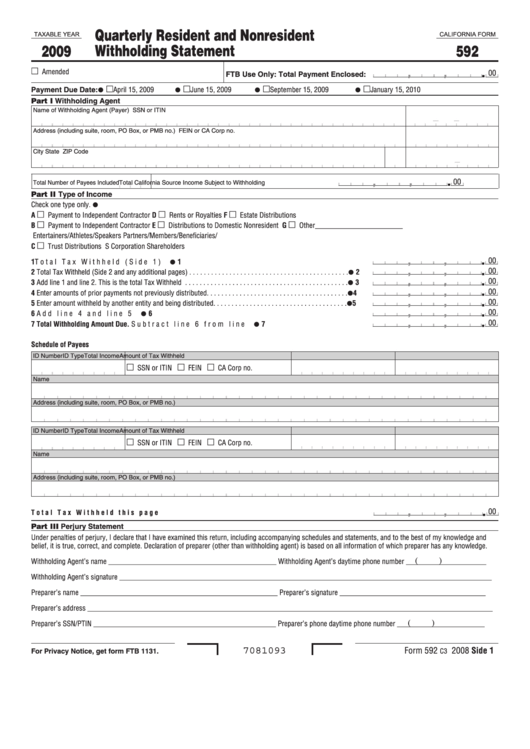

Ca Withholding Tax Form

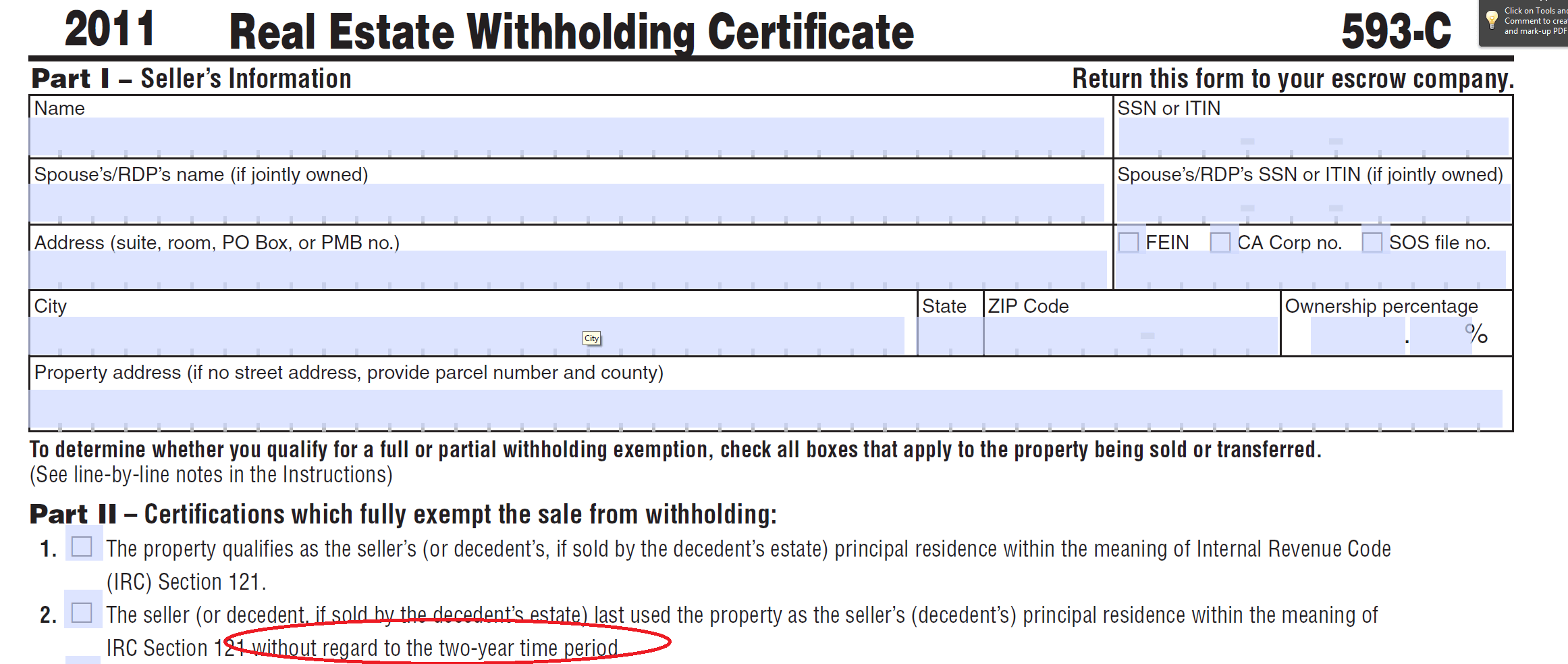

Ca Withholding Tax Form - Web simplified income, payroll, sales and use tax information for you and your business Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Pay your team and access hr and benefits with the #1 online payroll provider. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Ad free avalara tools include monthly rate table downloads and a sales tax rate calculator. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. Complete, edit or print tax forms instantly. Web adjust your wage withholding. You want to make sure you have the right amount of income tax withheld from your pay. Ad approve payroll when you're ready, access employee services & manage it all in one place. Ad approve payroll when you're ready, access employee services & manage it all in one place. If there is ca withholding reported on the. Complete, edit or print tax forms instantly. Form 592 includes a schedule of payees section, on side 2, that. Web welcome to the california tax service center, sponsored by the california fed state partnership. If there is ca withholding reported on the. Upload, modify or create forms. Web franchise tax board (ftb) (ftb.ca.gov). Identify the tax rate applicable to the income range and apply this rate to determine the amount of tax to be withheld for the year. Web adjust your wage withholding. Pay your team and access hr and benefits with the #1 online payroll provider. Web adjust your wage withholding. Web effective january 1, 2020, the following real estate withholding forms and instructions have been consolidated into one new form 593, real estate withholding statement:. Choose avalara sales tax rate tables by state or look up individual rates by address. Web. Need to withhold more money from your paycheck for taxes,. Web franchise tax board (ftb) (ftb.ca.gov). Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s. Web this article will assist you with entering the california real estate withholding reported on form. The form helps your employer. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Web california extends due date for california state tax returns. Our partnership of tax agencies includes board of equalization, california. Pay your team and access hr and benefits with the #1 online payroll provider. Web adjust your wage withholding. If there is ca withholding reported on the. Web your california personal income tax may be underwithheld if you do not file this de 4 form. Purposes if you wish to claim the same marital status, number of regular allowances, and/or the same additional. Web sellers of california real estate use form 593, real estate. You want to make sure you have the right amount of income tax withheld from your pay. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Employee's withholding certificate form 941; Complete, edit or print tax forms instantly. Pay your team and access hr. If you need information on your last california resident income tax return (ftb form 540), visit the franchise t ax board (ftb). Web your california personal income tax may be underwithheld if you do not file this de 4 form. Pay your team and access hr and benefits with the #1 online payroll provider. Upload, modify or create forms. Web. Choose avalara sales tax rate tables by state or look up individual rates by address. Unless you elect otherwise, state law requires that california personal income tax (pit) be withheld from payments of pensions and annuities. Employee's withholding certificate form 941; Pay your team and access hr and benefits with the #1 online payroll provider. You must file a de. Pay your team and access hr and benefits with the #1 online payroll provider. Need to withhold more money from your paycheck for taxes,. Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s. Web of california withholding allowances used in 2020. Complete, edit or print tax forms instantly. Ad approve payroll when you're ready, access employee services & manage it all in one place. Upload, modify or create forms. Web employers are required to withhold mandatory employee payroll deductions to pay into state payroll taxes for state disability insurance (sdi) and personal income tax (pit). Pay your team and access hr and benefits with the #1 online payroll provider. If there is ca withholding reported on the. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. We consistently offer best in class solutions to you & your client's tax problems. Purposes if you wish to claim the same marital status, number of regular allowances, and/or the same additional. Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. If you need information on your last california resident income tax return (ftb form 540), visit the franchise t ax board (ftb). Web adjust your wage withholding. Web your california personal income tax may be underwithheld if you do not file this de 4 form. Web your california personal income tax may be underwithheld if you do not file this de 4 form. Web california extends due date for california state tax returns. Ad free avalara tools include monthly rate table downloads and a sales tax rate calculator. Employee's withholding certificate form 941; Try it for free now! Choose avalara sales tax rate tables by state or look up individual rates by address. Form 592 includes a schedule of payees section, on side 2, that.1+ California State Tax Withholding Forms Free Download

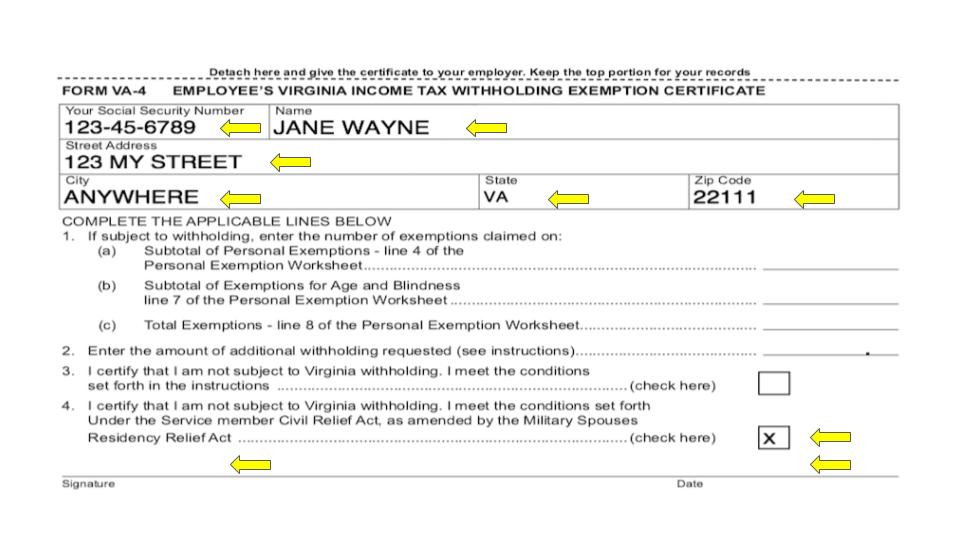

De4 California Tax Withholding Form

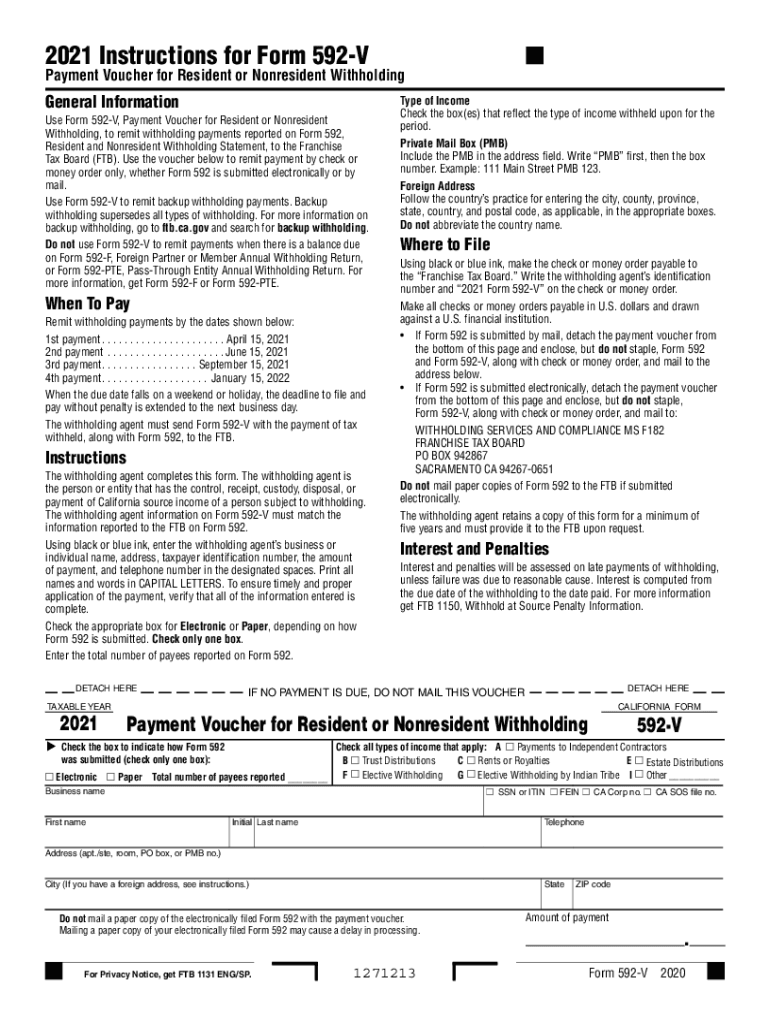

CA FTB 592F 2021 Fill out Tax Template Online US Legal Forms

California State Withholding Allowances Form

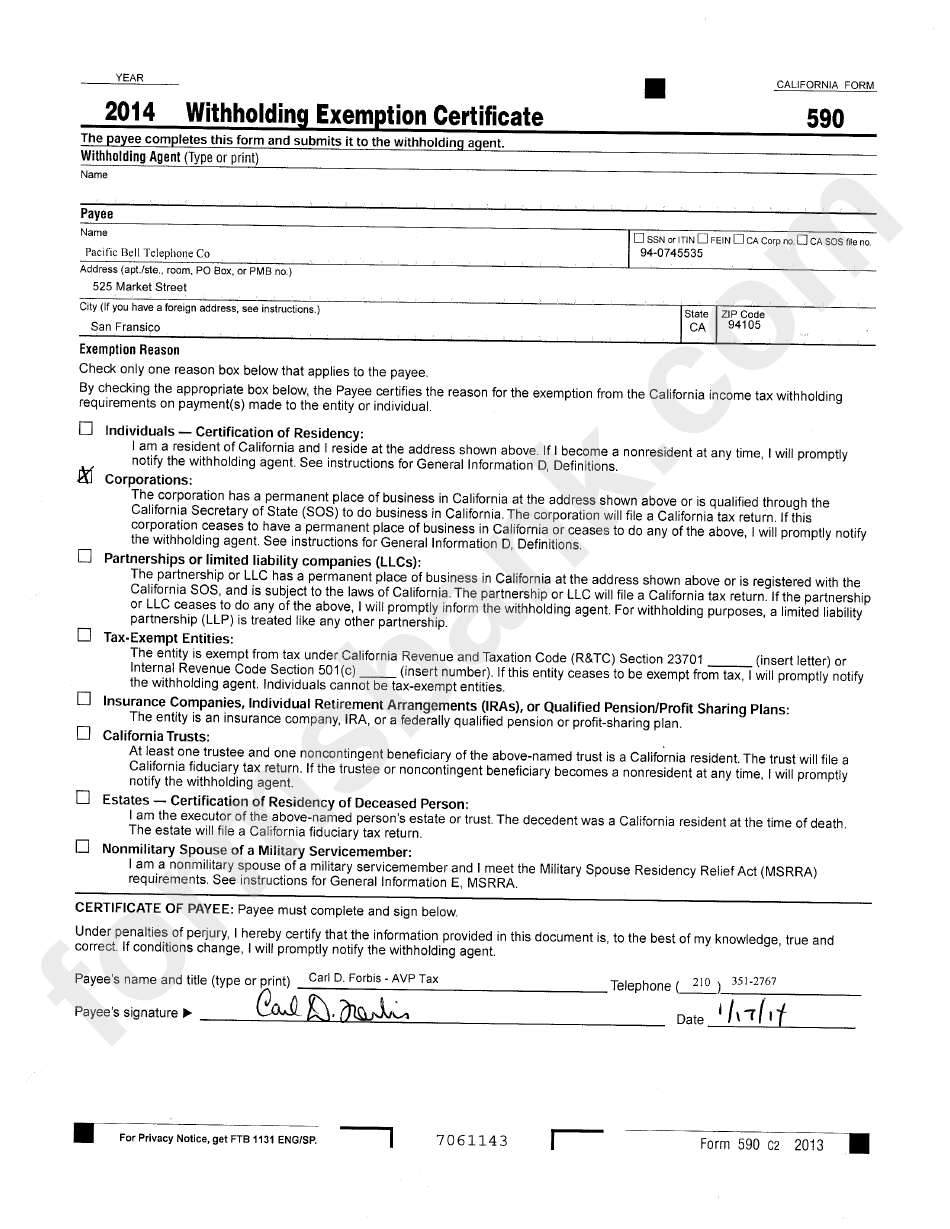

California Form 590 Withholding Exemption Certificate 2014

CA CalPERS Tax Withholding Election 2018 Fill and Sign Printable

California Withholding Tax

CA FTB 589 2019 Fill out Tax Template Online US Legal Forms

Withholding Form For Employee 2023

California State Withholding Fillable Form

Related Post: