Ca Form Ftb 3522

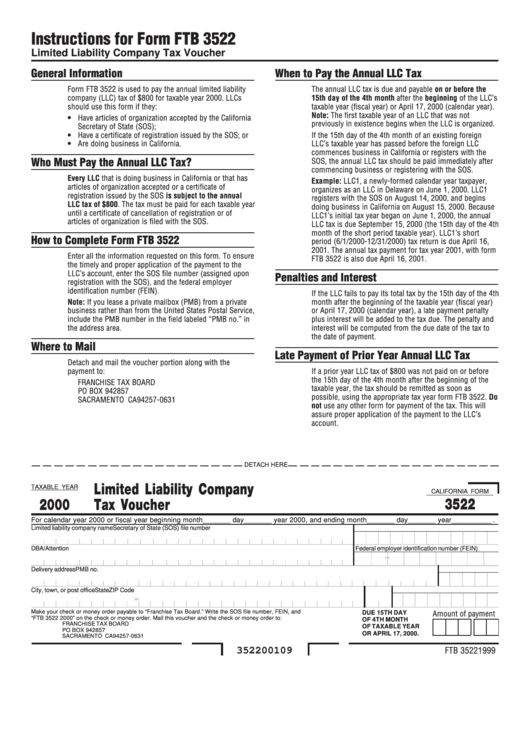

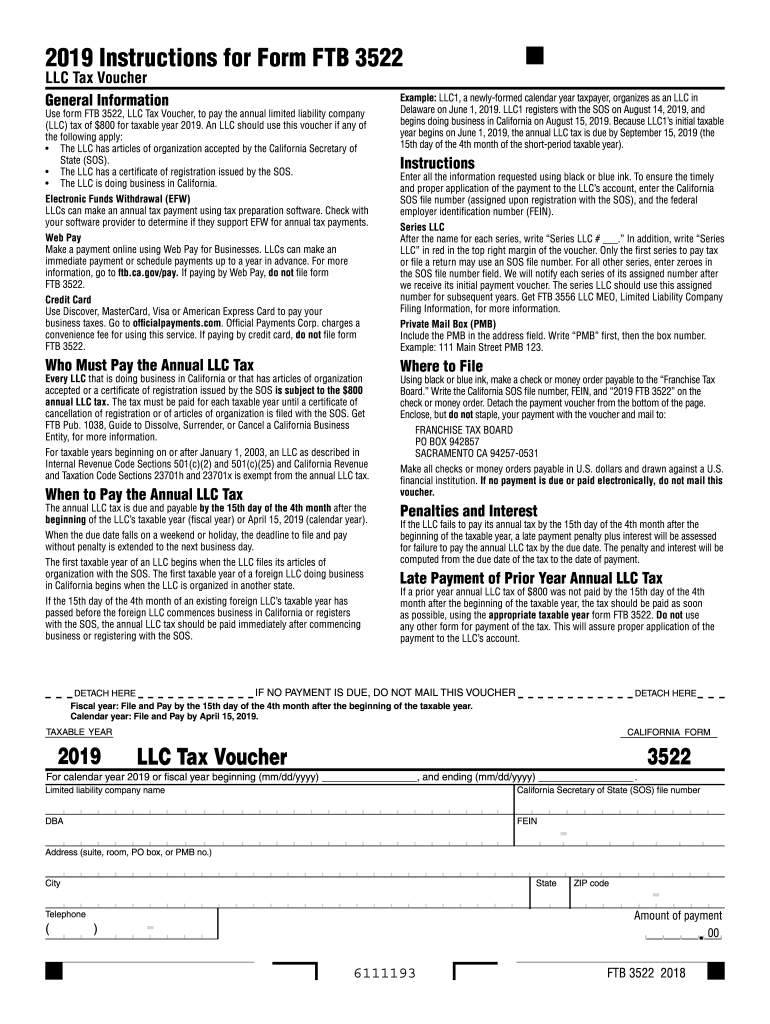

Ca Form Ftb 3522 - Does my california llc need to file form 3536. Web california llcs must file form ftb 3537 to request an extension for filing their tax returns. Visit the california franchise tax board website or search california form. Web ca ftb 3522 2022. Web california has a confusing number of llc payment vouchers… here is a quick guide that we’re passing around the office. An llc should use this. Web does my california llc need to file form 3522 (limited liability company tax voucher) in the 1st year? Web once you’ve finished signing your instructions for form ft 3522 california franchise tax board, choose what you wish to do after that — save it or share the file with other. It appears you don't have a pdf plugin for this browser. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2021. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web form ftb 3522. Web once you’ve finished signing your instructions for form ft 3522 california franchise tax. Web once you’ve finished signing your instructions for form ft 3522 california franchise tax board, choose what you wish to do after that — save it or share the file with other. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. All llcs in the state are. An llc should use this. Web form ftb 3522. Web california llcs must file form ftb 3537 to request an extension for filing their tax returns. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. An llc should use this voucher if any of the following. Web california — limited liability company tax voucher. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2023. All llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity. Understand what conditions prompt form 3522 to prepare. An llc should use this. Web 1 best answer. Please use the link below. Taxpayers may complete form ftb 3516 and write the name of the disaster. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2019. An llc should use this voucher if any of the following apply: Web ca ftb 3522 2022. Send filled & signed form or save. Web california — limited liability company tax voucher. Web form ftb 3522. Web california llcs must file form ftb 3537 to request an extension for filing their tax returns. Send filled & signed form or save. Web look for form 3522 and click the download link. Does my california llc need to file form 3536. All llcs in the state are required to pay this annual tax to stay compliant. The 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. California llcs must file form 3522 (llc tax voucher) to pay the. 540 2ez california resident. Open form follow the instructions. Send filled & signed form or save. 540 es estimated tax for. Please use the link below. Does my california llc need to file form 3536. 540 es estimated tax for. Web form ftb 3522. Web california has a confusing number of llc payment vouchers… here is a quick guide that we’re passing around the office. An llc should use this voucher if any of the following. All llcs in the state are required to pay this annual tax to stay compliant. Web once you’ve finished signing your instructions for form ft 3522 california franchise tax board, choose what you wish to do after that — save it or share the file with other. Web disaster victims also may receive free copies of their state returns to replace those lost or damaged. Taxpayers may complete form ftb 3516 and write the name of the disaster. Does my california llc need to file form 3536. It appears you don't have a pdf plugin for this browser. Web look for form 3522 and click the download link. California llcs must file form 3522 (llc tax voucher) to pay the. 540 2ez california resident income tax return. All llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity. Web does my california llc need to file form 3522 (limited liability company tax voucher) in the 1st year? All llcs in the state are required to pay this annual tax to stay compliant. Open form follow the instructions. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Web california has a confusing number of llc payment vouchers… here is a quick guide that we’re passing around the office. Web 1 best answer. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. Send filled & signed form or save. Visit the california franchise tax board website or search california form. The 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. An llc should use this voucher if any of the following.Form Ftb 3522 Fill Online, Printable, Fillable, Blank pdfFiller

Blank Form Ftb 3522 Fill Out and Print PDFs

Form Ftb 3522 Limited Liability Company Tax Voucher 2000 printable

California Form 3522 ≡ Fill Out Printable PDF Forms Online

2019 Form CA FTB 3522 Fill Online, Printable, Fillable, Blank pdfFiller

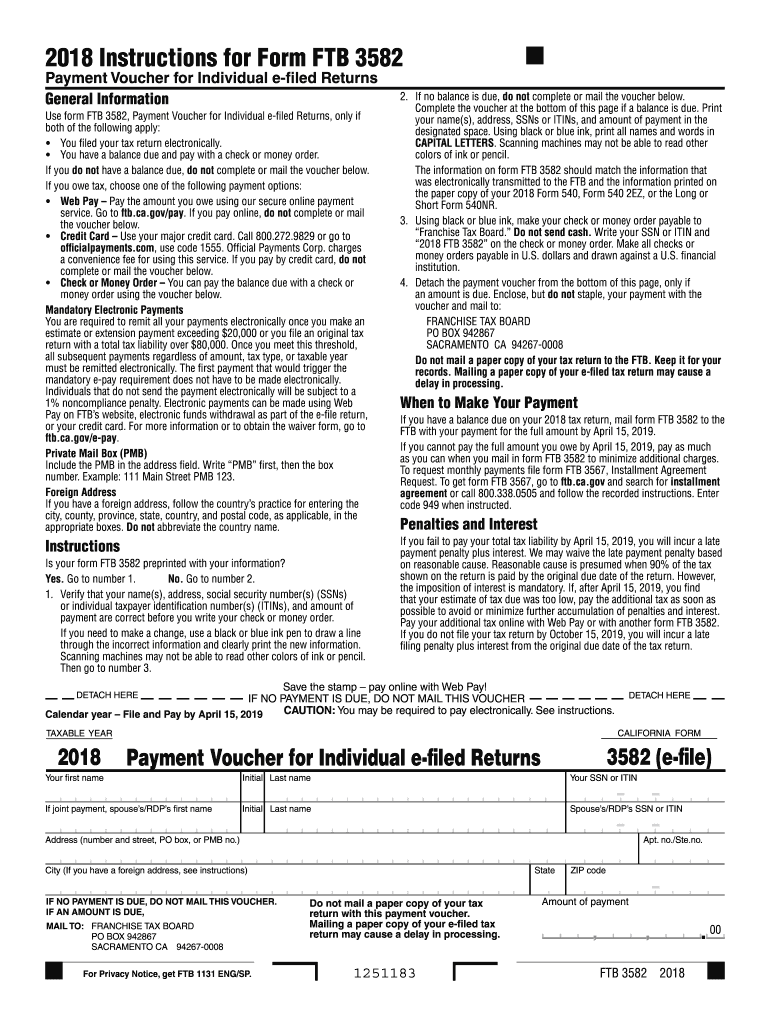

Ftb 3582 Fill Out and Sign Printable PDF Template signNow

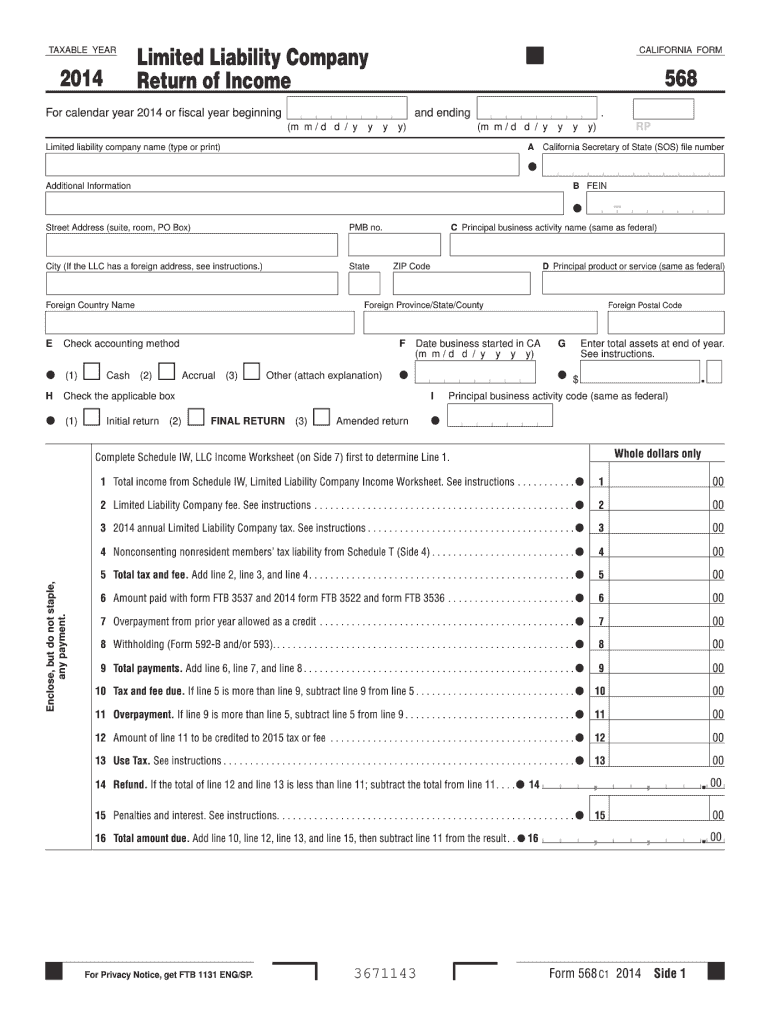

2014 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

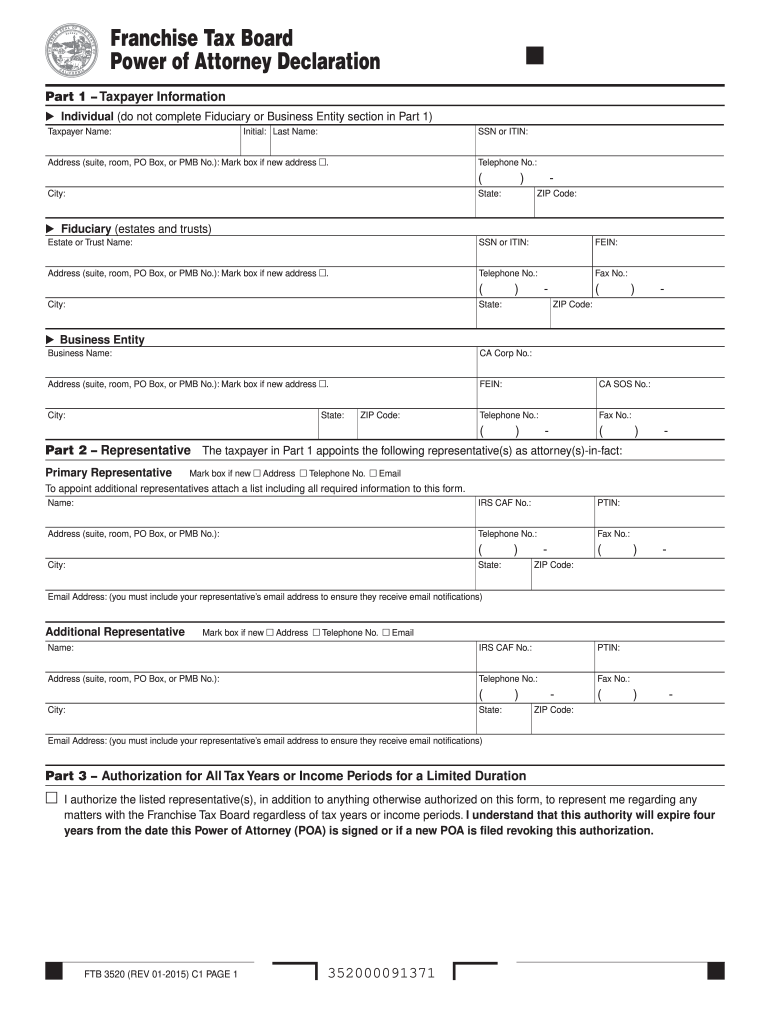

2015 Form CA FTB 3520Fill Online, Printable, Fillable, Blank pdfFiller

Form 3522 California ≡ Fill Out Printable PDF Forms Online

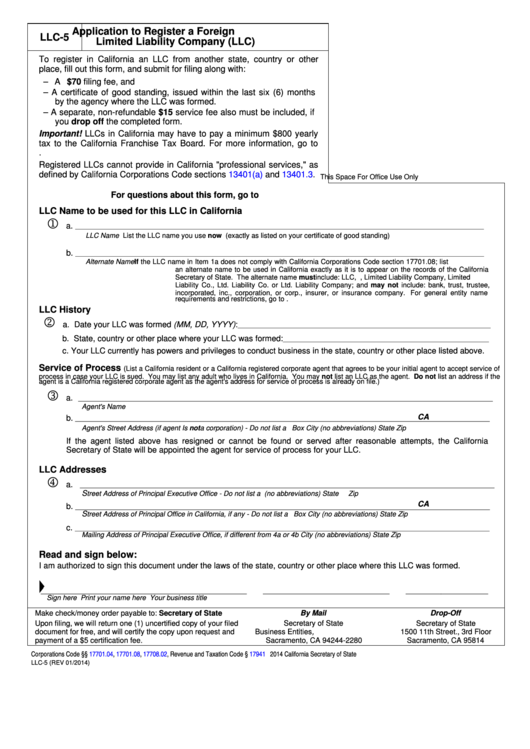

Top 15 California Llc Forms And Templates free to download in PDF format

Related Post: