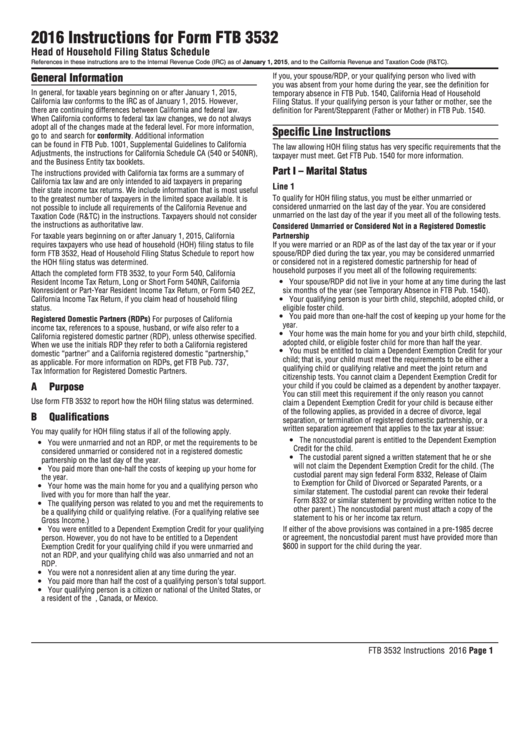

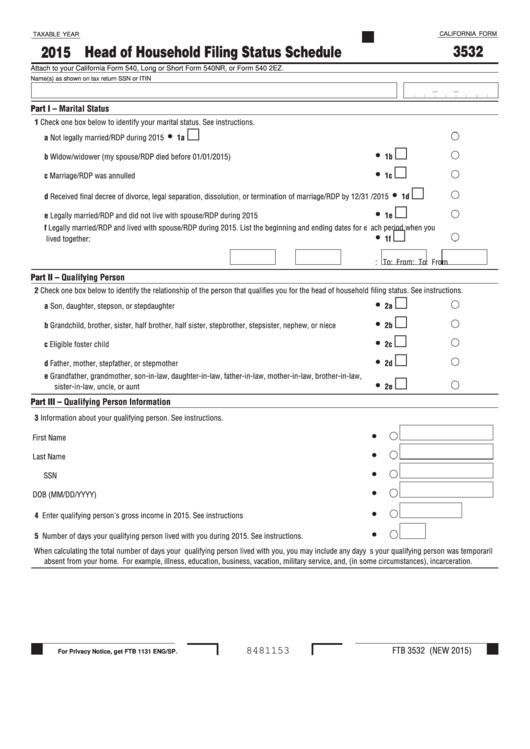

Ca Form 3532

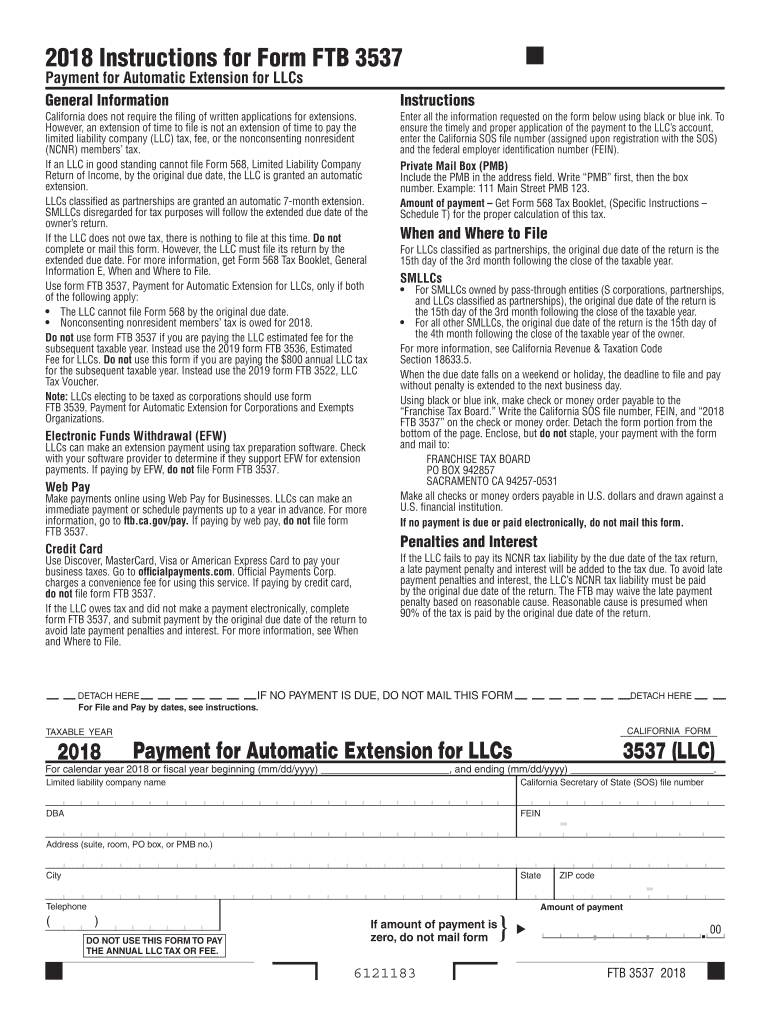

Ca Form 3532 - California requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status. Web simplified income, payroll, sales and use tax information for you and your business Web complete and include the head of household filing status schedule (ftb 3532) with your tax return. For the federal allowable exemption. Web 3532 attach to your california form 540, long or short form 540nr, or form 540 2ez. Web in order to attach form 3532 (head of household) to your california return, you will have to select filing status 4, head of household, in the basic information section of the. Attach to your california form 540, form 540nr, or form 540 2ez. Web ca form 3532 requires gross income of qualifying person. Web attach the completed form ftb 3532, to your form 540, california resident income tax return, long or short form 540nr, california. Name(s) as shown on tax return. Web what is california form ftb 3532? Web form 3532, head of household filing status schedule. Web if in your personal info or my info you entered that you were a resident of california and that your filing status is head of household, then form ca 3532 will be. Web is the ca form 3532 head of household schedule required. Web what is california form ftb 3532? California requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status. Lacerte does not carry info. Days and more than half a leap year is 184 days. Web the california franchise tax board (ftb) requires taxpayers filing as head of household to attach. Web intuit accountants community. Web ca form 3532 requires gross income of qualifying person. This form is for income earned in tax year 2022, with tax returns due in april. Send filled & signed form or save. Attach to your california form 540, form 540nr, or form 540 2ez. Name(s) as shown on tax return. California requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status. Lacerte does not carry info. Web we last updated california form 3532 in january 2023 from the california franchise tax board. Web in order to attach form 3532 (head of household) to your. Name(s) as shown on tax return. Web simplified income, payroll, sales and use tax information for you and your business Web intuit accountants community. For the federal allowable exemption. Web ca form 3532 requires gross income of qualifying person. Web in order to attach form 3532 (head of household) to your california return, you will have to select filing status 4, head of household, in the basic information section of the. California requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status. Web is the ca form 3532 head. Name(s) as shown on tax return. Web we last updated the head of household filing status schedule in january 2023, so this is the latest version of form 3532, fully updated for tax year 2022. Easily sign the form with your finger. For the federal allowable exemption. Web complete and include the head of household filing status schedule (ftb 3532). Web intuit accountants community. Attach to your california form 540, form 540nr, or form 540 2ez. Web is the ca form 3532 head of household schedule required for electronic filing? Attach to your california form 540, form 540nr, or form 540 2ez. If you do not attach a completed form ftb 3532 to your tax return, the ftb will deny. This form is for income earned in tax year 2022, with tax returns due in april. California requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status. Attach to your california form 540, form 540nr, or form 540 2ez. Web form 3532, head of household filing status schedule. Ca hoh. Name(s) as shown on tax return ssn or itin. Web use a ftb3532 template to make your document workflow more streamlined. Attach to your california form 540, form 540nr, or form 540 2ez. Web if in your personal info or my info you entered that you were a resident of california and that your filing status is head of household,. Name(s) as shown on tax return. Attach to your california form 540, form 540nr, or form 540 2ez. Web we last updated california form 3532 in january 2023 from the california franchise tax board. Web attach the completed form ftb 3532, to your form 540, california resident income tax return, long or short form 540nr, california. Web in order to attach form 3532 (head of household) to your california return, you will have to select filing status 4, head of household, in the basic information section of the. Web 2020 head of household filing status schedule. Name(s) as shown on tax return ssn or itin. Web intuit accountants community. Web simplified income, payroll, sales and use tax information for you and your business This form is for income earned in tax year 2022, with tax returns due in april. California requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status. Web 2022 head of household filing status schedule. Attach to your california form 540, form 540nr, or form 540 2ez. Web what is california form ftb 3532? Days and more than half a leap year is 184 days. Web is the ca form 3532 head of household schedule required for electronic filing? Web ca form 3532 requires gross income of qualifying person. Web if in your personal info or my info you entered that you were a resident of california and that your filing status is head of household, then form ca 3532 will be. Name(s) as shown on tax return. Web 2019 head of household filing status schedule.Ft 3537 Fill Out and Sign Printable PDF Template signNow

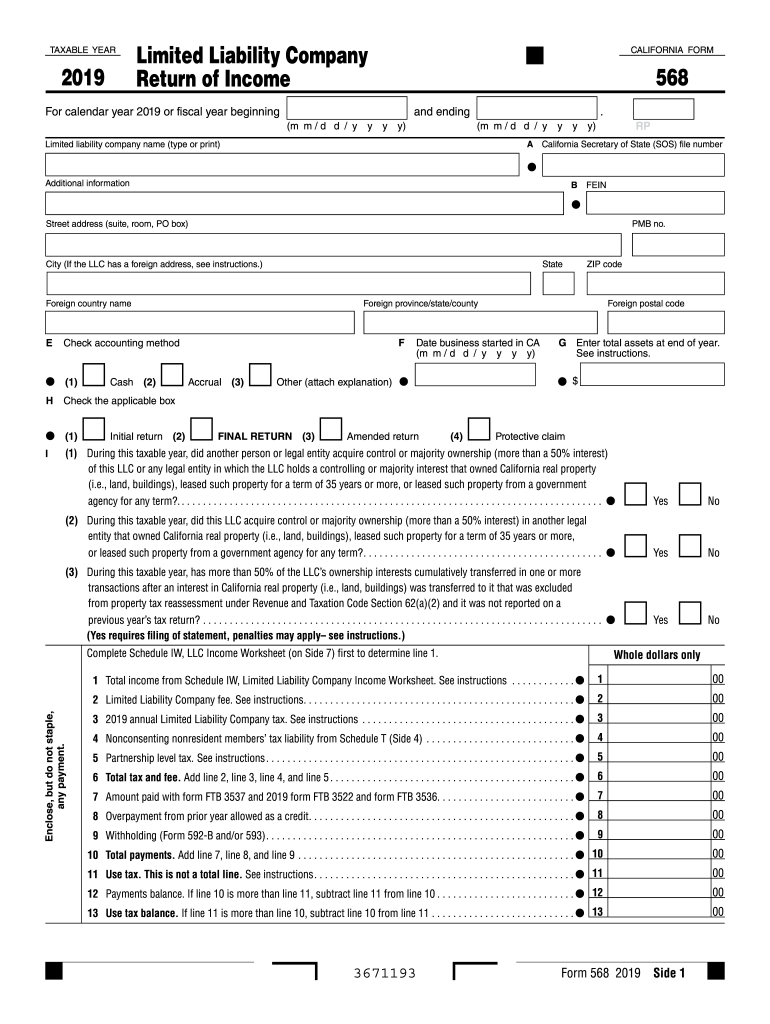

Form 568 Fill out & sign online DocHub

Instructions For Form Ftb 3532 Head Of Household Filing Status

CA CDPH 283 B 2011 Fill and Sign Printable Template Online US Legal

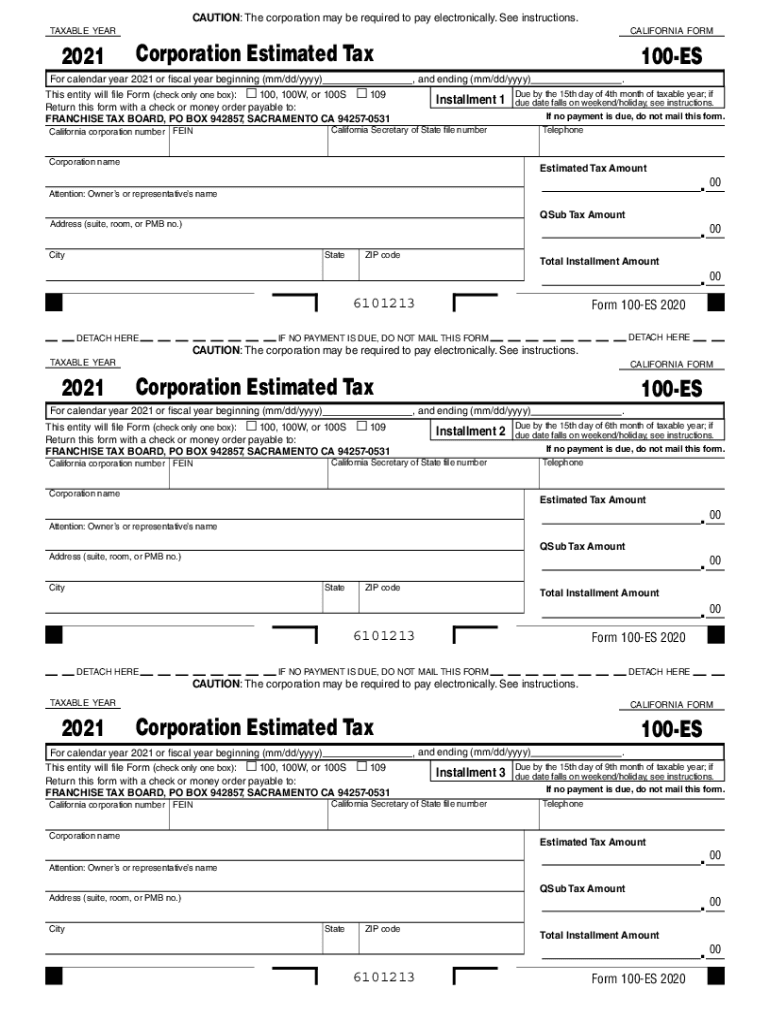

100 ca Fill out & sign online DocHub

CA OL 395 U 20142021 Fill and Sign Printable Template Online US

Form 3532 California Head Of Household Filing Status Schedule 2015

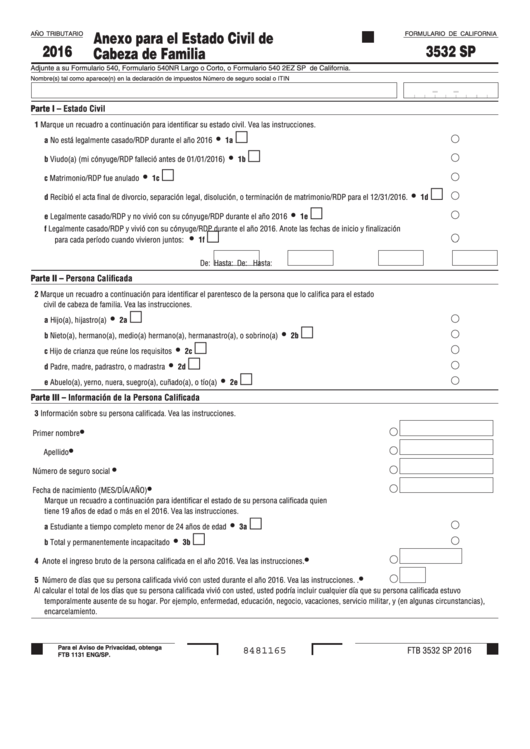

Fillable Form 3532 Anexo Para El Estado Civil De Cabeza De Familia

748 California Franchise Tax Board Forms And Templates free to download

748 California Franchise Tax Board Forms And Templates free to download

Related Post: