Ca Estimated Tax Payment Form

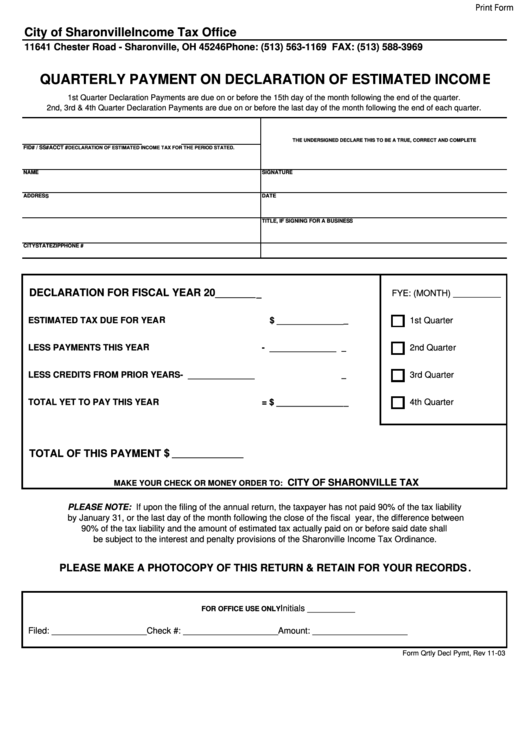

Ca Estimated Tax Payment Form - Web quarterly estimated tax payments (initially due on april 18, june 15 and sept. So, for example, if you had an estimated. 16, 2023, to file and pay their 2022 state taxes to avoid penalties. You must pay the tax as you earn or receive income during the year. We consistently offer best in class solutions to you & your client's tax problems. 100% of the prior year’s tax (including. Web quarterly estimated tax payments normally due on april 18, june 15 and sept. If you are self employed or do not have. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Web file your tax return for 2023 on or before march 1, 2024, and pay the total tax due. Fiscal year filers, enter year ending month: We consistently offer best in class solutions to you & your client's tax problems. Web estimated tax for individuals. This extension covers 55 of. There are two ways to. Web the irs tax deadline extension for people in california also applies to 2022 estimated payments of federal income tax. Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. Individual tax return form 1040 instructions; 16 to file their 2022 federal returns and pay any tax due. This extension. In this case, you do not need to make estimated tax payments for 2023. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. You must pay the tax as you earn or receive income during the year. Web quarterly estimated tax payments normally due on april 18, june. So, for example, if you had an estimated. This calculator does not figure tax for form 540 2ez. Web file your tax return for 2023 on or before march 1, 2024, and pay the total tax due. We consistently offer best in class solutions to you & your client's tax problems. If you are self employed or do not have. 16, 2023, to file and pay their 2022 state taxes to avoid penalties. Fiscal year filers, enter year ending month: In this case, you do not need to make estimated tax payments for 2023. Generally, you must make estimated tax payments if in 2022 you expect to owe at least: Web estimated tax for individuals. $250 if married/rdp filing separately and, you expect your withholding and credits to be less than the smallerof one of the following: Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. Estimated tax is the method used to pay tax on income that is not subject to withholding (for. You must pay the tax as you earn or receive income during the year. Use the 540 2ez tax. How do partnerships file and pay quarterly estimated tax payments? Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example,. Ad join us and see why tax pros have come to us for. Web the california franchise tax board confirmed that most californians have until nov. Web file your tax return for 2023 on or before march 1, 2024, and pay the total tax due. This extension covers 55 of. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from. Web simplified. Original due date is the 15th day of the 4th month after the close of the taxable year and extended due date is the 15th day of the 11th month after. 90% of the current year’s tax 2. Fiscal year filers, enter year ending month: Web quarterly estimated tax payments (initially due on april 18, june 15 and sept. Web. Ad what's the best payroll tax credit? Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. Individual tax return form 1040 instructions; This calculator does not figure tax for form 540 2ez. Original due date is the 15th day of the 4th month after the close of the taxable. 100% of the prior year’s tax (including. 90% of the current year’s tax 2. You must pay the tax as you earn or receive income during the year. Original due date is the 15th day of the 4th month after the close of the taxable year and extended due date is the 15th day of the 11th month after. Fiscal year filers, enter year ending month: This extension covers 55 of. Taxable year 2020 estimated tax for individuals fiscal year filers,. Generally, you must make estimated tax payments if in 2022 you expect to owe at least: Web b who must make estimated tax payments generally, you must make estimated tax payments if you expect to owe at least $500 ($250 if married/ rdp filing separately) in. There are two ways to. Use the 540 2ez tax. If the due date falls on a weekend or a legal holiday, the. We consistently offer best in class solutions to you & your client's tax problems. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example,. How do partnerships file and pay quarterly estimated tax payments? We consistently offer best in class solutions to you & your client's tax problems. Web the california franchise tax board confirmed that most californians have until nov. In this case, you do not need to make estimated tax payments for 2023. Web estimated tax for individuals. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years.Fillable Quarterly Payment Form On Declaration Of Estimated

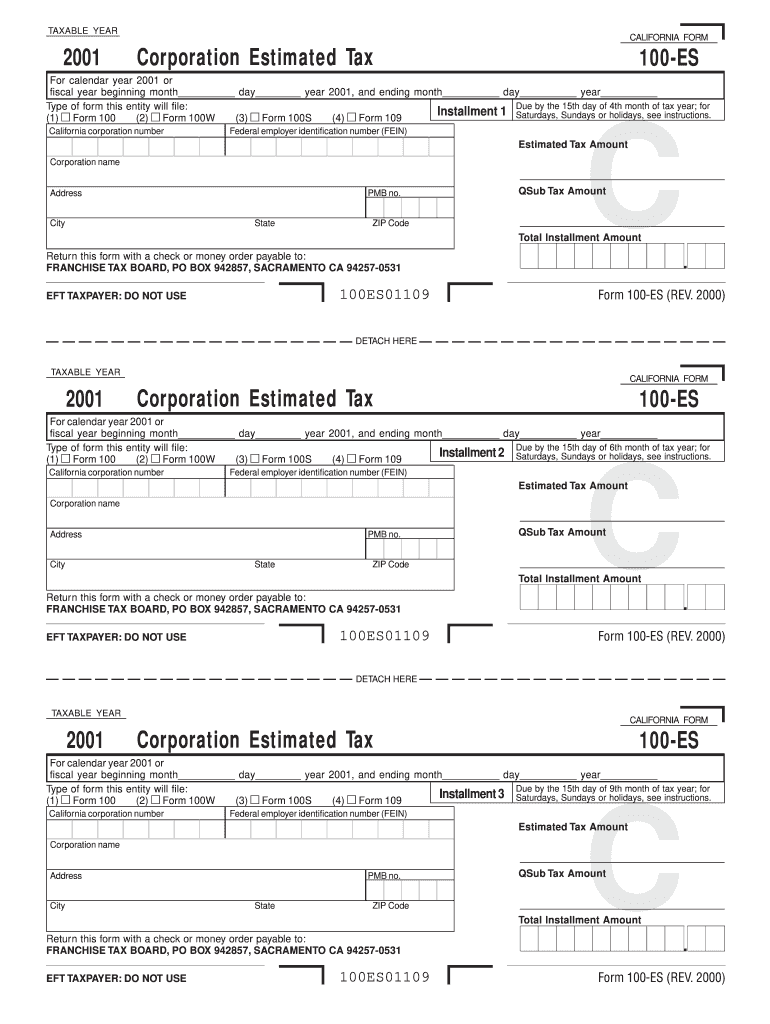

Form 100ES California Franchise Tax Board ftb ca Fill out & sign

2018 California Resident Tax Return Form 540 Instructions and

Ca tax rate schedule 2017 Fill out & sign online DocHub

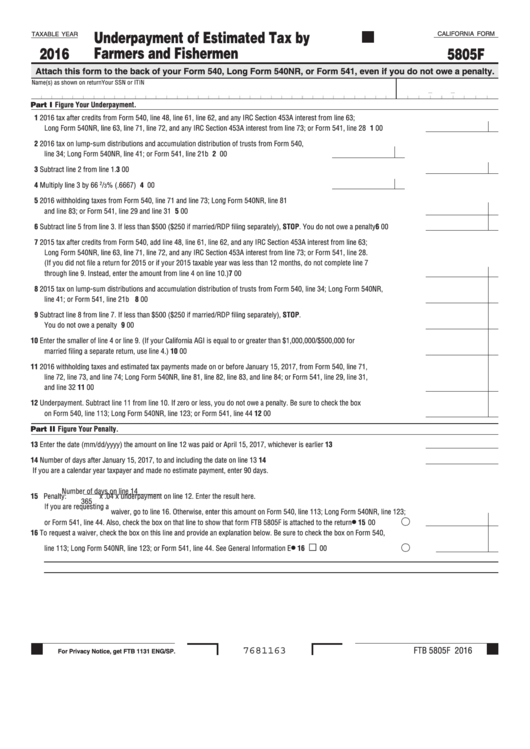

Fillable California Form 5805f Underpayment Of Estimated Tax By

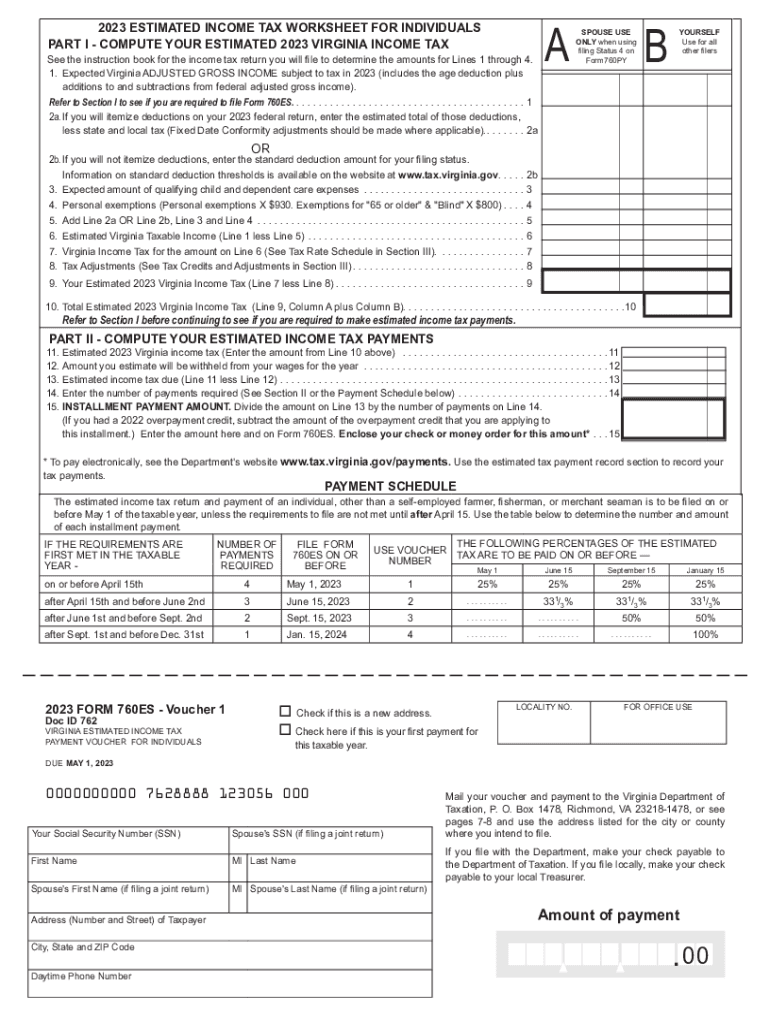

2023 Form 760ES, Estimated Tax Payment Vouchers for Individuals

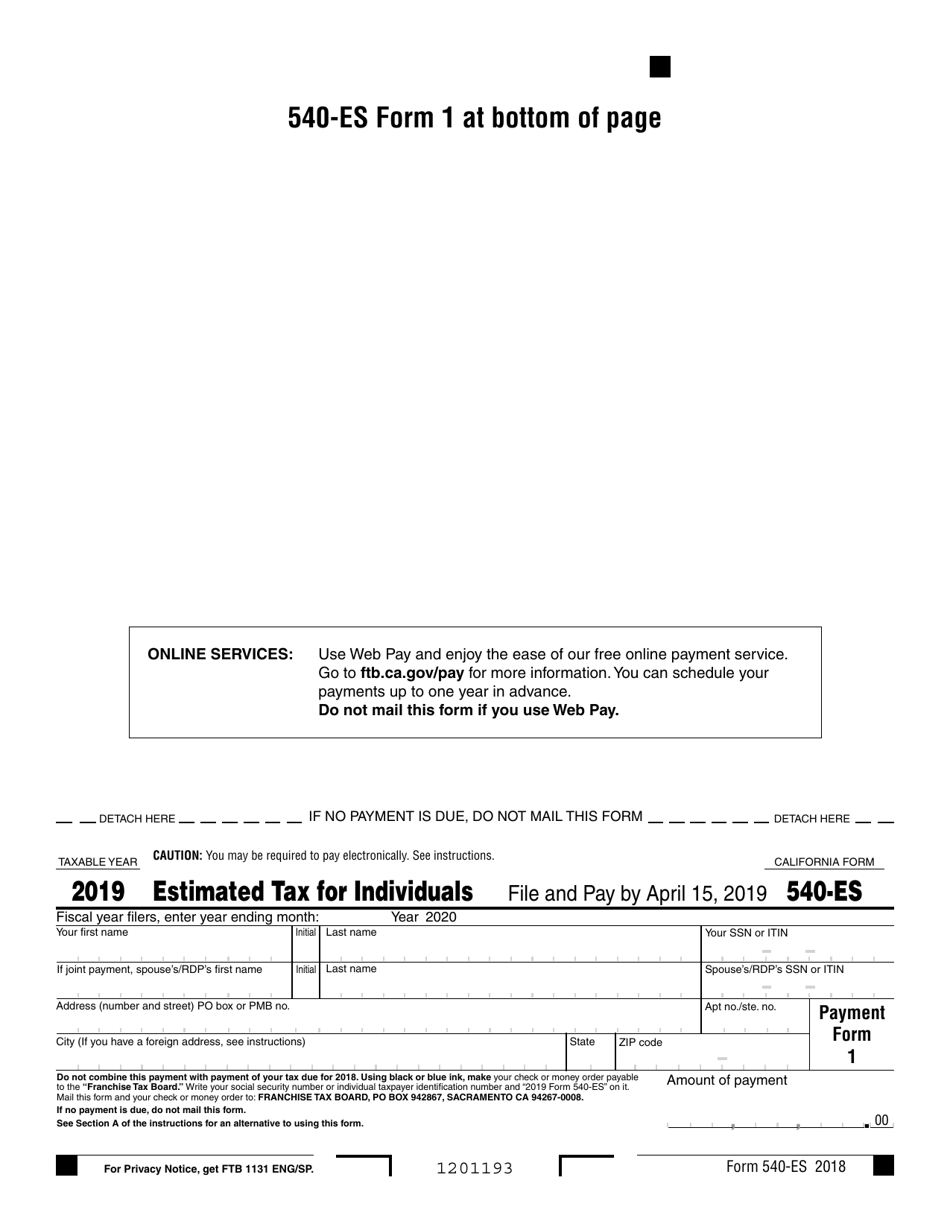

Form 540ES Download Fillable PDF or Fill Online Estimated Tax for

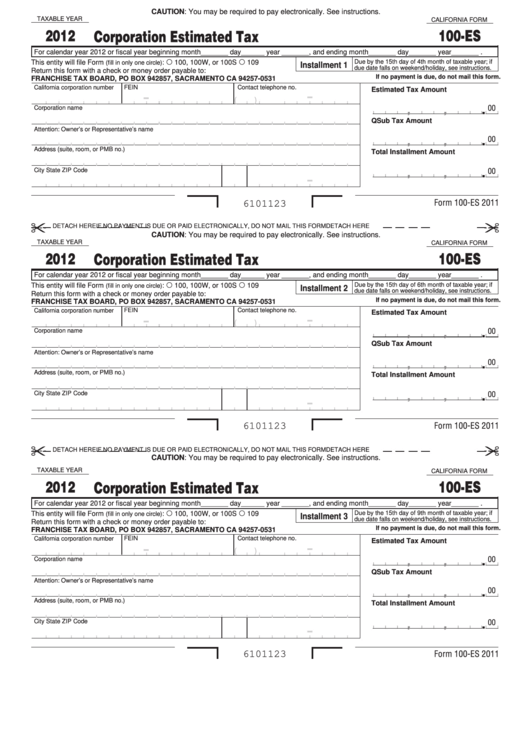

Fillable California Form 100Es Corporation Estimated Tax 2012

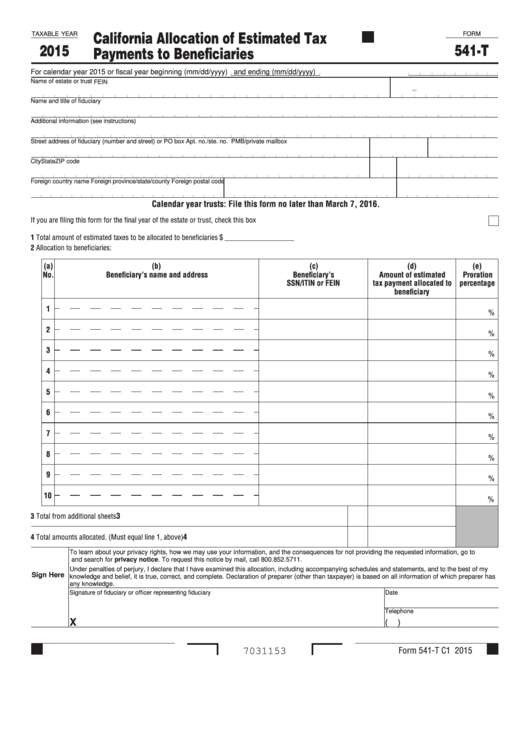

Fillable Form 541T California Allocation Of Estimated Tax Payments

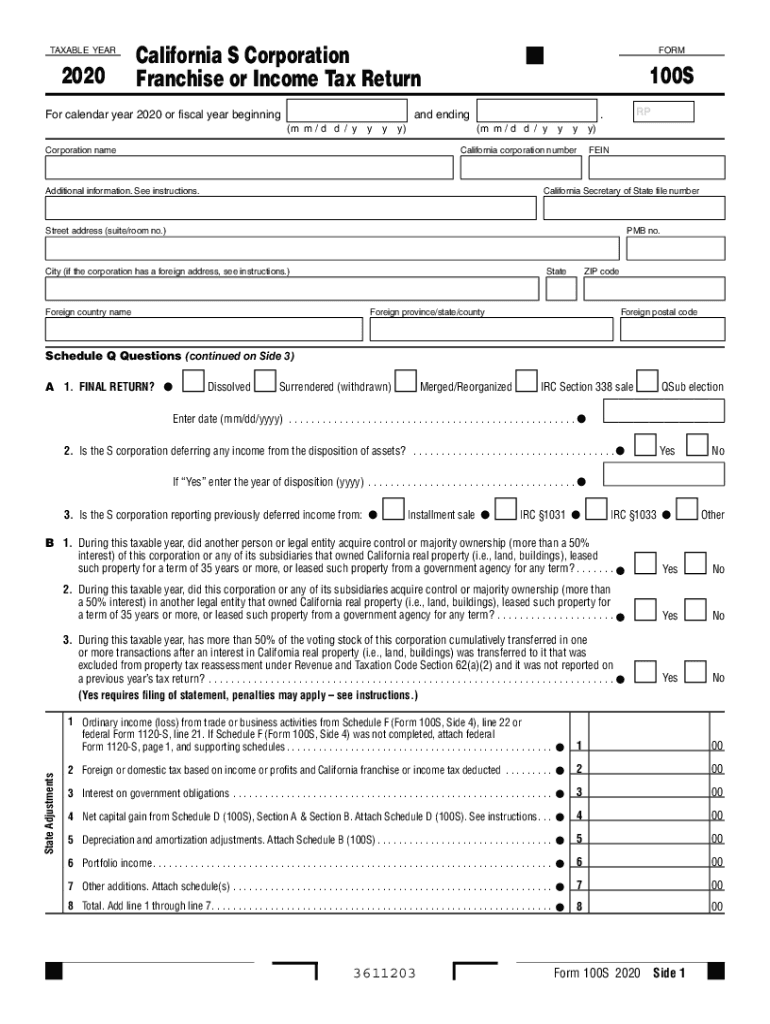

2020 Form CA FTB 100S Fill Online, Printable, Fillable, Blank pdfFiller

Related Post: