Ca De 4 Form

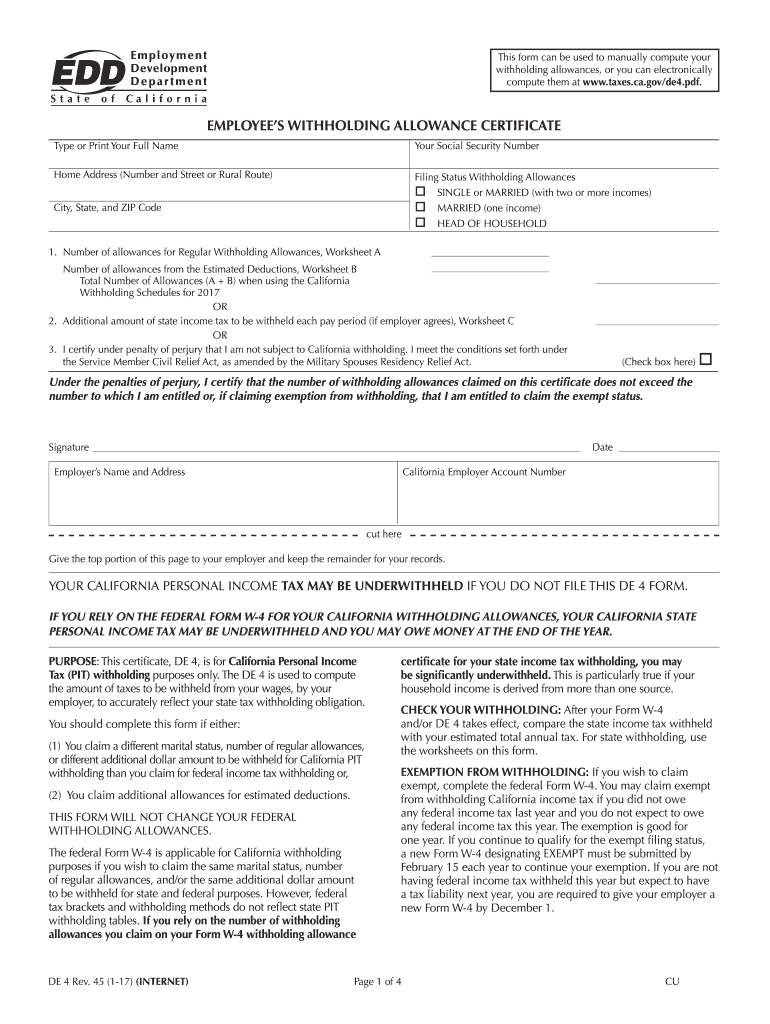

Ca De 4 Form - Web credit card services may experience short delays in service on saturday, october 21, from 9:00 p.m. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount of taxes to be withheld from. This certifi cate, de 4, is for california personal income tax (pit) withholding purposes only. Web this certificate, de 4, is for california personal income tax (pit) withholding purposes only. Web the franchise tax board or the employment development department (edd) may, by special direction in writing, require an employer to submit a de 4 when such forms are. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Only need to adjust your state withholding allowance, go to the. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. The de 4 is used to compute the amount of taxes to be withheld from your wages,. To download this form, log in using the orange sign. To sunday, october 22, at 3:00 a.m., pacific time, due to. Web the franchise tax board or the employment development department (edd) may, by special direction in writing, require an employer to submit a de 4 when such forms are. Web the 2020 form de 4, employee’s withholding allowance certificate,. To download this form, log in using the orange sign. Web credit card services may experience short delays in service on saturday, october 21, from 9:00 p.m. Web this certificate, de 4, is for. This certifi cate, de 4, is for california personal income tax (pit) withholding purposes only. Unless you elect otherwise, state law requires that california personal income. California personal income tax (pit) withholding. Web the franchise tax board or the employment development department (edd) may, by special direction in writing, require an employer to submit a de 4 when such forms are. Copy and distribute this form from the edd to employees so they can determine their withholding allowances. Free, fast, full version (2023) available! The de. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. The de 4 is used to compute the amount of taxes to be withheld from your wages,. California personal income tax (pit) withholding. The de 4 is used to compute the amount of taxes to be withheld from. Web previously, an employer. Only need to adjust your state withholding allowance, go to the. The de 4 is used to compute the amount of taxes to be withheld from. The de 4 is used to compute the amount of taxes to be withheld from. Web the franchise tax board or the employment development department (edd) may, by special direction in writing, require an. Web this certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount of taxes to be withheld from. This certifi cate, de 4, is for california personal income tax (pit) withholding purposes only. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. Web. The de 4 is used to compute the amount of taxes to be withheld from. California personal income tax (pit) withholding. The de 4 is used to compute the amount of taxes to be withheld from. Web previously, an employer could mandate use of state form de 4 only when employees elected to claim additional allowances for estimated deductions. This. Web the franchise tax board or the employment development department (edd) may, by special direction in writing, require an employer to submit a de 4 when such forms are. Only need to adjust your state withholding allowance, go to the. The de 4 is used to compute the amount of taxes to be. Web need to withhold less money from. Free, fast, full version (2023) available! Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Web the franchise tax board or the employment development department (edd) may, by special direction in writing, require an employer to submit a de 4 when such forms are. This certificate, de 4, is for california. This certificate, de 4, is for california personal income tax (pit) withholdingpurposes only. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. California personal income tax (pit) withholding. Web you must file the state form employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding. The de 4 is. The de 4 is used to compute the amount of taxes to be. California personal income tax (pit) withholding. Once available, it may be found here. The de 4 is used to compute the amount of taxes to be withheld from. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. The de 4 is used to compute the amount of taxes to be withheld from. To download this form, log in using the orange sign. Only need to adjust your state withholding allowance, go to the. The de 4 is used to compute the amount of taxes to be withheld from your wages,. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Free, fast, full version (2023) available! This certifi cate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount of taxes to be withheld from. Copy and distribute this form from the edd to employees so they can determine their withholding allowances. Web this certificate, de 4, is for. Web credit card services may experience short delays in service on saturday, october 21, from 9:00 p.m. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. Web the 2020 form de 4, employee’s withholding allowance certificate, has not yet been posted to the edd website. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. Web you must file the state form employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding.California DE4 App

Fill Free fillable De4 Employee's Withholding Allowance Certificate

2010 CA DMV Form REG 156 Fill Online, Printable, Fillable, Blank

How to Complete Forms W4 Attiyya S. Ingram, AFC

Ca De 4 20202022 Fill and Sign Printable Template Online US Legal

Sales tax exemption certificate california Fill out & sign online DocHub

California DE4 App

how to fill the form de 4 employees withholding allowance certificate

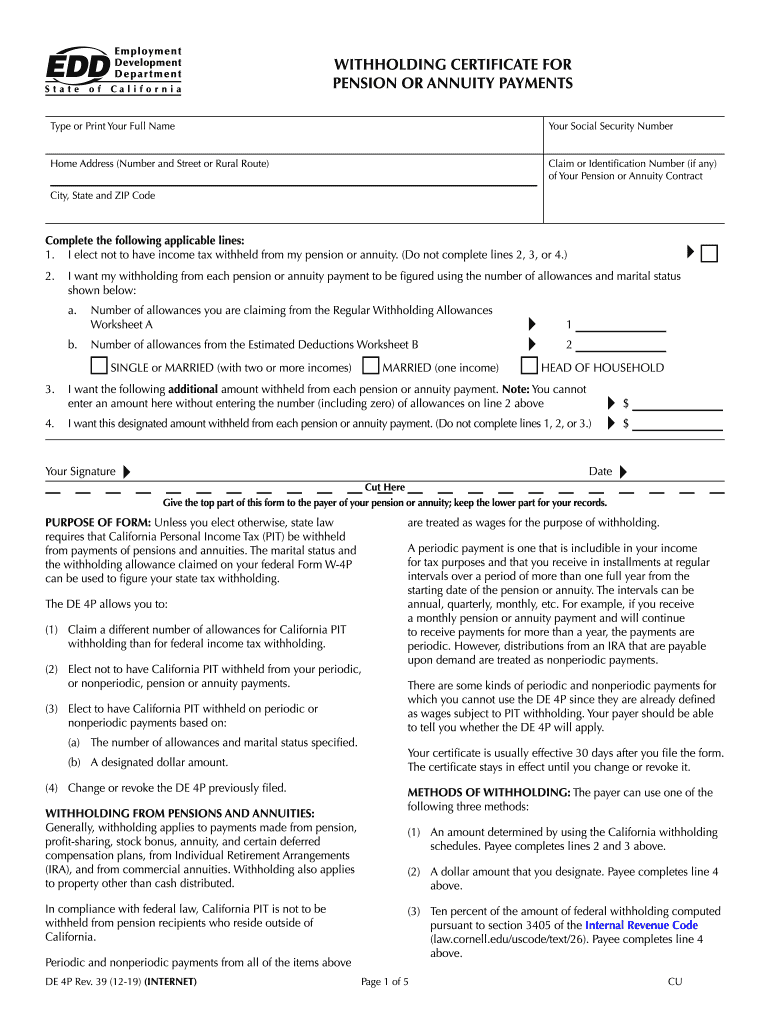

De 4p form 2018 Fill out & sign online DocHub

2018 Form CA EDD DE 4PFill Online, Printable, Fillable, Blank pdfFiller

Related Post: