Backdoor Roth Tax Form

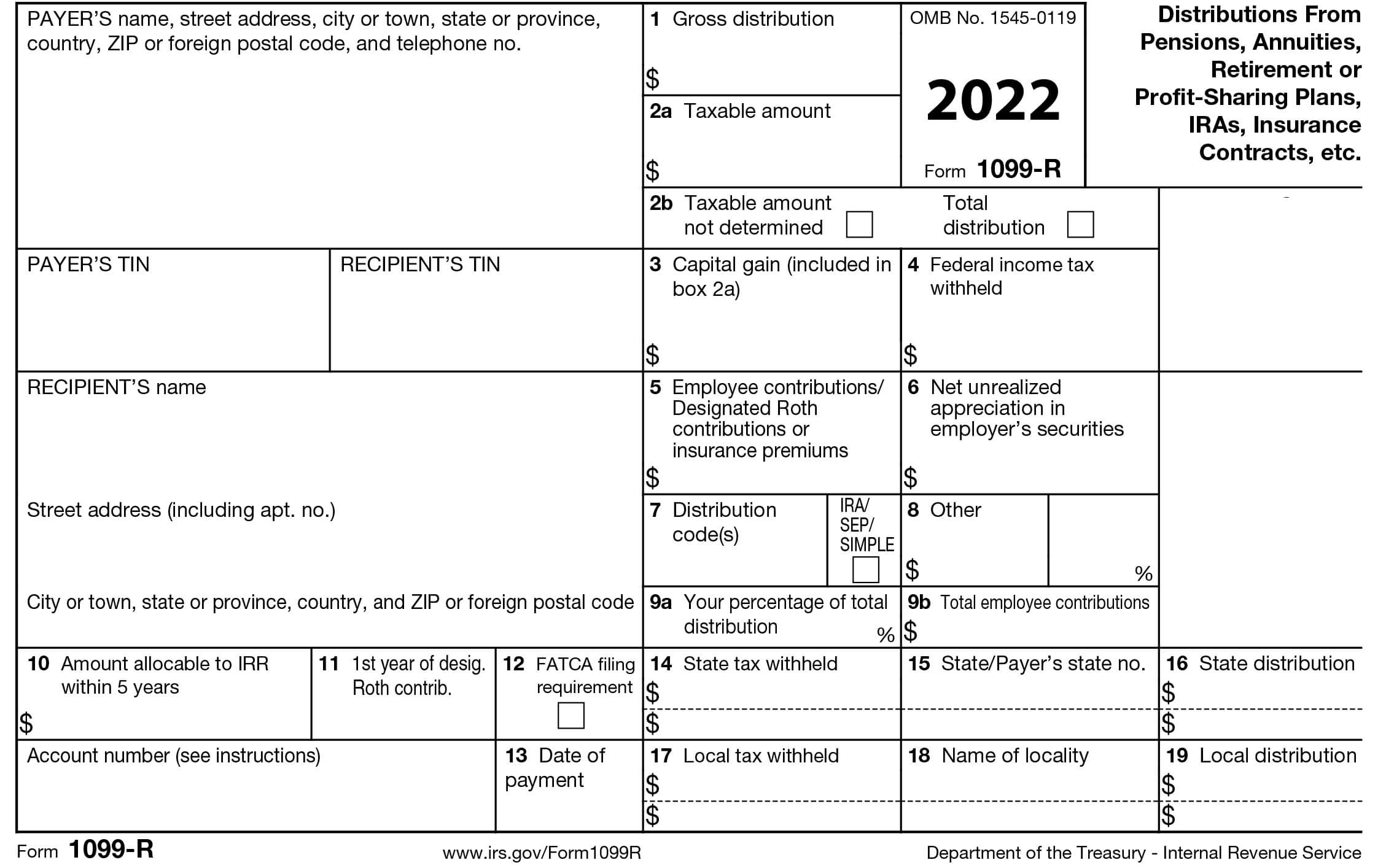

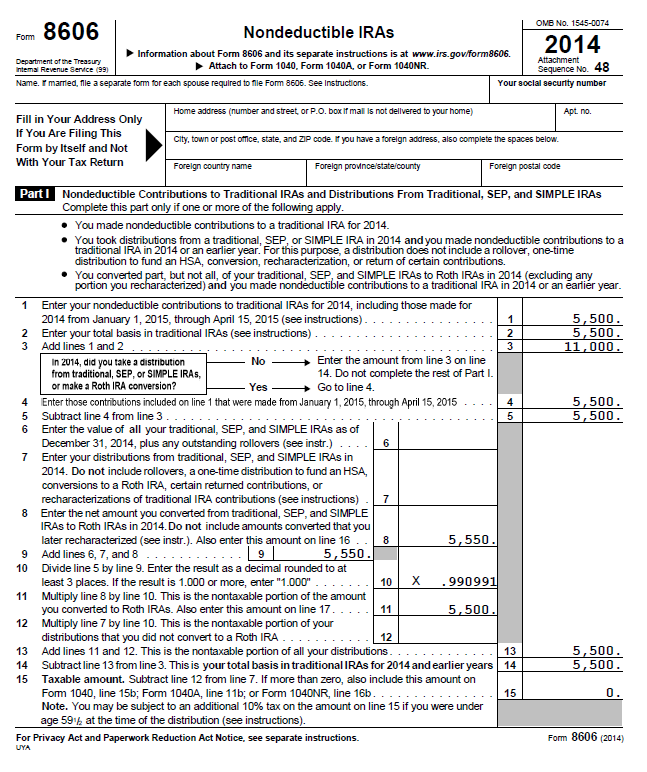

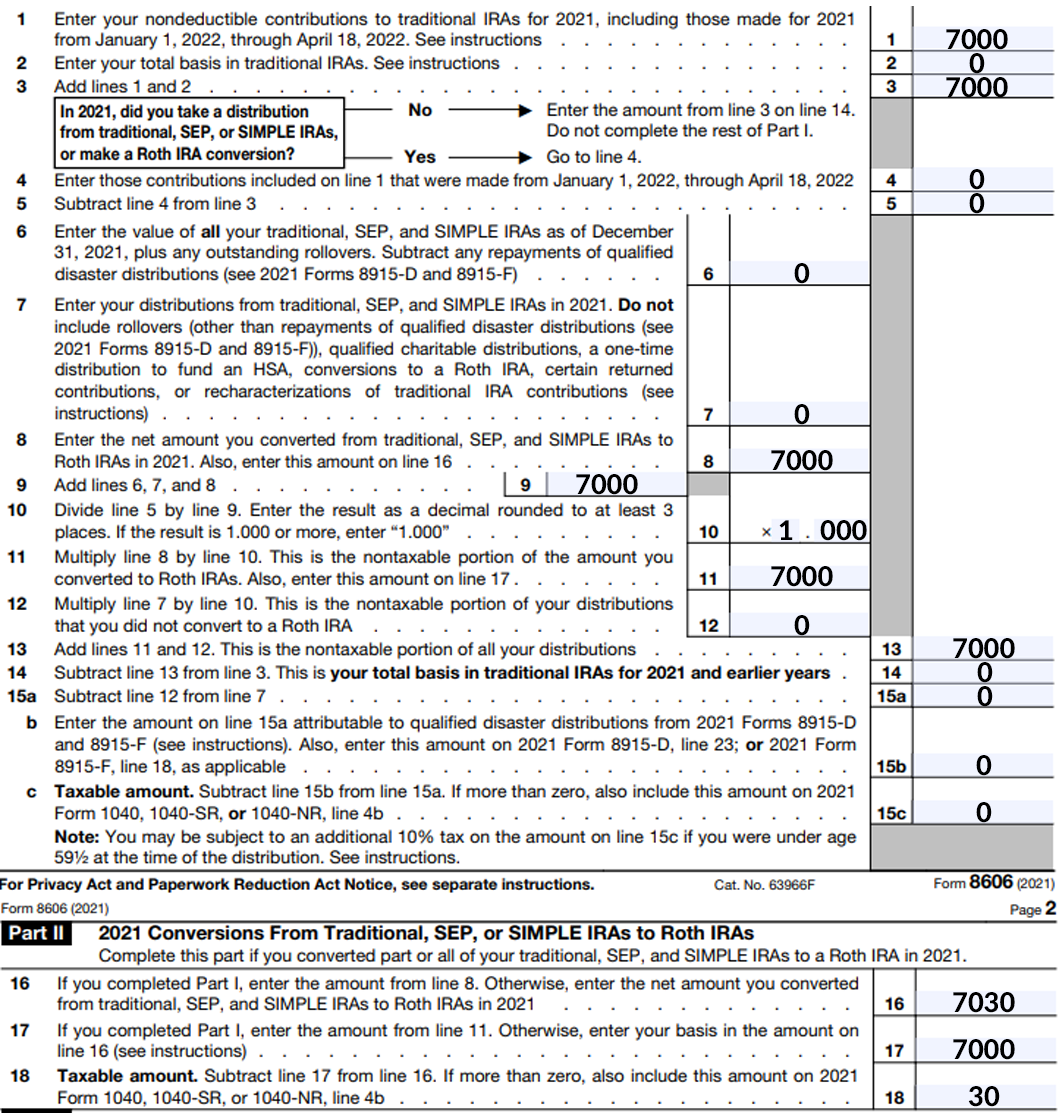

Backdoor Roth Tax Form - Report the strategy on form 8606. Web 2022 arizona state income tax rates and tax brackets. Rather than contribute directly to a roth, you contribute to a traditional. Using this strategy, you can contribute to an ira and roll. Now that we have walked through the steps, let’s. Taxable amountshould be zero unless you had earnings between the. Rules governing rollovers to roth iras that are described below. Arizona state income tax returns for tax year 2022 were due april 18, 2023, or oct. Talk to a vanguard expert today. Web i contributed $6000 after tax money to traditional ira in dec 2020 and did back door roth to roth ira in jan 2021. Web form 5498, which shows your traditional ira contributions made for the 2023 tax year. Using this strategy, you can contribute to an ira and roll. Report the strategy on form 8606. Talk to a vanguard expert today. Web your backdoor roth ira amount should be listed on form 1040, line 4a as ira distributions. Web 2022 arizona state income tax rates and tax brackets. Web i contributed $6000 after tax money to traditional ira in dec 2020 and did back door roth to roth ira in jan 2021. The key to doing it right is to. Solo 401(k) filing & reporting requirements; Rather than contribute directly to a roth, you contribute to a traditional. Web in order to accomplish a backdoor roth or nondeductible contribution, there are a few tax forms you need to report correctly. You can customize your roth ira portfolio with vanguard funds and etfs. Web your backdoor roth ira amount should be listed on form 1040, line 4a as ira distributions. Ad discover if a roth ira conversion will work. Web your backdoor roth ira amount should be listed on form 1040, line 4a as ira distributions. Using this strategy, you can contribute to an ira and roll. Taxable amountshould be zero unless you had earnings between the. Web it's a backdoor way of moving money into a roth ira, which is accomplished by making nondeductible contributions—or contributions on which. Web a backdoor roth ira permits account holders to work around income tax limits by converting what was originally a traditional ira into a roth ira.for people with. Web the backdoor roth ira is a strategy used by high earners for converting a traditional ira to a roth ira. Talk to a vanguard expert today. Web form 5498, which shows. Web it's a backdoor way of moving money into a roth ira, which is accomplished by making nondeductible contributions—or contributions on which you do. Be aware that this form doesn’t specify whether your contributions are. Web reporting the backdoor roth ira properly on turbotax is unfortunately even more complicated than filling out form 8606 by hand. Ad discover if a. Now that we have walked through the steps, let’s. Be aware that this form doesn’t specify whether your contributions are. Web reporting the backdoor roth ira properly on turbotax is unfortunately even more complicated than filling out form 8606 by hand. Web your backdoor roth ira amount should be listed on form 1040, line 4a as ira distributions. Solo 401(k). Web we recommend keeping form 5498 for your records, but you don’t need to report form 5498 in your tax filing. Web is the mega backdoor roth solo 401(k) still legal in 2023? Web 2022 arizona state income tax rates and tax brackets. Web our roth ira advisors can help you with a successful backdoor roth ira strategy that limits. Using this strategy, you can contribute to an ira and roll. Web reporting the backdoor roth ira properly on turbotax is unfortunately even more complicated than filling out form 8606 by hand. Taxable amountshould be zero unless you had earnings between the. Ad need help choosing investments for your ira? You can customize your roth ira portfolio with vanguard funds. Web 2022 arizona state income tax rates and tax brackets. Web i contributed $6000 after tax money to traditional ira in dec 2020 and did back door roth to roth ira in jan 2021. Report the strategy on form 8606. Web form 5498, which shows your traditional ira contributions made for the 2023 tax year. Web it's a backdoor way. Web our roth ira advisors can help you with a successful backdoor roth ira strategy that limits your tax bill. The key to doing it right is to. Web for now, though, getting familiar with the backdoor roth strategy and the role that irs form 8606 plays in implementing it could be a great way to give you. Web form 5498, which shows your traditional ira contributions made for the 2023 tax year. Solo 401(k) filing & reporting requirements; Web we recommend keeping form 5498 for your records, but you don’t need to report form 5498 in your tax filing. Talk to a vanguard expert today. Web the backdoor roth ira is a strategy used by high earners for converting a traditional ira to a roth ira. Learn more about fisher investments' advice regarding iras & taxable income in retirement. Rather than contribute directly to a roth, you contribute to a traditional. Web i contributed $6000 after tax money to traditional ira in dec 2020 and did back door roth to roth ira in jan 2021. Rules governing rollovers to roth iras that are described below. Web in order to accomplish a backdoor roth or nondeductible contribution, there are a few tax forms you need to report correctly. Web it's a backdoor way of moving money into a roth ira, which is accomplished by making nondeductible contributions—or contributions on which you do. Web your backdoor roth ira amount should be listed on form 1040, line 4a as ira distributions. Using this strategy, you can contribute to an ira and roll. Be aware that this form doesn’t specify whether your contributions are. Web 2022 arizona state income tax rates and tax brackets. Web turbotax and h&r block are the two major tax software for filing personal tax returns. Web is the mega backdoor roth solo 401(k) still legal in 2023?Fixing Backdoor Roth IRAs The FI Tax Guy

Backdoor IRA Gillingham CPA

LATE Backdoor ROTH IRA Tax Tutorial TurboTax & Form 8606 walkthrough

Make Backdoor Roth Easy On Your Tax Return

HOW TO FILL OUT FORM 8606 BACKDOOR ROTH IRA YouTube

Make Backdoor Roth Easy On Your Tax Return

The Backdoor Roth IRA and December 31st The FI Tax Guy

Considering a Backdoor Roth Contribution? Don’t Form 8606!

How To Do A Backdoor Roth IRA Contribution (Safely)

Make Backdoor Roth Easy On Your Tax Return

Related Post: