Arizona Form 285

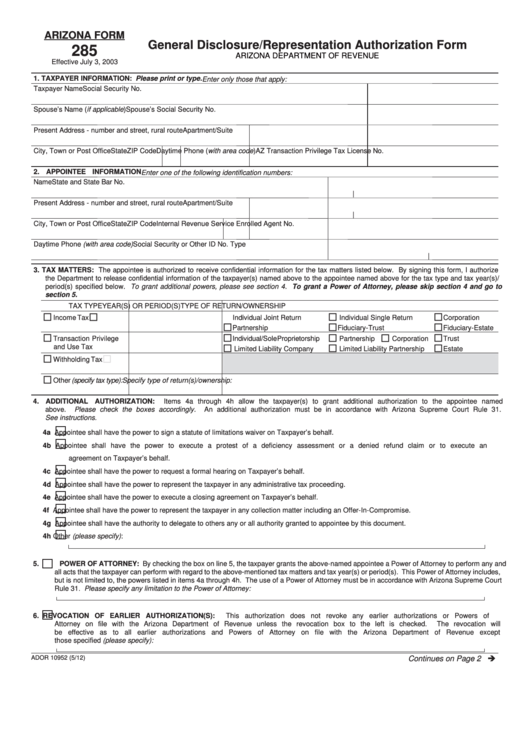

Arizona Form 285 - Generally, the authorization must be on. Taxpayer may use form 285 to authorize the department to release confidential information to the taxpayer’s appointee. Web 13 rows power of attorney (poa) / disclosure forms. Web 4h act on behalf of the property owner (taxpayer) regarding the tpt license listed in section 1 to: You hired a property management company (pmc) to file your transaction privilege. Web learn how to complete the arizona form 285 series. Use get form or simply click on the template preview to open it in the editor. Enter only those that apply: Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of arizona. Web a taxpayer may now submit the arizona form 285 and form 285b through email or fax, in addition to the mail. Web learn how to complete the arizona form 285 series. Web arizona department of revenue arizona form 285 effective july 3, 2003 1. These forms authorize the department to release confidential. Learn how to complete the arizona form 285, general disclosure/representation authorization form. Web an arizona tax power of attorney form 285 can be used to elect a person (usually. Web unclaimed property disclosure/representation authorization form arizona department of revenue arizona form 285up 1. Web 285 general disclosure/representation authorization form you must sign page 2 taxpayer information: You own residential rental property in arizona, and 2. This tutorial is designed to provide information on how to correctly complete the arizona department of revenue form. Web 13 rows power of attorney. Enter only those that apply: Generally, the authorization must be on. 22k views 7 years ago general information. Manage the license, file tax returns, pay taxes, file penalty abatement. Web 13 rows power of attorney (poa) / disclosure forms. Enter only those that apply: Web arizona form 285 general disclosure/representation authorization form you must sign page 2 taxpayer information: Generally, the authorization must be on. Web 285 general disclosure/representation authorization form you must sign page 2 taxpayer information: 22k views 7 years ago general information. You own residential rental property in arizona, and 2. Enter only those that apply: 22k views 7 years ago general information. Web learn how to complete the arizona form 285 series. Taxpayer may use form 285 to authorize the department to release confidential information to the taxpayer’s appointee. Enter only those that apply: Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of arizona. Web find and fill out the correct az 285 instructions. Manage the license, file tax returns, pay taxes, file penalty abatement. These forms authorize the. This tutorial is designed to provide information on how to correctly complete the arizona department of revenue form. Taxpayer may use form 285 to authorize the department to release confidential information to the taxpayer’s appointee. Enter only those that apply: Enter only those that apply: Use get form or simply click on the template preview to open it in the. Taxpayer may use form 285 to authorize the department to release confidential information to the taxpayer’s appointee. Use get form or simply click on the template preview to open it in the editor. Generally, the authorization must be on. The department may have to disclose confidential. Web arizona form 285 general disclosure/representation authorization form you must sign page 2 taxpayer. Web a taxpayer may now submit the arizona form 285 and form 285b through email or fax, in addition to the mail. These forms authorize the department to release confidential. 22k views 7 years ago general information. Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s. Choose the correct version of the editable pdf form from the list. Learn how to complete the arizona form 285, general disclosure/representation authorization form. Web taxpayer may use form 285 to authorize the department to release confidential information to the taxpayer’s appointee. Use get form or simply click on the template preview to open it in the editor. These forms. Enter only those that apply: The department may have to. Use get form or simply click on the template preview to open it in the editor. Choose the correct version of the editable pdf form from the list. Generally, the authorization must be on. The department may have to disclose confidential. Web unclaimed property disclosure/representation authorization form arizona department of revenue arizona form 285up 1. These forms authorize the department to release confidential. Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of arizona. Web 285 general disclosure/representation authorization form you must sign page 2 taxpayer information: You hired a property management company (pmc) to file your transaction privilege. Taxpayer may use form 285 to authorize the department to release confidential information to the taxpayer’s appointee. This tutorial is designed to provide information on how to correctly complete the arizona department of revenue form. Learn how to complete the arizona form 285, general disclosure/representation authorization form. Manage the license, file tax returns, pay taxes, file penalty abatement. Web arizona form 285 general disclosure/representation authorization form you must sign page 2 taxpayer information: Web find and fill out the correct az 285 instructions. Enter only those that apply: Web 13 rows power of attorney (poa) / disclosure forms. Enter only those that apply:Arizona Power Of Attorney Form 285 Instructions Form Resume

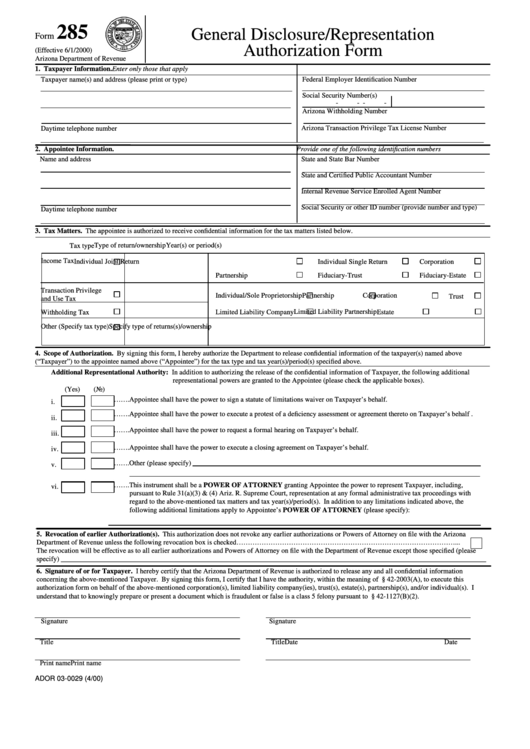

Form 285 General Disclosure/Representation Authorization Form

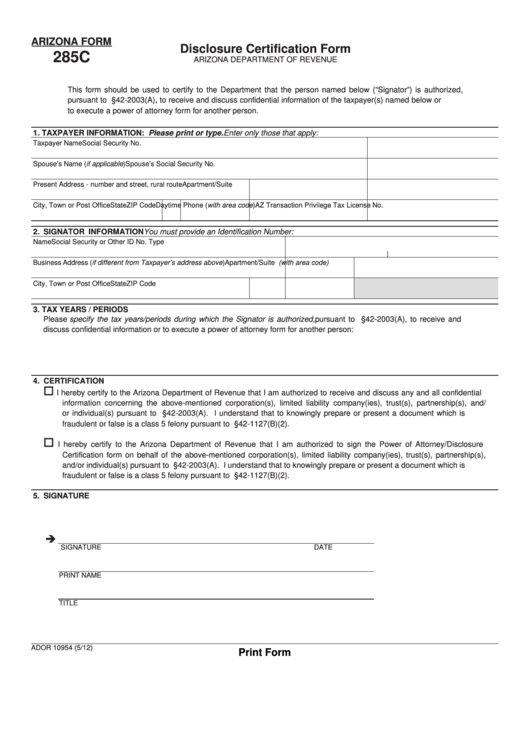

Fillable Arizona Form 285c Disclosure Certification Form printable

Free Arizona State Tax Power of Attorney (Form 285) PDF

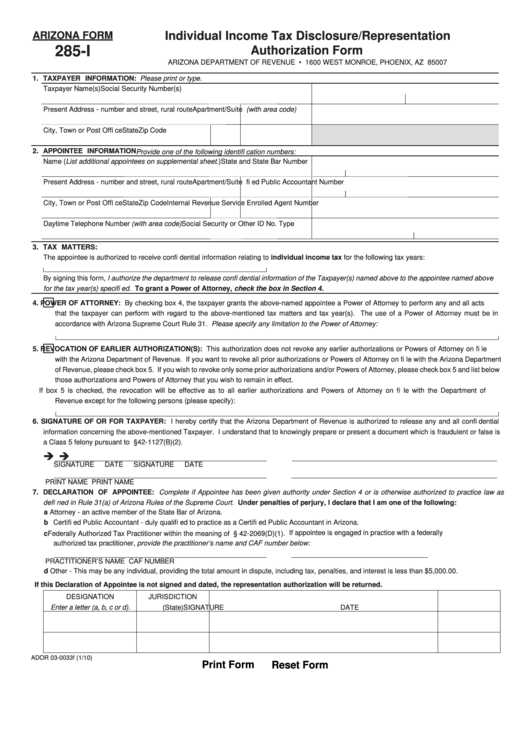

Fillable Arizona Form 285I Individual Tax Disclosure

Arizona

Free Arizona Tax Power of Attorney Form (285I) PDF eForms

Arizona Form 285 Fill Online, Printable, Fillable, Blank pdfFiller

Fillable Form 285 General Disclosure/representation Authorization

Fillable Arizona Form 285 General Disclosure/representation

Related Post: