941 X Worksheet 2 Fillable Form

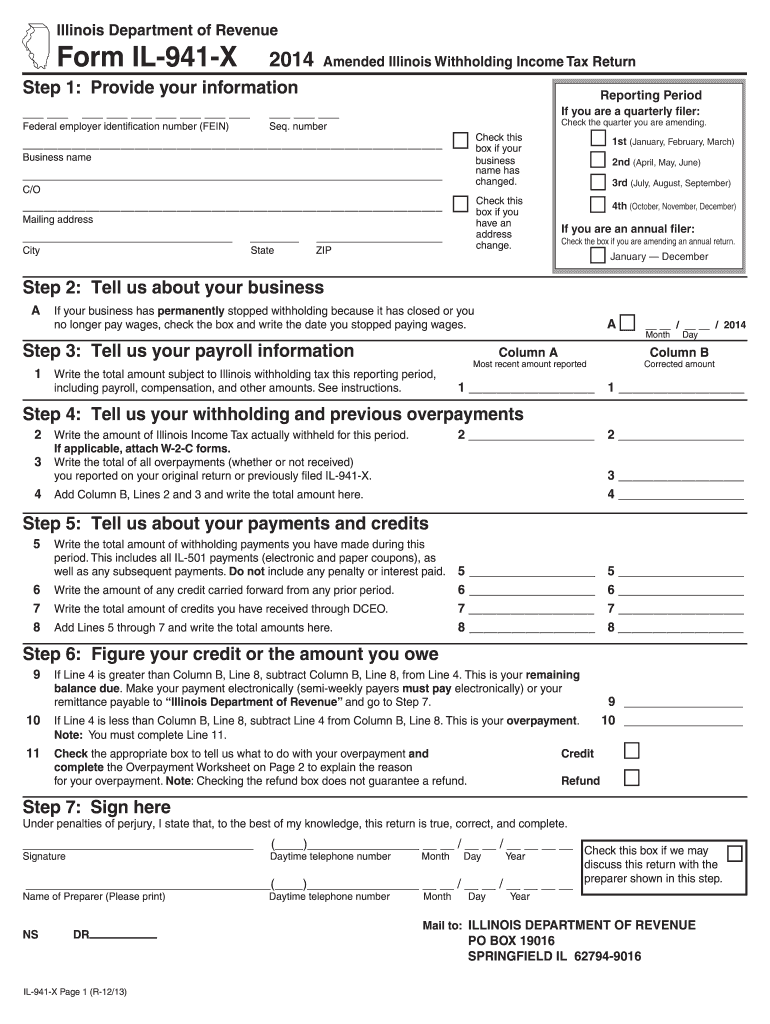

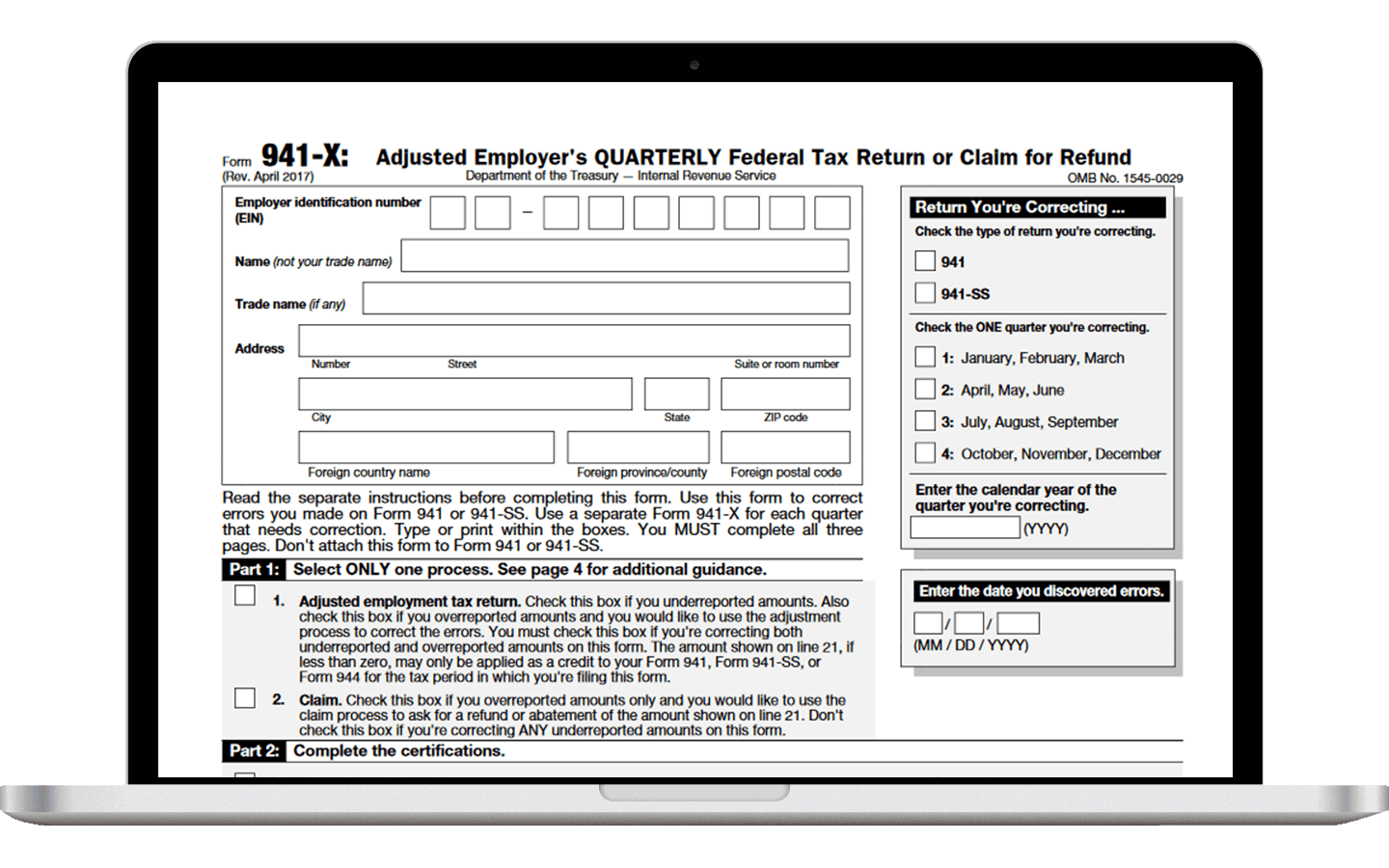

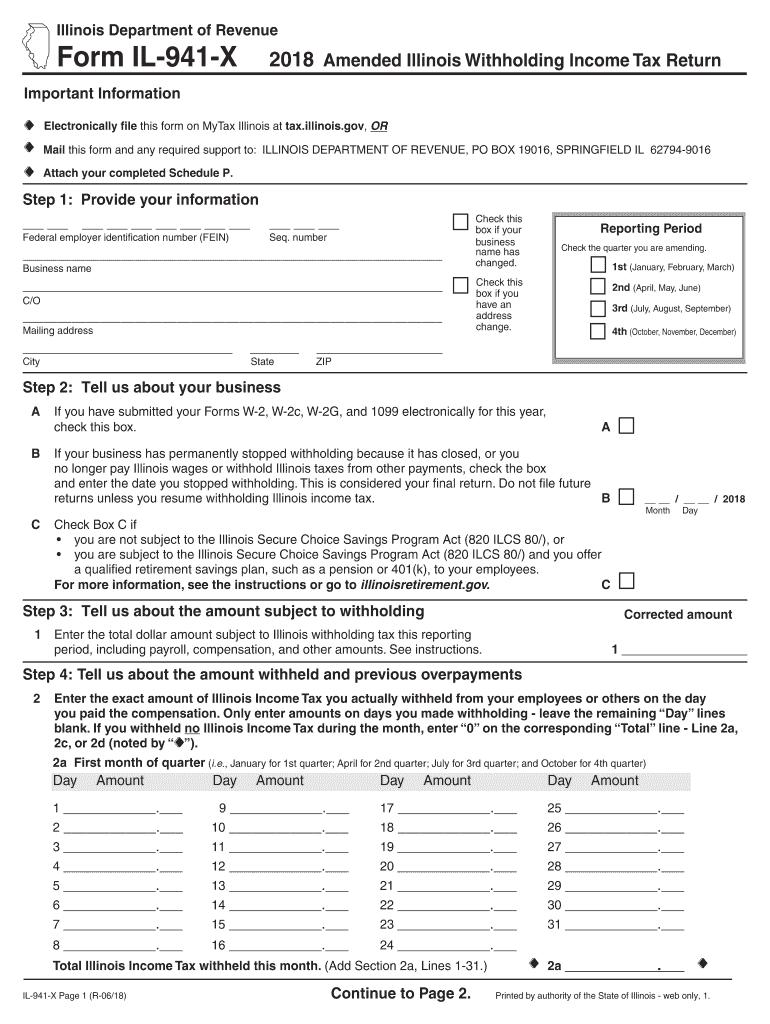

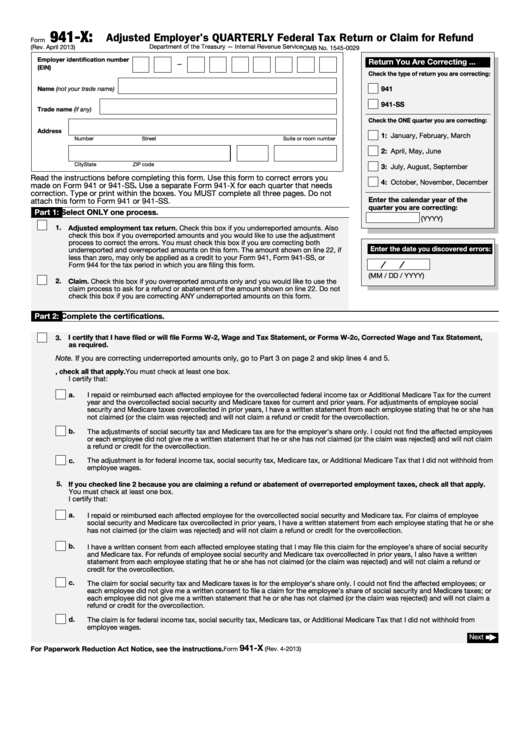

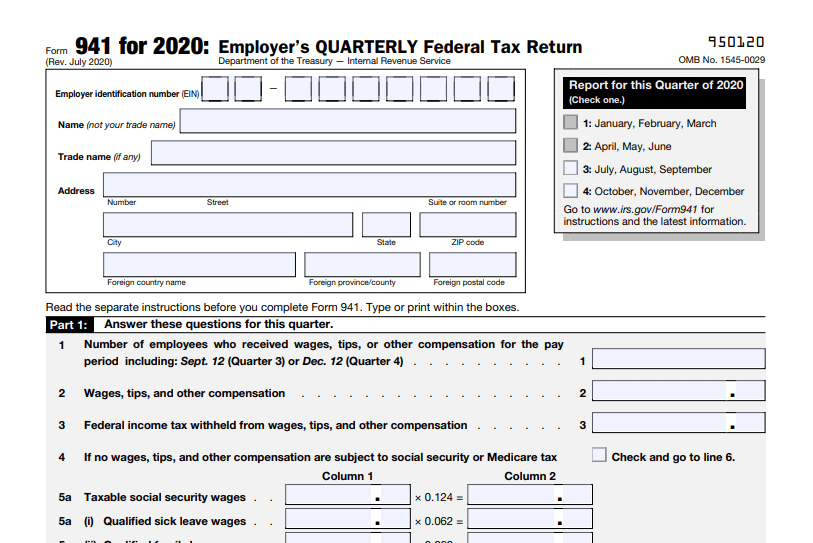

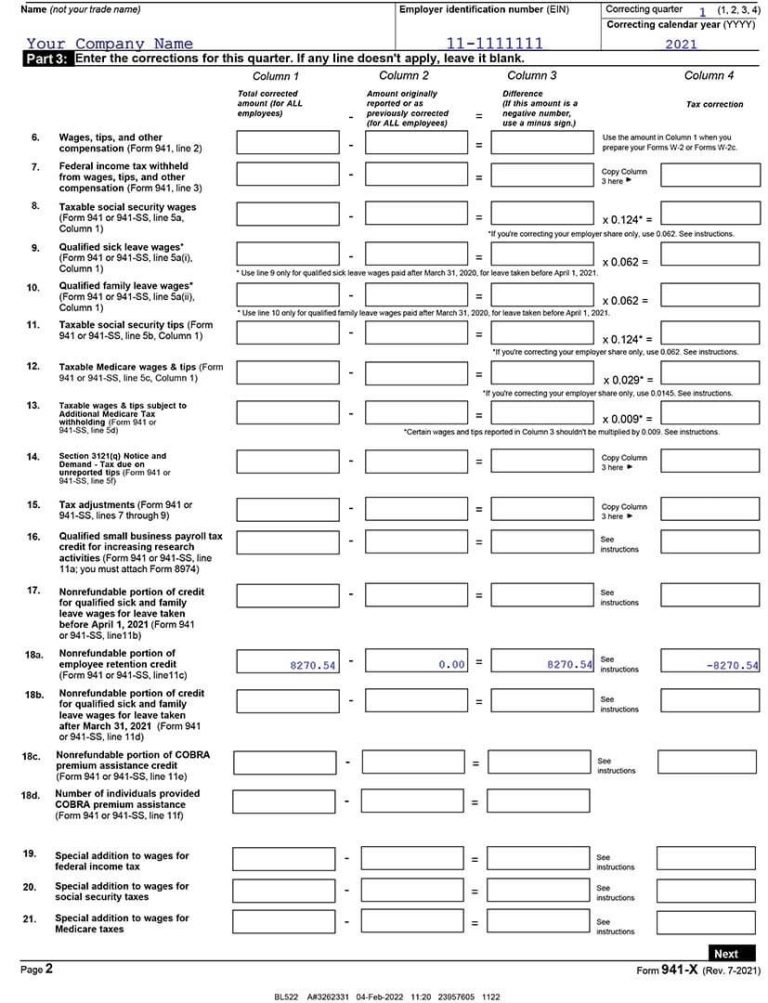

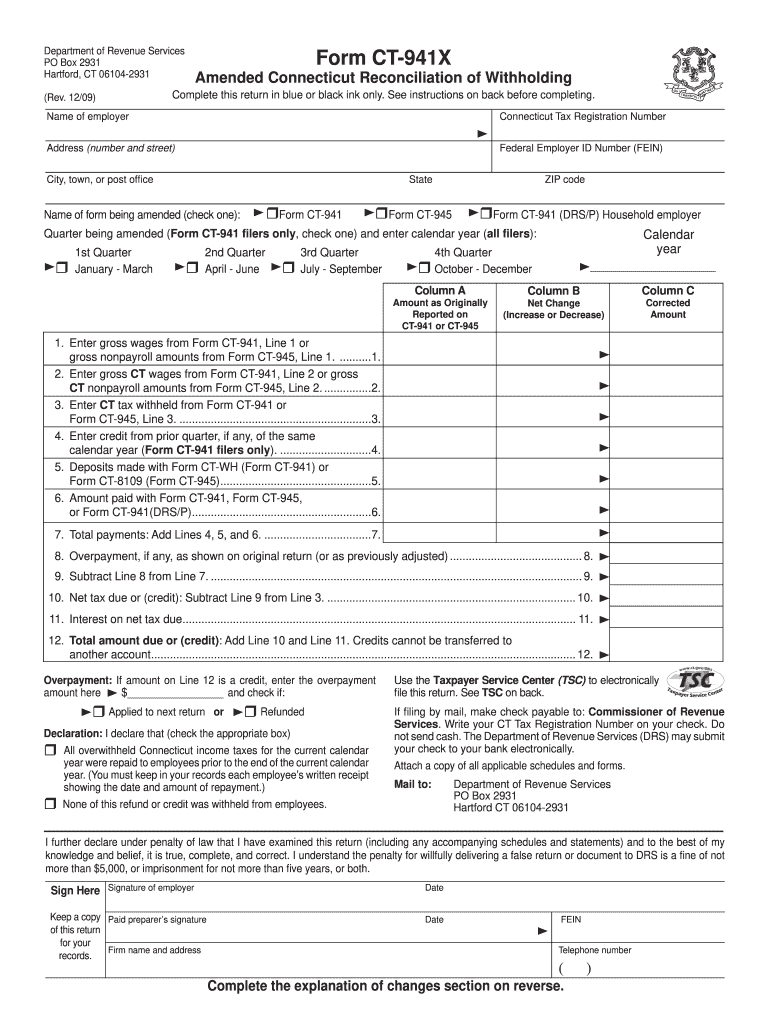

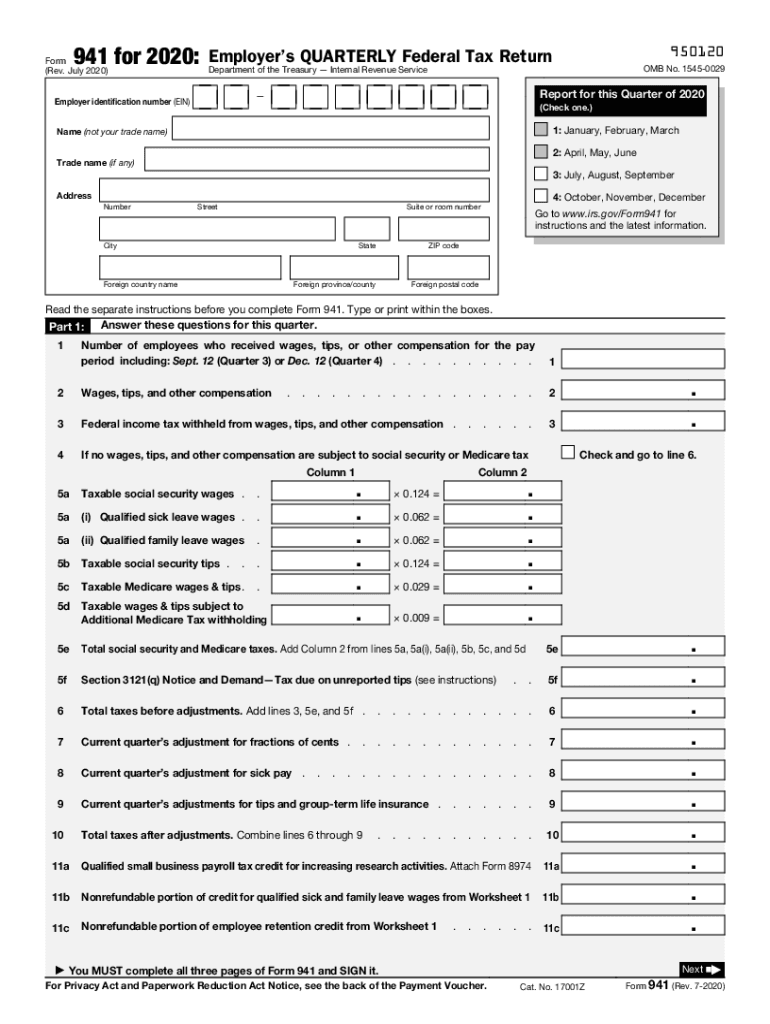

941 X Worksheet 2 Fillable Form - Form 941 is used by employers. Web form 941 worksheet 2 for q2 2021 step 1 worksheet 2, step 2 the second step of worksheet 2 actually helps employers calculate the refundable and. Web the 941 ertc worksheets for the 2q 2021 have changed. Web fillable forms such as 941 x worksheet 2 fillable form can be used in a range of methods, from gathering contact details to collecting comments on solutions. Ad access irs tax forms. Complete irs tax forms online or print government tax documents. Ad edit, fill, sign 2014 941 x & more fillable forms. Get ready for tax season deadlines by completing any required tax forms today. April, may, june read the separate instructions before completing this form. Web up to 10% cash back beginning in the second quarter of 2021, the credits for leave taken after march 31, 2021, are reported on form 941, worksheet 3. Complete irs tax forms online or print government tax documents. Web fillable forms such as 941 x worksheet 2 fillable form can be used in a range of methods, from gathering contact details to collecting comments on solutions. Complete, edit or print tax forms instantly. Instead of worksheet 1, worksheet 2 needs to be generated and completed to flow the. Complete, edit or print tax forms instantly. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web the new form 941 worksheet 2 for q2 2021 should be completed by all employers that paid qualified wages for the employee retention credit after april 1, 2021. Ad edit, fill,. Complete irs tax forms online or print government tax documents. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Web fillable forms such as 941. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. Web form 941 worksheet 2 for q2 2021 step 1 worksheet 2, step 2 the second step of worksheet 2 actually helps employers calculate the refundable. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. April, may, june read the separate instructions before completing this form. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web up to 10% cash back beginning in the second quarter of. Web fillable forms such as 941 x worksheet 2 fillable form can be used in a range of methods, from gathering contact details to collecting comments on solutions. Get ready for tax season deadlines by completing any required tax forms today. Form 941 is used by employers. Complete, edit or print tax forms instantly. Web form 941 worksheet 2 for. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,. Web form 941 worksheet 2 for q2 2021 step 1 worksheet 2, step 2 the second step of worksheet 2 actually helps employers calculate the refundable and. Web the new form 941 worksheet 2 for. Complete, edit or print tax forms instantly. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Form 941 is used by employers. Form has the process of adjusted. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Form 941 is used by employers. Ad access irs tax forms. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,. Adjusted employer's quarterly federal tax return or claim for refund keywords: Complete, edit or print tax forms instantly. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Ad edit, fill, sign 2014 941 x & more fillable forms. Get ready for tax season deadlines by completing any required tax forms today. April, may, june read the separate instructions before completing this form. Complete, edit or print tax. Ad edit, fill, sign 2014 941 x & more fillable forms. Form has the process of adjusted. Complete, edit or print tax forms instantly. Adjusted employer's quarterly federal tax return or claim for refund keywords: Complete irs tax forms online or print government tax documents. Instead of worksheet 1, worksheet 2 needs to be generated and completed to flow the ertc. Web up to 10% cash back beginning in the second quarter of 2021, the credits for leave taken after march 31, 2021, are reported on form 941, worksheet 3. Web the 941 ertc worksheets for the 2q 2021 have changed. Get ready for tax season deadlines by completing any required tax forms today. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web the new form 941 worksheet 2 for q2 2021 should be completed by all employers that paid qualified wages for the employee retention credit after april 1, 2021. Web fillable forms such as 941 x worksheet 2 fillable form can be used in a range of methods, from gathering contact details to collecting comments on solutions. Form 941 is used by employers. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. April, may, june read the separate instructions before completing this form. Ad access irs tax forms. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web form 941 worksheet 2 for q2 2021 step 1 worksheet 2, step 2 the second step of worksheet 2 actually helps employers calculate the refundable and.IL 941 X Form Fill Out and Sign Printable PDF Template signNow

941 Worksheets For Ertc

941x Worksheet 2 Fillable Form

IL 941x Fill Out and Sign Printable PDF Template signNow

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

941x Worksheet 2 Fillable Form

941x Worksheet 1 Excel

941 X Worksheet 2 Fillable Form Fillable Form 2023

941x Worksheet 1

Check Form 941 Worksheet 1 Pdf

Related Post: