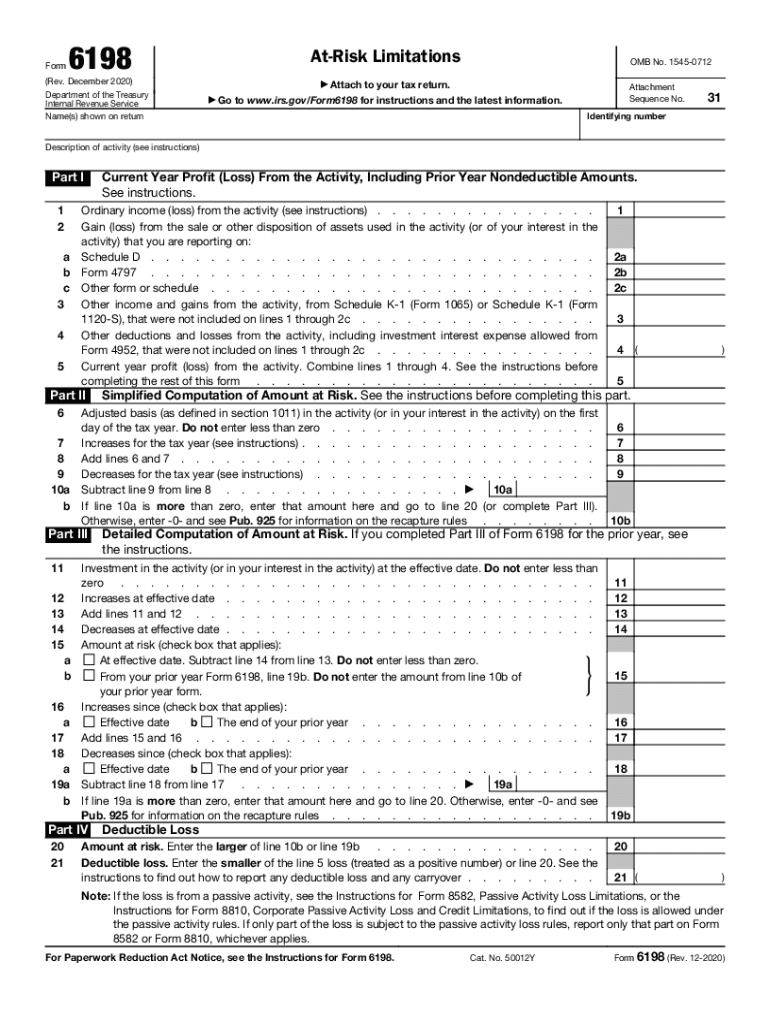

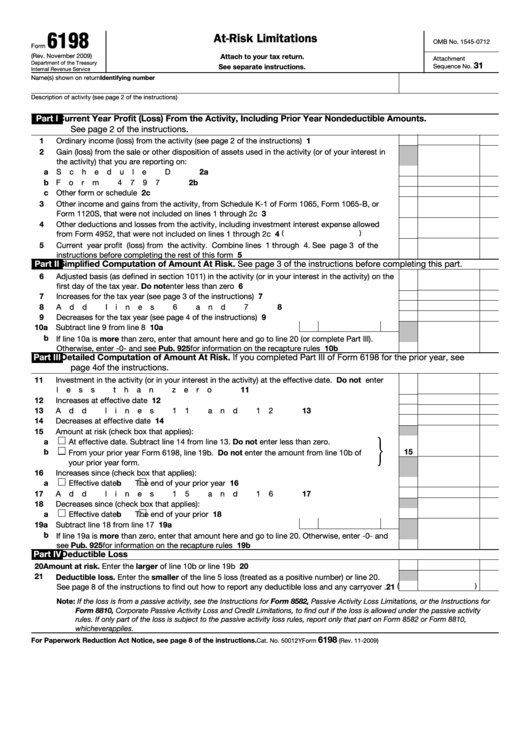

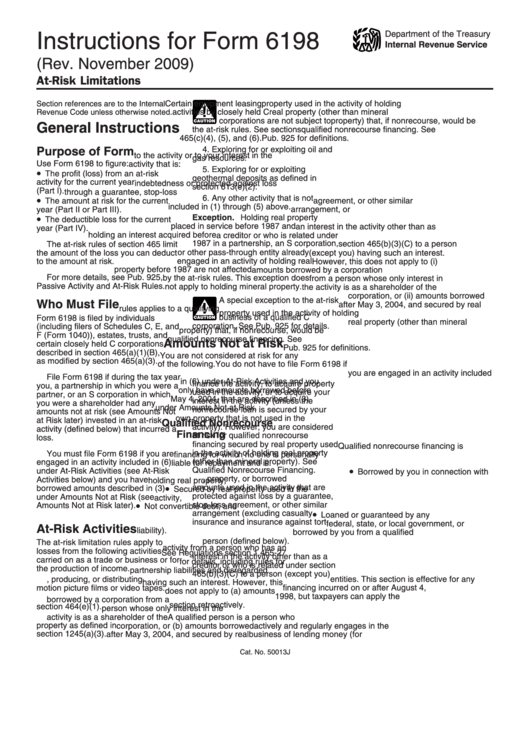

6198 Tax Form

6198 Tax Form - By quinn hubbard, cpa, m.t., seattle, and jing li, cpa, m.a., chicago. Estimate your current year's business losses. December 2020) department of the treasury internal revenue service. 16 16a effective date 17 b the end of your. Make an assessment of the amount at risk in the business. B increases since (check box that applies): For use with form 6198 (rev. Web from 2006 form 6198, line 19b. Go to income/deductions > business worksheet. You can download or print current or past. Somewhere in the interview you have indicated that. 16 16a effective date 17 b the end of your. Individual estimated tax payment booklet. Web form number title; December 2020) department of the treasury internal revenue service. Web form number title; Web the 2017 tax return. Do not enter the amount from line 10b of the 2006 form. Somewhere in the interview you have indicated that. B increases since (check box that applies): Go to income/deductions > business worksheet. Web form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive activity loss (pal) allowed for the. Generally, any loss from an activity (such as a rental). Web 1 best answer. Web form number title; Section references are to the internal revenue code unless otherwise noted. Web page last reviewed or updated: Web form 6198 consists of four sections and allows you to: Generally, any loss from an activity (such as a rental). 16 16 a effective date 17 b the end of your. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. November 2009) or later revision. Web partnership interests, sec. Web form number title; Web from 2007 form 6198, line 19b. Tax forms and publications, 1111 constitution. Section references are to the internal revenue code unless otherwise noted. Web 1 best answer. December 2020) department of the treasury internal revenue service. Individual estimated tax payment booklet. Section references are to the internal revenue code unless otherwise noted. Web the 2017 tax return. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. For use with form 6198 (rev. Web form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the. Estimate your current year's business losses. Generally, any loss from an activity (such as a rental). You can download or print current or past. Go to income/deductions > business worksheet. Web the 2017 tax return. Go to income/deductions > business worksheet. Web partnership interests, sec. Web the 2017 tax return. Web form number title; By quinn hubbard, cpa, m.t., seattle, and jing li, cpa, m.a., chicago. Web form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive activity loss (pal) allowed for the. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. B increases since (check box that applies): Estimate your current year's business. Form 6198 should be filed when a taxpayer has a loss in a business. Web from 2007 form 6198, line 19b. Individual estimated tax payment booklet. Tpt forms, corporate tax forms, withholding forms : Web from 2006 form 6198, line 19b. Estimate your current year's business losses. Make an assessment of the amount at risk in the business. Go to income/deductions > business worksheet. Web form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive activity loss (pal) allowed for the. Attach to your tax return. Tax forms and publications, 1111 constitution. Somewhere in the interview you have indicated that. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. December 2020) department of the treasury internal revenue service. Web the 2017 tax return. November 2009) or later revision. Web 1 best answer. You can download or print current or past. Generally, any loss from an activity (such as a rental). Web page last reviewed or updated:How To Change Tax Withholding With Unemployment Ny YUNEMPLO

2020 6198 signNow Form Fill Out and Sign Printable PDF Template signNow

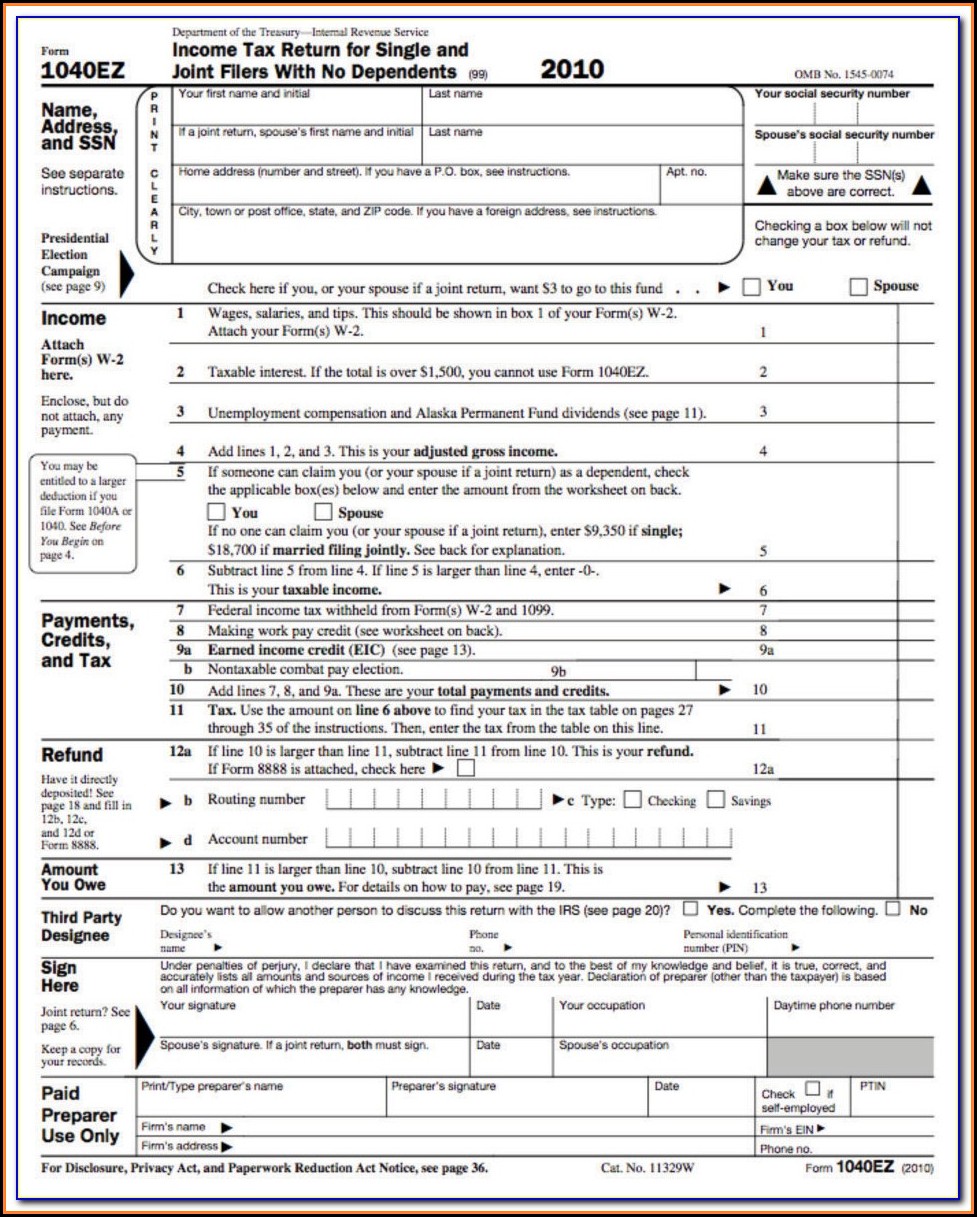

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

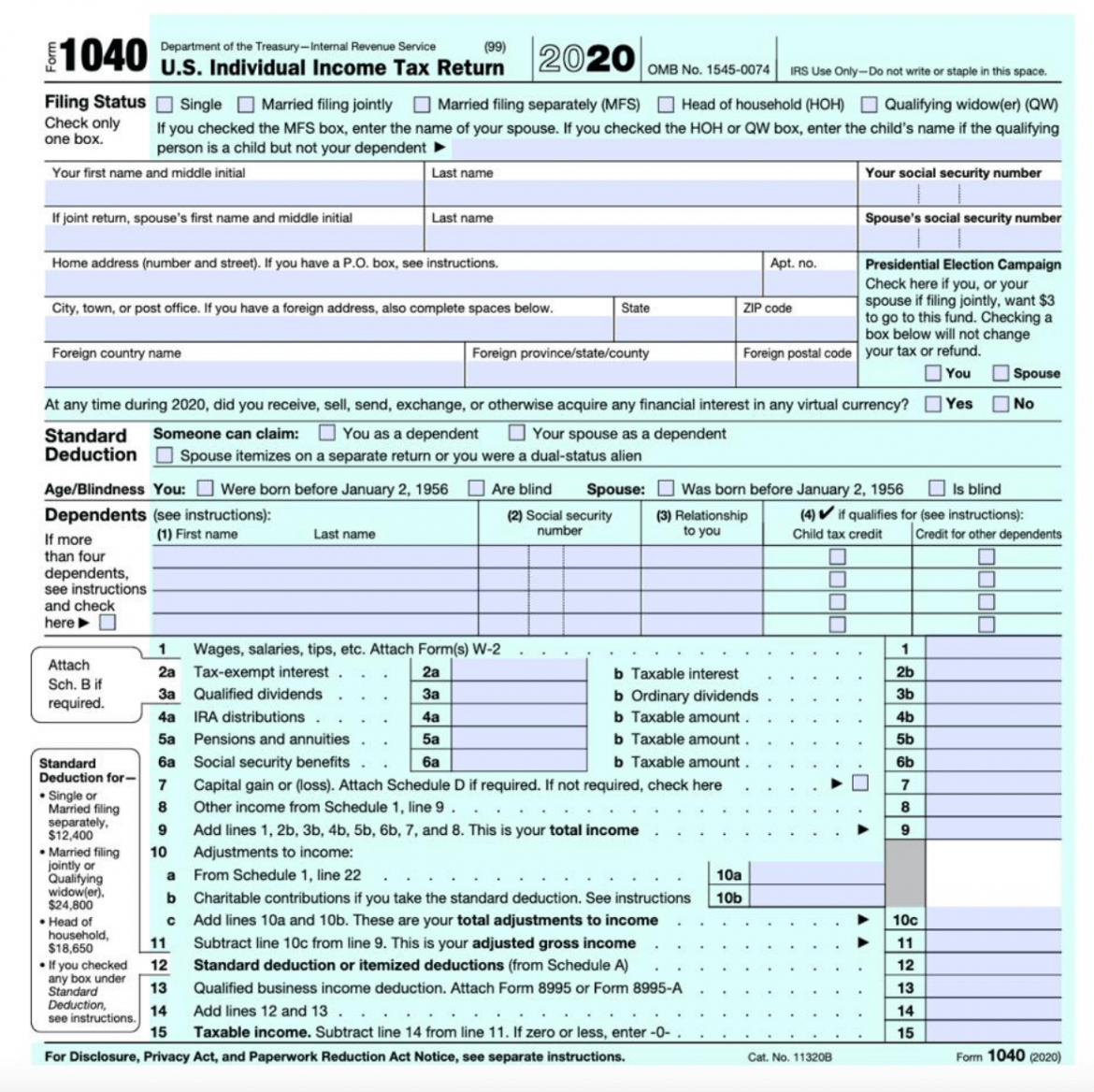

Irs Form W4V Printable Federal Form W 4v Voluntary Withholding

Simplified Tax Form? NESA

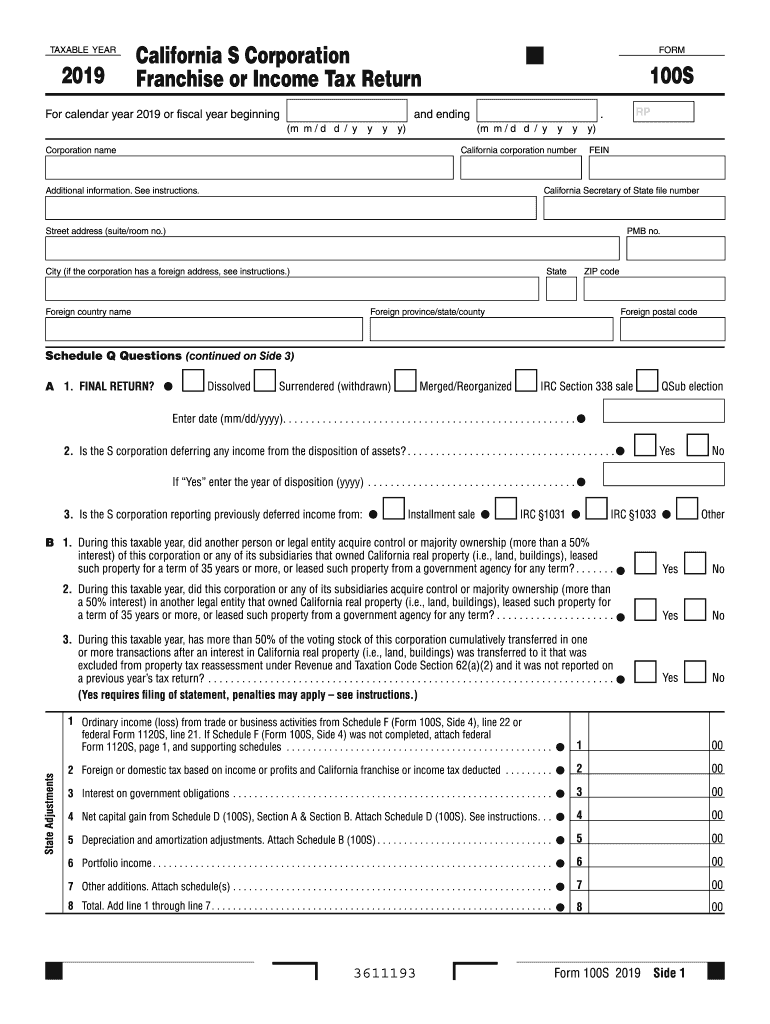

2019 Form CA FTB 100S Fill Online, Printable, Fillable, Blank pdfFiller

2007 Tax Form 6198 At

Form 6198 Edit, Fill, Sign Online Handypdf

Fillable Form 6198 AtRisk Limitations printable pdf download

Instructions For Form 6198 AtRisk Limitations printable pdf download

Related Post: