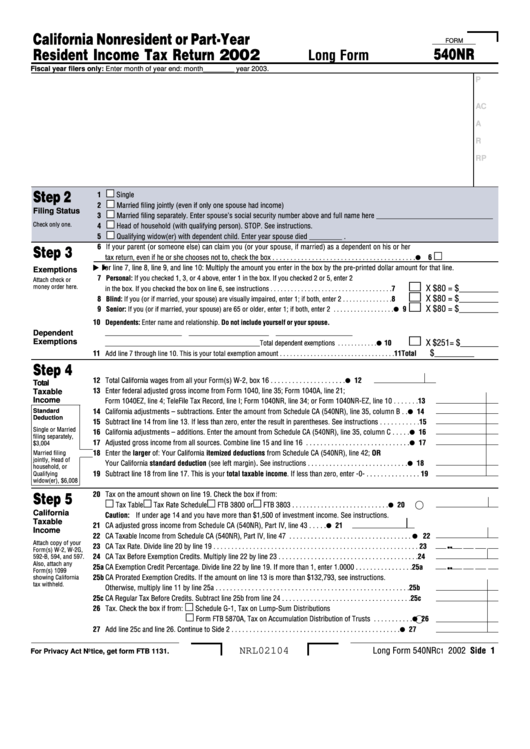

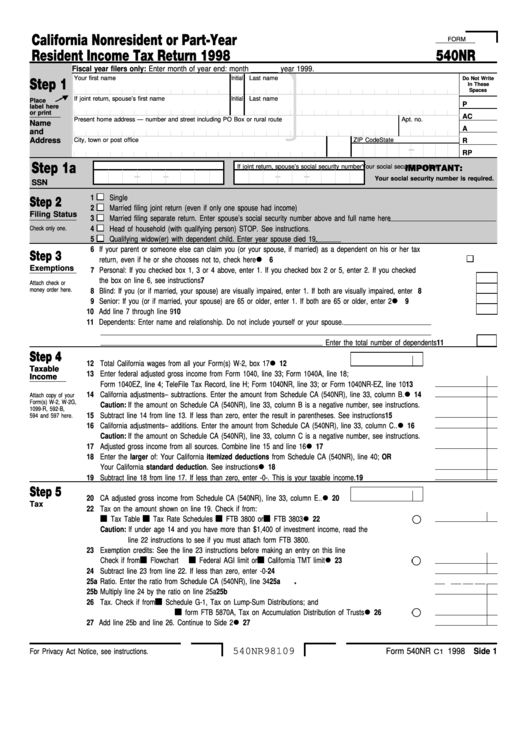

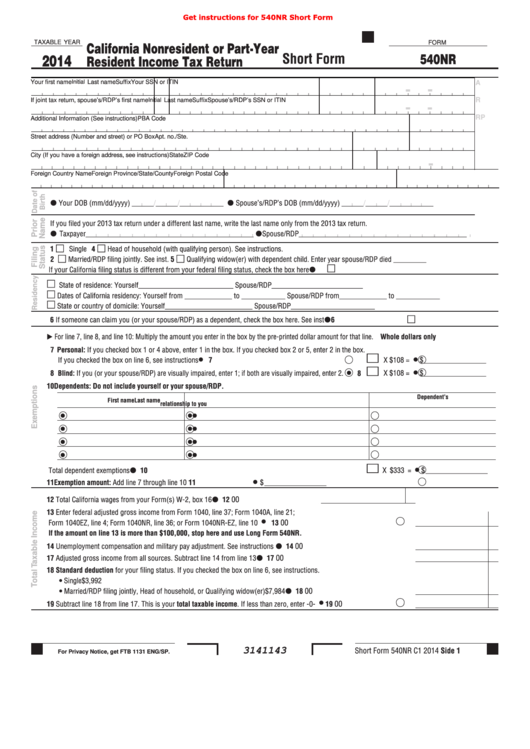

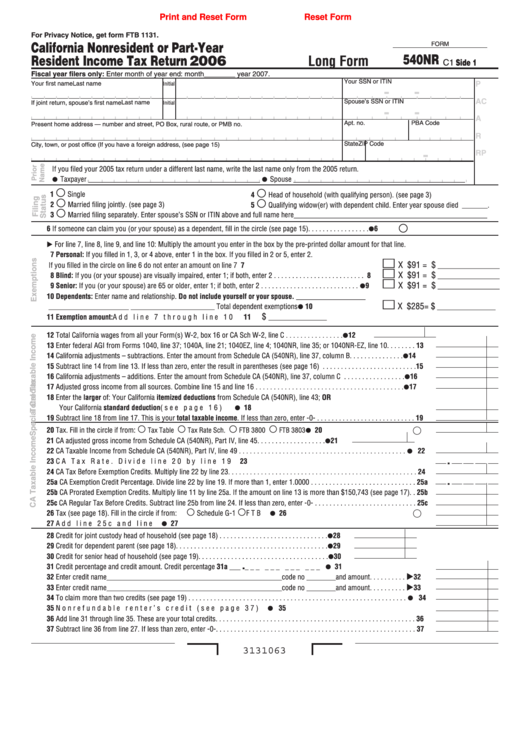

540Nr Tax Form

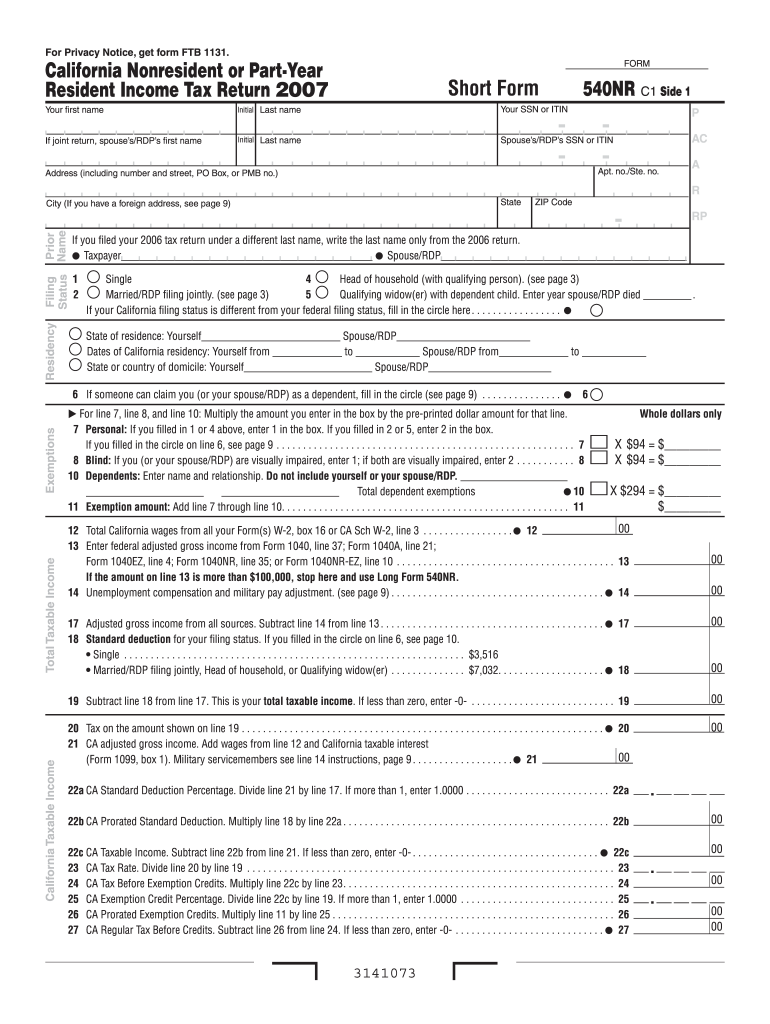

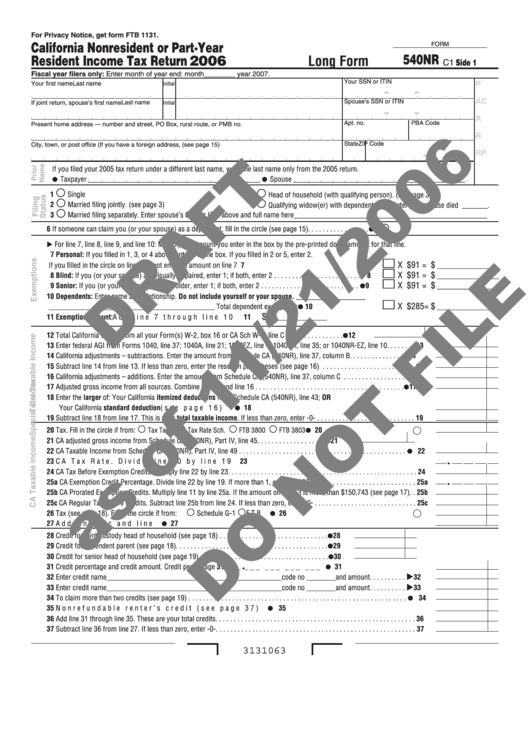

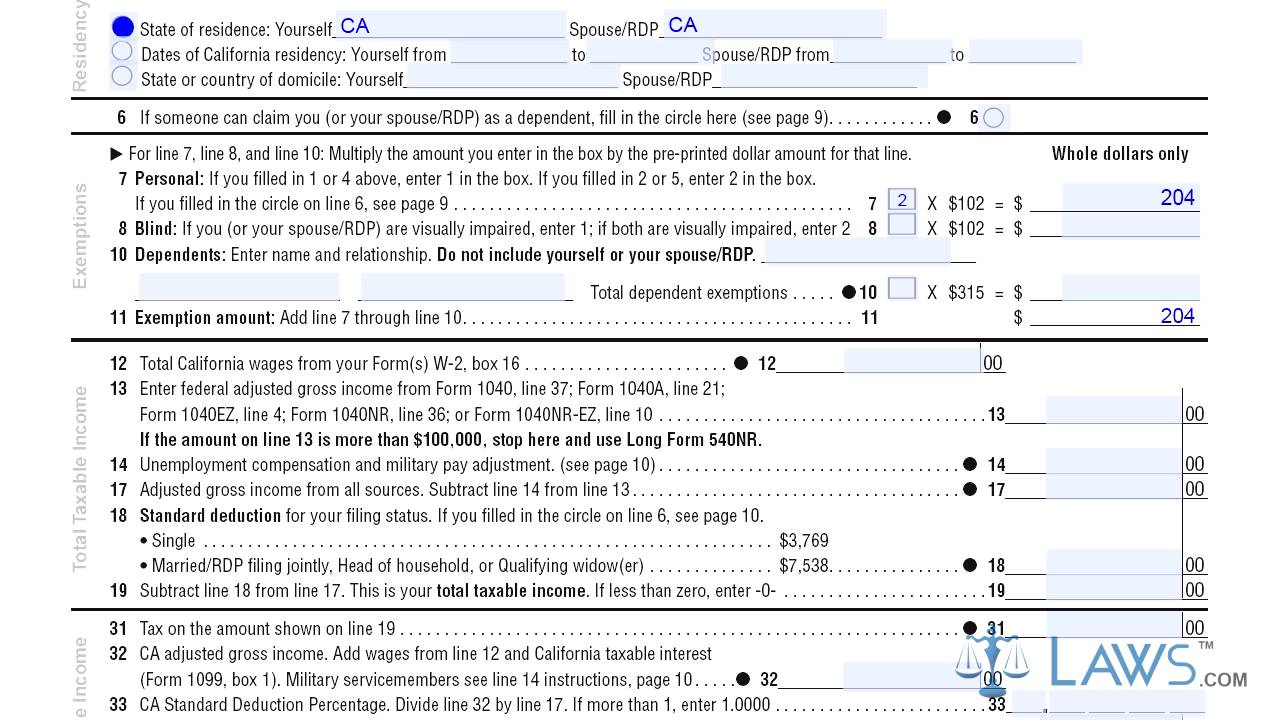

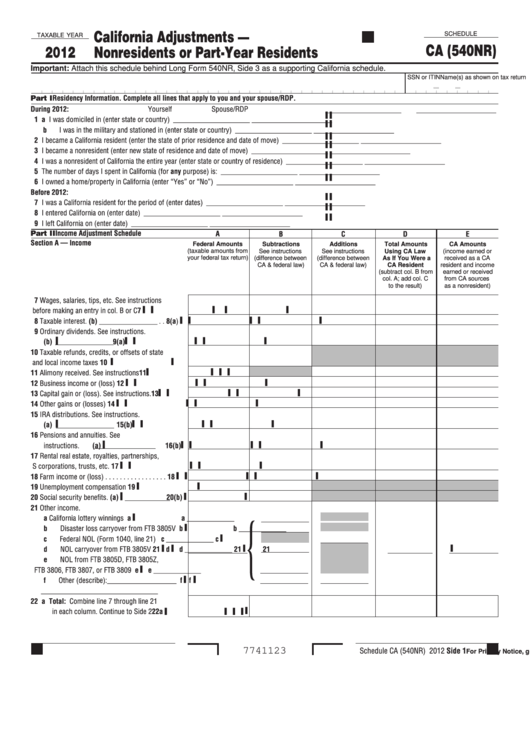

540Nr Tax Form - Tax on a qualified retirement plan. Download or email ador 10194 & more fillable forms, register and subscribe now! Enter month of year end: Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. Web if you have a tax liability for 2022 or owe any of the following taxes for 2022, you must file form 540nr. It appears you don't have a pdf plugin. Do not mark in this area. Part i alternative minimum taxable income (amti) important: • form 940 • form 940 schedule r. Web resident income tax return fiscal year filers only: Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. Simply complete form 540 (if you're a resident) or. Need to change or amend an accepted california state income tax return for the current or previous tax year? Web 88 81 80 one staple. It appears you don't have a pdf plugin. Ador 10177 (11) eff 8/2/2012 arizona form nonresident personal income tax. Web we last updated the nonresident personal income tax package in february 2023, so this is the latest version of form 140nr, fully updated for tax year 2022. Individual estimated tax payment booklet. Enter month of year end: It appears you don't have a pdf plugin. Free, fast, full version (2023) available! Complete, edit or print tax forms instantly. Web 88 81 80 one staple. Tax on a qualified retirement plan. Ad outgrow.us has been visited by 10k+ users in the past month Individual estimated tax payment booklet. Web tax year 2023 940 mef ats scenario 3 crocus company. Web resident income tax return fiscal year filers only: Fill out your personal information at the top of the form,. Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. Web attach this schedule to form 540nr. Web up to $40 cash back 01. Enter month of year end: No longer have the form. Individual estimated tax payment booklet. Free, fast, full version (2023) available! Simply complete form 540 (if you're a resident) or. Tax on a qualified retirement plan. Ad outgrow.us has been visited by 10k+ users in the past month • form 940 • form 940 schedule r. Complete, edit or print tax forms instantly. Web if you have a tax liability for 2022 or owe any of the following taxes for 2022, you must file form 540nr. Ador 10177 (11) eff 8/2/2012 arizona form nonresident personal income tax. Web attach this schedule to form 540nr. Tax on a qualified retirement plan. Free, fast, full version (2023) available! For the 2019 taxable year we: It appears you don't have a pdf plugin. Name(s) as shown on form 540nr. It covers the most common credits and is also the most used tax form for california residents. Name(s) as shown on form 540nr. Web tax year 2023 940 mef ats scenario 3 crocus company. It covers the most common credits and is also the most used tax form for california residents. Fill out your personal information at the top of the form,. Individual estimated tax payment booklet. Tax on a qualified retirement plan. 1 single 2 3 married/rdp filing jointly. Ad outgrow.us has been visited by 10k+ users in the past month It covers the most common credits and is also the most used tax form for california residents. Check here if this is an amended return. Tax on a qualified retirement plan. Web 88 81 80 one staple. Web tax year 2023 940 mef ats scenario 3 crocus company. Web if you have a tax liability for 2020 or owe any of the following taxes for 2020, you must file form 540nr. Free, fast, full version (2023) available! Complete, edit or print tax forms instantly. No longer have the form. Ador 10177 (11) eff 8/2/2012 arizona form nonresident personal income tax. Check here if this is an amended return. Name(s) as shown on form 540nr. Web up to $40 cash back 01. Do not mark in this area. • form 940 • form 940 schedule r. Need to change or amend an accepted california state income tax return for the current or previous tax year? Web if you have a tax liability for 2022 or owe any of the following taxes for 2022, you must file form 540nr. Part i alternative minimum taxable income (amti) important: It covers the most common credits and is also the most used tax form for california residents. Fill out your personal information at the top of the form,. Download or email ador 10194 & more fillable forms, register and subscribe now! Web resident income tax return fiscal year filers only:2007 540nr fillable form Fill out & sign online DocHub

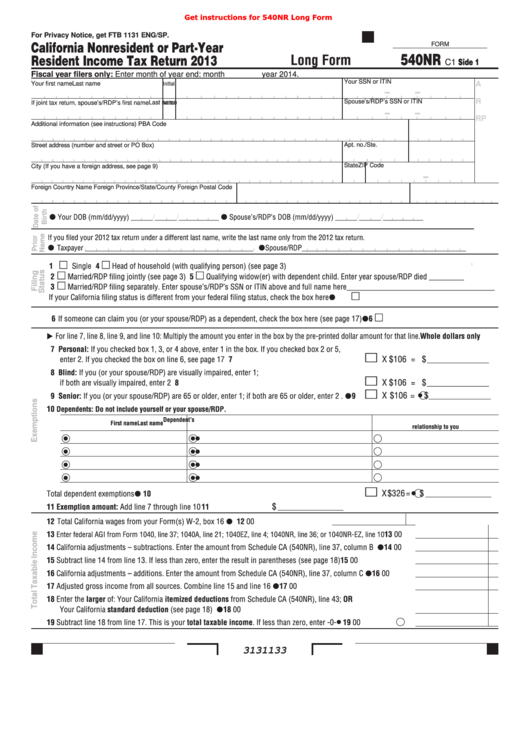

Form 540nr C1 Draft California Nonresident Or PartYear Resident

Form 540NR California Nonresident or Part Year Resident Tax

Fillable Schedule Ca (540nr) California Adjustments, Nonresidents Or

Form 540nr California Nonresident Or PartYear Resident Tax

Fillable Form 540nr California Nonresident Or PartYear Resident

Fillable Form 540nr California Nonresident Or PartYear Resident

Fillable Form 540nr California Nonresident Or PartYear Resident

Fillable Form 540nr California Nonresident Or PartYear Resident

CA FTB 540NR Schedule CA 20202022 Fill out Tax Template Online US

Related Post: