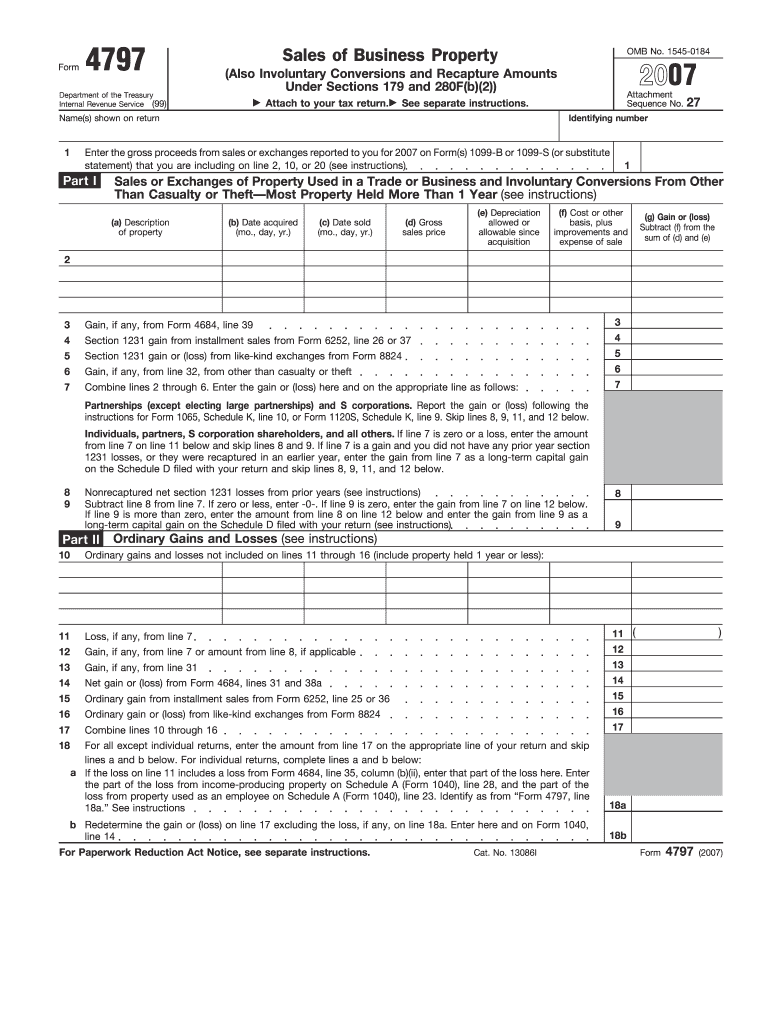

4797 Form Instructions

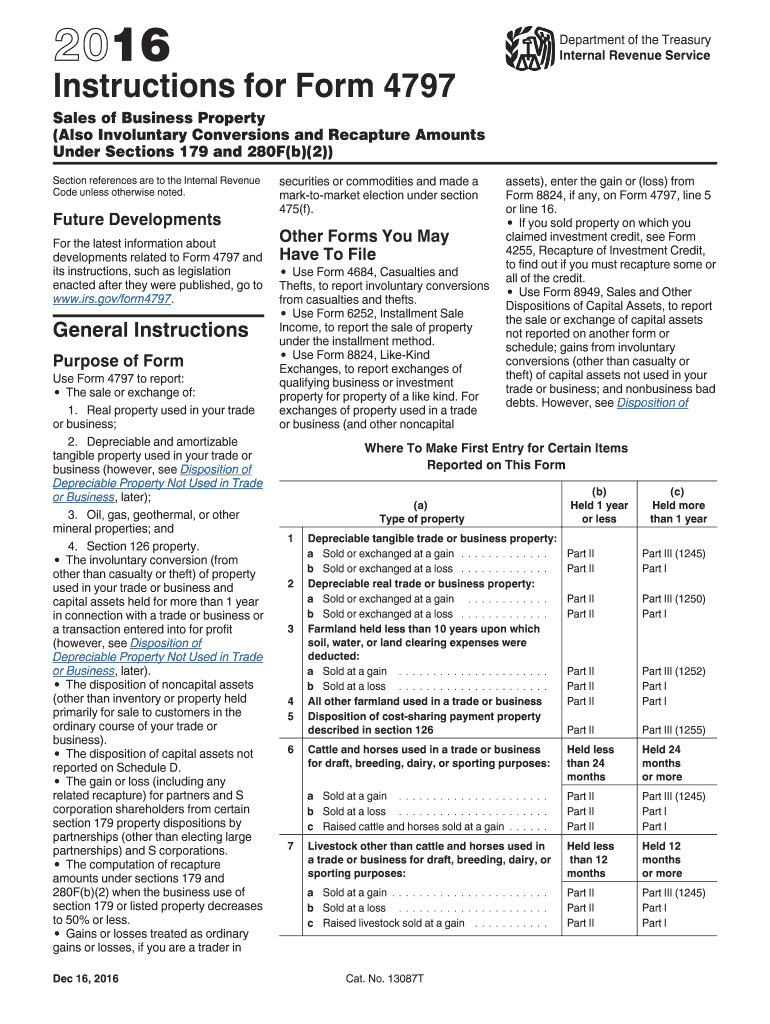

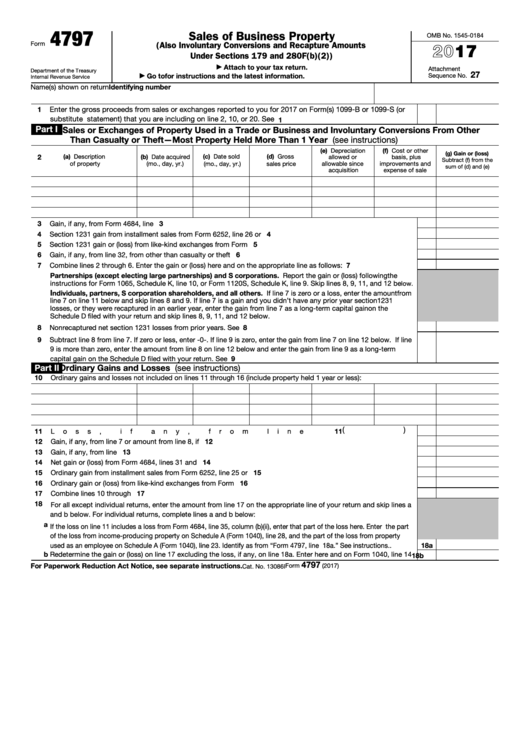

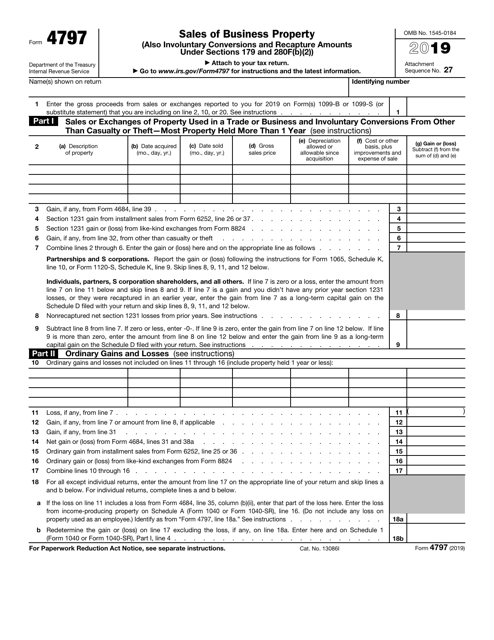

4797 Form Instructions - An installment sale of property used in your business or that earns rent or royalty income may result in a capital gain, an ordinary gain, or both. Report the gain or (loss) following the instructions for form 1065, schedule. 27 name(s) shown on return identifying number 1a enter the gross. Web step 1: Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Form 6252, lines 1 through 4; Form 4797 is for reporting the sale of capital. The involuntary conversion of property and. Web form 4797 department of the treasury. Web enter the amount in ordinary gain (loss) to be reported on 4797, line 10, or in passive ordinary gain (loss) to be reported on 4797, line 10. All or part of any. Date sold and property type are required entries. Upload, modify or create forms. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Form 6252, lines 1 through 4; Or form 8824, line 12 or 16. Web according to the irs, you should use your 4797 form to report all of the following: Get ready for tax season deadlines by completing any required tax forms today. Gains and losses on the sale of nondepreciable assets. Complete and file form 4797: Depreciable and amortizable tangible property used in your. Upload, modify or create forms. The sale or exchange of property. Web 4797 form sales of business property omb no. Report the gain or (loss) following the instructions for form 1065, schedule. Web form 4797 department of the treasury internal revenue service sales of business property. Date sold and property type are required entries. • report the amount from. Or form 8824, line 12 or 16. Web form 4797 department of the treasury. Complete and file form 4797: Web for instructions and the latest information. • report the amount from. Web to add form 4797 to your return: Web complete form 4797, line 10, columns (a), (b), and (c); Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Web for instructions and the latest information. The involuntary conversion of property and. Web enter the amount in ordinary gain (loss) to be reported on 4797, line 10, or in passive. Or form 8824, line 12 or 16. Web for instructions and the latest information. Web to add form 4797 to your return: First of all, you can get this form from the department of treasury or you can just download the irs form 4797. The sale or exchange of property. An installment sale of property used in your business or that earns rent or royalty income may result in a capital gain, an ordinary gain, or both. • report the amount from line 1 above on form 4797, line 10, column (d); All or part of any. Or form 8824, parts i and ii. Form 6252, lines 1 through 4; Form 4797 is for reporting the sale of capital. An installment sale of property used in your business or that earns rent or royalty income may result in a capital gain, an ordinary gain, or both. Real property used in your trade or business; Try it for free now! Web for instructions and the latest information. Ad download or email irs 4797 & more fillable forms, register and subscribe now! Web for instructions and the latest information. Web to add form 4797 to your return: Or form 8824, line 12 or 16. Get ready for tax season deadlines by completing any required tax forms today. Web according to the irs, you should use your 4797 form to report all of the following: • report the amount from. Web for instructions and the latest information. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Web to add form 4797 to your return: Gains and losses on the sale of nondepreciable assets. Web form 4797 department of the treasury. Complete and file form 4797: Or form 8824, line 12 or 16. Form 4797 is for reporting the sale of capital. Date sold and property type are required entries. An installment sale of property used in your business or that earns rent or royalty income may result in a capital gain, an ordinary gain, or both. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Web step 1: First of all, you can get this form from the department of treasury or you can just download the irs form 4797. Select take to my tax return, search for 4797, sale of business property (use this exact phrase) and then choose the jump to. The involuntary conversion of property and. Real property used in your trade or business; Web use form 4797 to report the following. Web 4797 form sales of business property omb no.IRS Form 4797 Instructions (2006) Exeter 1031 Exchange Services

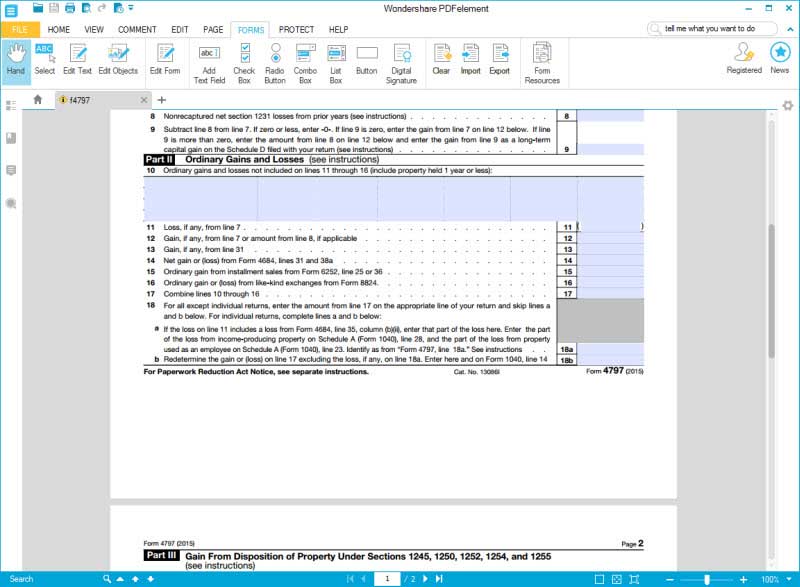

IRS Form 4797 Guide for How to Fill in IRS Form 4797

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

4797 Instructions Form Fill Out and Sign Printable PDF Template signNow

Fillable Form 4797 Sales Of Business Property 2016 printable pdf

IRS Form 4797 Download Fillable PDF or Fill Online Sales of Business

Instructions for Form 4797 Internal Revenue Service Fill Out and Sign

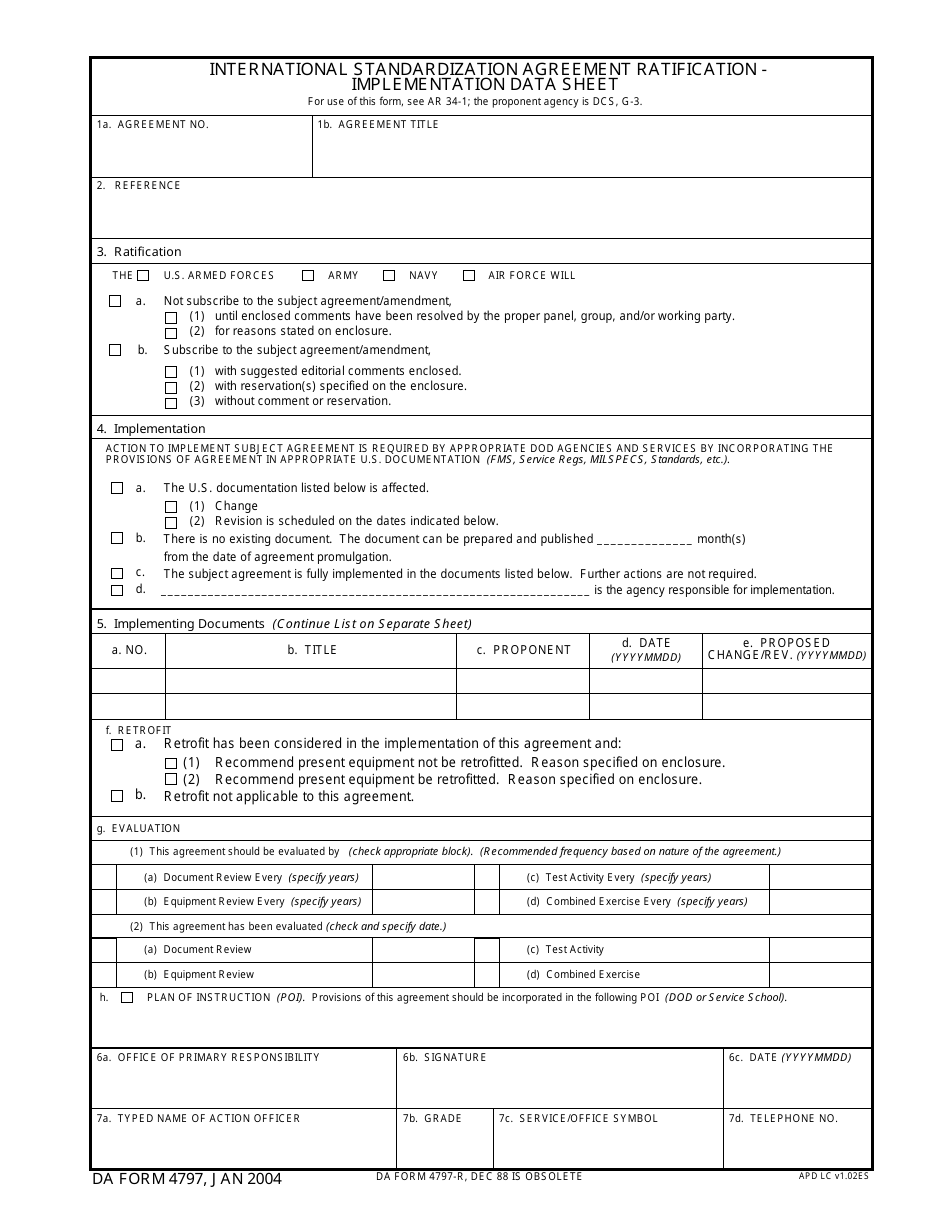

DA Form 4797 Fill Out, Sign Online and Download Fillable PDF

IRS 4797 2019 Fill and Sign Printable Template Online US Legal Forms

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Related Post:

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://www.formsbirds.com/formimg/more-tax-forms/8161/form-4797-sales-of-business-property-2014-l2.png)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://image.slidesharecdn.com/1273290/95/form-4797sales-of-business-property-2-728.jpg?cb=1239371111)