2290 Amendment Form

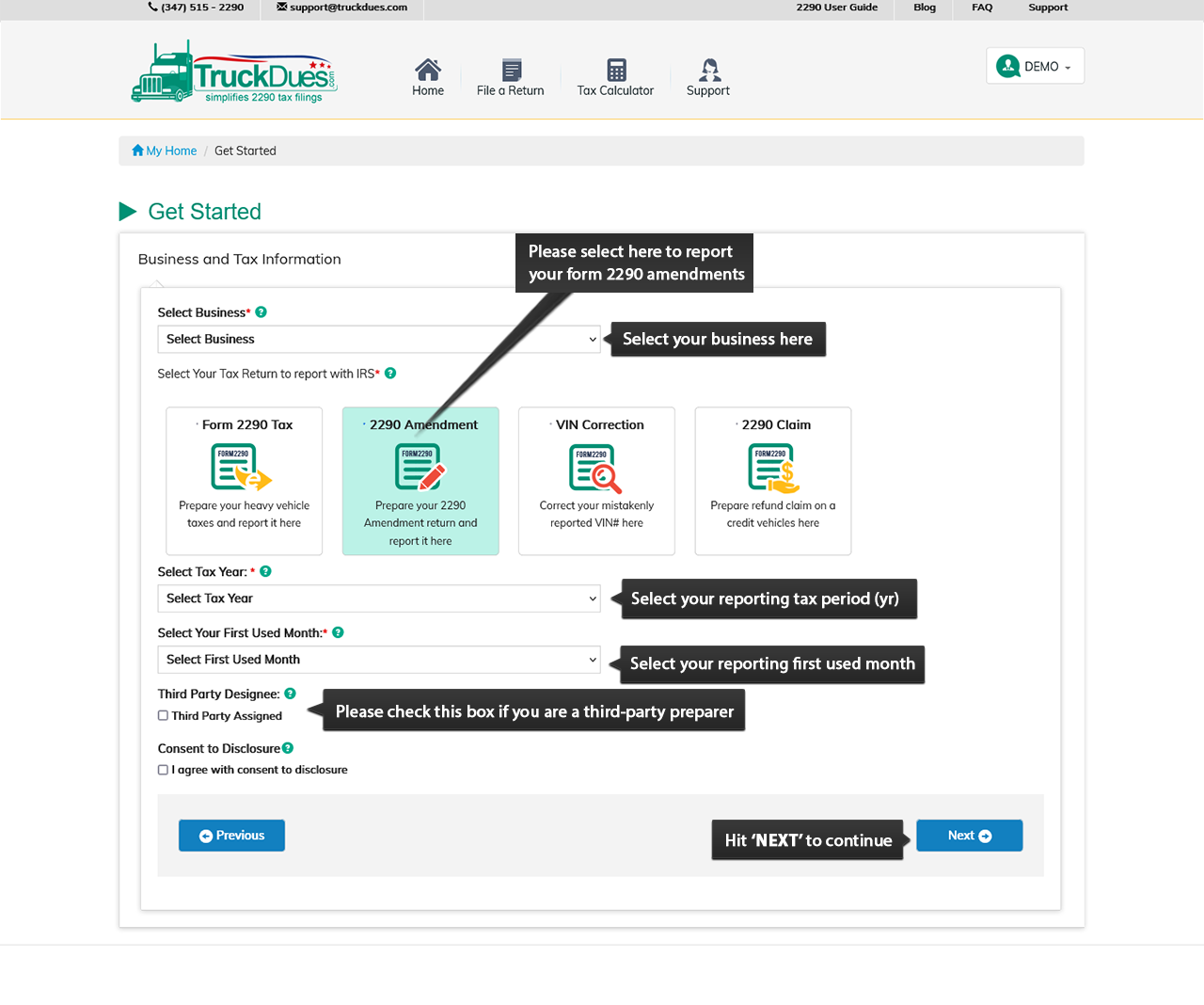

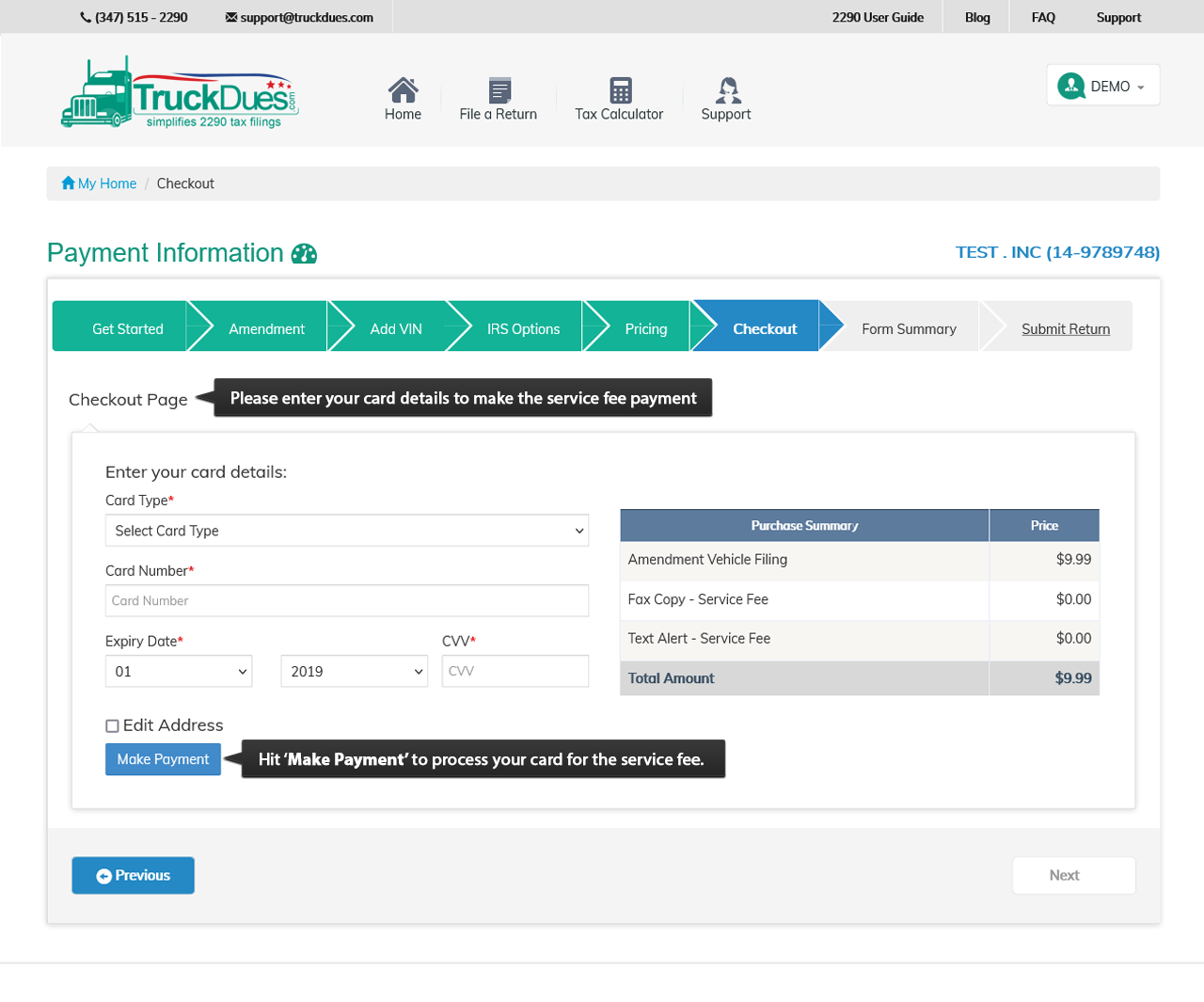

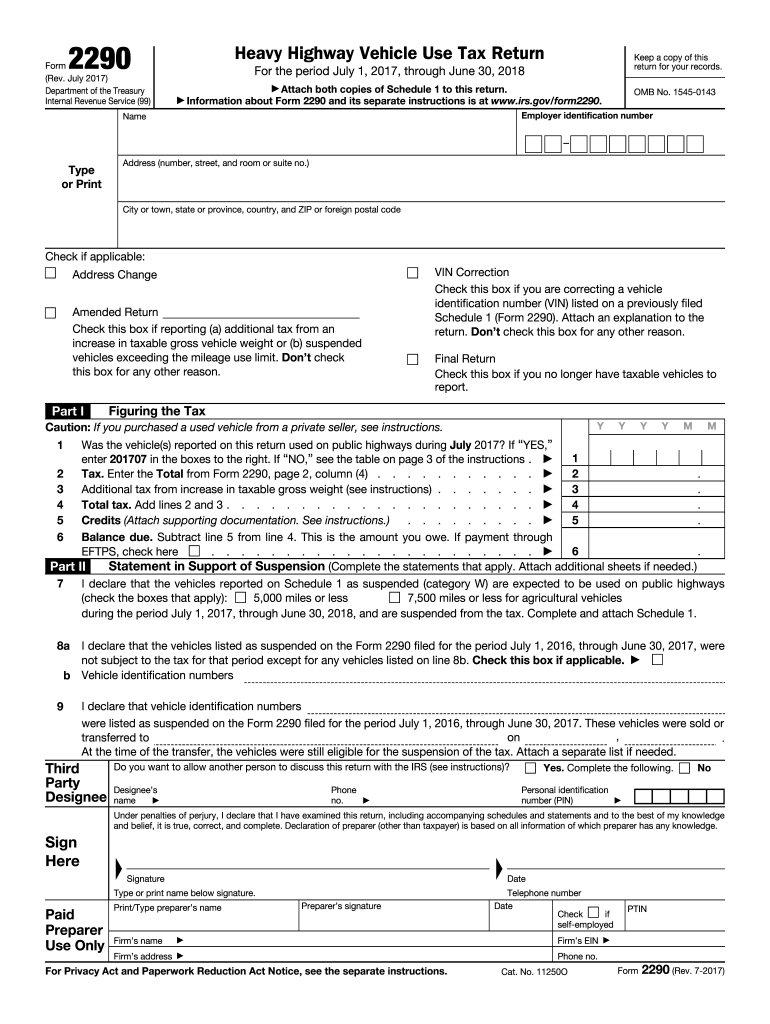

2290 Amendment Form - Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web irs form 2290 amendments online. It’s not a new form or different from form 2290. Web form 2290 returns can be amended only for the following reasons. Form 2290 amendment is an irs return that must be filed when there is a change in the reportable information of the heavy highway vehicle. File now and get your stamped schedule 1 in minutes. Do your truck tax online & have it efiled to the irs! The current period begins july 1, 2023, and ends june 30, 2024. Change in mileage use limit. Web form 2290 amendments learn more about the amendments you can file for form 2290 last updated on january 12, 2022 by eformblogadmin the tax code is a very long and complicated piece of information. File your 2290 online & get schedule 1 in minutes. Since there are so many different requirements and rules, there is always the possibility of errors occurring when filing them. What information can you amend with 2290 amendment? In any of the following scenarios, you have the option to do amendment for your previously accepted form 2290 returns: In other. 2290 amendment is usually filed for two reasons: Enter your business information step 4: Web what is form 2290 amendment? Here are a few steps for clients to make amendments with irs. Select 2290 amendment on the dashboard step 3: What information can you amend with 2290 amendment? Three events that require form 2290 amendments: Choose the amendment type step 5: 2290 amendment is usually filed for two reasons: A vehicle identification number (vin) was reported incorrectly. Increase in taxable gross weight. Here are a few steps for clients to make amendments with irs. Go to www.irs.gov/form2290 for instructions and the latest information. Tax experts standing by to help. It’s just a filing option on form 2290, and needs to be filed separately. If you carry out any changes to a previously filed and file it again, it is called an amended return. A vehicle previously reported as suspended exceeded the mileage use limit. Web the irs will stop mailing package 2290 to you. Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year. When the gross taxable weight of the vehicle increases. In other cases, if your vehicle information is wrong or changed from the previous form 2290 then the 2290 amendment is a must in order to report to the irs. 2290 amendment must be filed separately in correspondence with the previously filed 2290 returns to “amend” the reportable vehicle information. Web. Web irs form 2290 amendments online. The current period begins july 1, 2023, and ends june 30, 2024. Web what is form 2290 amendment? Increase in taxable gross weight mileage use limit exceeded incorrect vin increase in taxable gross weight All vehicles that are taxable, creditable and suspended can be amended. A return is considered an amended return if you are: Web steps for file a 2290 amendment form tax2efile.com has made the 2290 amendment for all the said categories in a simple way. How can i amend irs form 2290? Web when you find an error in filing form 2290 truck tax return, the tax filer must amend their return. Vehicle identification number (vin) correction. Generally the 2290 taxes are reported from july and august 31 is the deadline. Change in mileage use limit. However 2290 taxes are due based on the first use month on a public highway during the taxable period. Form 2290 amendment is a way for trucking business owners to make changes to their initial form. Web what is form 2290 amendment? Web what is the form 2290 amendment? Since there are so many different requirements and rules, there is always the possibility of errors occurring when filing them. Choose the amendment type step 5: You can only amend 2 aspects of 2290 reports with the 2290 amendment form. The current period begins july 1, 2023, and ends june 30, 2024. Reporting additional tax due to increase in taxable gross vehicle weight reporting an increase in mileage use limit on a suspended vehicles All vehicles that are taxable, creditable and suspended can be amended. Select 2290 amendment on the dashboard step 3: In any of the following scenarios, you have the option to do amendment for your previously accepted form 2290 returns: In other cases, if your vehicle information is wrong or changed from the previous form 2290 then the 2290 amendment is a must in order to report to the irs. Web irs form 2290 amendments online. Choose the amendment type step 5: 2290 amendment must be filed separately in correspondence with the previously filed 2290 returns to “amend” the reportable vehicle information. Web entities and individuals alike must file 2290 amendment in a variety of scenarios, where they communicate to the irs about any changes to the vehicle or misreported information. A vehicle previously reported as suspended exceeded the mileage use limit. It’s just a filing option on form 2290, and needs to be filed separately. When requesting an installment agreement for a business, form. Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year to stay on road. What information can you amend with 2290 amendment? A vehicle identification number (vin) was reported incorrectly. Generally the 2290 taxes are reported from july and august 31 is the deadline. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web the irs will stop mailing package 2290 to you. However 2290 taxes are due based on the first use month on a public highway during the taxable period.Form 2290 Amendment e File Step by Step Instructions

Form 2290 Amendment e File Step by Step Instructions

Irs Form 2290 Status Universal Network

Form 2290 Amendments What Are They And How Do You File?

Irs amendments 2290

Form 2290 Amendment e File Step by Step Instructions

Irs amendments 2290

2290 Form Fill Out and Sign Printable PDF Template signNow

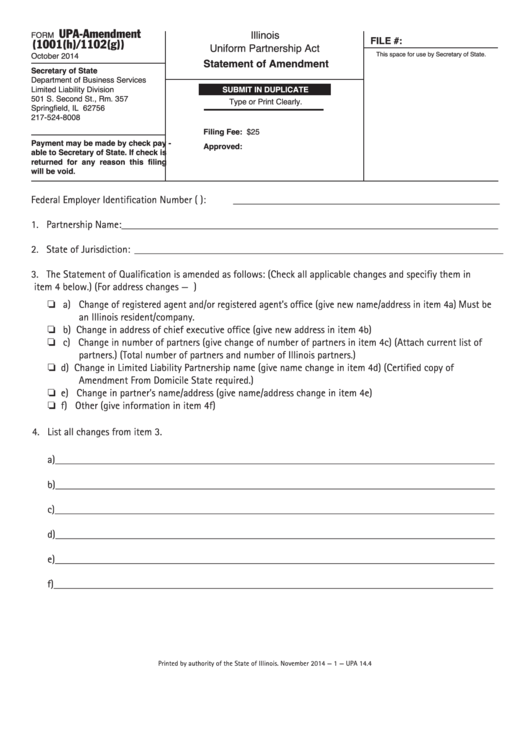

Fillable Statement Of Amendment printable pdf download

Irs Form 2290 Status Universal Network

Related Post: