2019 Form 1099 Nec

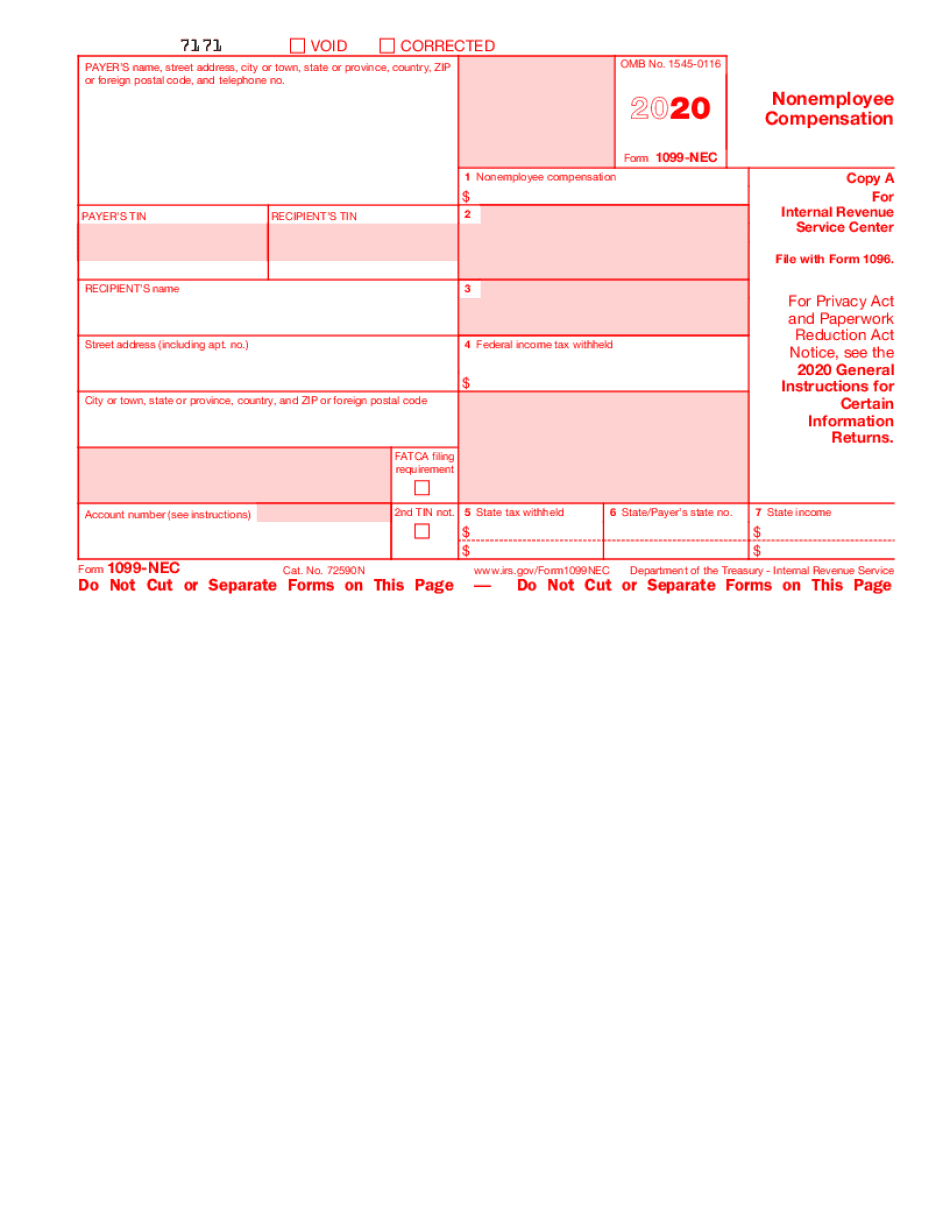

2019 Form 1099 Nec - If you are required to file a return, a. Ad approve payroll when you're ready, access employee services & manage it all in one place. Persons with a hearing or speech disability with. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Deliver form copies by mail or online. If your business made at least one of these payments to a 1099 vendor within the financial. Web $ (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. See how we can help! Web filing date when nonemployee compensation (nec) payments are reported in box 7. Ad read customer reviews & find best sellers. For your protection, this form may show only the last four digits of your social security number. Only few simple steps to complete & transmit to the irs. Starting in tax year 2020,. Payer’s information, including name, address and taxpayer identification number (tin). Ad read customer reviews & find best sellers. Starting in tax year 2020,. Payroll seamlessly integrates with quickbooks® online. Ad file form 1099 nec for 2022 with irs & state. See how we can help! Ad for more than 20 years, iofm has reduced your peers’ compliance risk. However, beginning in tax year 2020, that compensation needs to. Give these forms to payees and report them to the. Payroll seamlessly integrates with quickbooks® online. Web filing date when nonemployee compensation (nec) payments are reported in box 7. Persons with a hearing or speech disability with. Web filing date when nonemployee compensation (nec) payments are reported in box 7. However, beginning in tax year 2020, that compensation needs to. Ad for more than 20 years, iofm has reduced your peers’ compliance risk. Starting in tax year 2020,. Ad approve payroll when you're ready, access employee services & manage it all in one place. See how we can help! Ad for more than 20 years, iofm has reduced your peers’ compliance risk. If you are required to file a return, a. Ad approve payroll when you're ready, access employee services & manage it all in one place. Ad approve payroll when you're ready, access employee services & manage it all in one place. Payroll seamlessly integrates with quickbooks® online. Ad file form 1099 nec for 2022 with irs & state. Persons with a hearing or speech disability with. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported.. If you are required to file a return, a. Persons with a hearing or speech disability with. Starting in tax year 2020,. Web $ (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. See how we can help! For your protection, this form may show only the last four digits of your social security number. Only few simple steps to complete & transmit to the irs. If you are required to file a return, a. Ad for more than 20 years, iofm has reduced your peers’ compliance risk. Payer’s information, including name, address and taxpayer identification number (tin). Ad for more than 20 years, iofm has reduced your peers’ compliance risk. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. For your protection, this form may show only the last four digits. Payer’s information, including name, address and taxpayer identification number (tin). Web filing date when nonemployee compensation (nec) payments are reported in box 7. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Ad for more than 20 years, iofm has reduced your peers’ compliance risk. Web if you are required to file a. Payroll seamlessly integrates with quickbooks® online. Starting in tax year 2020,. Web $ (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. Used to report all payments over $600 made to independent contractors, freelancers, consultants, service providers, attorneys, and other non. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Ad approve payroll when you're ready, access employee services & manage it all in one place. Payer’s information, including name, address and taxpayer identification number (tin). However, beginning in tax year 2020, that compensation needs to. If your business made at least one of these payments to a 1099 vendor within the financial. Deliver form copies by mail or online. Ad for more than 20 years, iofm has reduced your peers’ compliance risk. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. For your protection, this form may show only the last four digits of your social security number. Web filing date when nonemployee compensation (nec) payments are reported in box 7. Ad read customer reviews & find best sellers. If you are required to file a return, a. Ad approve payroll when you're ready, access employee services & manage it all in one place. Give these forms to payees and report them to the. Web instructions for recipient recipient's taxpayer identification number (tin). Payroll seamlessly integrates with quickbooks® online.How has Form 1099MISC Changed with the Return of Form 1099NEC?

How to Report and Pay Taxes on 1099NEC

A Comprehensive Guide On Form 1099NEC For The Tax Year 20202021

What is Form 1099NEC for Nonemployee Compensation?

1099MISC or 1099NEC? What You Need to Know about the New IRS

What Is Form 1099NEC?

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

Form 1099NEC Instructions and Tax Reporting Guide

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

Form 1099 Nec Printable Blank PDF Online

Related Post:

:strip_icc()/i-received-a-1099-misc-form-what-do-i-do-with-it-35d7e9d37e8949de8c556777494dde39.png)

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)