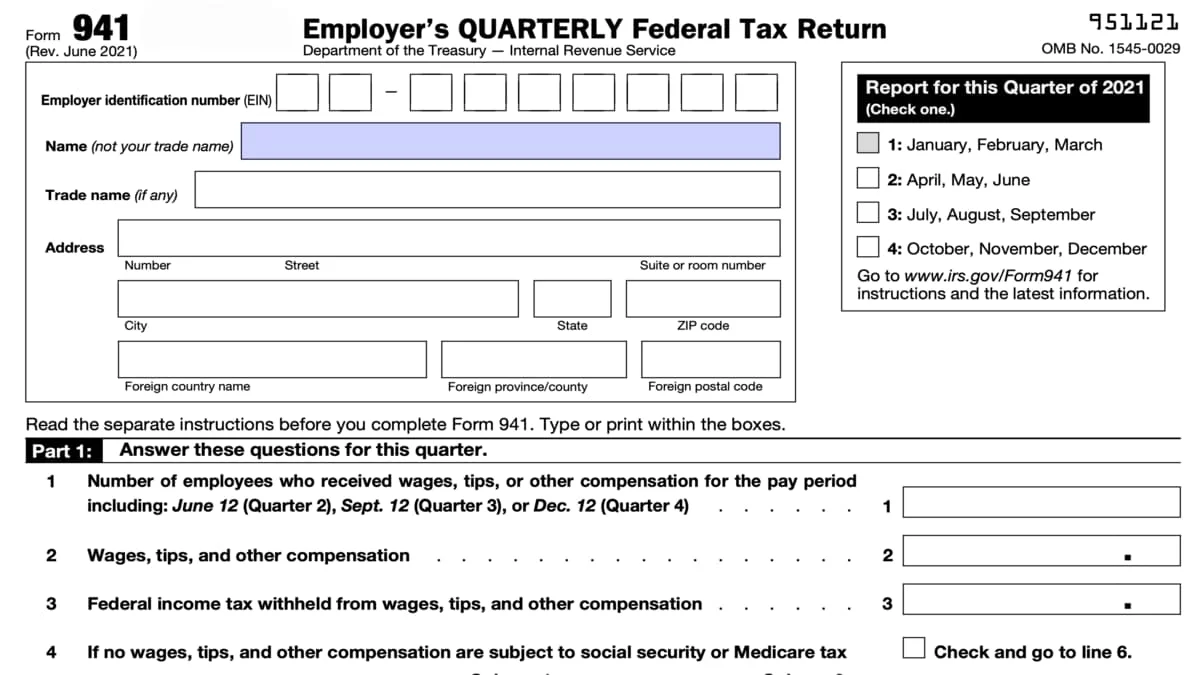

2017 941 Form

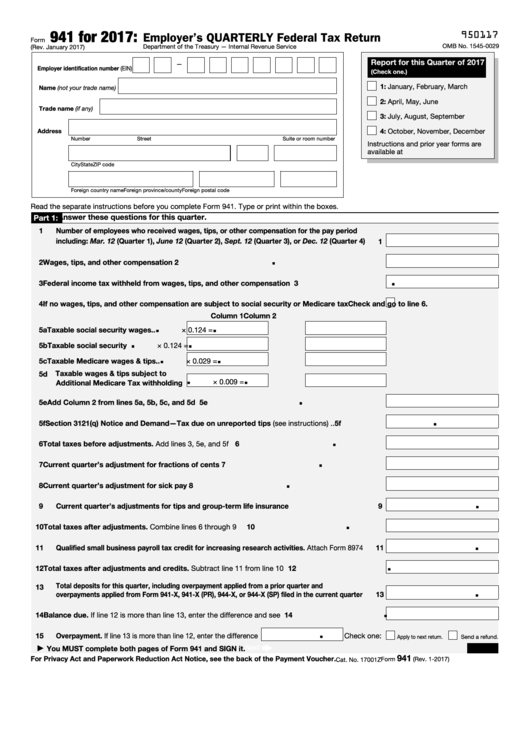

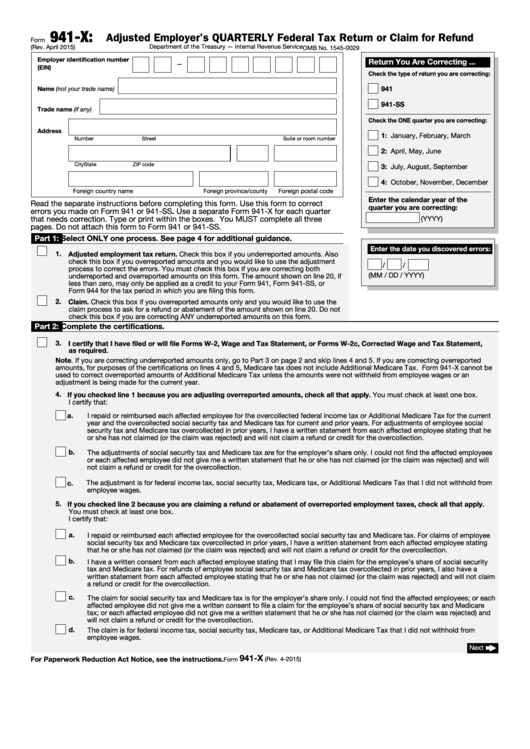

2017 941 Form - Web june 30, 2017) form 941, which is filed by july 31, 2017, is the first quarter that you can take the qualified small business payroll tax credit for increasing research Department of the treasury — internal revenue service omb no. Web get irs 941 2017. We need it to figure and collect the right amount of tax. Save your changes and share irs form 941 2017. We will use the completed voucher to credit your payment. Answer these questions for this quarter. For more information, visit irs.gov and enter “cobra” in. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web form 941 employer's quarterly federal tax return. Web report for this quarter of 2017 (check one.) 1: Easily fill out pdf blank, edit, and sign them. April 2017) adjusted employer's quarterly federal tax return or claim for refund. Employers engaged in a trade or business who. Web upload the 941 form 2017. Tell us about your business a. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web june 30, 2017) form 941, which is filed by july 31, 2017, is the first quarter that you can take the qualified small business payroll tax credit for increasing research Web you. Edit & sign 2017 form 941 from anywhere. Ad uslegalforms.com has been visited by 100k+ users in the past month Web complete form 941 (rev. April 2017) adjusted employer's quarterly federal tax return or claim for refund. Employer identification number (ein) tell us about your. Employer identification number (ein) tell us about your. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from. Employer's quarterly federal tax return online with us legal. For more information, visit irs.gov and enter “cobra” in. Edit & sign 2017 form 941 from anywhere. Instructions for form 1040 (2020) pdf. Web you can file 941 for 2017 as well 2016 tax year in few simple steps. Form 941 is used by employers. 12 (quarter 1), june 12. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web upload the 941 form 2017. We will use the completed voucher to credit your payment. Web form 941 employer's quarterly federal tax return. January 2017) department of the treasury — internal revenue service. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from. We need it to figure and collect the right amount of tax. Web upload the 941 form 2017. Employee's withholding certificate form 941; We will use the completed voucher to credit your payment. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Web you can file 941 for 2017. For more information, see the instructions for. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web form 941 employer's quarterly federal tax return. Tell us about your business a. File form 941 for the fourth quarter of the previous calendar year and deposit any undeposited income, social. Web report for this quarter of 2017 (check one.) 1: Web file form 941 or form 944. Answer these questions for this quarter. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Department of the treasury — internal revenue service omb no. We need it to figure and collect the right amount of tax. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Edit & sign 2017 form 941 from anywhere. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Employer identification number (ein) tell us about your. Rate the 941 for 2017. January 2017) department of the treasury — internal revenue service. Save your changes and share irs form 941 2017. Web form 941 employer's quarterly federal tax return. Instructions for form 1040 (2020) pdf. Web file form 941 or form 944. For more information, see the instructions for. For more information, visit irs.gov and enter “cobra” in. Number of employees who received wages, tips, or other compensation for the pay period including: Employer's quarterly federal tax return online with us legal forms. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. File form 941 for the fourth quarter of the previous calendar year and deposit any undeposited income, social security, and medicare taxes. Tell us about your business a. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Department of the treasury — internal revenue service omb no.941 Forms TaxUni

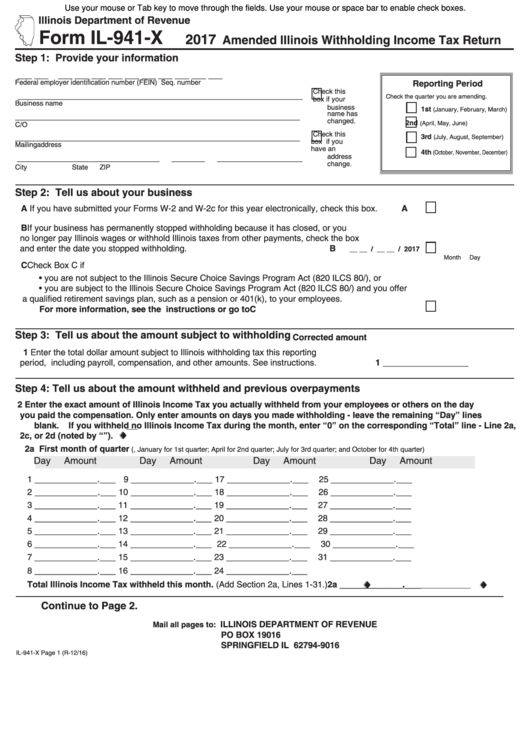

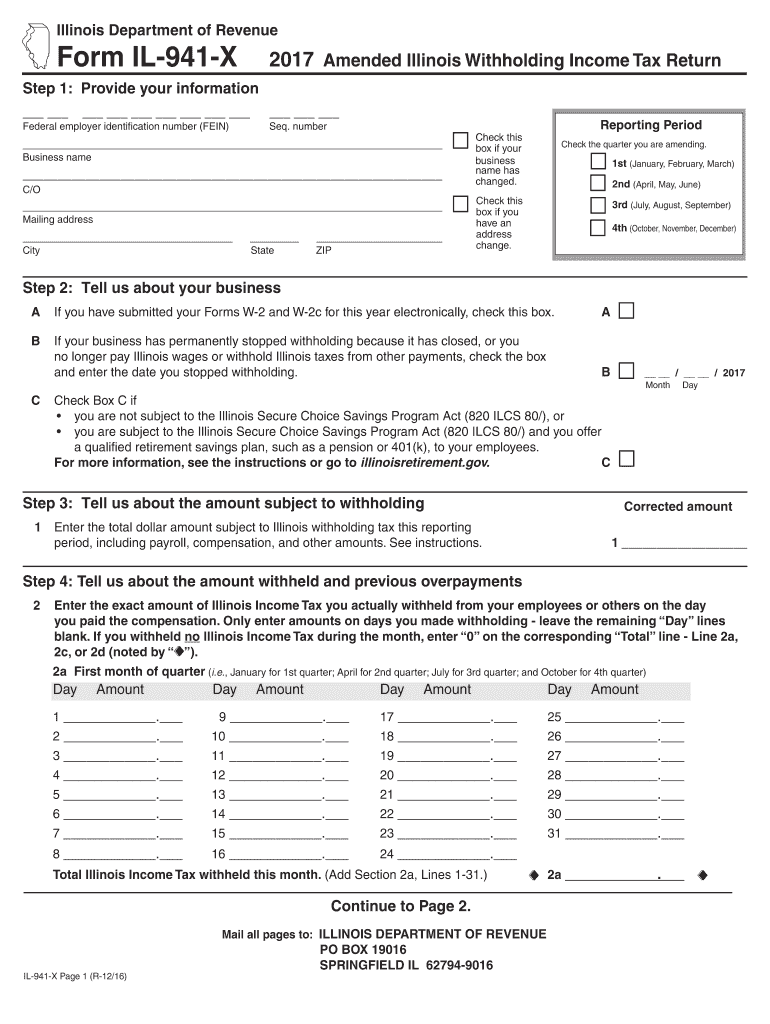

Fillable Form Il941X Amended Illinois Withholding Tax Return

3.11.13 Employment Tax Returns Internal Revenue Service

Fillable Form 941 Employer'S Quarterly Federal Tax Return 2017

Form 941 2017

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

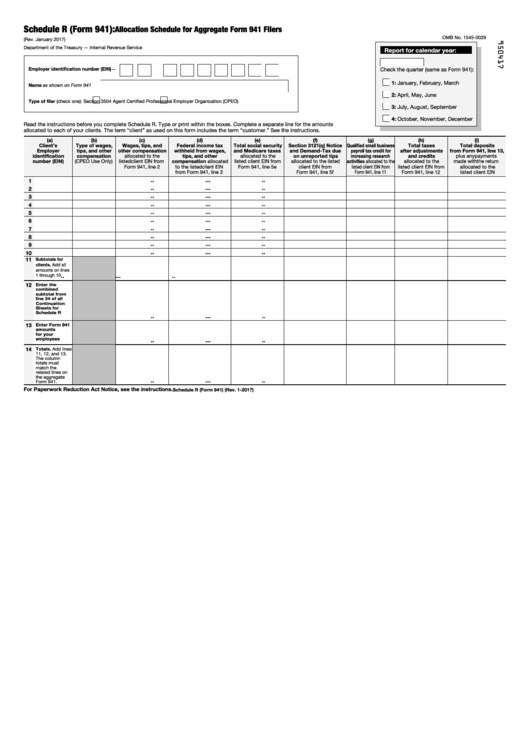

Fillable Schedule R (Form 941) Allocation Schedule For Aggregate Form

2017 Form IL DoR IL941X Fill Online, Printable, Fillable, Blank

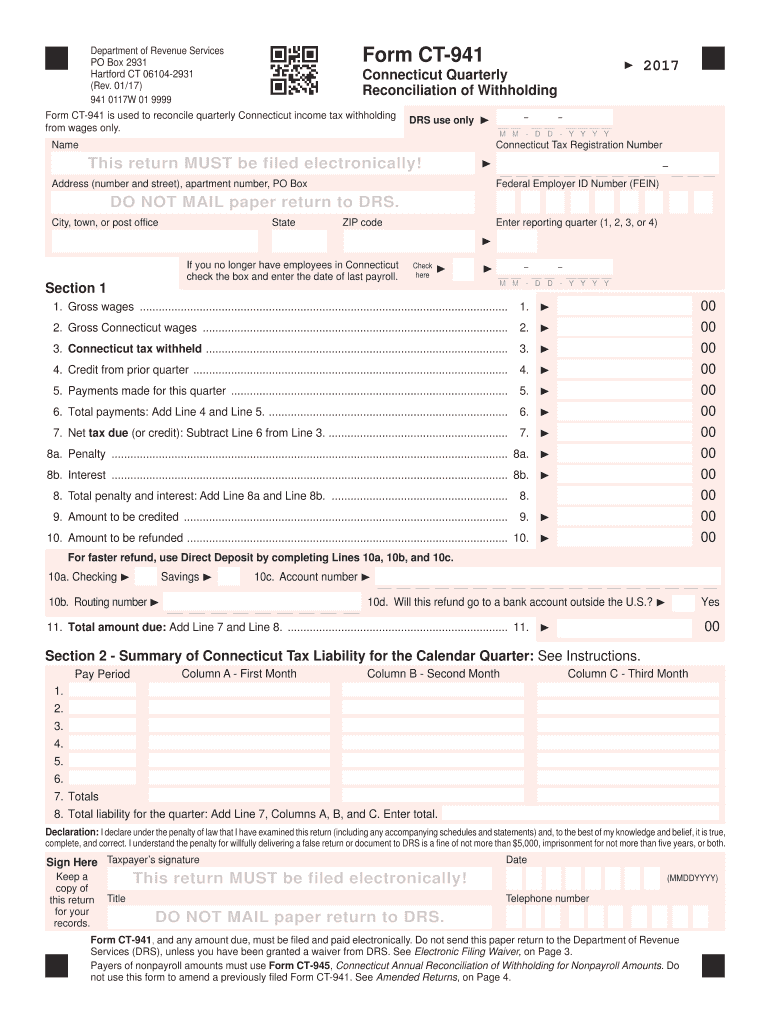

Ct 941 Form 2019 Fill Out and Sign Printable PDF Template signNow

Irs 941 Instructions Publication 15 All Are Here

Related Post: