199A Worksheet By Activity Form

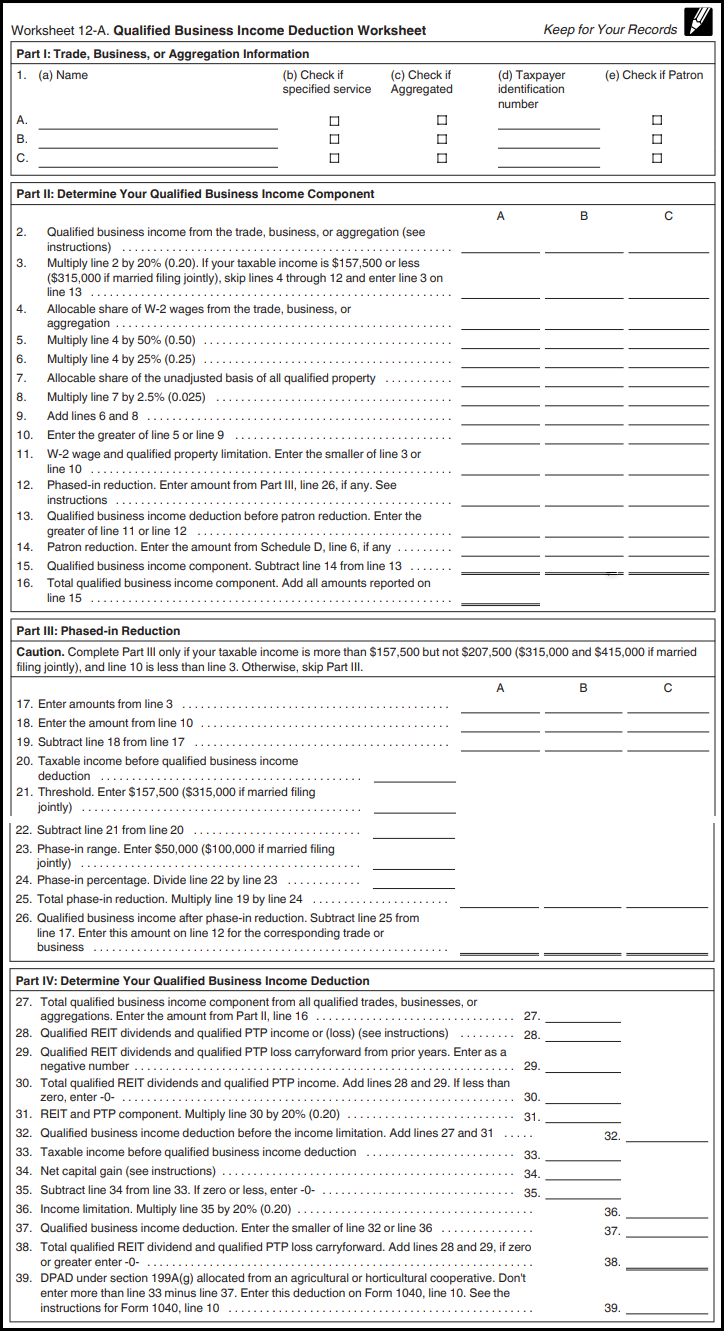

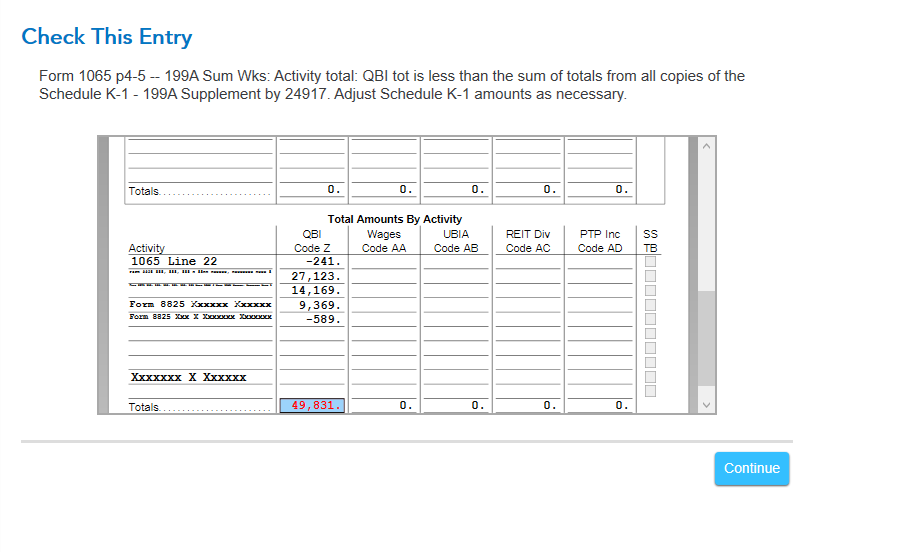

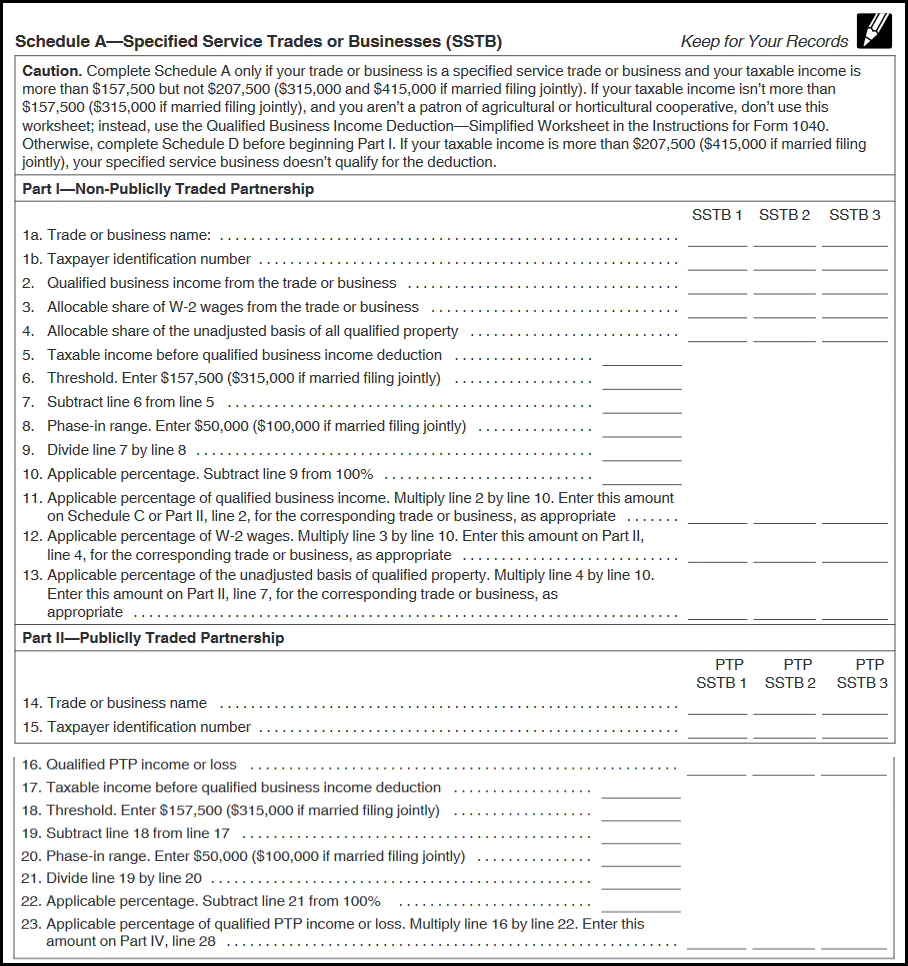

199A Worksheet By Activity Form - The images included below and in the expandable sections are draft copies. Web proseries will also produce a qbi component worksheet where you can review your entries by activity, and a qbi deduction summary worksheet showing the. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. Go to the qbi section for your activity: It is available from 2018 to 2025. However, it cannot be used for specified service trades or. Web section 199a is a qualified business income (qbi) deduction. Web 78 rows qbi entity selection calculator. In section 1, general, select field 1, all of taxpayer's activities are qualified. For aggregration of businesses see caution: Web when i print my form 1065 return for filing by mail, included is the 199a summary and the 199a worksheet by activity (the worksheet is marked keep for. Web qualified business income deduction. Web section 199a is a qualified business income (qbi) deduction. Web the section 199a information worksheet includes columns for multiple activities. With this deduction, select types. The images included below and in the expandable sections are draft copies. Web how to enter adjustments in 199a worksheet? Web 78 rows qbi entity selection calculator. Go to the qbi section for your activity: Web go to income/deductions > qualified business income (section 199a) worksheet. Web how to enter adjustments in 199a worksheet? Web when i print my form 1065 return for filing by mail, included is the 199a summary and the 199a worksheet by activity (the worksheet is marked keep for. Web like most of the changes in the individual income tax in p.l. Many owners of sole proprietorships, partnerships, s corporations and some. Web section 199a is a qualified business income (qbi) deduction. Web the partnership’s section 199a information worksheet and partner’s section 199a information worksheet are available in forms view and display the qualified business. In section 1, general, select field 1, all of taxpayer's activities are qualified. Web how to enter adjustments in 199a worksheet? A line is generated on the. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. Web section 199a is a qualified business income (qbi) deduction. Web qualified business income deduction. Web this video shows how to prepare the qualified business income deduction or qbid (section 199a) worksheets in a 1040 return using interview forms. A line is generated on the. A line is generated on the worksheet for each activity (located on screen. Web section 199a is a qualified business income (qbi) deduction. In section 1, general, select field 1, all of taxpayer's activities are qualified. Web when i print my form 1065 return for filing by mail, included is the 199a summary and the 199a worksheet by activity (the. However, it cannot be used for specified service trades or. Web the partnership’s section 199a information worksheet and partner’s section 199a information worksheet are available in forms view and display the qualified business. Web when i print my form 1065 return for filing by mail, included is the 199a summary and the 199a worksheet by activity (the worksheet is marked. However, it cannot be used for specified service trades or. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income. This worksheet is designed to determine the 199a deduction for a single business activity. It is available from 2018 to 2025. Web this video shows how to prepare the. In section 1, general, select field 1, all of taxpayer's activities are qualified. It is available from 2018 to 2025. You may mark more than one unit of screen qbi in the income & deductions folder as a qualifying. Web proseries will also produce a qbi component worksheet where you can review your entries by activity, and a qbi deduction. Web like most of the changes in the individual income tax in p.l. Web proseries will also produce a qbi component worksheet where you can review your entries by activity, and a qbi deduction summary worksheet showing the. Web the partnership’s section 199a information worksheet and partner’s section 199a information worksheet are available in forms view and display the qualified. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income. However, it cannot be used for specified service trades or. Web proseries will also produce a qbi component worksheet where you can review your entries by activity, and a qbi deduction summary worksheet showing the. Web how to enter adjustments in 199a worksheet? Web section 199a is a qualified business income (qbi) deduction. Web the partnership’s section 199a information worksheet and partner’s section 199a information worksheet are available in forms view and display the qualified business. Web the section 199a information worksheet includes columns for multiple activities. Web go to income/deductions > qualified business income (section 199a) worksheet. This worksheet is designed to determine the 199a deduction for a single business activity. Web 78 rows qbi entity selection calculator. For aggregration of businesses see caution: The images included below and in the expandable sections are draft copies. Go to the qbi section for your activity: Web qualified business income deduction. Web like most of the changes in the individual income tax in p.l. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. Web when i print my form 1065 return for filing by mail, included is the 199a summary and the 199a worksheet by activity (the worksheet is marked keep for. In section 1, general, select field 1, all of taxpayer's activities are qualified. This worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker.Worksheets & IRS Forms For 199A Deduction TaxBuzz

Lacerte Complex Worksheet Section 199A Qualified Business

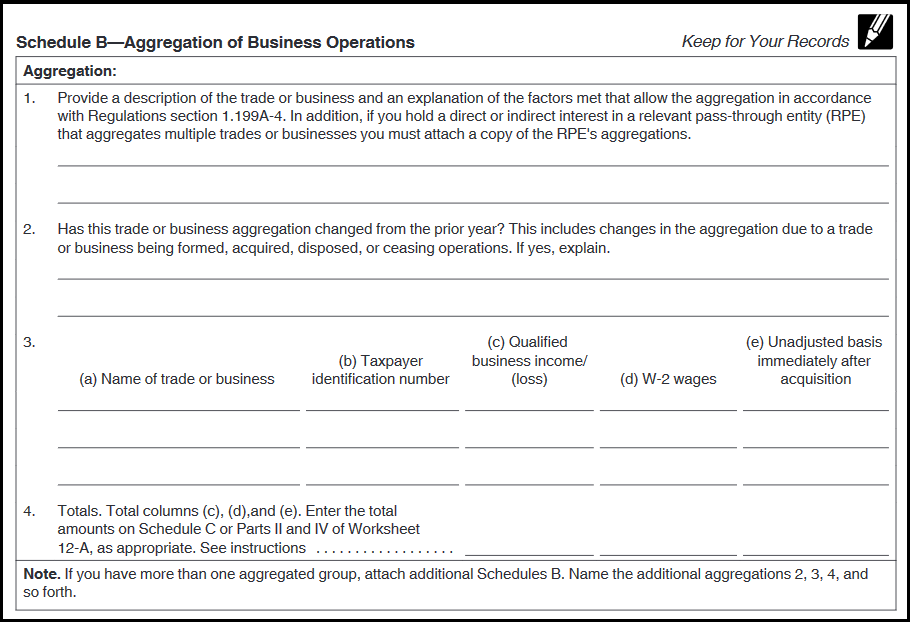

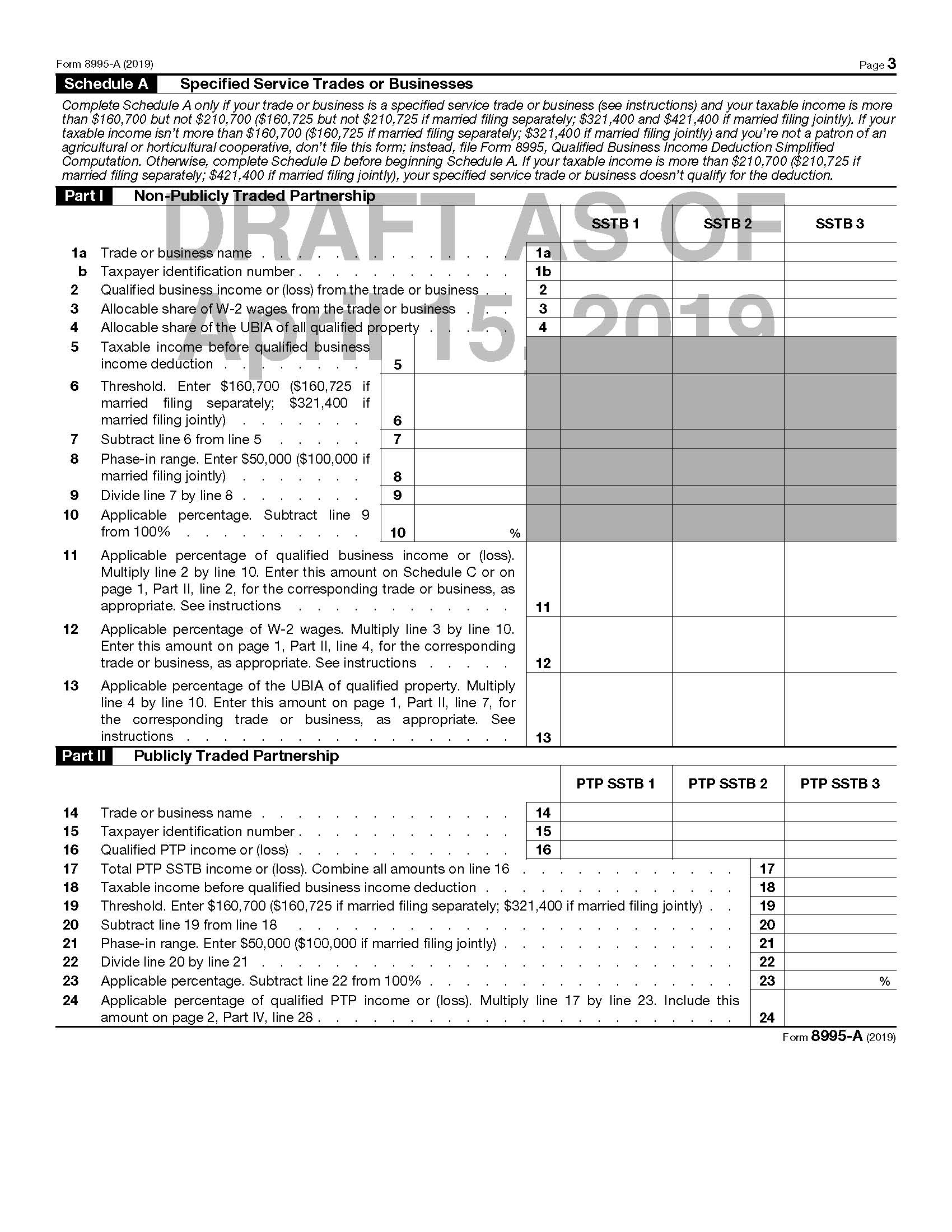

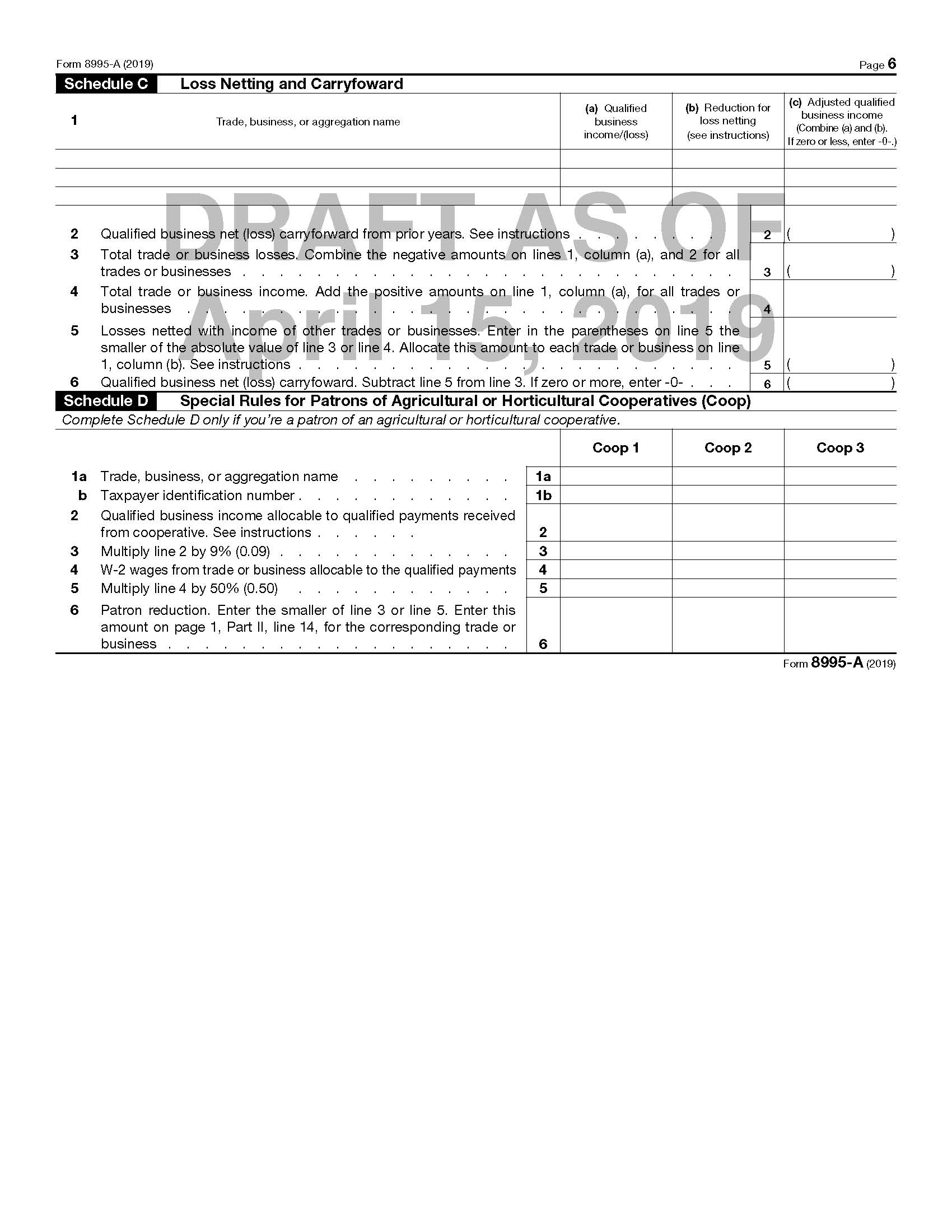

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

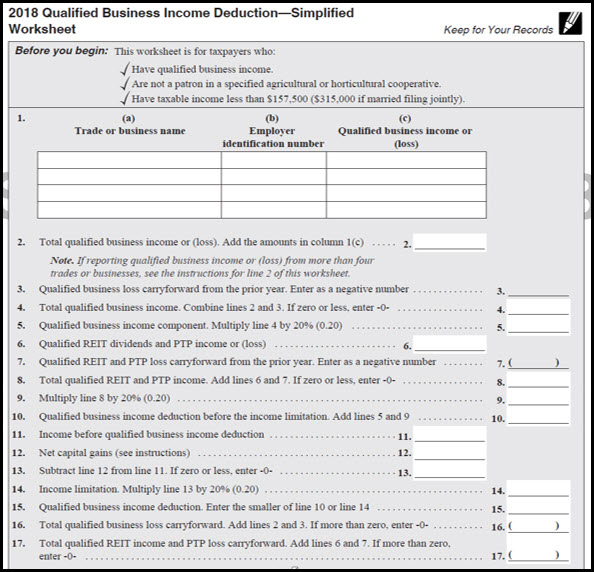

Worksheets & IRS Forms For 199A Deduction TaxBuzz

ProConnect Tax Online Simplified Worksheet Section 199A Qualif

Worksheets & IRS Forms For 199A Deduction TaxBuzz

Section 199a Information Worksheet

Does the 199A Summary Worksheet correctly compare the Totals on

Lacerte Complex Worksheet Section 199A Qualified Business

Related Post: