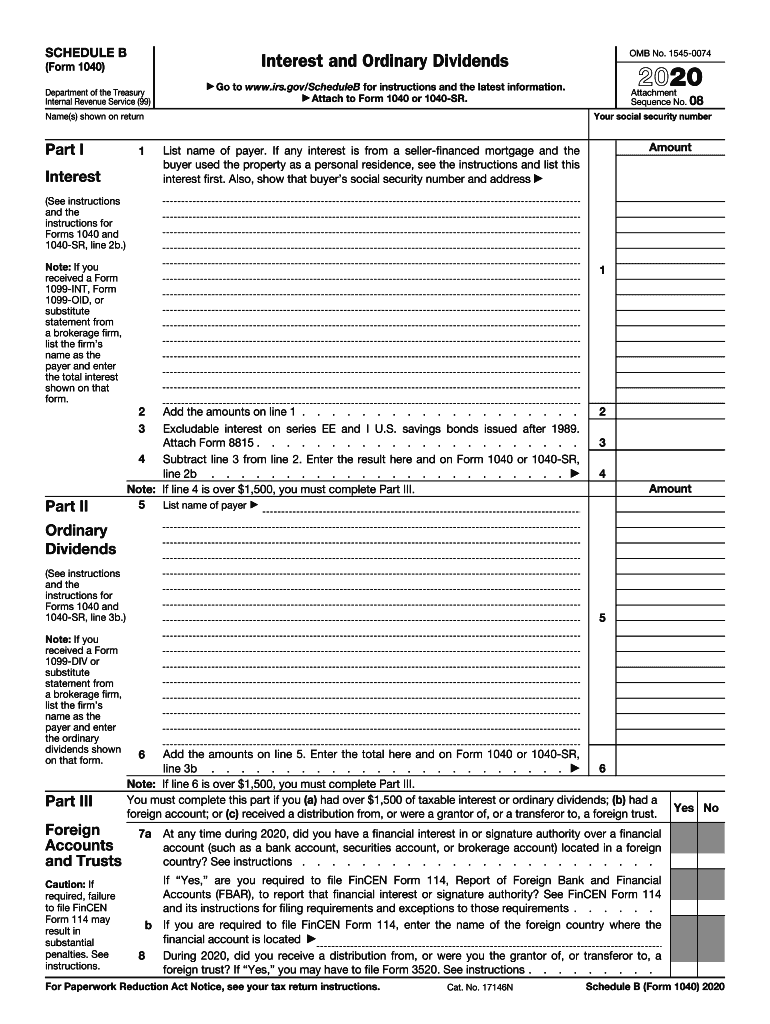

1041 Schedule B Form

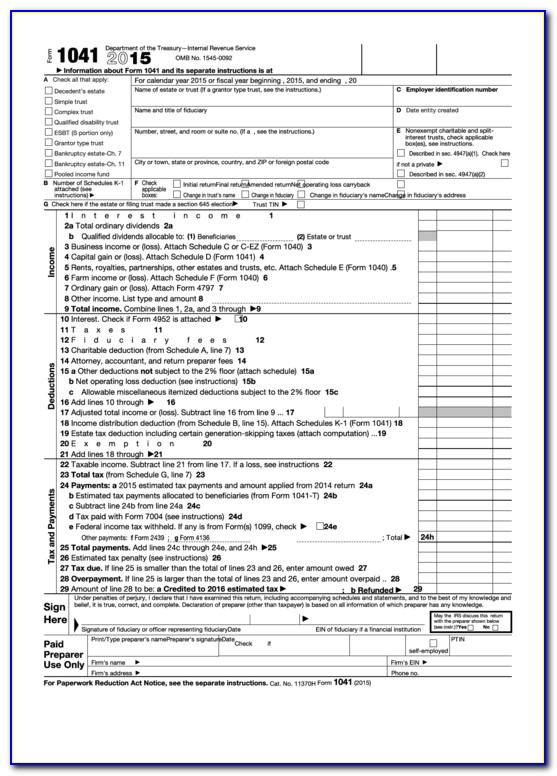

1041 Schedule B Form - To complete schedule b, follow these steps. This is a complex trust and the. Complete, edit or print tax forms instantly. Take a look at schedule b form 941 below. Enter the number of gravesites if the trust is a cemetery. Enter tax liability by month. The sales price prior to expenses or the sales price after expenses; The only asset in the estate was her home. Schedule g—tax computation and payments. Web use this field to override the calculated amount on form 1041, page 2, schedule b, line 12. Complete, edit or print tax forms instantly. Department of the treasury—internal revenue service. Source income subject to withholding. (1) the distributable net income (dni), or. Schedule g—tax computation and payments. Income tax return for estates and trusts. Ad access irs tax forms. For instructions and the latest. Department of the treasury—internal revenue service. Web complete 1041 schedule b online with us legal forms. Income tax return for estates and trusts. I cant figure out how this is computed by turbo tax business. Web form 1041 schedule b. Web trust accounting income form 1041 schedule b, line 8. Get ready for tax season deadlines by completing any required tax forms today. The sales price prior to expenses or the sales price after expenses; Take a look at schedule b form 941 below. (1) the distributable net income (dni), or. Web the income distribution deduction is calculated on schedule b (form 1041). Information about schedule b (form 1040), interest and ordinary dividends, including recent updates, related forms,. Income tax return for estates and trusts. The sales price prior to expenses or the sales price after expenses; Source income subject to withholding. The only asset in the estate was her home. Enter the number of gravesites if the trust is a cemetery. Web what amount should be on 1041, schedule b, line 10; Schedule j (form 1041)—accumulation distribution for certain complex trusts. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. Complete, edit or print tax forms instantly. Easily fill out pdf. The sales price prior to expenses or the sales price after expenses; Schedule g—tax computation and payments. Web what amount should be on 1041, schedule b, line 10; Enter tax liability by month. I am currently working on form 1041 for my mom's estate. Web don’t complete schedule b if you have a tax liability on form 941, line 12, that is less than $2,500 during the quarter. This is a complex trust and the. The only asset in the estate was her home. To complete schedule b, follow these steps. Save or instantly send your ready documents. Schedule g—tax computation and payments. The only asset in the estate was her home. This is a complex trust and the. For instructions and the latest. Ad access irs tax forms. Completes schedule b by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security. Income tax return for estates and trusts. Web form 1041 schedule b. Web use this field to override the calculated amount on form 1041, page 2, schedule b, line 12. The allowable. Take a look at schedule b form 941 below. The allowable deduction is the lesser of the following: Easily fill out pdf blank, edit, and sign them. Web page last reviewed or updated: Source income subject to withholding. Web complete 1041 schedule b online with us legal forms. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. Get ready for tax season deadlines by completing any required tax forms today. Web use screen 7, 1041 distributions, to enter distribution percentages, dollar distributions, and schedule b overrides. Web trust accounting income form 1041 schedule b, line 8. I am currently working on form 1041 for my mom's estate. Information about schedule b (form 1040), interest and ordinary dividends, including recent updates, related forms,. Web the income distribution deduction is calculated on schedule b (form 1041). The sales price prior to expenses or the sales price after expenses; As you can see, the quarter is broken down into 3 months and each month is. To complete schedule b, follow these steps. Income tax return for estates and trusts. Ad search for answers from across the web on superdealsearch.com. For instructions and the latest. Complete, edit or print tax forms instantly.IRS Instructions for Form 1041 and Schedules A B G J and K1 2017

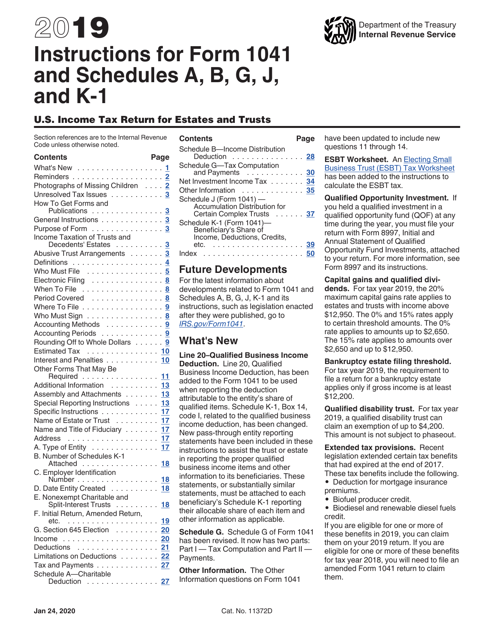

Form 1041 (Schedule I) Alternative Minimum Tax Estates and Trusts

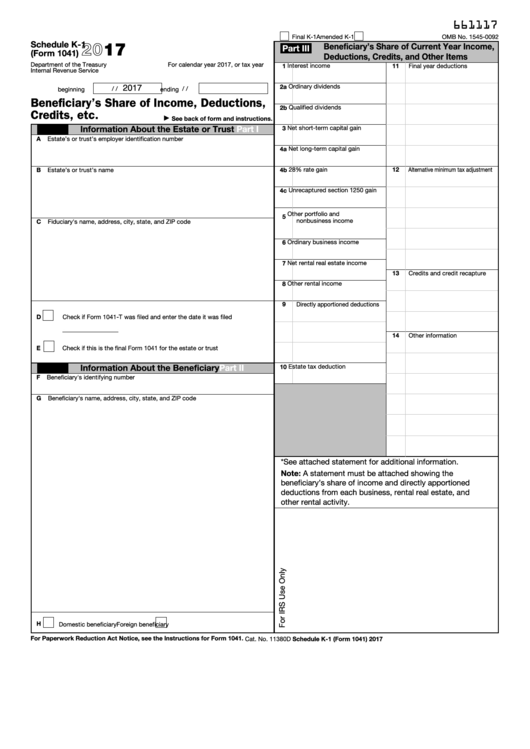

Fillable Schedule K1 (Form 1041) Beneficiary'S Share Of

Download Instructions for IRS Form 1041 Schedule A, B, G, J, K1 U.S

1041 i form 2017 Fill out & sign online DocHub

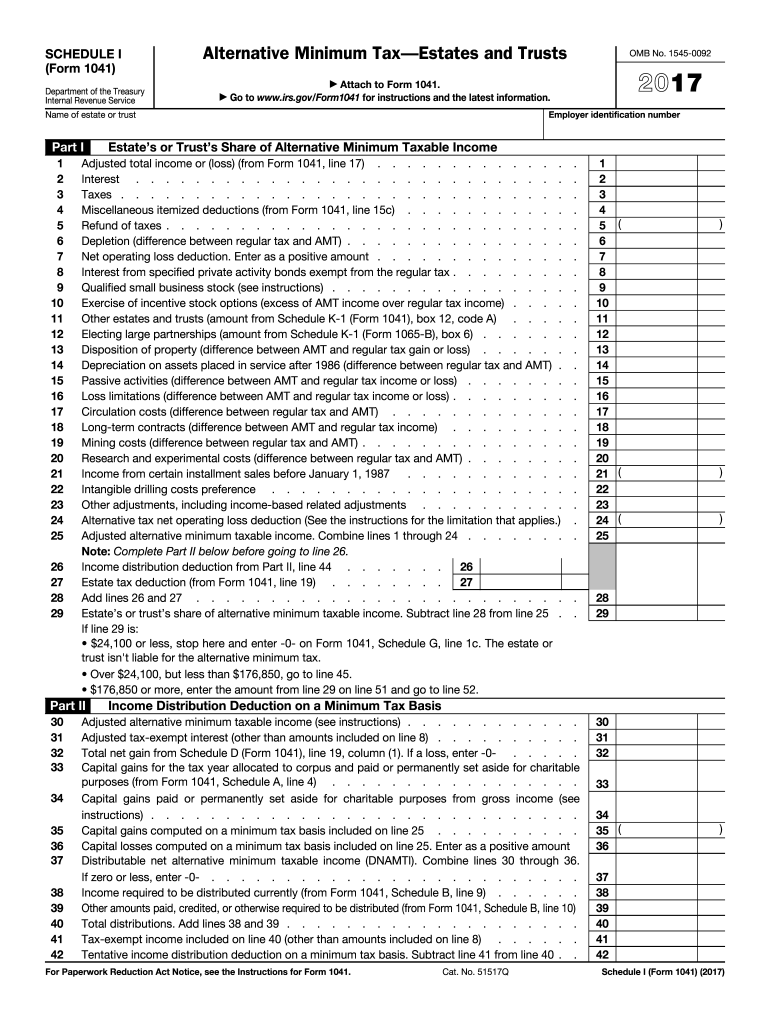

2020 Form IRS 1040 Schedule B Fill Online, Printable, Fillable, Blank

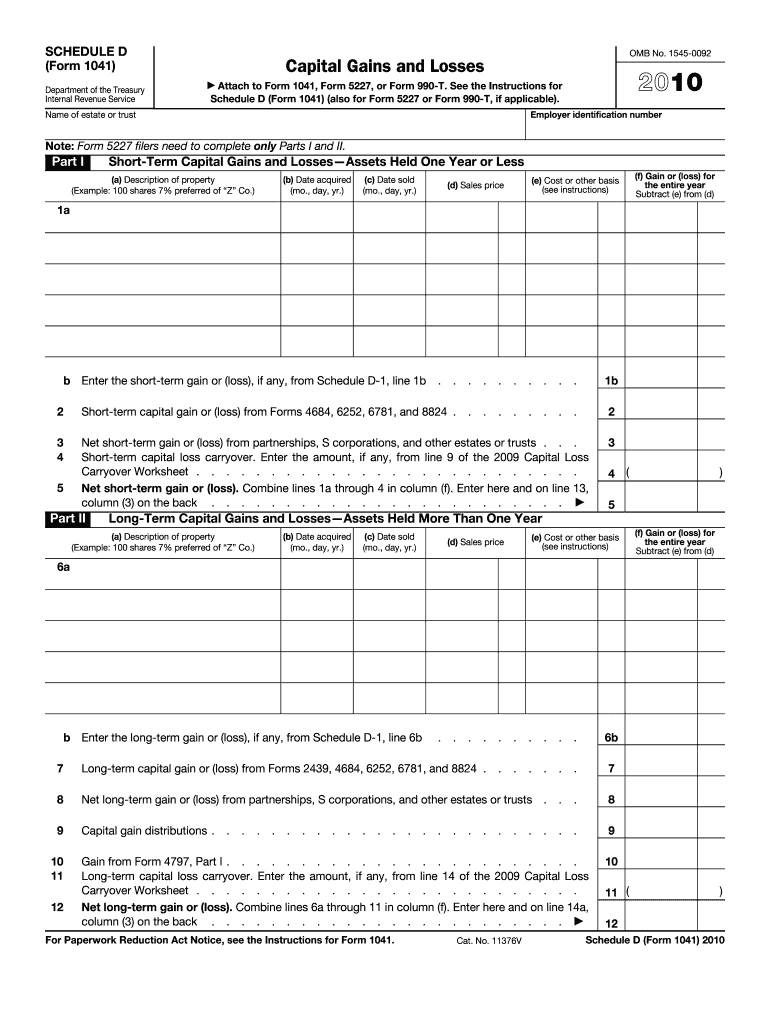

Form 1041 (Schedule D) Capital Gains and Losses (2014) Free Download

Irs Forms 1041 Schedule B Form Resume Examples EpDLBYgOxR

2010 form 1041 schedule d Fill out & sign online DocHub

Irs Form 1041 Schedule B prosecution2012

Related Post: